|

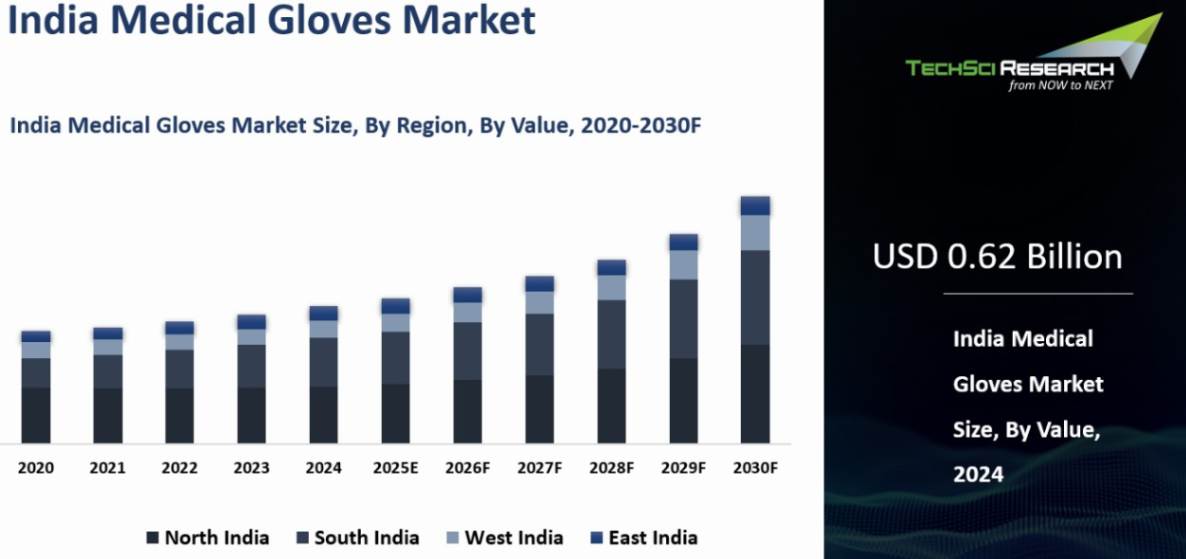

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD 0.62 Billion

|

|

Market

Size (2030)

|

USD

0.87 Billion

|

|

CAGR

(2025-2030)

|

5.75%

|

|

Fastest

Growing Segment

|

Surgical

|

|

Largest

Market

|

North

India

|

Market Overview

The India Medical Gloves Market was valued at USD 0.62 billion in 2024 and is expected to reach USD 0.87 billion by 2030, with a CAGR of 5.75% during the forecast period.

Medical gloves are essential disposable items used by healthcare professionals in hospitals, clinics, and laboratories to maintain hygiene, prevent infection, and protect against contaminants. As a core part of personal protective equipment (PPE), they must meet strict quality and safety standards to provide effective barriers against infectious agents, blood, and bodily fluids.

A secure fit, good grip, and comfort are vital for dexterity and to prevent fatigue during long procedures. Surgical gloves need higher tactile sensitivity for precision, while durability ensures reliability during medical tasks. Proper sterilization and packaging preserve sterility until use in operating rooms.

Rising health awareness and increased patient visits to healthcare facilities are driving demand for medical gloves in patient care and diagnostics. A 2020 study published in the National Library of Medicine estimated India’s national surgical rate at 3,646 surgeries per year per 100,000 people, with urban areas showing slightly higher rates than rural ones. The study also found that individuals aged 30-39 accounted for the highest number of surgeries, highlighting demographic variations in healthcare utilization.

India’s aging population is further increasing demand for medical gloves, as older adults require more frequent medical and surgical care. Strict infection control standards across healthcare settings, along with lessons from outbreaks such as COVID-19, have reinforced the importance of protective gear. As a result, demand for high-quality, durable medical gloves continues to rise across clinical, diagnostic, and elderly care applications.

Download Free Sample Report

Key Market Drivers

Technological Advancements

Nitrile gloves have gained strong demand due to their strength, puncture resistance, and latex-free design. The India Nitrile Gloves Market reached USD 620 million in 2025, driven by growing use in healthcare, chemical handling, food services, manufacturing, and retail. The Quality Control Order (QCO) for gloves is expected to regulate Rs 600-700 crore in annual glove imports, promoting domestic manufacturing. Ongoing innovations are improving tactile sensitivity, durability, and comfort. Neoprene gloves tailored for medical use are also being enhanced for improved protection and flexibility.

Smart gloves with integrated sensors represent a major advancement, enabling real-time monitoring of temperature, pulse, and blood pressure, especially in critical care. Some gloves incorporate antimicrobial agents to minimize pathogen transmission. Healthium Medtech’s TruShield antimicrobial gloves, made in Karnataka using patented technology, provide 99.99 percent protection for up to eight hours. Surgical site infections account for about 15 percent of all healthcare-associated infections and 37 percent in surgical patients, highlighting the importance of such innovations.

Environmental concerns have prompted research into biodegradable glove materials that decompose more easily. 3D printing now enables custom-fit gloves that improve comfort and reduce tearing risks. Advances in aseptic gloving ensure sterile conditions in surgeries through improved donning procedures. Powdered gloves are being phased out in favor of powder-free variants to reduce allergies and contamination, while new donning techniques have made them easier to wear.

Emerging designs include gloves with built-in heating elements for cold environments and ergonomic models that reduce hand fatigue during long procedures. Developments in glove sizing and customization enhance fit and comfort. Some prototypes now feature wearable technology such as haptic feedback or small displays for real-time data sharing.

Government support is reinforcing quality and manufacturing. In March 2024, surgical and examination gloves were proposed for inclusion under the QCO to curb substandard imports. In July 2023, Trivitron Healthcare launched India’s first automated radiation protection gloves facility at AMTZ in Visakhapatnam, with an annual capacity exceeding 200,000 units, marking a step toward self-reliance in medical glove production.

Rising Health Awareness

Rising health awareness motivates individuals to adopt personal protective measures, particularly during activities with potential health risks. Medical gloves are recognized for their role in minimizing contamination and infection across various environments. Health-conscious individuals prioritize routine check-ups, vaccinations, and medical consultations, often facilitated by healthcare providers employing medical gloves for safety and hygiene.

The trend towards home healthcare, driven by an aging population and a focus on well-being, further underscores the demand for medical gloves. The India Home Healthcare market reached USD 9.07 Billion in 2024, with India's senior citizen population expected to reach 194 million by 2031 and 298 million by 2051. Caregivers administering home healthcare tasks such as wound care, medication administration, and hygiene maintenance frequently rely on medical gloves.

Increased awareness of oral health has driven demand for gloves in dental clinics, where dentists and hygienists use them to protect patients and practitioners. India is home to over 300,000 practicing dentists and nearly 50,000 dental laboratories, with the dental care market projected to reach Rs 68,000 crore between 2024 and 2028. Likewise, health-conscious consumers advocate for improved food safety practices, prompting widespread use of gloves among food handlers and restaurant staff to prevent contamination and foodborne illness. India imported over 44 crore gloves worth Rs 55 crore between May and July 2024 alone, highlighting the substantial demand across food processing and hospitality sectors.

The Government of India is set to launch a credit incentive scheme valued at Rs. 50,000 crore (US$ 6.8 billion) to enhance the nation's healthcare infrastructure. The Indian healthcare industry is experiencing unparalleled expansion, as private equity and venture capital funding exceeded US$ 1 billion in the initial five months of 2024, representing a 220 rise compared to the prior year. Kanam Latex, a major manufacturer, operates with a manufacturing capacity exceeding 560 million pair of gloves annually. In fitness circles, individuals prioritize glove usage for weightlifting and gym activities to minimize contact with bacteria and germs on exercise equipment. Similarly, conscientious parents and caregivers prioritize children's health and hygiene by utilizing medical gloves for tasks like diaper changing, reducing the risk of skin irritation or infection.

Elevated awareness of past pandemics and infectious disease outbreaks fuels interest in personal protective equipment, including medical gloves, to prepare for potential health crises. Environmental consciousness also influences preferences, with some individuals and healthcare facilities opting for biodegradable or eco-friendly gloves to align with sustainability goals and responsible disposal practices. Most disposable glove manufacturers are currently operating at only about 30 capacity due to the dumping menace of cheaper imports. In workplaces with a focus on occupational health and safety, the use of gloves is mandated to shield employees from chemical exposure, contaminants, and other hazards, thereby accelerating demand in the India Medical Gloves Market.

Key Market Challenges

Counterfeit Products

Counterfeit medical gloves may not meet quality and

safety standards, putting patients at risk of infection and other health

complications. Substandard gloves can lead to the spread of diseases,

particularly in healthcare settings. Healthcare professionals who rely on

medical gloves for protection may be unknowingly exposed to health risks when

counterfeit gloves do not provide the intended barrier protection.

Counterfeit

gloves may not perform as expected, compromising their effectiveness during

medical procedures, surgeries, and other critical tasks. This can impact the

quality of healthcare services. The use of counterfeit gloves can lead to

non-compliance with healthcare regulations and standards, exposing healthcare

facilities to legal and regulatory risks. The presence of counterfeit medical

gloves can damage the reputation of reputable glove manufacturers and

distributors, eroding trust in the industry.

Healthcare facilities and

institutions that unknowingly purchase counterfeit gloves may face financial

losses due to the need to replace substandard products and address any

associated health complications. Detecting counterfeit gloves can be

challenging, as they are often designed to closely mimic genuine products,

making it difficult to distinguish them through visual inspection alone.

Competition

Intense competition can lead to price pressure,

with manufacturers and suppliers striving to offer competitive pricing. While

this can benefit buyers, it may also affect profit margins and the quality of

products. In a highly competitive market, some manufacturers may cut corners to

reduce costs, potentially compromising the quality and safety of medical

gloves. Maintaining high-quality standards is essential but can be challenging

in such an environment.

To gain a competitive edge, manufacturers must invest

in research and development to introduce innovative glove materials, designs,

and features that meet evolving healthcare needs and safety standards. India's

medical gloves market competes not only domestically but also internationally,

as it exports medical gloves to various countries. Competing in the global

market requires meeting international quality standards and cost

competitiveness. The medical gloves market can become saturated with numerous

suppliers offering similar products.

This can make it challenging for new

entrants and smaller companies to gain market share. Manufacturers and

suppliers must have efficient distribution networks to reach healthcare

facilities across India. Competition can result in challenges related to

distribution efficiency and coverage. Manufacturers often need to target

specific segments within the healthcare industry, such as hospitals, clinics,

and laboratories. Effectively serving these segments while facing competition

can be challenging. Efficient supply chain management is vital to ensure a

steady supply of medical gloves. Intense competition can add complexity to the

supply chain due to multiple suppliers and logistics considerations.

Key Market Trends

Environmental Considerations Leading to Higher Demand for Biodegradable Materials

There is increasing demand for medical gloves made from biodegradable, eco-friendly materials. Manufacturers are developing gloves that break down more easily in landfills, reducing their environmental footprint. The biodegradable gloves market reached USD 2.4 billion in 2025, with manufacturers focusing on energy-saving, sustainable, protein-free, and natural-rubber gloves that biodegrade 100 times faster than synthetic rubber. Manufacturers are adopting sustainable practices in glove production, such as reducing water and energy usage, minimizing waste, and using eco-friendly packaging materials.

Some manufacturers and healthcare facilities are exploring recycling programs for used medical gloves. These initiatives aim to divert gloves from landfills and give them a second life as new products. Healthcare facilities are educating staff about the proper disposal of medical gloves to minimize their environmental impact. This includes segregating and disposing of used gloves in an eco-friendly manner. Some companies are offering medical gloves that are certified as environmentally responsible. These gloves meet specific criteria for sustainability and environmental impact reduction. HANDCARE® has introduced EVA (Ethylene Vinyl Acetate) medical grade gloves that are oxo biodegradable, providing a skin-feel and satin smooth touch.

Efforts are being made to reduce single-use plastics, including disposable gloves. This involves exploring alternative materials for glove packaging and finding ways to reduce plastic waste in healthcare settings. Under India's Biomedical Waste Management Rules 2016, plastic bags, gloves, and blood bags have to be phased out within 2 years to eliminate emissions of dioxins and furans during their burning into the environment. Some patients and healthcare professionals are more inclined to choose environmentally friendly products when given the option. This can influence procurement decisions. Manufacturers are increasingly labeling their gloves with information about their environmental attributes and certifications, making it easier for healthcare facilities to select eco-friendly options.

Increasing Stringent Infection Control Standards

Comprehensive infection control standards require healthcare facilities to adopt strict practices to prevent infection spread, making medical gloves essential, especially in high-risk environments. India’s expanding healthcare infrastructure supports this demand, with the sector valued at USD 400 billion in 2024 and projected to reach USD 638 billion by 2025. The hospital market alone is expected to rise from USD 99 billion in 2023 to USD 193 billion by 2032. Hospitals, clinics, and diagnostic centers remain major consumers of medical gloves. Government initiatives, such as the Rs. 50,000 crore (USD 6.8 billion) credit incentive scheme and over USD 1 billion in private investments in early 2024, are further strengthening healthcare capacity and infection control measures.

Healthcare professionals depend on gloves across departments to prevent cross-contamination and maintain sterility. National regulations enforce these standards, with the National Guidelines for Infection Prevention and Control in Healthcare Facilities 2020 emphasizing gloves as a core part of protective equipment. Compliance requires the use of high-quality, certified gloves from reliable manufacturers.

The COVID-19 pandemic highlighted the importance of stringent infection control and drove unprecedented demand for disposable and examination gloves. Public awareness of hygiene and disease prevention continues to shape expectations for safety in healthcare settings, where patients and families now insist on visible infection control practices. Preventive healthcare procedures such as vaccinations and check-ups also rely on gloves to maintain safety standards.

Government investments, including five new AIIMS institutes and 202 healthcare infrastructure projects launched in 2024, reinforce the country’s commitment to infection control. Laboratories and testing facilities also depend on gloves to maintain sample integrity. Beyond healthcare, industries with exposure risks follow similar standards, supporting steady growth in India’s medical gloves market.

Segmental Insights

Type Insights

In 2024, the India Medical

Gloves Market largest share was held by Surgical type segment and is predicted

to continue expanding over the coming years. Surgical gloves are

designed to provide a high level of precision and dexterity. They are crucial

for surgeons and other medical professionals performing intricate procedures,

where even the slightest loss of tactile sensitivity can have serious consequences.

Surgical procedures demand the highest level of hygiene and sterility. Surgical

gloves are manufactured and processed with the utmost care to ensure they meet

the stringent standards required in the operating room.

Surgical gloves play a critical

role in infection control during surgical procedures. They provide a barrier

between the surgeon and the patient's body fluids, preventing

cross-contamination and the transmission of infections. Surgical gloves are

often made from specialized materials, such as natural rubber latex, nitrile,

or neoprene, which are chosen for their unique properties, including barrier

protection and tactile sensitivity. Surgical gloves are subject to rigorous

regulatory standards and quality control measures.

Manufacturers must meet

specific requirements to ensure the gloves' safety and effectiveness in

surgical settings. Surgical gloves are used in a wide variety of surgical

procedures, ranging from general surgery to specialized fields like

orthopedics, neurosurgery, and cardiothoracic surgery. The diversity of

surgical applications leads to a higher demand for surgical gloves.

Material Type Insights

In 2024, the India Medical

Gloves Market largest share was held by Natural Rubber segment and is predicted

to continue expanding over the coming years. Natural rubber latex gloves are generally

more cost-effective to produce compared to synthetic alternatives like nitrile

or neoprene. This cost advantage makes them a preferred choice for healthcare

facilities, especially those operating on tight budgets. Natural rubber gloves

have been used in the healthcare industry for many decades.

This long history

of use has established a level of trust and familiarity with these gloves among

healthcare professionals. Natural rubber latex gloves are known for their

excellent elasticity and comfort. They provide a snug fit, which is important

for medical procedures that require precision, and they offer a high level of

tactile sensitivity. Natural rubber latex is an effective barrier material,

providing protection against pathogens, bodily fluids, and other contaminants.

This barrier protection is crucial in healthcare settings to prevent the

transmission of infections.

Natural rubber latex is a biodegradable material,

which is an important consideration for some healthcare facilities and

individuals concerned about the environmental impact of disposable medical

gloves. Natural rubber gloves have a long history of use and are subject to

established regulatory standards and quality control measures. This makes it

easier for manufacturers to ensure compliance with relevant regulations.

Download Free Sample Report

Regional Insights

The North India region dominated the India Medical

Gloves Market in 2024. North

India is home to a significant portion of India's population. This higher population density leads to more healthcare facilities, hospitals, and clinics, which, in turn, drive demand for medical gloves. The region has

several healthcare hubs and metropolitan cities, such as Delhi, NCR (National

Capital Region), and Chandigarh, which are known for their advanced medical

infrastructure. These areas require a substantial supply of medical gloves to

support their healthcare services.

The North Indian states, including the

national capital, receive substantial government investment in healthcare

infrastructure development. Government-funded healthcare initiatives often lead

to a higher consumption of medical gloves, boosting the market. The region

hosts many prestigious medical colleges, research institutions, and teaching

hospitals. These institutions drive the demand for medical gloves for medical

training, research, and patient care.

Recent Developments

- In May 2025, Wadi Surgicals introduced Enliva accelerator‑free nitrile gloves in India, positioned as India’s first accelerator‑free nitrile range for dermatological safety while meeting EN 455/EN ISO 374/ISO 13485 standards.

- In May 2025, Enliva (Wadi Surgicals) announced plans to invest ₹100 crore to scale operations from its Visakhapatnam facility, adding new lines and exploring partnerships and acquisitions to deepen India‑based glove supply and R&D.

- In May 2025, Enliva confirmed domestic manufacturing and a multi‑variant portfolio for healthcare, cleanroom, food, and industrial users, reinforcing India's availability and export readiness from its Andhra Pradesh unit.

- In Mar 2025, Industry body IRGMA highlighted the incoming Medical and Surgical Gloves Quality Control Order (2024) and urged enforcement against substandard imports ahead of BIS‑mandatory implementation, a change expected to influence hospital procurement and supplier qualifications.

- In Jun 2024, AIIMS New Delhi/NCI Jhajjar/CRHSP Ballabgarh/NDDTC Ghaziabad floated a GeM bid/reverse auction for sterile surgical gloves (pre‑powdered), signaling institutional demand and supplier engagement for FY2024–25.

- In Apr 2024, BCG Vaccine Laboratory (Government of India) issued a tender for the supply of sterile disposable nitrile gloves, establishing a two‑bid process for vendor selection and rate contracts.

- In Dec 2024, HLL Lifecare opened its FY2024–25 e‑tendering cycle for medical supplies, maintaining its role as a centralized procurement agency that routinely includes surgical and examination gloves within framework awards and rate contracts.

- In March 2024, the Indian government is preparing to include surgical gloves and single-use medical examination gloves under the Quality Control Order (QCO), aiming to restrict the import of substandard products while elevating domestic manufacturing standards. This strategic move is expected to enhance product quality across the healthcare sector, ensuring compliance with stringent regulations and fostering competitiveness among domestic producers.

Key

Market Players

- Ansell Ltd.

- B Braun Medical (India)

Private Limited

- Sempertrans India Private

Limited

- Medline Industries India

Private Limited

- MRK Healthcare Pvt. Ltd

- RFB Latex Limited

- Primus Gloves Private

Limited

- Kanam Latex Industries Pvt.

Ltd.

- Asma Rubber Products Pvt.

Ltd.

- Cardinal Health international India Pvt. Ltd

|

By Type

|

By Product Type

|

By Material

Type

|

By Form

|

By End User

|

By Region

|

|

|

|

- Natural Rubber

- Nitrile

- Viny

- Neoprene

- Polyethylene

- Others

|

|

- Hospitals &

Clinics

- Ambulatory Care

Centers

- Home Healthcare

- Others

|

- North India

- South India

- East India

- West India

|

Report Scope:

In this report, the India Medical Gloves Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- India Medical Gloves Market, By Type:

o Surgical

o Examination

- India Medical Gloves Market, By Product Type:

o Reusable

o Disposable

- India Medical Gloves

Market, By Material Type:

o Natural Rubber

o Nitrile

o Viny

o Neoprene

o Polyethylene

o Others

- India Medical Gloves

Market, By Form:

o Powdered

o Non-Powdered

- India Medical Gloves

Market, By End-User:

o Hospitals & Clinics

o Ambulatory Care Centers

o Home Healthcare

o Others

- India Medical Gloves Market, By Region:

o North India

o

South

India

o

East

India

o

West

India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the

India Medical Gloves Market.

Available Customizations:

India Medical Gloves Market report with the given

market data, TechSci Research offers customizations according to a company's

specific needs. The following customization options are available for the

report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

India Medical Gloves Market is an upcoming report

to be released soon. If you wish an early delivery of this report or want to

confirm the date of release, please contact us at [email protected]