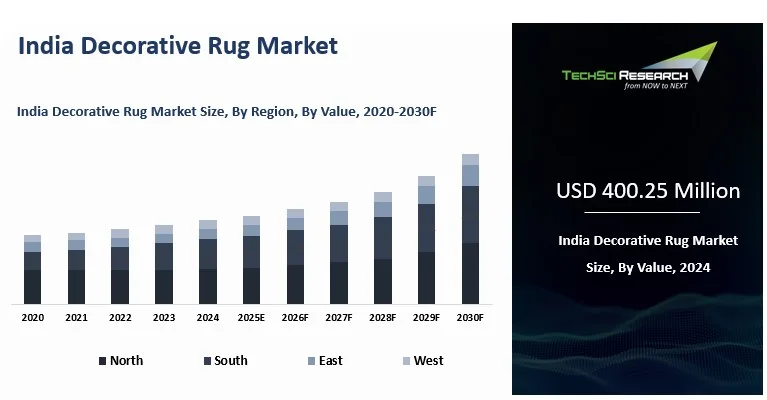

Forecast Period | 2026-2030 |

Market Size (2024) | USD 400.25 Million |

CAGR (2025-2030) | 5.62% |

Fastest Growing Segment | Online |

Largest Market | North |

Market Size (2030) | USD 555.66 Million |

Market Overview

India Decorative Rug Market was valued at USD 400.25 Million in 2024 and is expected

to reach USD 555.66 Million by 2030 with a CAGR of 5.62% during the forecast

period. The India decorative rug market is experiencing steady growth, driven by

rising urbanization, increasing disposable incomes, and a growing demand for

home decor. Northern and Western India dominate the market, with states like

Uttar Pradesh, Rajasthan, and Gujarat being key hubs for rug production,

especially handmade varieties. The market is supported by the rich tradition of

weaving in these regions, coupled with the rise of e-commerce and export

demand. Increasing consumer preference for aesthetic, sustainable designs fuels

market expansion.

Key Market Drivers

Rise

of Urbanization and Changing Lifestyles

Urbanization has been one of the most influential

factors driving the growth of the Indian decorative rug market. As India

experiences rapid urban development, more people are moving to urban areas in

search of better opportunities, contributing to the growth of metropolitan

cities and towns. Urban consumers tend to prefer aesthetically pleasing living

spaces, often opting for decorative rugs to enhance the appearance of their

homes. The increasing number of urban households has led to a surge in demand

for decorative rugs, as more consumers seek to furnish and personalize their

homes. Additionally, urban consumers are more likely to embrace global design

trends, further fueling the demand for trendy, high-quality rugs. As cities

continue to expand and more people adopt modern lifestyles, the demand for

decorative rugs, especially those that offer both functionality and design

appeal, is likely to grow.

Increasing

Disposable Incomes and Changing Consumer Preferences

With rising disposable incomes, particularly among the

middle and upper-middle classes, Indian consumers have become more willing to

spend on premium and decorative products to enhance their living spaces.

According to reports, India's middle-class population is expected to grow to

547 million by 2030, which will drive demand for a range of consumer goods,

including decorative rugs. As income levels rise, consumers are increasingly

looking for premium and luxury products to furnish their homes, including handwoven

and eco-friendly rugs, which are perceived as status symbols. The growing

affluence in urban centers has led to greater interest in home decor as a form

of self-expression. Consumers are now more inclined to invest in rugs that

reflect their aesthetic preferences, choosing designs, textures, and materials

that align with their tastes. Additionally, the demand for sustainable products

has also risen, with more consumers opting for eco-friendly rugs made from

natural fibers, like jute and wool. As disposable incomes continue to increase,

the demand for higher-quality decorative rugs, both domestic and imported, is

expected to remain strong.

Growing

Home Decor Trends and Influence of International Designs

The growing trend of home decor in India has

significantly boosted the demand for decorative rugs. As consumers increasingly

seek to personalize their living spaces, decorative rugs have become essential

elements in home furnishing. The popularity of home decor television shows,

social media influencers, and online platforms showcasing interior design

trends has heightened interest in decorative rugs. Platforms such as Instagram

and Pinterest have exposed Indian consumers to global design trends, with modern,

bohemian, and minimalist rug designs gaining traction. Indian consumers are now

looking for rugs that not only complement their interiors but also serve as

statement pieces. The increased exposure to international rug designs, coupled

with the growing awareness of various weaving techniques, has created demand

for a wide range of styles, from traditional handwoven Indian carpets to

contemporary, machine-made rugs. Furthermore, the younger generation of

consumers, particularly millennials and Gen Z, are embracing home decor trends

and are more likely to purchase decorative rugs to enhance the aesthetics of

their living spaces. This demand for stylish and functional home decor is set

to fuel the growth of the decorative rug market.

Expansion

of E-Commerce and Online Shopping Platforms

The rise of e-commerce and online shopping platforms

has played a transformative role in the Indian decorative rug market. Over the

past decade, e-commerce in India has seen exponential growth, with online

retail sales in the country expected to reach USD 200 billion by 2026. Online

platforms like Amazon, Flipkart, and specialized decor websites have made it

easier for consumers to access a wide variety of decorative rugs, both domestic

and imported, from the comfort of their homes. These platforms provide consumers

with the ability to browse through thousands of designs, compare prices, and

read reviews, empowering them to make informed purchase decisions.

Additionally, online shopping offers convenient delivery options, including

doorstep delivery and easy returns, which further incentivizes customers to

purchase rugs online. The availability of international rug brands and

manufacturers on these platforms has broadened the consumer’s options, making

it easier to access global designs at competitive prices. The rise of digital

payment methods, along with attractive discounts and offers, has also

encouraged more consumers to purchase decorative rugs online. As internet

penetration continues to rise, particularly in tier 2 and tier 3 cities, the

e-commerce sector is expected to continue playing a crucial role in expanding

the market reach of decorative rugs.

Key Market Challenges

Challenges

in Raw Material Sourcing and Cost Fluctuations

One of the major challenges faced by the Indian

decorative rug market is the sourcing of raw materials, particularly for

handmade and high-quality rugs. Many traditional handwoven rugs are made from

natural fibers like wool, silk, and cotton, which are often sourced from

specific regions. The availability and cost of these materials are subject to

fluctuations based on weather patterns, agricultural yields, and global supply

chain disruptions. For instance, wool prices can be highly volatile due to the fluctuations

in global markets, while cotton and jute prices can vary based on domestic

agricultural performance. Additionally, while India has a long history of

rug-making in regions like Uttar Pradesh and Rajasthan, the demand for

eco-friendly, natural fiber-based rugs has placed increased pressure on

sourcing sustainable materials. Small and medium-sized manufacturers often

struggle to source high-quality raw materials at competitive prices, which can

impact production costs and overall profitability. This challenge becomes more

pronounced for businesses that rely on handmade products, as skilled artisans

are in short supply and wages can be higher due to their expertise.

Furthermore, the rising global demand for such raw materials, driven by

eco-conscious consumer behavior, has intensified competition among

manufacturers, further increasing material costs and supply chain constraints.

Competition

from Synthetic Rugs and Low-Cost Imports

The Indian decorative rug market faces significant

competition from synthetic alternatives, particularly machine-made rugs.

Synthetic rugs made from polyester, polypropylene, and nylon are more

affordable compared to traditional handwoven or wool rugs. These synthetic rugs

are often perceived as more durable, easy to clean, and resistant to wear and

tear, which makes them an attractive option for price-sensitive consumers. The

growing availability of machine-made rugs, both domestically and through imports,

has led to an increase in the overall market supply, putting pressure on

traditional rug manufacturers. Consumers, especially in tier 2 and tier 3

cities, often prioritize price over quality, which leads to a preference for

cheaper synthetic options rather than high-end handwoven rugs. Another factor

contributing to this challenge is the influx of low-cost imports from countries

like China, Turkey, and Iran, which offer competitive pricing due to lower

labor and manufacturing costs. These imported rugs, though sometimes lower in

quality, have captured a significant share of the Indian market, especially in

online retail platforms. As a result, local manufacturers of high-quality,

handcrafted rugs struggle to compete in terms of pricing, and many are forced

to either lower their prices or shift their focus to niche, high-end markets to

maintain profitability.

Supply

Chain and Distribution Issues

The supply chain and distribution systems for

decorative rugs in India face several inefficiencies that can hamper market

growth. India’s infrastructure, though improving, still faces significant

challenges when it comes to logistics and transportation. The long lead times

for shipping raw materials from rural areas to manufacturing hubs, along with

delayed shipments for finished products, can result in increased costs and

missed opportunities. For manufacturers relying on manual labor and traditional

methods, delays in production due to transportation and distribution

inefficiencies further add to the challenge. The lack of a streamlined supply

chain often results in higher inventory costs and operational inefficiencies,

which ultimately impact the pricing and availability of products in the market.

In addition, the distribution network for decorative rugs is not always

well-developed, particularly in smaller cities and rural areas, where demand

for high-quality rugs is growing. Retailers in these regions may lack access to

diverse product ranges, making it difficult for consumers to find the styles

and designs they want. E-commerce platforms have been able to address some of

these issues by providing nationwide delivery services, but for small and

medium-sized manufacturers, establishing a direct-to-consumer distribution

channel remains a major challenge.

Limited

Consumer Awareness and Education

Another significant challenge for the Indian

decorative rug market is the limited consumer awareness and education regarding

high-quality rugs, especially those made from natural fibers or produced

through traditional weaving techniques. Many consumers in India are not fully

aware of the value, craftsmanship, and longevity that handmade or

premium-quality rugs offer. As a result, they may opt for synthetic

alternatives without fully understanding the differences in material quality,

durability, and aesthetic appeal. In addition, the concept of investment in

long-lasting, premium rugs is not yet fully ingrained in Indian consumer

culture. Many consumers still prioritize short-term affordability over

long-term quality, which affects the demand for high-end, handcrafted rugs.

This limited understanding can be attributed to a lack of awareness about the

intricate craftsmanship and cultural heritage associated with traditional

rug-making practices, which often go unnoticed in a market dominated by

cheaper, mass-produced alternatives. Manufacturers and retailers must invest in

educating consumers about the benefits of investing in quality, eco-friendly

rugs, emphasizing their sustainability, design uniqueness, and long-term value.

A lack of awareness also impacts the export potential of Indian-made rugs, as

foreign buyers may not always recognize the high-quality craftsmanship or value

of Indian rugs compared to other countries' offerings.

Key Market Trends

Eco-Friendly

and Sustainable Rugs

Sustainability has become a central theme in the

Indian decorative rug market, as consumers increasingly prioritize eco-friendly

products. With growing concerns about the environmental impact of consumer

goods, many buyers are turning toward rugs made from natural, biodegradable

materials such as wool, cotton, jute, and hemp. These materials are seen as

more environmentally responsible compared to synthetic options, which can have

a long-lasting negative impact on the planet. The demand for such rugs has been

fueled by a rising awareness of climate change and a shift in consumer

behavior, especially among environmentally conscious urban dwellers. The demand

for sustainable rugs has not only increased within urban regions but also in

areas with a growing middle class that is more attuned to global sustainability

concerns. Manufacturers are responding to this trend by offering eco-friendly

rugs that emphasize not just sustainable materials but also ethical production

processes, including fair trade practices and the use of natural dyes.

Additionally, the longevity and durability of these products have appealed to

consumers looking for long-lasting investments, rather than opting for cheaper,

mass-produced alternatives that need frequent replacement.

Growth

of E-Commerce

E-commerce has become a dominant force in the Indian

decorative rug market, transforming how consumers shop for home decor. India's e-commerce sector is

poised to become the world's second-largest by 2034, with a projected annual

gross merchandise value of USD 350 billion by 2030. This expansion is fueled by

rising internet penetration, evolving consumer preferences, and advancements in

logistics infrastructure. The rise of online shopping platforms, including

large-scale e-commerce giants and specialized home decor websites, has made it

easier for consumers to access a wide variety of rugs from across the country

and even internationally. This trend has been accelerated by increasing

internet penetration and the growing use of smartphones, which has made online

shopping more accessible, particularly in smaller cities and towns. E-commerce

allows consumers to compare prices, styles, materials, and reviews before making

a purchase, providing a more informed shopping experience. Online platforms

also offer the convenience of home delivery, enabling buyers to easily shop

from the comfort of their homes. The flexibility of choosing from an extensive

range of designs, sizes, and colors has contributed to the popularity of online

rug shopping, as consumers seek greater variety than what is typically

available in physical retail stores. The ease of access to international brands

and global design trends has also fueled demand for imported and unique rug

styles that were previously not available in local markets. As e-commerce

continues to grow, it is expected to account for an even larger share of the

market, with manufacturers and retailers investing in digital marketing and

user-friendly online stores to capture this expanding customer base.

Customization

and Personalization

As consumers seek to make their living spaces reflect

their individual tastes and styles, customization has become an increasingly

important trend in the Indian decorative rug market. More buyers are turning to

personalized rugs that match their specific needs and preferences, such as

choosing particular colors, patterns, sizes, and even materials. This trend is

particularly strong in urban areas, where home decor is often seen as a

reflection of personal identity. Manufacturers are responding by offering greater

flexibility in design, allowing consumers to create bespoke rugs that align

with their home’s aesthetic and their personal tastes. Online platforms have

made it easier for consumers to engage in the customization process, often

providing interactive tools that allow buyers to visualize their chosen

designs. Some companies even offer monogramming or embroidery services for a

truly one-of-a-kind rug. This trend towards personalized products also ties

into the broader rise of consumer demand for individuality in home decor, where

mass-market products are often less appealing due to their ubiquity. The desire

for personalization has led to increased competition among manufacturers, who

must find innovative ways to differentiate their offerings and cater to the

specific needs of a more discerning consumer base.

Machine-Made

Rugs and Affordability

While handmade rugs continue to hold cultural and

aesthetic value, the growing demand for machine-made rugs has reshaped the

market dynamics, particularly in terms of affordability and production

efficiency. Machine-made rugs, often crafted from synthetic fibers like

polyester and polypropylene, are less expensive to produce and more affordable

for budget-conscious consumers. The use of synthetic materials also makes these

rugs easier to maintain, as they are resistant to stains, fading, and wear. As

disposable incomes rise and more people seek affordable home decor options,

machine-made rugs have gained popularity, especially in smaller towns and less

affluent regions. These rugs can be mass-produced quickly, allowing

manufacturers to meet the high demand for affordable options. The increasing

availability of affordable, machine-made rugs has led to a democratization of

home decor, as more consumers can now access stylish, durable, and

low-maintenance rugs at accessible price points. While machine-made rugs are

often perceived as less luxurious than handmade options, advances in

manufacturing technology have allowed these products to mimic the appearance

and feel of higher-end rugs, offering consumers a balance of affordability and

style. This trend is expected to continue as more consumers in India look for

functional, budget-friendly home decor solutions without compromising on

design.

Technological

Innovations in Rug Production

Technological advancements in rug manufacturing have

introduced new possibilities for design, production speed, and

cost-effectiveness. The use of computer-aided design (CAD) software and

automated weaving machines has revolutionized how rugs are made, allowing for

greater precision and more intricate patterns than ever before. These

technologies also reduce production time and costs, enabling manufacturers to

meet growing demand more efficiently. Digital printing has emerged as another

key innovation, enabling manufacturers to produce high-resolution designs and

more complex patterns on rugs, further expanding creative possibilities. With

digital printing, manufacturers can offer custom-made rugs with unique designs

that might have been costly and time-consuming to create with traditional

techniques. Additionally, these technological advancements have improved the

durability and colorfastness of rugs, making them more resistant to fading and

wear. The ability to produce high-quality rugs more efficiently at a lower cost

has also made it possible to offer machine-made rugs that resemble handcrafted

ones, providing consumers with affordable yet aesthetically pleasing options.

Segmental Insights

Application

Insights

The residential segment dominated the

Indian decorative rug market, driven by growing consumer interest in home decor

and interior design. With rising disposable incomes, particularly in urban

areas, homeowners are increasingly investing in decorative rugs to enhance the

aesthetic appeal and comfort of their living spaces. As interior design trends

evolve, consumers are seeking unique, high-quality rugs that complement their

home decor. Additionally, the rise in home renovation projects and the increasing

focus on personalized living spaces further fuel demand. The residential sector

remains the primary driver of market growth, outpacing the commercial segment

in terms of sales and overall demand.

Download Free Sample Report

Regional Insights

The North region of India holds a dominant position in

the decorative rug market, driven by high consumer spending power,

urbanization, and a growing demand for home decor. Major cities like Delhi,

Chandigarh, and Jaipur contribute significantly to this market, with consumers

in these areas increasingly investing in stylish, premium-quality rugs to

enhance their homes. The North's strong middle and upper-middle-class

population, coupled with a flourishing real estate and interior design sector,

further fuels demand. Additionally, the region's proximity to manufacturing

hubs in areas like Panipat, known for its rug production, strengthens its

position in the overall market.

Recent Developments

- In 2023, Jaipur Rugs launched the third

edition of its annual event, Rug Utsav, showcasing over 1,000 new handcrafted

rug designs. The event highlights the company's commitment to promoting

traditional craftsmanship while catering to modern tastes.

- Jaipur Rugs is launching three new

collections at Salone del Mobile 2024, including collaborations with Vimar1991,

Michele De Lucchi, and DAAA Haus. The collections blend Indian craftsmanship

with Italian design aesthetics, showcasing contemporary patterns and textures.

The new pieces reflect innovation in modern carpet-making, drawing from

traditional influences while offering fresh, artistic designs.

Key Market Players

- Jaipur Rugs Company Pvt. Ltd.

- Maa

Collections

- The Rug Republic

- Kaleen India

- Saraswati Global Pvt. Ltd

- Yak Carpet Private Limited

- M.A. Trading, Inc.

- Dhurrie Store

- Underfoot Solutions Private Limited (Villedomo)

- Saif Handmade Carpets LLP

|

By Product Type

|

By Application

|

By Distribution

Channel

|

By Region

|

- Machine-Made Rugs

- Hand-tufted Rugs

- Hand-knotted Rugs

- Others

|

|

|

|

Report Scope:

In this report, the India Decorative Rug Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- India Decorative Rug Market,

By Product Type:

o Machine-Made Rugs

o Hand-tufted Rugs

o Hand-knotted Rugs

o Others

- India Decorative Rug Market,

By Application:

o Residential

o Commercial

- India Decorative Rug Market,

By Distribution Channel:

o Online

o Offline

- India Decorative Rug Market,

By Region:

o North

o South

o East

o West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents

in the India Decorative Rug Market.

Available Customizations:

India Decorative Rug Market report with the given

market data, TechSci Research offers customizations according to a company's

specific needs. The following customization options are available for the

report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Decorative Rug Market is an upcoming report

to be released soon. If you wish an early delivery of this report or want to

confirm the date of release, please contact us at [email protected]