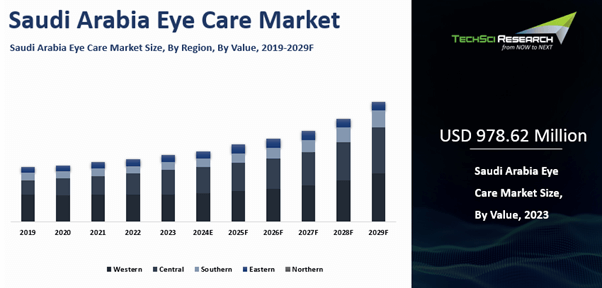

Forecast Period | 2025-2029 |

Market Size (2023) | USD 978.62 Million |

Market Size (2029) | USD 1536.83 Million |

CAGR (2024-2029) | 7.77% |

Fastest Growing Segment | Eye Drops |

Largest Market | Western Region |

Market Overview

Saudi

Arabia Eye Care Market was valued at USD 978.62 Million in 2023 and is expected to reach USD 1536.83 Million by 2029 with a CAGR of 7.77% during the forecast period.

The Saudi

Arabia Eye Care Market is driven by several key factors. Rising prevalence of

eye disorders, including dry eye, glaucoma, and diabetic retinopathy, due to

increasing diabetes and aging population fuels demand for eye care solutions.

Urbanization and excessive screen time contribute to higher cases of digital

eye strain, further propelling market growth. Advances in technology and the

introduction of innovative treatments enhance diagnostic and therapeutic

options, attracting more consumers. The government’s healthcare initiatives and

investments in modern facilities also support market expansion. Increasing

public awareness and preventive eye care measures drive demand for regular eye

check-ups and advanced treatments. As the healthcare infrastructure improves

and disposable incomes rise, the market for eye care products and services is

expected to continue growing robustly.

Download Free Sample Report

Key Market Drivers

Rising Prevalence of Eye Disorders

The growing prevalence of eye disorders in Saudi Arabia is a key driver of its eye care market, mirroring global trends of increasing eye health concerns. Conditions such as dry eye syndrome, glaucoma, cataracts, diabetic retinopathy, and macular degeneration are becoming more common, primarily due to lifestyle changes, an aging population, and the rising burden of chronic diseases like diabetes.

Dry eye syndrome is escalating as prolonged screen time leads to reduced blinking and greater exposure to environmental irritants. Age-related disorders such as glaucoma and cataracts are also increasing, while diabetic retinopathy reflects the country’s growing diabetes epidemic. Similarly, macular degeneration, linked to aging, is contributing to higher rates of vision loss.

A study titled “Prevalence and Causes of Visual Impairment among Saudi Adults Attending Primary Health Care Centers in Northern Saudi Arabia” surveyed 620 adults aged 18 and above. Of the 617 examined, 43.6% were female, with a mean age of 38.6 years. The study reported a 13.9% prevalence of visual impairment (95% CI: 11.4%-16.9%). Major causes included refractive errors (36%), cataracts (29.1%), and diabetic retinopathy (20.9%), while glaucoma was least common (5.8%). Factors associated with visual impairment included age (P<.05), gender (P<.001), and prior eye injury (P<.05).

Rising eye disease prevalence underscores the need for advanced diagnostics and treatments. Technologies such as Optical Coherence Tomography (OCT) and fundus cameras now enable detailed retinal imaging for early and accurate diagnosis. Meanwhile, new therapies ranging from next-generation anti-glaucoma drugs to femtosecond laser-assisted cataract surgery (FLACS) are enhancing precision, improving outcomes, and shortening recovery times. These advancements collectively support Saudi Arabia’s growing focus on modern, technology-driven eye care.

Technological Advancements in Eye Care

Technological advancements are a major force driving the Saudi Arabia eye care market, transforming how eye diseases are diagnosed and treated. The adoption of advanced technologies is enhancing diagnostic precision, treatment effectiveness, and overall patient outcomes.

One of the most significant developments is high-resolution imaging. Optical Coherence Tomography (OCT) provides detailed cross-sectional images of the retina, crucial for detecting and monitoring macular degeneration, diabetic retinopathy, and glaucoma. By capturing subtle structural changes, OCT enables early diagnosis that traditional methods might miss; its advanced form, OCTA, is used in Saudi-based studies to detect early microvascular changes in diabetic patients before vision is affected. Likewise, advanced retinal cameras deliver high-quality retinal photographs, supporting comprehensive assessments. As part of the national telemedicine program, 20 of the country's 31 level-3 neonatal intensive care units are equipped with wide-field digital retinal cameras to screen for retinopathy of prematurity.

Surgical innovations have also redefined eye care. Laser-based techniques such as LASIK and femtosecond laser-assisted cataract surgery have improved both precision and safety. LASIK effectively corrects refractive errors like myopia, hyperopia, and astigmatism with minimal downtime. Femtosecond lasers allow for precise lens fragmentation in cataract surgery, reducing manual intervention and recovery time. This procedure was introduced at King Khaled Eye Specialist Hospital in December 2012, and a study at the hospital reported no cases of capsular block syndrome, a known complication.

Another transformative area is robotic-assisted surgery. Equipped with high-definition imaging and advanced control systems, robotic tools enable unparalleled precision in delicate eye operations like retinal detachment repairs or complex lens replacements. Systems like the da Vinci robot are used at major centers such as Johns Hopkins Aramco Healthcare and King Faisal Specialist Hospital and Research Center. The latter institution achieved a world-first by performing a fully robotic heart transplant, demonstrating the high level of precision available in the Kingdom.

Collectively, these innovations spanning imaging, laser, and robotic technologies are propelling Saudi Arabia’s eye care sector toward a new era of accuracy, safety, and efficiency, ensuring improved vision outcomes and higher patient satisfaction across the nation.

Aging

Population

The aging population in Saudi Arabia is a key driver of the expanding eye care market, as the growing number of older adults significantly increases demand for eye care products and services. The number of individuals aged 60 and over is projected to increase fivefold between 2020 and 2050, from 2 million to 10.5 million. With advancing age, individuals are more prone to developing eye conditions such as presbyopia, cataracts, and age-related macular degeneration (AMD), which are fueling market growth.

Presbyopia, marked by the gradual loss of near-focusing ability, affects nearly everyone over 40, creating sustained demand for reading glasses and bifocals. A population-based survey in Saudi Arabia revealed that a significant number of adults were not aware of presbyopia, and among 785 participants, there was a notable prevalence of uncorrected presbyopia. This creates a sustained demand for corrective lenses.

Cataracts, characterized by the clouding of the eye’s natural lens, are the leading cause of blindness in Saudi Arabia. This has driven the need for cataract surgeries; a study at King Khaled Eye Specialist Hospital reviewed 1,520 cataract extraction procedures performed over a six-month period. However, the adoption of immediate sequential bilateral cataract surgery remains low, with one survey indicating that only a small fraction of ophthalmologists in the country perform the procedure.

AMD, one of the leading causes of vision loss in older adults, primarily impacts central vision. A retrospective review of 3,067 individuals at King Abdulaziz University Hospital in Jeddah found a notable prevalence of AMD among patients. Managing AMD requires advanced diagnostics and therapies, including injections and laser treatments.

As Saudi Arabia’s elderly population continues to grow, a larger share of citizens will be susceptible to such conditions, creating sustained demand for specialized eye care solutions. The ophthalmologist-to-population ratio was 1 to 13,500 in 2021, indicating a growing need for services. Regular eye check-ups are crucial for early detection, yet one study found that only one-third of respondents received them regularly. Consequently, the country is witnessing increased demand for diagnostic services, specialized clinics, and personalized care to address the needs of its aging population.

Government

Initiatives and Healthcare Investments

Government initiatives and investments in

healthcare infrastructure play a crucial role in driving the eye care market in

Saudi Arabia. The Saudi government’s commitment to improving healthcare

services, as outlined in Vision 2030, includes significant investments in

modernizing healthcare facilities and expanding access to advanced medical

technologies. Initiatives such as the National Health Strategy and various

public health campaigns promote the adoption of cutting-edge eye care solutions

and support the development of specialized eye care centers. These investments

facilitate the availability of high-quality eye care services and products,

thereby driving market growth. Government support for healthcare innovation and

infrastructure development ensures that the eye care market continues to evolve

and expand.

Key Market Challenges

Limited Access to Eye Care Services in Rural Areas

One of the significant challenges facing the Saudi

Arabia eye care market is the limited access to eye care services in rural and

remote areas. While urban centers, particularly major cities like Riyadh and

Jeddah, benefit from advanced eye care facilities and specialized clinics,

rural regions often lack adequate infrastructure and resources. This disparity

creates a gap in access to essential eye care services, including routine eye

examinations, treatments, and surgeries. The shortage of qualified ophthalmologists

and eye care professionals in these areas exacerbates the issue. Patients in

rural areas may face long travel distances, resulting in delayed diagnoses and

treatments for eye conditions. Addressing this challenge requires targeted

efforts to expand eye care services to underserved regions, including mobile

eye clinics, telemedicine solutions, and partnerships with local healthcare

providers to improve access and ensure equitable eye care across the country.

High Cost of Advanced Eye Care Treatments

The high cost of advanced eye care treatments

presents a significant challenge for the Saudi Arabia eye care market. While

technological advancements have led to the development of innovative diagnostic

and therapeutic solutions, these high-tech treatments often come with

substantial costs. Procedures such as laser eye surgery, advanced retinal

treatments, and specialized diagnostic tests can be prohibitively expensive,

creating financial barriers for many patients. The cost of cutting-edge

equipment and the need for ongoing maintenance and updates contribute to the

overall expense of eye care services. This issue is compounded by the

variability in insurance coverage and reimbursement policies, which can affect

patients' ability to afford necessary treatments. To address this challenge,

there is a need for more affordable treatment options, improved insurance

coverage, and financial assistance programs to make advanced eye care

accessible to a broader population.

Key Market Trends

Growth in Medical Tourism

The rise of medical tourism in Saudi Arabia is a major catalyst for the eye care market, showcasing the nation’s growing status as a hub for specialized eye treatments. This growth is driven by the country’s advanced healthcare infrastructure, cutting-edge technologies, and strong commitment to high-quality medical services. Modern hospitals and clinics across Saudi Arabia are now equipped with state-of-the-art diagnostic tools and surgical systems, offering everything from routine eye exams to complex surgeries.

The integration of advanced technologies such as high-resolution imaging, laser-based surgical tools, and innovative therapeutic devices has significantly improved precision, safety, and treatment outcomes, attracting international patients seeking superior care. In November 2022, Abdulla Fouad Group, in partnership with Dividend Gate Capital Group (DGC), acquired a majority stake in Al-Hokama Eye Specialist Center, a leading institution known for its advanced expertise in ophthalmology. This acquisition aligns with Saudi Vision 2030, underscoring the health sector’s strategic importance, which ranks second only to education in national expenditure.

Saudi Arabia’s investment in next-generation technologies like Optical Coherence Tomography (OCT), femtosecond laser cataract surgery, and robotic-assisted operations has positioned it as a regional leader in ophthalmology. These advancements enable more accurate diagnoses and minimally invasive procedures, drawing patients from neighboring and international markets. The country’s medical facilities have also earned global accreditations, assuring world-class care.

Highly trained ophthalmologists many with international experience further enhance Saudi Arabia’s appeal as a trusted medical destination. The growing influx of foreign patients boosts demand for advanced diagnostics, surgeries, and postoperative care. In turn, this rising demand fuels continuous innovation and expansion within the nation’s eye care ecosystem, cementing Saudi Arabia’s reputation as a premier global destination for advanced eye treatment.

Expansion of Retail and Online Channels

The expansion of retail and online channels is a major factor driving the growth of the Saudi Arabia eye care market, improving accessibility and availability of products across the country. Traditionally, pharmacies and optical stores have been the primary sources for eye care solutions, but both have significantly evolved in recent years. Pharmacies are broadening their offerings beyond basic items like eye drops and lubricants to include prescription lenses and specialized diagnostic tools. Meanwhile, optical stores now provide comprehensive eye care services such as eye examinations, contact lens fittings, and an extensive range of eyewear. The growing presence and specialization of these outlets are making eye care products and services more accessible, thereby fueling market expansion.

At the same time, online channels have revolutionized purchasing behavior by bringing greater convenience and variety to consumers. The rapid growth of e-commerce platforms enables people to order contact lenses, vision correction aids, and other eye care products from the comfort of their homes. This shift is particularly valuable in Saudi Arabia, where long distances and varying access to retail outlets can limit in-person shopping.

E-commerce platforms enhance consumer experience through detailed product descriptions, customer reviews, and comparison tools, empowering buyers to make informed choices. They also offer a broader selection of brands and specialty products that may not be available locally. The combination of expanding retail networks and the surge in online shopping is reshaping the Saudi eye care market making products easier to access, increasing competition, and driving consistent growth across both urban and remote regions.

Segmental Insights

Product Type Insights

Based on the Product Type, eye

drops are the dominant product segment. This predominance is driven by a

combination of rising prevalence of eye disorders, increasing awareness of eye

health, and the growing accessibility of eye care solutions. Eye drops serve a

wide range of purposes, including the management of dry eye syndrome, relief

from allergic reactions, and treatment of conditions like glaucoma and

conjunctivitis. The versatility of eye drops, combined with their ease of use

and effectiveness, makes them a preferred choice for many patients and

healthcare providers.

The market for eye drops is bolstered by the increasing

incidence of conditions that require regular application of these products. For

instance, the prevalence of dry eye syndrome, exacerbated by factors such as

prolonged screen time and environmental conditions, has led to a surge in

demand for lubricating and moisturizing eye drops. The treatment of chronic conditions

like glaucoma necessitates the use of therapeutic eye drops to manage

intraocular pressure and prevent disease progression.

The growing awareness of

eye health among the Saudi population contributes significantly to the

dominance of eye drops in the market. As more individuals become informed about

the importance of maintaining good eye health and the benefits of timely

treatment, the demand for eye care products, including eye drops, has

increased. Educational campaigns and health initiatives aimed at promoting eye

care and encouraging regular eye exams have further amplified the use of eye

drops, as patients are more likely to seek out and utilize these products for

both preventive and therapeutic purposes.

The accessibility of eye drops

through various retail channels also plays a crucial role in their market

dominance. Eye drops are readily available in pharmacies, optical stores, and

online platforms, making them easily accessible to consumers. The growth of

e-commerce and online shopping has particularly enhanced the convenience of

purchasing eye drops, allowing individuals to obtain these products quickly and

discreetly. This widespread availability ensures that patients can easily

access the necessary eye care solutions without significant effort or delay.

Coating Insights

Based on the Coating, UV

protection is the dominant segment when compared to anti-glare products. This

dominance is primarily due to the critical need to safeguard eyes from the

harmful effects of ultraviolet (UV) radiation, which is prevalent in the

region's intense sunlight and high temperatures. UV protection is essential

because of Saudi Arabia’s geographical location, which subjects the population

to high levels of UV radiation from the sun. Prolonged exposure to UV rays can

lead to a variety of eye problems, including cataracts, macular degeneration,

and photokeratitis.

This makes UV-blocking eyewear and lenses particularly

important in protecting eye health and preventing long-term damage. The high

prevalence of such conditions due to UV exposure drives significant demand for

eyewear that incorporates UV protection features. This includes sunglasses,

prescription glasses with UV coatings, and lenses designed specifically to

filter UV rays.

Increased awareness of UV

damage is contributing to the growing preference for UV-protective eyewear.

Public health campaigns and educational initiatives have heightened awareness

about the risks associated with UV exposure, leading to a greater emphasis on

eye protection. As people become more informed about the dangers of UV rays and

the benefits of protective eyewear, they are more inclined to invest in

products that offer comprehensive UV protection. This shift in consumer

behavior is driving the growth of UV protection products in the eye care

market. Technological advancements in UV protection are also playing a role in

the segment's dominance.

Modern lens technologies, such as advanced UV-blocking

coatings and high-quality lens materials, provide enhanced protection against

UV radiation. These innovations ensure that eyewear offers superior defense

against harmful UV rays without compromising on comfort or optical clarity. As

a result, consumers are increasingly opting for eyewear products that feature

these advanced UV protection technologies. Regulatory and industry standards

further support the prominence of UV protection in the market. Eyewear

manufacturers and optical retailers are adhering to strict standards for UV

protection to ensure that their products meet safety requirements. Compliance

with these regulations not only boosts consumer confidence but also drives

market growth as consumers seek out products that are certified for UV

protection.

Download Free Sample Report

Regional Insights

In the Saudi Arabia eye care market, the Western

Region is the dominant. This region's prominence is largely due to its

significant economic activity, high population density, and the presence of key

healthcare infrastructure and facilities. The Western Region, which includes

major cities such as Jeddah and Makkah, is home to a substantial portion of

Saudi Arabia's population. Jeddah, as a major urban center, serves as a

commercial and cultural hub, drawing people from various parts of the country

and beyond. This high population density translates into a substantial demand

for eye care products and services, including comprehensive eye examinations,

advanced diagnostic tools, and specialized treatments.

Economic factors play a

crucial role in the dominance of the Western Region. Jeddah's economic

landscape is bolstered by its strategic location as a port city and a gateway

to the Islamic holy cities of Makkah and Madinah. This economic prosperity

translates into higher disposable incomes and greater spending capacity for

health-related services, including eye care. The affluent population in this

region is more likely to invest in quality eye care solutions, such as premium

eyewear and advanced treatments, driving the growth of the market.

Healthcare infrastructure in the Western Region is

also a significant factor. The region boasts several well-established

hospitals, clinics, and specialized eye care centers. Institutions like King

Abdulaziz University Hospital in Jeddah and specialized eye care centers offer

state-of-the-art facilities and comprehensive services, contributing to the

region's dominance in the eye care market. The concentration of high-quality

healthcare facilities attracts patients seeking specialized eye treatments and

advanced diagnostic services. The presence of medical tourism in the Western

Region further supports its leading position in the eye care market. Jeddah and

Makkah are key destinations for medical tourism, with patients from within the

region and internationally seeking advanced eye care treatments. The influx of

medical tourists seeking specialized eye care services enhances the market

demand and stimulates the growth of eye care products and services in the

region.

Recent Developments

- In May 2025, In the broader eye care sector, Saudi-based MAGRABi Retail Group announced the acquisition of Kuwait's Kefan Optics. This deal, pending regulatory approval, is part of MAGRABi's strategy to expand its eye care and eyewear network across the Middle East.

- In July 2024, The MAGRABi Retail Group announced an ambitious expansion plan to open 36 new "Doctor M" eyewear stores across Saudi Arabia. This move is aimed at increasing access to vision care and eyewear products throughout the country.

- In October 2024, At the Global Health Exhibition in Riyadh, Philips unveiled a range of new HealthTech innovations, including AI-powered diagnostic tools for eye care. These technologies are designed to enhance diagnostic accuracy and support the digital transformation of the healthcare sector.

- In May 2024, Alcon, officially opened its Middle

East headquarters in Jeddah, Saudi Arabia. Alongside this, the company has

announced a new partnership with the Saudi Society of Optometry. These

milestones underscore Alcon's commitment to shaping the future of eye care in

Saudi Arabia and the broader region, as well as advancing educational and

career development opportunities for Saudi professionals.

- In January 2024, Lenskart, launched its third store

in Riyadh, Saudi Arabia, marking its largest outlet in the region so far. This

expansion strengthens Lenskart's presence in the Middle East, aiming to capture

a share of the affluent consumer base in the area. The new store follows the

opening of Lenskart’s second Riyadh location at Salaam Mall earlier this

January, which offers a similar range of brands and products. By increasing its

store footprint in Riyadh, Lenskart is strategically positioning itself to

cater to the growing demand for eye care solutions in the region.

Key Market Players

- Johnson and Johnson Medical Saudi Arabia Limited

- AbbVie Biopharmaceuticals GmbH

- Novartis Saudi Arabia

- Pfizer Saudi Limited Corporate

- Saudi Services & Health CARE Co. Ltd.

|

By Product Type

|

By Coating

|

By Lens Material

|

By Distribution Channel

|

By Region

|

- Eyeglasses

- Contact Lens

- Intraocular Lens

- Eye Drops

- Eye Vitamins

- Others

|

|

- Normal Glass

- Polycarbonate

- Trivex

- Others

|

- Retail Stores

- E-Commerce

- Clinics

- Hospitals

|

- Western Region

- Central Region

- Southern Region

- Eastern Region

- Northern Region

|

Report Scope:

In this report, the Saudi Arabia Eye Care Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- Saudi Arabia Eye Care Market, By Product Type:

o Eyeglasses

o Contact Lens

o Intraocular Lens

o Eye Drops

o Eye Vitamins

o Others

- Saudi Arabia Eye Care Market, By Coating:

o Anti-Glare

o UV

o Others

- Saudi Arabia Eye Care Market, By Lens Material:

o Normal Glass

o Polycarbonate

o Trivex

o Others

- Saudi Arabia Eye Care Market, By Distribution Channel:

o Retail Stores

o E-Commerce

o Clinics

o Hospitals

- Saudi Arabia Eye Care Market,

By Region:

o Western Region

o Central Region

o Southern Region

o Eastern Region

o Northern Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the Saudi Arabia Eye Care Market.

Available Customizations:

Saudi Arabia Eye Care Market report with the

given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Saudi Arabia Eye Care Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]