|

Forecast

Period

|

2025-2029

|

|

Market

Size (2023)

|

USD

86.27 Million

|

|

CAGR

(2024-2029)

|

4.85%

|

|

Fastest

Growing Segment

|

Patch

Pumps

|

|

Largest

Market

|

Southern

Vietnam

|

|

Market

Size (2029)

|

USD

113.32 Million

|

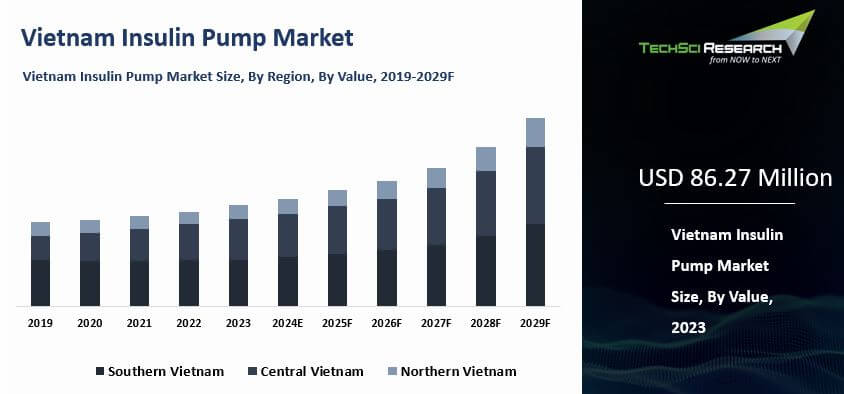

Market Overview

Vietnam Insulin Pump Market was valued at USD

86.27 Million in 2023 and is expected to reach USD

113.32 Million by 2029 with a CAGR of 4.85% during the forecast period.

An insulin pump is a healthcare device employed for

dispensing insulin into the patient for management of diabetes mellitus, also

referred to as uninterrupted subcutaneous insulin management. A traditional

insulin pump mainly comprises of three components which include a processing

module, a disposable reservoir for insulin, and a disposable infusion set for

subcutaneous insertion. Conventional insulin pumps deliver insulin from a

reservoir inside the pump through tubing to a site on the skin that is linked

to a smaller pliable plastic tube (cannula). In contrast, insulin patch pumps

employ a pliable plastic tube under the skin, but the insulin delivery

reservoir and the cannula are integrated into a single "pod" that

adheres to the skin with an adhesive patch.

According to a 2020 survey conducted in 37 countries, including Vietnam, pumps were the most common method used by doctors to administer insulin to patients, after syringes and insulin pens. According to the Ministry of Health, the diabetic population in Vietnam reached nearly 5 million in 2021, accounting for approximately 7.1% of the total adult population. Moreover, approximately 29,000 patients die due to diabetes in Vietnam every year. The insulin pump market has showcased a notable growth over recent years, which can be ascribed to certain factors. Increase in prevalence of diabetes, growth in

technological advancements associated with function of insulin pumps and rise

in product launches related to diabetic care with FDA approval are anticipated

to register an impressive growth to Vietnam Insulin Pump Market in the forecast

period.

Key Market Drivers

Increase in Prevalence of Diabetes

Diabetes is a persistent medical condition that arises when

the pancreas fails to produce enough insulin or when the body is unable to use the insulin it produces efficiently. Insulin is a

hormone that regulates the level of glucose in the bloodstream. Diabetes can be

broadly categorized into three types which include Type 1 diabetes, Type 2

diabetes, and gestational diabetes. Individuals suffering from diabetes are

vulnerable to infections caused by elevated blood sugar levels, weakened immune

system, circulatory complications, and other concurrent conditions like high

blood pressure, abnormal lipid metabolism, and cardiovascular diseases.

Diabetes has the possibility to become an epidemic and consequently, impose

significant public health and financial burden in Vietnam. Although the incidence of diabetes in remote areas remains relatively low,

it is increasing. In prominent urban centers, diabetes is as prevalent as in

other Western societies. A national survey was conducted in Vietnam in 2022

based on risk factors associated with type 2 diabetes and prediabetes mellitus.

In this cross-sectional study, a total of 5244 individuals aged between 30 to

69 years old were enrolled.

The National Hospital of Endocrinology, Vietnam

took blood samples from all participants to measure their fasting blood glucose

level and conducted a 2-hour post load oral glucose tolerance test. It was

observed that male participants aged 50 to 59 years old with hypertension and

WHR risk had a higher prevalence of prediabetes. Diabetes was found to have a

significant association with participants having hypertension. The study found

that 17.9% of the participants had prediabetes and 7.3% had diabetes. The mean

age of the participants was 49.62 ± 0.15 years, and more than half were female (52.0%) and had completed secondary education through high school. Among men, 23.7% were overweight or obese, and 6.6% were underweight, which was higher than the corresponding figures for women (19.9% overweight or obese and 5.0% underweight).

The WHR risk was lower among male participants (20.2%)

than female participants (88.4%). The prevalence of hypertension was 38.5%

among male participants and 26.8% among female participants. The proportion of

male participants with prediabetes and diabetes were 7.2% and 6.4%,

respectively, while the corresponding figures for female participants were 6.2%

and 4.5%. Insulin pumps can dispense minute quantities of insulin on a regular basis (basal) or a bolus dose near mealtime to regulate spikes in blood glucose (blood sugar) levels after meals.

This mode of delivery mirrors the body's natural release of insulin. The

insulin pump can be synchronized with a continuous glucose monitor (CGM) to

gain insight into how blood glucose levels change and adjust the insulin dose accordingly in certain scenarios.

Download Free Sample Report

Technological Advancements

Due to advances in technologies such as continuous glucose monitors, traditional insulin pumps are becoming more intelligent devices that can automate insulin

administration. The desire to create closed-loop systems has led to numerous collaborations between insulin pump and CGM manufacturers. Presently,

Medtronic is at the forefront with its 780G system, an

"advanced hybrid closed loop" system. This system enables Medtronic

pumps to receive information from linked Medtronic CGMs and adjust their

insulin distribution independently. In 2022, Insulet announced that the FDA authorized its Omnipod 5 Automated Insulin Delivery System for individuals aged 6 years and older with type 1 diabetes. Omnipod 5, the first tubeless automated insulin delivery system, integrates with the Dexcom G6

Continuous Glucose Monitoring (CGM) System and smartphone management to

automatically regulate insulin levels and prevent hyperglycemia and

hypoglycemia. Moreover, Tandem Diabetes Care obtained FDA approval for bolus insulin dosing on the t:slim X2 insulin pump via the t:connect mobile

application in mid-February 2022. This achievement marked the first

FDA-approved smartphone app that can initiate insulin administration on iOS and Android.

Rising Demand for Personalized

Diabetes Management

The growing demand for personalized diabetes management is a key driver of the insulin pump market in Vietnam. As healthcare shifts toward more individualized care, diabetic patients are increasingly seeking tailored treatment options to better manage their condition. Insulin pumps offer a sophisticated solution, providing continuous insulin delivery that can be adjusted based on individual needs, lifestyle, and glucose levels. This customization allows for improved blood sugar control and a reduction in complications, especially for individuals with type 1 diabetes. Personalized diabetes management is also supported by technological advancements such as continuous glucose monitoring (CGM) systems, which provide real-time data on blood glucose levels. Insulin pumps integrated with CGM allow for automated insulin adjustments, making it easier for patients to manage their diabetes without constant monitoring. As awareness of the benefits of personalized care grows, there is a rising preference for insulin pumps over traditional insulin delivery methods. This trend is also fueled by the increasing access to advanced medical devices among Vietnam’s growing middle class, which is willing to invest in personalized healthcare solutions.

Key Market Challenges

Limited Awareness and Accessibility

Limited awareness and accessibility pose significant

barriers to the growth of the insulin pump market in Vietnam. Firstly, a lack

of awareness among healthcare professionals and patients about insulin pumps hampers the adoption of this advanced diabetes management technology. Without

adequate knowledge of the benefits and features of insulin pumps, healthcare providers may not recommend them as a treatment option, and patients may not actively seek them out. Additionally, limited accessibility to

insulin pumps further exacerbates this issue, particularly in rural or remote

areas where healthcare infrastructure may be underdeveloped. The lack of specialized diabetes care centers and trained healthcare professionals capable of supporting insulin pump therapy limits patients' access to these devices.

Moreover, the high cost of insulin pumps presents an affordability barrier for

many individuals, further limiting accessibility.

High Cost

The high cost of insulin pumps poses a significant impediment to market growth in Vietnam. Affordability is a critical

factor influencing the adoption of insulin pump therapy, particularly in a

country where healthcare expenses can place a considerable financial burden on

individuals and families. The upfront cost of purchasing an insulin pump, along

with ongoing expenses for supplies, maintenance, and training, may be

prohibitive for many patients, especially those from lower-income backgrounds.

Moreover, limited insurance coverage and reimbursement options for insulin

pumps further exacerbate the financial barrier, forcing patients to bear the

full cost out of pocket. As a result, individuals with diabetes may opt for

less expensive treatment alternatives, such as insulin injections or oral

medications, despite the potential benefits of insulin pump therapy in terms of

improved glycemic control and quality of life.

Key Market Trends

Telemedicine and Remote Monitoring

Telemedicine and remote monitoring hold significant

potential to positively influence the growth of the insulin pump market in

Vietnam. As the country faces challenges in healthcare access and infrastructure, telemedicine platforms can help bridge the gap by enabling remote

consultations between patients and healthcare providers. This allows

individuals with diabetes, including those in rural or underserved areas, to

access specialized care and guidance regarding insulin pump therapy without the

need for in-person visits to healthcare facilities. Moreover, remote monitoring

technologies integrated with insulin pumps enable continuous tracking of

glucose levels and treatment adherence, empowering healthcare providers to

remotely monitor patients' progress and intervene proactively in case of any

issues.

This not only improves patient safety and outcomes but also enhances

the efficiency of diabetes management by reducing the need for frequent clinic

visits and hospitalizations. By leveraging telemedicine and remote monitoring

solutions, healthcare providers can extend the reach of diabetes care, increase

patient engagement, and ultimately drive the adoption of insulin pump therapy

as a preferred treatment option for individuals with diabetes in Vietnam. However,

ensuring reliable internet connectivity and promoting digital literacy among

both patients and healthcare professionals will be essential to realize the

full potential of these technologies in advancing diabetes care across the

country.

Focus on Continuous Glucose Monitoring

(CGM) Integration

The focus on continuous glucose monitoring (CGM)

integration is poised to significantly influence the growth of the insulin pump

market in Vietnam. CGM technology provides real-time insights into glucose

levels, enabling more precise, timely adjustments to insulin therapy, which can lead to better glycemic control and a reduced risk of complications. By

integrating CGM functionality into insulin pump systems, manufacturers offer

users a seamless and comprehensive solution for diabetes management. This integration

eliminates the need for separate CGM devices and simplifies monitoring, making it more convenient and user-friendly for individuals with

diabetes. Furthermore, the combination of CGM and insulin pump therapy enables

automated insulin delivery algorithms, known as hybrid, closed-loop systems,

which adjust insulin doses based on real-time glucose readings, further

optimizing blood sugar levels while minimizing the risk of hypoglycemia. As

awareness grows about the benefits of CGM-integrated insulin pumps among

healthcare professionals and patients in Vietnam, demand for these advanced

technologies is expected to rise, driving market growth, and improving outcomes

for individuals living with diabetes in the country.

Segmental Insights

Type Insights

Based on Type, Patch Pumps emerged as the fastest growing segment in the Vietnam Insulin Pump market during the forecast period. Patch

pumps are more compact, lightweight, and discreet than traditional insulin

pumps, offering enhanced comfort for patients seeking a less visible solution

for diabetes management. Unlike conventional pumps, which rely on tubing and

external devices, patch pumps are adhesive and attach directly to the skin,

making them more convenient for extended wear, especially for those with active

lifestyles. As technology advances, patch pumps now feature wireless

connectivity, remote control capabilities, and integration with continuous

glucose monitoring (CGM) systems, offering a more streamlined and flexible

approach to diabetes management. Their smaller, tubeless design enhances

comfort, making them ideal for individuals who find traditional pumps bulky.

With the growing trend towards personalized healthcare, patch pumps allow users

to adjust insulin delivery to meet their specific needs, driving their

increasing popularity in the market.

Application Insights

Based on Application, the Type 1 diabetes emerged as the dominating segment in the Vietnam insulin pump market in 2023. Type 1 diabetes occurs when the body cannot produce insulin, requiring individuals to rely on external insulin sources, typically via injections or insulin pumps. Insulin pumps are particularly beneficial for these patients, offering a continuous insulin supply that helps maintain stable blood glucose levels and minimizes the risk of complications. Type 1 diabetes typically develops in childhood or adolescence, meaning these patients need lifelong insulin management. This ongoing need for consistent insulin therapy makes insulin pumps an ideal solution for effective diabetes management. Technological advancements in insulin pumps such as smaller, more convenient, and comfortable designs have made them even more appealing. These devices provide precise insulin delivery, improving diabetes control and appealing to Type 1 diabetes patients who require constant monitoring. Compared to traditional injections, insulin pumps deliver insulin more efficiently and consistently, mimicking the body’s natural release, leading to better glucose control and fewer complications. While Type 2 diabetes is becoming more prevalent, Type 1 diabetes still accounts for a larger share of the population requiring insulin pumps, as these patients typically need insulin therapy earlier in their treatment. Thus, the Type 1 diabetes segment continues to dominate the insulin pump market due to the sustained and direct need for insulin management.

Download Free Sample Report

Regional Insights

By region, Southern Vietnam emerged as the leading region in the Vietnam Insulin Pump Market in 2023. The

southern region, particularly cities like Ho Chi Minh City, has a higher

concentration of healthcare facilities, specialized diabetes clinics, and

trained healthcare professionals compared to other regions. This concentration

of healthcare resources facilitates better access to insulin pump therapy and

related support services, making it more convenient for individuals with diabetes

to seek treatment in the southern region. Additionally, the southern region

tends to have higher levels of economic development and disposable income,

which may enable more individuals to afford the upfront cost of insulin pumps

and ongoing expenses for supplies and maintenance. Furthermore, the southern

region often serves as a hub for medical tourism and healthcare innovation,

attracting investments from manufacturers and distributors of medical devices,

including insulin pumps.

Recent Development

- In October 2025, Medtronic Vietnam renewed an MoU with Hue Central Hospital focused on skill-building and training, and Medtronic’s regional news listing explicitly includes insulin pumps as part of the company’s device portfolio context.

- In January 2025, Vietnam began construction of a plasma-based biopharmaceutical production facility in Thu Duc City’s high-tech park led by Binh Viet Duc Co., Ltd., and the project description included facilities for vaccine and insulin production (a local insulin-supply chain and manufacturing capacity update relevant to intensive insulin therapy ecosystems).

- In

November 2024, Novo Nordisk Vietnam launched community initiatives to celebrate

World Diabetes Day. These initiatives included a livestream to raise awareness of diabetes care, educational sessions to prevent complications for individuals living with diabetes, and a community cycling and

walking event to highlight the role of physical activity in diabetes

management.

- In

July 2024, Novo Nordisk Vietnam marked a significant milestone with the first

shipment of its products as a Foreign Invested Enterprise (FIE). This

development underscores the company's commitment to expanding its presence in

Vietnam, enhancing its local operations, and creating new employment

opportunities.

Key Market Players

- Roche Vietnam Co.,

Ltd.

- Medtronic Vietnam

- Abbott Laboratories GmbH

- B. Braun Vietnam Co.,

Ltd.

- NIPRO PHARMA VIETNAM

CO., LTD.

- Novo Nordisk Pharma

Operations A/S Vietnam

|

By

Type

|

By

Insulin Used

|

By

Application

|

By

End User

|

By

Region

|

- Traditional Insulin Pumps

- Patch Pumps

|

- Short Acting Insulin

- Rapid Acting Insulin

|

- Type 1 Diabetes

- Type 2 Diabetes

|

- Hospitals & Clinics

- Diagnostic Centers

- Home Care

|

- Southern Vietnam

- Northern Vietnam

- Central Vietnam

|

Report Scope:

In this report, the Vietnam Insulin Pump Market has been

segmented into the following categories, in addition to the industry trends

which have also been detailed below:

- Vietnam

Insulin Pump Market,

By Type:

o

Traditional

Insulin Pumps

o

Patch

Pumps

- Vietnam

Insulin Pump Market,

By Insulin Used:

o

Short

Acting Insulin

o

Rapid

Acting Insulin

- Vietnam

Insulin Pump Market,

By Application:

o

Type

1 Diabetes

o

Type

2 Diabetes

- Vietnam

Insulin Pump Market,

By End User:

o

Hospitals

& Clinics

o

Diagnostic

Centers

o

Home

Care

- Vietnam Insulin

Pump Market, By

Region:

o Southern Vietnam

o Northern Vietnam

o Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of

the major companies present in the Vietnam Insulin Pump Market.

Available Customizations:

Vietnam Insulin Pump Market report with the given market

data, TechSci Research offers customizations according to a company's specific

needs. The following customization options are available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Vietnam Insulin Pump Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]