|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

325.47 Million

|

|

CAGR

(2025-2030)

|

6.58%

|

|

Fastest

Growing Segment

|

Capsules

|

|

Largest

Market

|

Northern

|

|

Market

Size (2030)

|

USD

471.73 Million

|

Market Overview

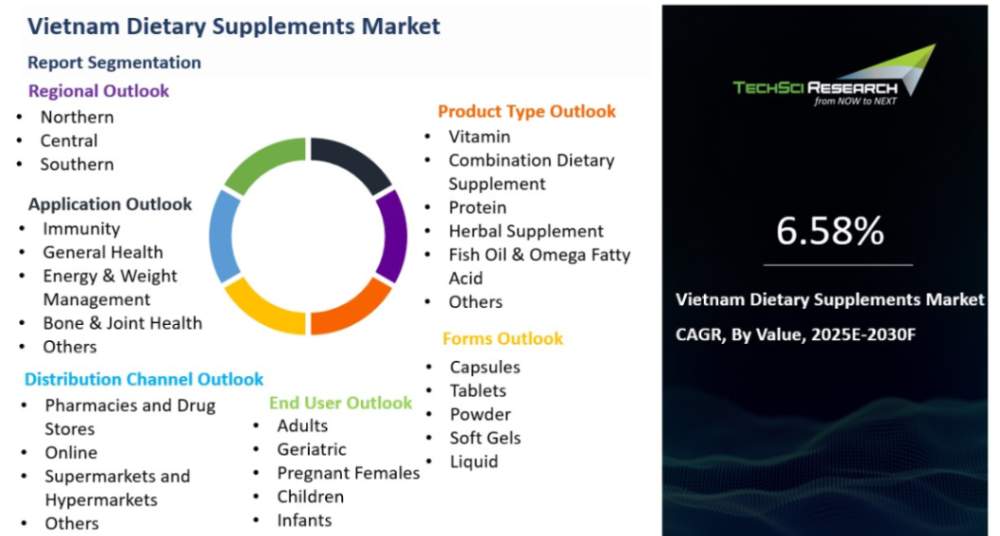

Vietnam Dietary Supplements Market was valued at USD 325.47 Million in 2024 and is expected to reach USD 471.73 Million by 2030 with a CAGR of 6.58% during the forecast period.

A major driver for the growth of the

dietary supplements market in Vietnam is the rising awareness among consumers

about the importance of maintaining good health and preventing diseases. As

Vietnamese consumers become more educated about the role of nutrition in

promoting health and preventing diseases, they are increasingly seeking dietary

supplements to fulfill their nutritional needs. Additionally, Vietnam's rapidly aging population is

another key factor contributing to the growth of this market. With the aging

process, individuals often require additional nutritional support to maintain

their health, which further drives the demand for dietary supplements.

In this highly competitive market, both domestic

and international players are vying for market share. Leading companies such as

Amway, Herbalife, and Nu Skin Enterprises offer a wide range of dietary

supplements, including vitamins, minerals, herbal supplements, and probiotics, catering

to the diverse needs of consumers. Despite the competition, the dietary supplements

market in Vietnam presents ample opportunities for growth.

The increasing

consumer preference for natural and organic products creates a lucrative

opportunity for manufacturers to develop new and innovative dietary supplements

that align with these preferences. By capitalizing on this trend, companies can

tap into the growing demand and establish a strong foothold in the market.

Key Market Drivers

Rise in Health Awareness

Vietnamese consumers are becoming increasingly health-conscious, recognizing the importance of nutrition in maintaining wellness and preventing diseases. This rising awareness has led to a sharp increase in demand for dietary supplements across the country. The global health and wellness movement, which promotes balanced nutrition and regular exercise, has further strengthened this trend among Vietnamese consumers.

As people become more informed about nutrition, they are turning to dietary supplements to fill nutrient gaps, strengthen immunity, enhance physical performance, and improve overall well-being. Products such as vitamins, minerals, probiotics, and herbal supplements are witnessing rapid growth as consumers seek more effective ways to support their health.

According to the International Monetary Fund (IMF), Vietnam’s GDP reached USD 406.45 billion in 2022, making it the fifth-largest economy in Southeast Asia. The World Bank projects that by 2030, the middle and affluent classes will account for 20% of the population, while the Economist Intelligence Unit (EIU) reports healthcare spending at USD 18.5 billion, or 4.6% of GDP in 2022. Rising incomes and a growing middle class have significantly boosted health awareness nationwide.

This increased focus on health and wellness is fueling the demand for dietary supplements as more consumers invest in products that promote better living and disease prevention. Rising healthcare expenditure and greater spending power further drive market expansion, positioning Vietnam as a strong growth market for dietary supplements in Southeast Asia.

Manufacturers and health organizations are leveraging marketing campaigns and educational initiatives to raise awareness about the benefits of dietary supplements. These efforts also reinforce the importance of balanced diets and regular exercise, helping Vietnamese consumers make more informed health choices.

With this growing commitment to wellness, Vietnam’s dietary supplements market continues to flourish. Consumers are actively adopting supplements to support long-term health, signaling sustained market growth as health-conscious lifestyles become a defining trend among Vietnamese citizens.

Surge in Disposable Income

Vietnam’s strong economic growth has significantly increased disposable income, transforming consumer behavior and spending habits. With rising affluence, Vietnamese citizens are placing more emphasis on health and wellness, leading to a sharp rise in demand for dietary supplements. Consumers are now prioritizing investments in their well-being, driving expansion across the country’s growing dietary supplements market.

Higher disposable income has fueled not only greater consumption but also a willingness to pay premium prices for high-quality health products. This shift has led to a broader product range catering to diverse nutritional needs. According to the Ministry of Construction, Vietnam is among the fastest urbanizing countries in East Asia, with 888 urban areas and an urbanization rate of about 41.5% as of September 2022.

Rapid urbanization and a growing consumer class have spurred demand for high-quality, nutritious food products that meet global standards. Vietnamese consumers are seeking safer and more wholesome products, creating strong demand for organic, natural, and premium dietary supplements that align with their evolving lifestyle choices.

The surge in disposable income has also reinforced the trend toward clean-label and organic products. As Vietnamese consumers become more health-conscious and environmentally aware, they are increasingly drawn to supplements made from natural and sustainable ingredients. This growing preference highlights a broader cultural shift toward holistic wellness and mindful consumption.

The remarkable rise in income levels continues to serve as a key driver of Vietnam’s thriving dietary supplements market. As the economy expands, demand for wellness-focused and natural products is expected to grow further, offering lucrative opportunities for both domestic and international manufacturers. Companies that align their offerings with these evolving consumer preferences can establish a strong foothold in Vietnam’s dynamic and rapidly growing dietary supplement industry..

Download Free Sample Report

Key Market Challenges

Surge in Regulatory Compliance

In recent years, the Vietnamese government has

implemented stringent regulations to address the labeling, advertising, and

quality control of dietary supplements. These regulations have been put in

place to ensure the safety and efficacy of these products, protect consumers

from potential harm, and prevent the circulation of counterfeit supplements in

the market. The government's intention is to create an environment where

consumers can have confidence in the quality and authenticity of the dietary

supplements they purchase.

However, due to the complexity of the regulatory

landscape and the ambiguity surrounding product classifications, manufacturers

face significant challenges in navigating the regulatory requirements. The

process of ensuring compliance with all relevant regulations can be

time-consuming, requiring extensive testing and documentation. This not only

slows down the launch of new products in the market but also adds to the

operational costs for manufacturers.

Non-compliance with these regulations can have

serious consequences for manufacturers. It not only exposes them to financial

penalties and product recalls but also poses a risk to their reputation. The

trust and credibility of a company can be severely damaged if it is found to be

non-compliant with the regulations, leading to a loss of consumer confidence.

Moreover, the surge in regulatory compliance has

led to an increase in operational costs for manufacturers. From conducting

extensive testing to hiring regulatory experts, manufacturers need to allocate

significant resources to meet the stringent requirements. These additional

costs can ultimately affect the profitability of companies and may result in

higher prices for consumers.

Overall, while the Vietnamese government's efforts

to regulate the dietary supplement industry are commendable, the challenges

posed by the complex regulatory landscape need to be addressed. Balancing the

need for safety and quality control with the ease of doing business is crucial

to ensure the continued growth and success of the industry.

Key Market Trends

Rising Focus on Natural and Herbal Supplements

Natural and herbal supplements are rapidly gaining traction among Vietnamese consumers. Derived from carefully extracted plant-based ingredients and other natural sources, these products are seen as healthier and safer alternatives to synthetic supplements. This shift towards natural and herbal supplements aligns with the global trend favoring organic and natural products. For instance, the Vietnam Medipharm Expo 2024, scheduled for December 5-7 in Hanoi, will feature around 100 booths from eight countries and territories, attracting approximately 9,000 visitors. The event will provide foreign companies with valuable insights into Vietnam's distribution channels and competitive landscape, presenting new opportunities in this dynamic market. Key domestic brands like Vi Dieu Nam Medicine and Pharmacy Limited Company, which specializes in natural products and traditional Vietnamese herbal remedies, and Nature Gift Pharma JSC, known for its U.S.-imported health supplements, will also be showcased.

Traditional medicine continues to have a strong presence in Vietnam, with many consumers preferring natural treatments over synthetic drugs. Herbal supplements, seen as an extension of traditional medicine, have naturally gained popularity, reflecting the value placed on the country's rich heritage. Vietnam, home to over 5,100 medical plant species, has significant potential to capitalize on its herbal medicine sector, even for export, according to Nguyen The Thinh, Head of the Traditional Medicine Management Department under the Health Ministry. The growing body of scientific research highlighting the health benefits of specific herbs and natural ingredients has further bolstered the popularity of these supplements. As more evidence supports their efficacy, consumers are becoming increasingly confident in their use. This rising demand for natural and herbal supplements is driving a transformation in Vietnam's dietary supplements market. In response, manufacturers are focusing on developing innovative products that feature a broader array of natural ingredients while eliminating artificial additives, thereby reinforcing the position of natural and herbal supplements within the market.

Segmental Insights

Product Type Insights

Based on Product Type, the Vitamin emerged as the dominating segment in the Vietnam Dietary Supplements market in 2024. Vietnam's robust economic growth has not only brought about an

increase in personal disposable income but has also paved the way for an

upsurge in spending on health and wellness products, with dietary supplements

taking center stage. As Vietnamese consumers find themselves with more

financial resources at their disposal, they are increasingly investing in their

well-being, resulting in a heightened demand for vitamin supplements.

Accompanying this rise in disposable income is a

noteworthy shift in consumer behavior towards health consciousness among the

Vietnamese population. This demographic is actively seeking holistic wellness

solutions and placing a premium on cultivating a healthy lifestyle.

Consequently, incorporating dietary supplements, including vitamins, into their

daily routines has become a key aspect of their wellness regimen.

The prominence of vitamins in Vietnam's dietary

supplements market can be attributed to various factors, one of which is the

prevalence of vitamin deficiencies, particularly vitamin D deficiency. Limited

sunlight exposure and inadequate vitamin intake from food sources contribute to

this widespread deficiency. Consequently, an increasing number of individuals

are of individuals are turning to vitamin supplements as a means to bridge the

nutrient gap and fulfill their dietary requirements, thereby fueling the demand

for these products.

The convergence of Vietnam's economic growth,

heightened health consciousness among consumers, and the prevalence of vitamin

deficiencies has created a favorable environment for the flourishing dietary

supplements market in the country. As the Vietnamese population continues to

prioritize their health and well-being, the demand for vitamin supplements is

expected to soar, driving further growth in this dynamic industry.

Form Insights

Based on Form, capsules emerged as the fastest growing segment in the Vietnam Dietary Supplements market during the forecast period. Vietnamese consumers strongly believe

in the health benefits of natural and organic products, as they prioritize

their well-being and seek products that align with their values. Capsules, with

their ability to deliver natural supplements in an easy-to-consume format, have

gained popularity among health-conscious individuals in Vietnam. These capsules

are meticulously formulated without any artificial or additional additives,

ensuring that consumers can enjoy the benefits of the natural ingredients

without compromising their health.

The convenience of capsules cannot be overstated.

Their small size, portability, and ease of swallowing make them a preferred

option for many people in Vietnam. With busy schedules and increasing health

awareness, incorporating capsules into daily routines has become a seamless

process for individuals striving to maintain their well-being.

Furthermore, capsules offer immense versatility in

terms of ingredients. From essential vitamins and minerals to potent herbal

extracts, a wide range of beneficial components can be incorporated into these

capsules. This versatility caters to the diverse needs of consumers in the

dietary supplements market, where there is a growing demand for various

supplement options that can address specific health concerns.

Download Free Sample Report

Regional Insights

Based on Region, Northern Vietnam emerged as the dominant region in the Vietnam Dietary Supplements market in 2024. The northern region of Vietnam, particularly Hanoi, is the country's political and economic center. With a high concentration of businesses, government institutions, and a growing affluent population, northern Vietnam experiences a strong demand for health and wellness products, including dietary supplements. The Northern Key Economic Region (KER) encompasses seven cities and provinces: Hanoi, Hai Phong, Quang Ninh, Vinh Phuc, Bac Ninh, Hai Duong, and Hung Yen. Together, this region contributes over 32% of the national GDP (ranking second after the Southern KER) and accounts for 26% of Vietnam's total foreign direct investment (FDI). The region benefits from robust infrastructure and connectivity, which supports the efficient distribution of supplements.

Northern Vietnam also has deep cultural ties to traditional medicine, including the use of herbal remedies and natural health products. This cultural preference for natural treatments drives the demand for dietary supplements that align with these practices. Consequently, the region is more open to herbal and natural supplement options, which are gaining popularity across the country. Additionally, health awareness in northern urban areas like Hanoi has risen significantly, with consumers becoming more informed about nutrition and wellness.

The region’s strategic location, close to international markets like China, facilitates the import and trade of health products, enhancing the availability of global dietary supplement brands and fostering market competition. Furthermore, the presence of a wide range of pharmacies, health stores, and modern retail outlets in northern Vietnam makes it easier for consumers to access various health products.

Recent Developments

- In July 2025, Vietnam's Ministry of Health proposed significant revisions to Decree 15/2018/N-CP, aiming to strengthen the regulatory framework for functional foods and dietary supplements. The proposed changes focus on enhancing consumer safety, product transparency, and scientific accountability by requiring more comprehensive documentation from manufacturers.

- In August 2024, RIKEN VITAMIN CO., LTD., a key ingredient provider for the functional food industry, announced its plan to establish a subsidiary in Vietnam by 2025 to meet the growing demand.

- In

July 2024, the Vietnamese brand Lúave introduced its instant boba milk tea

across Asia, beginning with low-fat, low-sugar variants in Singapore. The

product is available in a range of flavors, including original, cheese, matcha,

and Hong Kong (yuan-yang). At the Speciality Food & Drinks Asia (SFDA) 2024

event, held at the Sands Expo & Convention Centre in Singapore from June 26

to 28, Lúave also unveiled two new flavors: durian and chocolate. The company

plans to expand the launch of its instant boba milk tea to Singapore, Thailand,

and South Korea by the third quarter of this year.

- In

March 2024, CMG Pharmaceutical entered into an agreement with local distributor

An Thinh Phat to introduce its products to the Vietnamese market starting in

May. The South Korean cosmetics company will partner with Home & Mall

Shopping to develop a specialized range of beauty products and nutritional

supplements tailored for the local market.

- In

March 2024, the Vietnam Food Administration, under the Ministry of Health,

issued a warning regarding certain dietary supplements from Kobayashi

Pharmaceutical Co. of Japan, which have been associated with kidney disorders.

The Food Administration cited global media reports linking the use of these

products to kidney disease and other health issues. These supplements, sold in

the Vietnamese market, prompted Kobayashi Pharmaceutical, based in Osaka, to

voluntarily recall a range of products containing beni kōji fermented rice

following the reported cases of kidney problems.

Key Market Players

- Herbalife Vietnam Ltd.

- Traphaco JSC

- Bayer Vietnam Ltd.

- DHG Pharmaceuticals Joint

Stock Company

- Amway Vietnam Ltd.

- Nestle Vietnam Ltd.

- Forever Living Vietnam Ltd.

- Tiens Vietnam Co Ltd.

- Life Extension Vietnam

- Nu Skin

- Mega Lifesciences Public

Company Limited

|

By

Product Type

|

By

Forms

|

By

Application

|

By

Distribution Channel

|

By

End User

|

By Region

|

- Vitamin

- Combination

Dietary Supplement

- Protein

- Herbal Supplement

- Fish Oil &

Omega Fatty Acid

- Others

|

- Capsules

- Tablets

- Powder

- Soft Gels

- Liquid

|

- Immunity

- General Health

- Energy & Weight Management

- Bone & Joint Health

- Others

|

- Pharmacies and Drug Stores

- Online

- Supermarkets and Hypermarkets

- Others

|

- Adults

- Geriatric

- Pregnant Females

- Children

- Infants

|

|

Report Scope:

In this report, the Vietnam Dietary Supplements Market

has been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- Vietnam Dietary Supplements Market, By Product Type:

o Vitamin

o Combination Dietary Supplement

o Protein

o Herbal Supplement

o Fish Oil & Omega Fatty Acid

o Others

- Vietnam Dietary Supplements Market, By Form:

o Capsules

o Tablets

o Powder

o Soft Gels

o Liquid

- Vietnam Dietary Supplements Market, By Distribution Channel:

o Pharmacies and Drug Stores

o Online

o Supermarkets and Hypermarkets

o Others

- Vietnam Dietary Supplements Market, By Application:

o Immunity

o General Health

o Energy & Weight Management

o Bone & Joint Health

o Others

- Vietnam Dietary Supplements Market, By End User:

o Adults

o Geriatric

o Pregnant Females

o Children

o Infants

- Vietnam Dietary Supplements Market, By Region:

o Northern

o Central

o Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Dietary

Supplements Market.

Available Customizations:

Vietnam Dietary Supplements Market report with the

given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Vietnam Dietary Supplements Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]