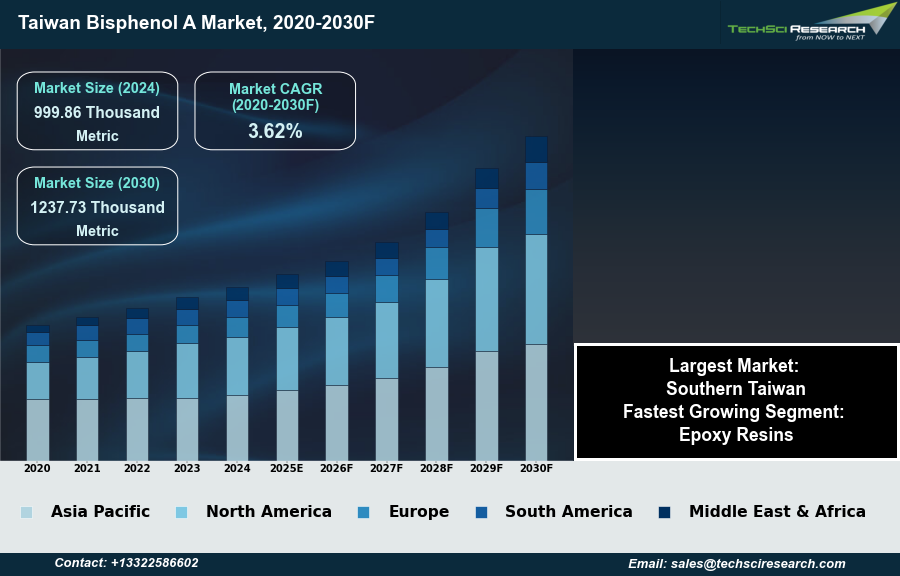

Forecast Period | 2026-2030 |

Market Size (2024) | 999.86 Thousand Metric Tonnes |

CAGR (2025-2030) | 3.62% |

Fastest Growing Segment | Epoxy Resins |

Largest Market | Southern Taiwan |

Market Size (2030) | 1237.73 Thousand Metric Tonnes |

Market Overview

The Taiwan Bisphenol A Market, valued at 999.86 Thousand Metric Tonnes in 2024, is projected to experience robust expansion with a CAGR of 3.62% to reach 1237.73 Thousand Metric Tonnes by 2030. Bisphenol A (BPA) is an industrial chemical predominantly employed in the manufacturing of polycarbonate plastics and epoxy resins, serving as a critical foundational monomer for numerous downstream applications. The Taiwan Bisphenol A market is significantly driven by robust demand from key industrial sectors, notably the electronics, automotive, and construction industries. Polycarbonate resins, valued for their durability, optical clarity, and heat resistance, are extensively utilized in electronic devices and automotive components, while epoxy resins provide essential adhesive qualities and chemical resistance for coatings, sealants, and structural applications within the construction and aerospace sectors. According to a 2023 survey referencing official data, Taiwan's actual BPA production in recent years was approximately 700,000 tons per year, with the nation's total production capacity exceeding 840,000 tons annually.

Despite these growth catalysts, a notable challenge impeding market expansion stems from increasing global regulatory scrutiny and heightened health concerns associated with BPA. This regulatory landscape compels manufacturers to invest in research and development for BPA-free alternatives and implement stricter production practices, influencing consumer preferences toward more sustainable and eco-friendly products.

Key Market Drivers

The Taiwan Bisphenol A market experiences significant influence from the rising demand for polycarbonate plastics and the expanding applications for epoxy resins. The enduring strength of polycarbonate plastics stems from their superior attributes such as durability, optical clarity, and heat resistance, which are crucial for numerous downstream industries. These materials are extensively employed in automotive components, electronic displays, and various high-performance consumer goods, contributing substantially to overall demand. For example, the continued expansion of key sectors like information technology relies heavily on advanced materials. According to the Ministry of Finance, in its Annual External Trade Report in 2023, Taiwan's exports of information, communication and audio-video products grew by 28.9% compared to the previous year, highlighting robust demand in a major end-use market for polycarbonates.

Concurrently, the expanding applications for epoxy resins represent another pivotal driver for the Bisphenol A market, as BPA serves as a fundamental building block in their synthesis. Epoxy resins are highly valued for their exceptional adhesive qualities, chemical resistance, and electrical insulation properties, finding widespread use in protective coatings, advanced composites for aerospace and wind energy, and critical components within the electronics industry. Taiwan's industrial landscape, with its focus on high-tech manufacturing, particularly benefits from these applications. According to Nan Ya Plastics corporate information, the company maintains an epoxy resin capacity of 200,000 metric tons per year, showcasing its substantial role in supplying these essential materials globally. Furthermore, the broader petrochemical sector in Taiwan continues to attract strategic investments; for instance, CPC Corporation, Taiwan, announced in February 2023 that it and its partners would jointly provide NT$36.7 billion for three facilities to produce hydrocarbon resin, isononyl alcohol, and styrene, signaling ongoing development and confidence within the chemical manufacturing base.

Download Free Sample Report

Key Market Challenges

The increasing global regulatory scrutiny and heightened health concerns surrounding Bisphenol A (BPA) pose a significant challenge to the Taiwan Bisphenol A market. This intensified oversight compels manufacturers to allocate substantial resources towards research and development for viable BPA-free alternatives, diverting capital and innovation away from traditional BPA production. Simultaneously, the necessity to implement more stringent production practices to meet evolving environmental and safety standards directly increases operational costs for Taiwanese producers. These factors, combined with a growing consumer preference for sustainable and eco-friendly products, directly translate into reduced demand for conventional BPA-based materials.

This challenging environment contributes to a broader slowdown in the chemical sector. According to the Petrochemical Industry Association of Taiwan, the nation's overall petrochemical output value in 2022 experienced a notable decline of 5.7%. This contraction, attributed partly to a general demand slowdown, indicates market conditions where substances facing additional regulatory and health-related pressures, such as BPA, would experience exacerbated limitations on growth. The evolving landscape necessitates producers to adapt to declining conventional demand and increased investment burdens.

Key Market Trends

The Taiwan Bisphenol A (BPA) market is significantly influenced by two distinct and impactful trends: the emergence of biomass-derived BPA production and continuous innovation in novel BPA derivatives and resin formulations. These trends represent a dual focus on sustainable sourcing and product diversification within the industry.

The emergence of biomass-derived BPA production signifies a critical shift towards sustainability, addressing environmental concerns and reducing reliance on fossil-based feedstocks. This trend involves developing and implementing processes to synthesize BPA from renewable biological resources such as plants or agricultural waste. While specific production statistics from Taiwanese industrial associations for biomass-derived BPA are not publicly available, the broader commitment to green chemistry is evident. For instance, according to an "Invest Taiwan" report published in December 2024, Taiwanese manufacturers have increasingly encountered demands from European customers to incorporate recycled plastics into their products to avoid plastic packaging taxes, signaling a strong market pull for sustainable material alternatives. This pressure drives investment in bio-based chemical solutions.

Concurrently, innovation in novel BPA derivatives and resin formulations is expanding the market by creating advanced materials with enhanced properties for diverse applications. This trend moves beyond conventional polycarbonate and epoxy resins, exploring new functionalities and performance characteristics for BPA-based products. Taiwan's industrial sector demonstrates a strong commitment to research and development, which underpins such innovations. According to the Ministry of Economic Affairs, in its report released in September 2025, Taiwan's R&D spending reached NT$937.3 billion (US$30.63 billion) in 2023, with enterprises contributing 85.1% of this total. This substantial investment supports the development of high-performance industrial chemicals, as exemplified by DuPont's investments in advanced R&D centers in Taiwan, focusing on new formulations and high-performance materials, as highlighted in a Mobility Foresights report in September 2025.

Segmental Insights

The Taiwan Bisphenol A market highlights the epoxy resins segment as the fastest growing, driven by robust demand across pivotal industrial sectors. This expansion is primarily attributed to Taiwan's prominent electronics and semiconductor manufacturing industry, where epoxy resins are indispensable for advanced semiconductor packaging, printed circuit board insulation, and high-performance electronic components, leveraging their superior electrical, mechanical strength, and thermal resistance properties. Concurrently, the burgeoning construction and infrastructure development initiatives within Taiwan necessitate epoxy resins for durable coatings, sealants, and structural adhesives, valued for their exceptional resilience and chemical resistance in extensive projects. Furthermore, increasing applications in the automotive sector for lightweight composites and protective layers contribute significantly to this segment's rapid growth.

Regional Insights

Southern Taiwan leads the Taiwan Bisphenol A market due to its robust and integrated petrochemical infrastructure. The region hosts major petrochemical complexes, such as CPC's Linyuan Complex and refinery operations, which provide a consistent and cost-effective supply of crucial raw materials like phenol and acetone, essential for Bisphenol A production. Key manufacturers, including Chang Chun Group, have established significant Bisphenol A production facilities within Southern Taiwan. Additionally, the region benefits from a substantial downstream demand for polycarbonate and epoxy resins, driven by prominent electronics and automotive industries with major consumers like Chi-Mei Company situated locally.

Recent Developments

- In September 2025, Chang Chun Plastics was scheduled to undertake planned maintenance at two of its Bisphenol A (BPA) units located in Jiangsu. This operational adjustment by the Taiwanese chemical producer is a routine measure designed to ensure the reliability and efficiency of its production assets. While a temporary reduction in output was anticipated during this period, such maintenance activities are crucial for sustaining long-term operational capabilities and upholding product quality within the company's BPA manufacturing portfolio.

- In January 2025, Nan Ya Plastics Corporation and Taiwan Mitsui Chemicals, Inc. announced a collaboration to develop and market biomass-based plastic products. Under this initiative, Nan Ya Plastics will utilize biomass-derived acetone from Taiwan Mitsui Chemicals to manufacture biomass-derived bisphenol A (BPA) in Taiwan. Both companies, having obtained International Sustainability and Carbon Certification (ISCC) PLUS, aim to produce sustainable plastics like epoxy and polycarbonate resins. This partnership emphasizes the development of eco-friendly alternatives with properties identical to petroleum-based counterparts, marking a significant step towards reducing greenhouse gas emissions within the Taiwanese BPA industry.

- In July 2024, the Taiwanese chemical industry, including key Bisphenol A producers, continued to experience market shifts driven by global demand for polycarbonate plastics and epoxy resins. Amidst these conditions, manufacturers were observed to be increasingly investing in research and development to address evolving regulatory landscapes and consumer preferences. This includes efforts towards sustainable BPA usage and the exploration of bio-based BPA analogues, as companies adapt their strategies to strengthen the business case for more environmentally responsible production methods.

- In January 2024, Nan Ya Plastics, a major subsidiary of Taiwan's Formosa Group, successfully recommenced bisphenol A (BPA) production at its Ningbo facility in China. This followed a scheduled maintenance period that began in December of the previous year. The company's new production line, which had been inaugurated in early December, has an annual capacity of 170 thousand tons of BPA. This strategic expansion and operational restart by the Taiwanese-headquartered company contribute to its overall BPA production capabilities and global market presence, impacting the broader supply dynamics for BPA.

Key Market Players

- Nan Ya Plastic Co.

- Chang Chun Plastic Co.Ltd.

- Taiwan Prosperity Chem Co.

- Vast Spring Enterprise Co., Ltd.

By End-Use | By

Sales Channel | By

Region |

| Polycarbonate ResinsEpoxy ResinsUnsaturated Polyester ResinsFlame RetardantsOthers | Direct SaleIndirect Sale | Northern TaiwanSouthern TaiwanCentral Taiwan |

Report Scope:

In this report, the Taiwan Bisphenol A Markethas been segmented into the following categories, in addition to the industrytrends which have also been detailed below:

- Taiwan Bisphenol A Market, By End-Use:

o Polycarbonate Resins

o Epoxy Resins

o Unsaturated Polyester Resins

o Flame Retardants

o Others

- Taiwan Bisphenol A Market, By

Sales Channel:

o Direct Sale

o Indirect Sale

- Taiwan Bisphenol A Market, By

Region:

o Northern Taiwan

o Southern Taiwan

o Central Taiwan

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Taiwan Bisphenol A Market.

Available Customizations:

Taiwan Bisphenol A Market report with the given market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Taiwan Bisphenol A Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]