|

Forecast Period

|

2025-2029

|

|

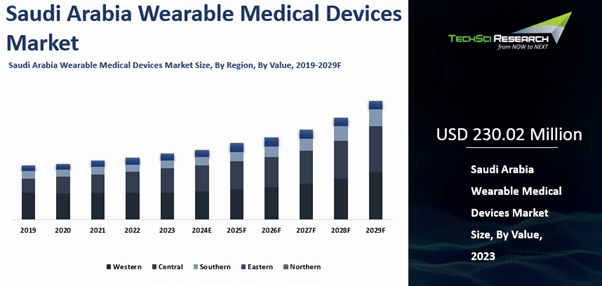

Market Size (2023)

|

USD 230.02 Million

|

|

Market Size (2029)

|

USD 396.78 Million

|

|

CAGR (2024-2029)

|

9.47%

|

|

Fastest Growing Segment

|

Diagnostics

|

|

Largest Market

|

Central Region

|

Market Overview

Saudi

Arabia Wearable Medical Devices Market was valued at USD 230.02 Million in 2023 and is

expected to reach USD 396.78 Million by 2029 with a CAGR of 9.47% during the

forecast period.

Several key factors are driving the Saudi Arabia wearable medical devices market. The increasing prevalence of chronic diseases

such as diabetes and cardiovascular conditions necessitates continuous health

monitoring, which wearable devices effectively provide. Technological

advancements, including improved sensors and connectivity, have enhanced the

functionality and accuracy of these devices, making them more appealing to

consumers. Rising health awareness and a growing emphasis on preventive care

are encouraging more individuals to adopt wearable health technologies.

Government initiatives supporting digital health and investments in healthcare

infrastructure further boost market growth. The combination of these factors is

fueling the demand for wearable medical devices, leading to a dynamic and

expanding market in Saudi Arabia.

Download Free Sample Report

Key Market Drivers

Rising Prevalence of Chronic Diseases

The escalating prevalence of chronic diseases,

including diabetes, cardiovascular disorders, and respiratory conditions, is a

crucial factor driving the growth of the wearable medical devices market in

Saudi Arabia. Chronic diseases are characterized by their long-lasting and

often progressive nature, necessitating continuous monitoring and management to

mitigate complications and maintain effective symptom control. For individuals

managing these conditions, regular and accurate health tracking becomes

essential.

According to a study titled “A national perspective on

cardiovascular diseases in Saudi Arabia”, the study aimed to estimate the

national and regional prevalence rates of cardiovascular diseases (CVDs) within

the Saudi population. Among individuals aged 15 years and older, the national

prevalence of CVDs was found to be 1.6% (n = 236,815). The prevalence is

notably higher in males at 1.9% compared to 1.4% in females. Age plays a

crucial role, with the prevalence of CVDs gradually increasing up to the age of

50, followed by a significant rise thereafter. The highest prevalence was

observed in the age group of 65 years and older, at 11% (n = 93,971), followed

by the 60–64 years age group at 6.5% (n = 31,156), and the lowest prevalence

was recorded in those under 40 years at 1.2% (n = 108,226). Regional variations

were also noted, with Makkah exhibits the highest prevalence of 1.9% (n =

85,814), while Riyadh follows with a prevalence rate of 1.7% (n = 79,191).

Wearable medical devices, such as continuous

glucose monitors for diabetes management, heart rate monitors for

cardiovascular health, and devices for respiratory tracking, play a pivotal

role in this ongoing management. These devices provide real-time health data

that is indispensable for effective disease management. For instance,

continuous glucose monitors offer diabetics real-time insights into their blood

sugar levels, enabling them to make timely adjustments to their medication and

lifestyle to maintain optimal glucose control. Similarly, heart rate monitors

can alert individuals with cardiovascular disorders to any irregularities or

changes in their heart rate, facilitating early intervention and potentially

preventing severe health events. As the prevalence of chronic diseases rises,

the demand for wearable medical devices has surged. This trend is driven by the

increasing need for technologies that support continuous health monitoring and

early detection of potential issues.

Technological Advancements

Technological advancements are significantly propelling the growth of the wearable medical devices market in Saudi Arabia. Innovations such as advanced sensors, miniaturization, and integration with mobile and cloud technologies have transformed the landscape of health monitoring. Modern wearable devices now feature highly sensitive sensors that can detect minute changes in health metrics such as blood glucose, heart rate, and respiratory rate. These sensors have become more compact and comfortable, making it easier for users to incorporate them into their daily lives.

The integration of wearables with mobile and cloud technologies has further revolutionized the market, aligning with Saudi Vision 2030's digital health agenda. Wearable devices now seamlessly connect with smartphones and tablets, allowing users to monitor their health in real-time through dedicated apps. Cloud connectivity enables the storage and remote access of health data, facilitating continuous monitoring and offering valuable insights to both users and healthcare providers.

Continuous monitoring capabilities represent another significant advancement. Devices like continuous glucose monitors (CGMs) provide real-time data on blood sugar levels, which is crucial for managing diabetes effectively, a condition highly prevalent in the Kingdom. Similarly, wearable ECG monitors offer ongoing heart activity tracking, helping to detect cardiovascular issues early. This continuous monitoring improves disease management and enhances early detection of potential health problems. The incorporation of data analytics and artificial intelligence (AI) into wearable devices has further enhanced their functionality. AI algorithms analyze extensive health data to identify patterns, predict health issues, and offer personalized recommendations. This sophisticated data analysis helps users and healthcare providers make informed decisions, improving treatment outcomes and overall health management.

Increasing Health Awareness and Preventive Care

The rising trend of health awareness and preventive care is significantly influencing the wearable medical devices market in Saudi Arabia. As the population becomes increasingly aware of the benefits of proactive health management, with over 80% living in urban areas and some surveys indicating that 62% of Saudis are interested in using wearables for health tracking, the demand for devices that support this approach is growing. This shift towards health consciousness is rooted in the understanding that early detection and continuous monitoring of health metrics can play a crucial role in preventing chronic diseases like diabetes, which affects over 4 million adults and is projected to impact 7.5 million by 2045, and cardiovascular conditions, the leading cause of death in the Kingdom.

Wearable medical devices offer users the ability to actively monitor a range of health parameters, including heart rate, blood pressure, glucose levels, and physical activity. This real-time data empowers individuals to make informed decisions about their health and lifestyle. For instance, a wearable device that tracks physical activity can help users set and achieve fitness goals, while continuous glucose monitors can assist diabetic patients in managing their blood sugar levels more effectively. The emphasis on preventive healthcare has led to a greater focus on technologies that can provide early warnings and continuous feedback.

Educational campaigns and public health initiatives under Saudi Vision 2030, driven by the Ministry of Health and supported by a national healthcare budget of over $36.8 billion, are also contributing to this shift. These initiatives often highlight how wearable medical devices can aid in early detection and ongoing health management, further fueling consumer interest and adoption. The growth in health and wellness culture, coupled with advancements in technology, has made wearable medical devices more accessible and appealing to the average consumer. As devices become more user-friendly, stylish, and affordable, they are more likely to be integrated into daily routines. This integration supports a culture of regular health monitoring and encourages individuals to take a more active role in their health management..

Government Initiatives & Investments

The Saudi Arabia government’s strong commitment to

advancing healthcare through digital solutions has a profound impact on the

wearable medical devices market. This commitment is prominently reflected in

the Vision 2030 plan, a strategic initiative that underscores the importance of

integrating cutting-edge technology into the healthcare system to enhance

patient care and optimize healthcare delivery.

The Vision 2030 plan envisions a

comprehensive transformation of the healthcare sector, emphasizing the role of

technology in improving health outcomes and expanding access to quality care. Central

to this vision is the substantial investment in healthcare infrastructure and

digital health programs. The government is actively funding the development of

state-of-the-art healthcare facilities that incorporate digital technologies,

including wearable medical devices. This investment helps build a robust

infrastructure capable of supporting advanced health monitoring solutions and

ensures that these technologies are integrated into everyday healthcare

practices.

The Saudi Arabia government’s support extends to

research and development (R&D) in the field of digital health. By funding

research initiatives and fostering collaborations with global technology firms,

the government encourages innovation and the creation of new, effective

wearable medical devices. This support accelerates the development of advanced

health monitoring technologies, contributing to the market’s growth and making

it possible for more sophisticated devices to become available to consumers.

Government-backed

digital health programs play a crucial role in promoting the adoption of

wearable medical devices. These programs often involve initiatives aimed at

educating both healthcare providers and the public about the benefits of

wearable technology. Through awareness campaigns and training sessions, the

government helps build trust and familiarity with wearable devices, encouraging

their use among patients and healthcare professionals alike.

Key Market Challenges

High Costs of Technology and Innovation

The high costs associated with developing,

manufacturing, and maintaining wearable medical devices pose a significant

challenge in Saudi Arabia. Advanced wearable devices often require cutting-edge

technology and significant research and development investment. The costs of

designing and producing devices with sophisticated sensors, data analytics

capabilities, and integration with digital health platforms can be substantial.

Companies must invest in ongoing maintenance and upgrades to keep pace with

technological advancements and evolving consumer needs. These high costs can

limit the affordability of wearable devices for consumers and healthcare

providers. Manufacturers and stakeholders must balance the need for innovation

with cost considerations, ensuring that products are both advanced and

accessible to a broad market segment.

Data Privacy and Security Concerns

As wearable medical devices collect and transmit

sensitive health data, ensuring data privacy and security is a major challenge.

The integration of wearables with digital health ecosystems involves storing

and sharing personal health information, which can be vulnerable to breaches

and unauthorized access. Protecting this data from cyber threats and ensuring

compliance with data protection regulations is crucial. In Saudi Arabia, there

is a growing emphasis on data privacy laws, and companies must adhere to strict

regulations regarding the handling of personal health data. Ensuring robust

data encryption, secure data storage, and adherence to privacy standards is

essential for gaining consumer trust and maintaining regulatory compliance.

Addressing these concerns effectively is crucial for the successful adoption and

continued use of wearable medical devices.

Key Market Trends

Improved Healthcare

Infrastructure

The ongoing development and

enhancement of healthcare infrastructure in Saudi Arabia significantly bolster

the growth of the wearable medical devices market. The Kingdom's strategic

investments in modernizing healthcare facilities and expanding services play a

crucial role in integrating advanced technologies, including wearable devices,

into patient care. Improved healthcare infrastructure encompasses the

construction of new hospitals, clinics, and specialized medical centers, as

well as the upgrading of existing facilities.

These advancements create a more

conducive environment for the incorporation of wearable medical technologies.

For instance, newly established and refurbished healthcare facilities are often

equipped with the latest digital health tools, including wearable devices that

monitor vital signs, track health metrics, and provide real-time data to

healthcare providers. In June 2024, the Ministry of Health (MOH) awarded a

Public-Private Partnership (PPP) to Altakassusi Alliance Medical to enhance

radiology and imaging services across seven hospitals, impacting over one

million people. The MOH plans to privatize 290 hospitals and 2,300 healthcare

institutions, increasing private sector involvement from 40% to 65%. This

initiative will establish the nation’s first collaborative network aimed at

supporting hospital staff, thereby improving treatment quality in rural areas.

These partnerships will facilitate the transfer of knowledge and skills,

benefiting the local healthcare workforce through training programs and

knowledge exchange.

With better infrastructure,

healthcare providers are increasingly able to integrate wearable medical

devices into their practice. These devices offer the capability to remotely

monitor patients, which is particularly beneficial for managing chronic

conditions and ensuring continuous care. For example, wearable glucose monitors

can track blood sugar levels in diabetic patients, while wearable ECG monitors

can provide ongoing heart health data. The ability to monitor patients remotely

not only enhances the quality of care but also reduces the need for frequent

in-person visits, thereby streamlining healthcare delivery.

The expansion of

healthcare infrastructure also supports the broader adoption of wearable

medical devices by making these technologies more accessible to both patients

and healthcare professionals. Enhanced infrastructure often includes improved

connectivity and data management systems, which facilitate the effective use of

wearable devices. Healthcare providers can more easily collect, analyze, and

utilize health data from wearable devices, integrating these insights into

patient care plans. This data-driven approach allows for more personalized and

proactive management of health conditions.

Integration with Digital

Health Ecosystems

The integration of wearable

medical devices with broader digital health ecosystems represents a pivotal

driver for the growth of the wearable medical devices market. This integration

creates a more interconnected and cohesive health management experience,

significantly enhancing the utility and appeal of wearable technologies. Wearable

medical devices, such as fitness trackers, heart rate monitors, and glucose

sensors, are increasingly designed to interface seamlessly with mobile apps,

cloud platforms, and electronic health records (EHRs).

This connectivity

enables users to synchronize their health data across multiple platforms, providing

a comprehensive and real-time overview of their health status. For instance, a

wearable glucose monitor can transmit blood sugar levels to a mobile app, which

then updates the user’s health profile on a cloud-based platform. This

integration ensures that health data is continuously updated and accessible

from various devices, making it easier for users to track their health metrics

and manage their conditions effectively.

The ability to share data

seamlessly between wearable devices and digital health platforms facilitates

remote monitoring and proactive health management. Healthcare providers can

access up-to-date health information from their patients through EHRs, allowing

them to monitor vital signs, track health trends, and make timely interventions.

This remote monitoring capability is particularly beneficial for managing

chronic conditions, as it enables continuous oversight without requiring

frequent in-person visits. For example, a patient using a wearable heart rate

monitor can have their data transmitted directly to their cardiologist, who can

then assess the patient’s condition and adjust treatment plans accordingly.

Segmental Insights

Type Insights

Based on the Type, the

diagnostic segment is currently dominating over the therapeutic segment. The

growth and prominence of diagnostic wearables can be attributed to several key

factors that align with the country's healthcare priorities and technological

advancements. The increasing prevalence of chronic diseases such as diabetes,

cardiovascular disorders, and respiratory conditions in Saudi Arabia has

heightened the need for accurate and continuous monitoring of health metrics.

Diagnostic wearable devices, including glucose monitors, heart rate trackers,

and blood pressure monitors, offer real-time data and early detection

capabilities that are crucial for managing these conditions.

These devices

provide immediate feedback on various health parameters, enabling users to monitor

their health status continuously and make informed decisions about their care.

For instance, continuous glucose monitors (CGMs) are widely used by individuals

with diabetes to track their blood sugar levels in real-time, providing

critical information that helps in adjusting insulin dosages and dietary

choices. This functionality is essential for preventing complications and

managing chronic conditions effectively, driving the demand for diagnostic

wearables.

The shift towards

preventive healthcare and proactive health management in Saudi Arabia further

supports the dominance of diagnostic wearables. The government’s Vision 2030

plan emphasizes the importance of early detection and prevention of diseases,

aligning with the capabilities offered by diagnostic wearable devices. By

providing users with continuous health monitoring and immediate access to

diagnostic data, these wearables enable early identification of potential

health issues before they develop into more severe conditions. This proactive

approach is essential for improving overall health outcomes and reducing the

burden on the healthcare system, contributing to the growing adoption of

diagnostic wearables.

Application Insights

Based on the Application, Remote

Patient Monitoring (RPM) is currently the dominant segment over General Health

& Fitness and Home Healthcare. This dominance is driven by several key

factors that align with the country's evolving healthcare landscape,

technological advancements, and increasing healthcare needs. Remote Patient

Monitoring has gained prominence due to its critical role in managing chronic

diseases and supporting the country's healthcare system's shift towards more

integrated and efficient care. RPM wearables, such as continuous glucose

monitors (CGMs), heart rate monitors, and blood pressure trackers, provide

healthcare professionals with real-time data on patients' health conditions.

This capability is essential for managing chronic diseases such as diabetes,

cardiovascular disorders, and hypertension, which are prevalent in Saudi

Arabia. The ability to monitor patients remotely allows for timely

interventions, adjustments in treatment plans, and prevention of complications,

thereby improving patient outcomes and reducing hospital readmissions. This proactive

approach to managing chronic conditions is a significant driver behind the

growth of RPM devices in the Saudi market.

The government's strategic

focus on enhancing healthcare delivery through technology and digital health

solutions is another crucial factor contributing to RPM's dominance. Under the

Vision 2030 plan, Saudi Arabia is investing heavily in healthcare

infrastructure and digital health initiatives to improve patient care and

streamline healthcare services. RPM aligns perfectly with these objectives by

enabling continuous monitoring and data-driven decision-making. The integration

of RPM devices into the healthcare system supports the country's goals of

improving healthcare accessibility, reducing costs, and enhancing the quality

of care. As a result, RPM devices are increasingly being adopted by healthcare

providers and patients alike, driving their market dominance.

Technological

advancements also play a significant role in the prominence of RPM devices.

Innovations in wearable technology, such as improved sensors, data analytics,

and connectivity features, have enhanced the functionality and accuracy of RPM

devices. Modern RPM wearables provide real-time health data, are user-friendly,

and offer seamless integration with mobile apps and electronic health records.

This technological progress has made RPM devices more effective in monitoring

and managing health conditions, contributing to their widespread adoption and

market leadership.

Download Free Sample Report

Regional Insights

Among the various regions in Saudi Arabia, the Central Region is currently the dominant player in the wearable medical devices market. This dominance is attributed to a confluence of factors including high population density, advanced healthcare infrastructure, and strategic investments in digital health technologies. The Central Region, which includes major cities such as Riyadh, is the economic and administrative heart of the country. Riyadh, being the capital city, serves as a hub for numerous healthcare initiatives and technological advancements.

The presence of well-established hospitals like King Faisal Specialist Hospital & Research Centre, specialized medical centers, and research institutions in Riyadh facilitates the adoption and integration of advanced medical technologies, including wearable devices. The region's robust healthcare infrastructure, with over 40 hospitals in the capital alone, provides an ideal environment for the deployment and utilization of wearable medical devices, driving their widespread adoption .

The Central Region benefits from significant government investments and healthcare projects aimed at enhancing the quality of care and improving health outcomes. The Health Sector Transformation Program, part of Saudi Vision 2030, emphasizes the development of digital health solutions and technological innovations, and Riyadh is at the forefront of these initiatives. The government's focus on integrating advanced technologies into healthcare systems aligns with the region's role in leading the market for wearable medical devices.

The high population density in the Central Region also contributes to its dominance in the wearable medical devices market. With a large and diverse population exceeding 8 million in Riyadh, there is a significant demand for healthcare solutions that can manage chronic diseases, monitor health conditions, and provide real-time data. Wearable medical devices, which offer continuous monitoring and health management capabilities, are particularly valuable in this context. The dense population ensures a substantial market for these devices, leading to their widespread use and integration into healthcare practices..

Recent Developments

- In August 2025, in a follow-up to the earlier authorization, the SFDA officially granted marketing authorization for the hand-worn medical wearable developed by King Saud University. This approval underscores the increasing regulatory support for home-grown innovations in the Saudi healthcare market and is expected to accelerate the adoption of locally produced medical wearables.

- In January 2025, Johnson & Johnson MedTech announced the commencement of its direct operations in Saudi Arabia. This strategic move is aimed at strengthening the company's presence in the region and improving access to its portfolio of medical technologies, including those in the wearable and remote patient monitoring sectors.

- In February 2024, GE HealthCare began the deployment of its Portrait™ Mobile wearable monitoring solution across 80 hubs in eight of the Ministry of Health's hospitals. This technology allows for continuous, real-time monitoring of patients' vital signs, enhancing patient safety and enabling earlier detection of clinical deterioration.

- August 2024: The Saudi Food and Drug Authority (SFDA) granted authorization for a locally developed hand-worn medical device from King Saud University. This device, which is protected by patents in both Saudi Arabia and the United States, represents a significant milestone in the Kingdom's push for domestic innovation in medical technology.

- In April 2024, the Boston-based wearable technology

brand has enhanced its executive leadership team as part of its international

expansion, focusing on new markets in the Gulf region. Whoop has bolstered its

C-suite to support its ongoing global growth and is now extending its presence

into the Middle East and Southeast Asia. This includes entering markets such as

Qatar, Saudi Arabia, Kuwait, Bahrain, Hong Kong, Israel, Korea, and Taiwan.

- In May 2024, Bayer and Huma Therapeutics Limited (“Huma”), a top digital health firm, announced the launch of their cutting-edge heart health screening tool in Saudi Arabia. This debut follows

the Bayer Aspirin Heart Health Risk Assessment’s introduction in the US in 2023

and aligns with the key goals of Saudi Arabia's Vision 2030 strategy.

- In February 2024, Saudi Health launched a new

project offering tele-electroencephalogram (EEG) services through the SEHA

Virtual Hospital (SVH). This initiative allows medical officers to monitor EEG

recordings around the clock, as the EEG devices are directly linked to the SEHA

Virtual Hospital.

Key Market Players

- Medtronic Saudi Arabia LLC

- Abbott Saudi Arabia Trading LLC

- VitalAire Arabia

- Zimmo Trading Co. Ltd. (OMRON Healthcare)

- Elite Health Care Co.

|

By Type

|

By Products

|

By Purpose

|

By Application

|

By Distribution Channel

|

By Region

|

|

|

- Activity Monitors/Trackers

- Smartwatches

- Patches

- Smart Clothing

|

- Heart Rate

- Physical Activities

- Blood Oxygen Saturation

- Body Temperature

- Others

|

- General Health & Fitness

- Remote Patient Monitoring

- Home Healthcare

|

- Pharmacies

- E-Commerce

- Others

|

- Western Region

- Central Region

- Southern Region

- Eastern Region

- Northern Region

|

Report Scope:

In this report, the Saudi Arabia Wearable Medical

Devices Market has been segmented into the following categories, in addition to

the industry trends which have also been detailed below:

- Saudi Arabia Wearable

Medical Devices Market, By Type:

o Diagnostics

o Therapeutic

- Saudi Arabia Wearable

Medical Devices Market, By Products:

o Activity Monitors/Trackers

o Smartwatches

o Patches

o Smart Clothing

- Saudi Arabia Wearable

Medical Devices Market, By Purpose:

o Heart Rate

o Physical Activities

o Blood Oxygen Saturation

o Body Temperature

o Others

- Saudi Arabia Wearable

Medical Devices Market, By Application:

o General Health & Fitness

o Remote Patient Monitoring

o Home Healthcare

- Saudi Arabia Wearable

Medical Devices Market, By Distribution Channel:

o Pharmacies

o E-Commerce

o Others

- Saudi Arabia Wearable

Medical Devices Market, By Region:

o Western Region

o Central Region

o Southern Region

o Eastern Region

o Northern Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the Saudi Arabia Wearable Medical Devices Market.

Available Customizations:

Saudi Arabia Wearable Medical Devices Market report

with the given market data, Tech Sci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Saudi Arabia Wearable Medical Devices Market is

an upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]