Forecast Period | 2025-2029 |

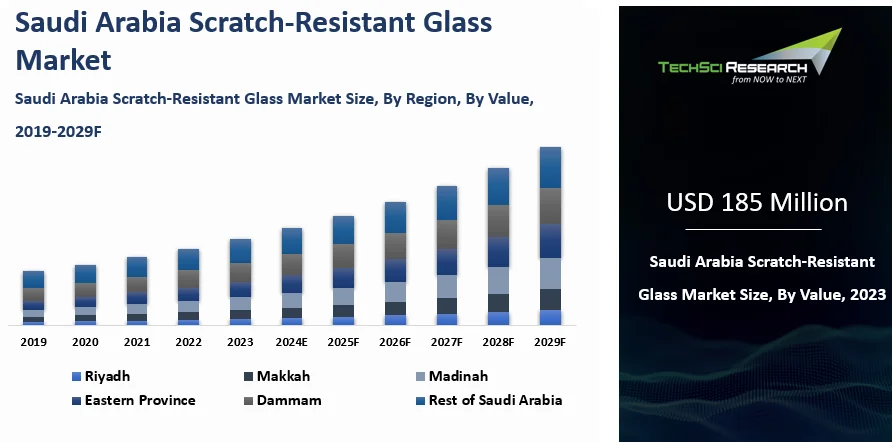

Market Size (2023) | USD 185 Million |

Market Size (2029) | USD 314 Million |

CAGR (2024-2029) | 9.10% |

Fastest Growing Segment | Smartphones & Tablets |

Largest Market | Riyadh |

Market Overview

Saudi Arabia Scratch-Resistant Glass

Market was valued at USD 185 Million in 2023 and is expected to reach USD 314 Million by 2029 with a CAGR of 9.10% during the forecast period.

The Scratch-Resistant Glass market

refers to the sector within the glass industry focused on producing glass

materials that are resilient to scratches and abrasions. This specialized type

of glass is designed to maintain its clarity and structural integrity even

after prolonged use, reducing the need for frequent replacement and enhancing

durability in various applications. Key players in this market include

manufacturers who develop and distribute scratch-resistant glass for

smartphones, tablets, automotive windshields, and architectural purposes.

Demand for scratch-resistant glass has

grown steadily due to its ability to enhance the longevity and aesthetic appeal

of products while ensuring better user experience through improved resistance

to everyday wear and tear. Innovations in materials and manufacturing processes

have further bolstered market expansion, allowing for the production of

thinner, lighter, and more scratch-resistant glass variants. The market

dynamics are influenced by technological advancements, consumer preferences for

durable and high-performance materials, and regulations promoting safety and

quality standards in various industries. As global industries continue to

prioritize sustainability and efficiency, the Scratch-Resistant Glass market is

expected to evolve with ongoing research and development efforts aimed at

enhancing performance characteristics and expanding application possibilities.

Download Free Sample Report

Key Market Drivers

Increasing Demand in Consumer Electronics

The increasing demand for scratch-resistant glass in consumer electronics is another significant driver of the market in Saudi Arabia. As consumer electronics such as smartphones, tablets, and wearable devices continue to proliferate, there is a growing need for durable display materials with thickness ranging from 0.4 mm to 2.0 mm that can withstand everyday use and maintain optical clarity over time.

In Saudi Arabia, as in many other parts of the world, consumers value high-quality products that offer superior durability and aesthetics. Scratch-resistant glass plays a crucial role in enhancing the longevity of electronic devices by protecting their screens from scratches, smudges, and abrasions, offering up to 10 times more resistance to scratches than normal glass. This not only improves the user experience by ensuring clear visibility with light transmittance up to 90-92% and touch sensitivity but also reduces the frequency of screen replacements, contributing to cost savings for consumers and manufacturers alike.

The demand for scratch-resistant glass in consumer electronics is driven by advancements in display technologies such as OLED and AMOLED, which require robust and scratch-resistant cover materials with hardness ratings of 6-7 on the Moh's scale and coatings incorporating materials like silica, cerium oxide, or titanium dioxide to maintain optimal performance. Saudi Arabian manufacturers have capitalized on this trend by developing specialized glass solutions with chemical strengthening and up to 4x improvement in scratch resistance that meet the stringent requirements of electronic device manufacturers for thinness, lightness, and durability.

The proliferation of mobile computing and communication devices has fueled the adoption of scratch-resistant glass in Saudi Arabia's consumer electronics market. As more consumers rely on smartphones and tablets for everyday tasks such as communication, entertainment, and productivity, there is an increasing emphasis on the reliability and longevity of these devices' display screens.

The trend towards premiumization in consumer electronics has prompted manufacturers to integrate scratch-resistant glass with enhanced impact tolerance and optical clarity into flagship and high-end models. Saudi Arabian manufacturers have responded to this trend by offering customizable solutions that cater to the specific needs and preferences of electronic device OEMs, ensuring compatibility with advanced technologies and design aesthetics..

Growth in Automotive Sector Applications

The automotive sector's increasing adoption of scratch-resistant glass represents a significant driver for the market in Saudi Arabia. As the kingdom continues to invest in infrastructure and economic diversification, the automotive industry has experienced substantial growth, with the country registering approximately 625,000 new vehicles in 2023 and vehicle imports exceeding one million annually, driving demand for advanced materials that enhance vehicle safety, aesthetics, and performance.

In Saudi Arabia, scratch-resistant glass is primarily used in automotive applications such as windshields, side windows, and rear windows. These glass components are crucial for providing clear visibility, protecting occupants from external elements, and contributing to the overall structural integrity of vehicles. The demand for scratch-resistant glass in the automotive sector is driven by stringent safety regulations, consumer preferences for enhanced driving experiences, and advancements in vehicle design and technology.

One of the key factors driving the adoption of scratch-resistant glass in the automotive sector is its ability to improve the durability and longevity of vehicle components. Saudi Arabian manufacturers have invested in specialized glass formulations and coating technologies that enhance scratch resistance while maintaining optical clarity and impact resistance. This allows automotive OEMs to offer vehicles with robust and aesthetically pleasing glass surfaces that withstand environmental hazards and everyday wear and tear.

The integration of advanced driver assistance systems (ADAS) and smart technologies in modern vehicles has heightened the demand for high-performance glass materials. Scratch-resistant glass plays a crucial role in supporting the functionality of sensors and cameras embedded in vehicle windshields and windows, ensuring reliable performance and accuracy of ADAS features such as lane departure warning and collision avoidance systems.

The trend towards lightweighting in automotive design has prompted Saudi Arabian manufacturers to develop thinner and lighter scratch-resistant glass solutions. These advancements not only contribute to fuel efficiency and reduced carbon emissions but also align with global sustainability goals and regulatory standards in the automotive industry, particularly as the Kingdom plans to locally produce over 300,000 vehicles annually by 2030 and aims to have 3-4 OEMs producing over 400,000 passenger vehicles by the same year. Saudi Arabia is the largest automotive market in the Gulf Cooperation Council (GCC) region, with over 600,000 new car sales annually.

Key Market Challenges

Cost and Pricing Pressures

One of the significant

challenges confronting the Scratch-Resistant Glass market in Saudi Arabia is

the cost and pricing pressures associated with manufacturing and marketing

high-performance glass materials. While scratch-resistant glass offers superior

durability and aesthetic benefits, it typically requires specialized coatings,

advanced manufacturing techniques, and quality control processes that

contribute to higher production costs.

In Saudi Arabia, where the

manufacturing sector is evolving and infrastructure investments are

substantial, manufacturers face competitive pressures to optimize production

efficiency while maintaining product quality and cost competitiveness. The cost

of raw materials, including specialized coatings and glass substrates, can

fluctuate based on global market trends and supply chain dynamics, impacting

the overall cost structure of scratch-resistant glass products.

Pricing pressures in the

global marketplace pose challenges for Saudi Arabian manufacturers seeking to

penetrate international markets and compete with established players. Overseas

competitors often benefit from economies of scale, established distribution

networks, and brand recognition, allowing them to offer competitive pricing

strategies that may undercut local producers in Saudi Arabia.

The diverse applications of

scratch-resistant glass across sectors such as consumer electronics,

automotive, and construction necessitate customized solutions that meet

specific performance requirements and regulatory standards. This customization

adds complexity to the manufacturing process and may require additional

investments in research and development, testing, and certification to ensure

compliance with industry specifications and customer expectations.

To address these challenges,

Saudi Arabian manufacturers are increasingly focusing on innovation and

technological advancements to enhance production efficiency, reduce material

costs, and differentiate their offerings in the market. Collaborations with research

institutions, adoption of automation and smart manufacturing technologies, and

strategic partnerships with global suppliers are strategies employed to

mitigate cost pressures and improve competitiveness.

Fostering a supportive

regulatory environment and incentivizing investments in advanced manufacturing

capabilities can facilitate the growth of the Scratch-Resistant Glass market in

Saudi Arabia. By aligning industry stakeholders, government agencies, and

academic institutions, Saudi Arabia can strengthen its position as a hub for

innovative glass technologies and enhance its competitiveness in the global

marketplace.

Technological and Material Challenges

Another challenge facing the

Scratch-Resistant Glass market in Saudi Arabia relates to technological

limitations and material constraints that impact product innovation, quality

assurance, and market adoption. Despite advancements in manufacturing processes

and coating technologies, Saudi Arabian manufacturers may encounter challenges

in achieving consistent product performance, durability, and compatibility with

evolving industry standards.

One of the primary

technological challenges is the development of advanced coating techniques that

enhance scratch resistance without compromising other essential properties such

as optical clarity, impact resistance, and chemical durability. Coatings applied

to scratch-resistant glass must withstand environmental factors, including

humidity, temperature variations, and UV radiation, which can degrade

performance over time if not properly formulated and applied.

In Saudi Arabia, where

environmental conditions can be harsh and variable, ensuring the long-term

durability and reliability of scratch-resistant glass products is crucial for

meeting customer expectations and regulatory requirements across different sectors.

Manufacturers must invest in research and development to refine coating

formulations, optimize application processes, and conduct rigorous testing to

validate product performance under real-world conditions.

The availability and quality

of raw materials used in scratch-resistant glass production can pose challenges

for Saudi Arabian manufacturers. Dependence on imported materials, fluctuations

in global supply chains, and regulatory barriers affecting the procurement of

specialty chemicals and coatings may impact production schedules, cost

structures, and product quality control measures.

Technological advancements

in alternative materials and competing technologies present both opportunities

and challenges for the Scratch-Resistant Glass market in Saudi Arabia. Emerging

trends such as polymer-based coatings, nanotechnology solutions, and advanced

ceramics offer potential alternatives to traditional glass substrates,

presenting manufacturers with choices and considerations regarding material

selection, performance trade-offs, and market differentiation.

Addressing these

technological and material challenges requires a collaborative approach among

industry stakeholders, government entities, and academic institutions in Saudi

Arabia. Investments in research and development, technology transfer

initiatives, and partnerships with international experts can accelerate

innovation cycles, foster knowledge exchange, and strengthen local capabilities

in advanced glass manufacturing.

Key Market Trends

Increasing Demand in Smartphones and Consumer

Electronics

A prominent trend in the Saudi Arabian

Scratch-Resistant Glass market is the increasing demand from the consumer

electronics sector, particularly in smartphones and other mobile devices. As

technological advancements continue to drive innovation in display technologies

and device designs, there is a growing emphasis on integrating durable and

high-performance materials such as scratch-resistant glass to enhance product

longevity and user experience.

In Saudi Arabia, consumers are increasingly adopting

smartphones equipped with scratch-resistant glass to protect against everyday

wear and tear, including scratches, smudges, and impact damage. This trend is

driven by the kingdom's youthful demographic, high smartphone penetration

rates, and consumer preferences for premium devices that offer superior

durability and aesthetics.

The proliferation of mobile applications and digital

services has further fueled the demand for scratch-resistant glass in Saudi

Arabia's consumer electronics market. As smartphones and tablets become

indispensable tools for communication, entertainment, and productivity, there

is a heightened awareness among consumers regarding the importance of investing

in devices equipped with robust screen protection technologies.

Advancements in smartphone design, including

bezel-less displays and edge-to-edge screens, have increased the surface area

susceptible to scratches and damage. Saudi Arabian manufacturers have responded

by developing specialized scratch-resistant glass solutions that maintain

optical clarity, touch sensitivity, and structural integrity while meeting the

stringent design specifications of leading smartphone OEMs.

The integration of scratch-resistant glass in premium

and flagship smartphone models has become a key differentiator for device

manufacturers seeking to capture market share in Saudi Arabia's competitive

consumer electronics landscape. By offering devices with enhanced durability

and visual appeal, smartphone brands can cater to discerning consumers who

prioritize quality, reliability, and long-term value.

Growth in Automotive Safety and Design Applications

Another notable trend in the Saudi Arabian

Scratch-Resistant Glass market is the growing adoption of scratch-resistant

glass in automotive applications, driven by advancements in vehicle safety,

design aesthetics, and regulatory compliance. As the kingdom continues to

invest in infrastructure development and automotive manufacturing, there is an

increasing emphasis on integrating high-performance materials that enhance

vehicle safety, comfort, and visual appeal.

In Saudi Arabia, scratch-resistant glass is primarily

used in automotive applications such as windshields, side windows, and

panoramic roofs. These glass components play a critical role in providing clear

visibility, protecting occupants from external elements, and supporting the

structural integrity of vehicles during collisions and adverse weather

conditions.

One of the key drivers behind the adoption of

scratch-resistant glass in the automotive sector is the evolution of safety

regulations and industry standards that prioritize occupant protection and

crashworthiness. Saudi Arabian manufacturers have invested in advanced glass

technologies, including laminated and tempered glass solutions with integrated

scratch-resistant coatings, to meet stringent safety requirements and enhance

overall vehicle performance.

Consumer preferences for luxurious and technologically

advanced vehicles have influenced the integration of scratch-resistant glass in

premium and luxury automotive models available in the Saudi Arabian market.

These vehicles often feature advanced driver assistance systems (ADAS) and

infotainment displays that rely on durable and optically clear glass materials

to optimize functionality and user experience.

The trend towards lightweighting in automotive design

has prompted Saudi Arabian manufacturers to develop thinner and lighter

scratch-resistant glass solutions that contribute to fuel efficiency and

reduced carbon emissions. By leveraging innovative glass formulations and

manufacturing techniques, automotive OEMs can achieve significant weight

savings without compromising on safety or performance.

The rise of electric and autonomous vehicles (EVs and

AVs) has opened new opportunities for scratch-resistant glass manufacturers in

Saudi Arabia. These vehicles require advanced glass solutions that support the

integration of sensors, cameras, and augmented reality displays while

maintaining reliability and durability in diverse operating environments.

Segmental Insights

Product Type Insights

The Chemically Strengthened Glass held the largest market share

in 2023. Chemically strengthened glass

offers a compelling balance of scratch resistance, durability, and

cost-effectiveness. Through a chemical process involving ion exchange,

typically with potassium salts, the surface of the glass is hardened, creating

a compressive layer that enhances its resistance to scratches and impacts. This

process allows manufacturers to produce scratch-resistant glass that meets

stringent quality standards while remaining competitive in terms of pricing compared

to alternative materials like sapphire glass.

Chemically strengthened glass maintains

excellent optical clarity and transparency, which are essential for

applications such as smartphone screens, automotive windows, and architectural

glazing. This optical clarity ensures that users experience minimal distortion

and optimal visual performance, making it a preferred choice in consumer

electronics and architectural projects where aesthetics play a crucial role.

The manufacturing process for chemically

strengthened glass is well-established and scalable, enabling efficient

production to meet growing market demands in Saudi Arabia. Manufacturers can

achieve consistent quality and performance metrics while adapting production

capabilities to accommodate diverse product specifications and customer

requirements across different industries.

Chemically strengthened glass is known

for its versatility in design and customization. It can be tempered to varying

thicknesses and shapes, offering flexibility for integration into different

applications without compromising on its scratch-resistant properties. This

versatility extends its usability across sectors ranging from smartphones and

tablets to automotive windshields and high-rise building facades, catering to

the diverse needs of consumers and businesses alike.

Download Free Sample Report

Regional Insights

Riyadh held the largest market share in

2023. The Riyadh region emerges as a

dominant force in the Saudi Arabia Scratch-Resistant Glass market due to several

key factors that collectively bolster its position as a hub for manufacturing,

demand, and strategic significance within the kingdom's economic landscape.

Riyadh, as the capital city and

administrative center of Saudi Arabia, serves as a focal point for industrial

development and investment. The region's robust infrastructure, including

industrial zones and manufacturing facilities, provides a conducive environment

for the production and distribution of scratch-resistant glass products.

Manufacturers in Riyadh benefit from access to skilled labor, logistical

networks, and supportive governmental policies aimed at fostering industrial

growth and innovation.

Riyadh's status as a major commercial

and financial hub amplifies its role in driving demand for scratch-resistant

glass across various sectors. The region's burgeoning consumer electronics

market, fueled by a tech-savvy population and rising disposable incomes, drives

significant demand for smartphones, tablets, and wearable devices equipped with

durable and high-performance glass materials. Manufacturers in Riyadh cater to

this demand by supplying scratch-resistant glass solutions that meet stringent quality

standards and technological specifications.

Riyadh's position as a center of

automotive manufacturing and construction activities further enhances its

dominance in the Scratch-Resistant Glass market. The automotive sector, in

particular, relies on scratch-resistant glass for applications such as windshields,

side windows, and panoramic roofs, where durability and safety are paramount.

Riyadh-based manufacturers leverage advanced technologies and specialized

coatings to meet the stringent requirements of automotive OEMs and enhance

vehicle performance and aesthetics.

Riyadh's geographical location and

strategic importance within the Gulf Cooperation Council (GCC) region

contribute to its dominance in the Scratch-Resistant Glass market. The region

serves as a gateway for trade and commerce, facilitating the export of scratch-resistant

glass products to neighboring countries and beyond. This geographical advantage

positions Riyadh-based manufacturers favorably in capturing market share and

expanding their footprint in the competitive global marketplace.

Recent Developments

- In December 2024, SCHOTT agreed to acquire QSIL GmbH Quarzschmelze Ilmenau, a German producer of high-purity quartz glass and semiconductor materials. The deal supports SCHOTT’s plan to expand its high-performance semiconductor glass range and strengthen its role in advanced packaging and lithography, with closing expected in early 2025.

- In January 2025, SCHOTT completed the QSIL acquisition. The company integrated QSIL’s quartz glass capabilities and semiconductor material expertise into its specialty glass portfolio to meet rising demand for precise, high-performance materials used in AI and next-generation chip production.

- In February 2024, Motorola stated that all devices in its 2024 lineup would feature Corning Gorilla Glass starting in the second half of the year. The move reflects a push for stronger and more reliable devices and expands Lenovo’s ongoing partnership with Corning across laptops, tablets, and smartphones.

- In June 2024, Corning has unveiled

Gorilla Glass 7i, a cutting-edge glass technology designed to offer superior

drop protection for budget and mid-range smartphones. Laboratory testing has

demonstrated its ability to withstand drops from heights of up to 1 meter onto

surfaces resembling asphalt. This performance surpasses that of competing

lithium aluminosilicate glasses, which generally fail when dropped from less

than half a meter. Furthermore, the new glass boasts twice the scratch

resistance of other glasses in its class, positioning it as a compelling choice

for manufacturers aiming to enhance the durability and longevity of their

mobile devices.

Key Market Players

- Saint-Gobain Group

- Nippon Sheet Glass Co., Ltd.

- Koch Inc

- AGC Inc.

- Central Glass Co. Ltd.

- Corning Incorporated

- Xinyi Glass Holdings Limited

- Vitro, S.A.B de C.V.

|

By Product Type

|

By Application

|

By Region

|

- Chemically Strengthened Glass

- Sapphire Glass

|

- Automotive

- Interior Architecture

- Smartphones & Tablets

- Consumer Electronics

- Others

|

- Riyadh

- Makkah

- Madinah

- Eastern Province

- Dammam

- Rest of Saudi Arabia

|

Report Scope:

In this report, the Saudi Arabia Scratch-Resistant

Glass Market has been

segmented into the following categories, in addition to the industry trends

which have also been detailed below:

- Saudi

Arabia Scratch-Resistant

Glass Market, By Product Type:

o Chemically Strengthened Glass

o Sapphire Glass

- Saudi

Arabia Scratch-Resistant

Glass Market, By Application:

o Automotive

o Interior Architecture

o Smartphones & Tablets

o Consumer Electronics

o Others

- Saudi

Arabia Scratch-Resistant Glass Market, By Region:

o Riyadh

o Makkah

o Madinah

o Eastern Province

o Dammam

o Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the Saudi Arabia Scratch-Resistant Glass Market.

Available Customizations:

Saudi Arabia Scratch-Resistant Glass Market report

with the given market data, TechSci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Saudi Arabia Scratch-Resistant Glass Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]