|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

1625.85 Million

|

|

Market

Size (2030)

|

USD

2240.63 Million

|

|

CAGR

(2025-2030)

|

5.45%

|

|

Fastest

Growing Segment

|

Active

Pharmaceutical Ingredient (API)

|

|

Largest

Market

|

Northern

& Central

|

Market Overview

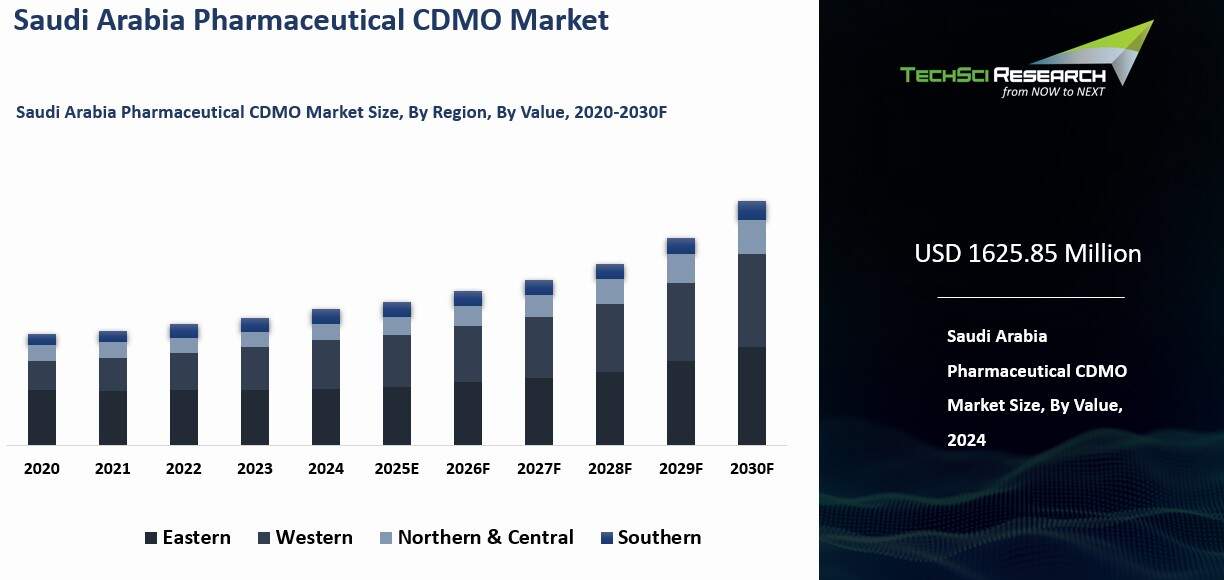

Saudi Arabia Pharmaceutical CDMO Market was valued at USD 1625.85 Million in 2024 and is expected to reach USD 2240.63 Million by 2030 with a CAGR of 5.45% during the forecast period.

Vitamin supplements are designed to enhance the regular diet by providing individuals with the necessary daily nutritional value. Vitamins play crucial roles in the development and proper functioning of the body, acting as hormones, coenzymes, and antioxidants. Various factors such as shifting dietary preferences, busy lifestyles, rising employment rates, and increased awareness of the health benefits associated with vitamin supplements are expected to positively influence the market growth.

Due to hectic schedules, many individuals struggle to maintain a balanced diet, resulting in nutrient deficiencies. Consequently, there has been a significant rise in the consumption of vitamin supplements to fulfill daily nutrient and vitamin requirements, promoting overall health and vitality.

The increasing healthcare expenditure worldwide is also anticipated to drive the demand for vitamin supplements. Additionally, the growing elderly population in both developed and developing economies presents lucrative opportunities for market players in the forecast period. The senior population, in particular, relies on vitamin supplements to meet their dietary needs, promote bone health, and support overall well-being.

Download Free Sample Report

Key Market Drivers

Increasing Domestic Demand for Pharmaceuticals

Rising domestic demand for pharmaceuticals is a major growth driver for Saudi Arabia’s pharmaceutical CDMO market. This demand stems from demographic expansion, increasing healthcare needs, and evolving patient expectations, underpinned by expanded insurance coverage exceeding 13 million beneficiaries and broad digital access through the national Sehhaty platform. The country’s preference for branded and prescription medicines is strong, with prescription products leading channel sales. Saudi Arabia leads the region in pharmaceutical market value, indicating a robust base for CDMO services. The growing and urbanizing population continues to boost the need for a wide range of medicines, from over-the-counter to advanced prescription drugs.

As the population ages, the prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer is rising, creating sustained demand for pharmaceuticals, exemplified by an estimated 3.39 million adults with diabetes. CDMOs play a critical role by supporting local drug production and reducing reliance on international supply chains. Their scalable, cost-efficient manufacturing capabilities help meet the growing need for generics, biosimilars, and specialized treatments.

Vision 2030’s diversification strategy is accelerating domestic pharmaceutical production. Government initiatives to modernize healthcare infrastructure, increase access to essential drugs, and attract private partnerships are driving CDMO growth. Local manufacturing helps lower healthcare costs, reduce import dependence, and ensure steady medicine availability. CDMOs are well-positioned to collaborate with both local and global firms to supply critical therapies to the Saudi market.

Generics are gaining importance due to their affordability and long-term role in managing chronic conditions. CDMOs provide high-quality, large-scale production of generics, helping maintain supply stability and cost control. The government’s localization push offers incentives for CDMOs to expand operations within the Kingdom, addressing supply vulnerabilities and strengthening pharmaceutical resilience.

Regulatory reforms have simplified approval processes and encouraged investment in domestic production. Public health programs, including vaccination and disease prevention initiatives, further raise demand for essential medicines. By supporting these programs through contract manufacturing, CDMOs ensure consistent availability of critical pharmaceuticals, reinforcing Saudi Arabia’s goal of achieving a self-sufficient, resilient healthcare ecosystem.

Health System Modernization

Health system modernization is a key factor driving the growth of Saudi Arabia’s pharmaceutical CDMO market. Ongoing reforms, policy updates, and large-scale investments are transforming healthcare delivery, improving patient access, and expanding pharmaceutical manufacturing capacity. The country has developed some of the most advanced hospitals in the Middle East, featuring tertiary care facilities that rival those in Western Europe, and continues to build new hospitals and specialized centers.

Non-communicable diseases are a major concern, accounting for 84% of all deaths in Saudi Arabia. Cardiovascular diseases contribute 49%, ischemic heart disease 24%, and strokes 16%. As the nation moves toward universal health coverage, more citizens will gain access to healthcare services, significantly increasing demand for pharmaceuticals. CDMOs are crucial to meeting this need by producing generics, vaccines, and biologics at scale to support broader health coverage and expanded treatment capacity.

The government’s emphasis on preventive healthcare and early detection further drives pharmaceutical demand. National campaigns on vaccination, screening, and wellness require consistent drug and vaccine production, areas where CDMOs play a vital role by delivering cost-effective and efficient manufacturing. Healthcare modernization also prioritizes treatment for cancer, diabetes, and autoimmune diseases, fueling the need for biologics and personalized therapies. CDMOs provide the technical and operational expertise to manufacture complex products like biosimilars and gene therapies that support specialized medical centers.

Regulatory improvements led by the Saudi Food and Drug Authority (SFDA) have streamlined drug approvals, encouraging domestic production. Vision 2030 aims to reduce import dependence by promoting local manufacturing facilities and fostering self-sufficiency in essential medicines. Public-private partnerships are expanding across manufacturing, research, and distribution. With their advanced production capabilities, CDMOs are central to these collaborations, helping strengthen the supply chain and ensuring Saudi Arabia’s healthcare system evolves into a modern, resilient, and innovation-driven model.

Cost Efficiency and Global Competitiveness

Cost efficiency and global competitiveness are major growth drivers for Saudi Arabia’s pharmaceutical CDMO market. As companies face pressure to cut costs while maintaining quality, Saudi Arabia’s strategy to produce 40% of its pharmaceutical products domestically plays a central role. Local manufacturing reduces expenses tied to import duties, logistics, and long lead times, while lower labor costs, raw material availability, and government incentives strengthen the cost base.

Rising demand for chronic disease treatments and biologics enables CDMOs to achieve economies of scale, improving operational efficiency and lowering unit costs. Advanced production methods such as automation and continuous manufacturing further enhance productivity, making Saudi CDMOs attractive to regional and global partners. Vision 2030 reinforces this competitiveness through tax breaks, subsidies, and financial incentives that reduce operational burdens and support affordable, large-scale manufacturing.

Saudi Arabia’s geographic position linking Asia, Africa, and Europe provides a strategic advantage. Its proximity to major trade routes and GCC partnerships reduces transportation costs and ensures faster market access. This location strengthens the country’s position as a regional manufacturing hub for international pharmaceutical companies.

Technology adoption is another key driver of cost efficiency. CDMOs are investing in automation, artificial intelligence, and robotics to streamline production, reduce waste, and maintain consistent quality. Compliance with FDA, EMA, and WHO standards positions Saudi CDMOs as trusted global suppliers. As outsourcing grows worldwide, global pharmaceutical firms increasingly turn to Saudi Arabia for cost-effective, compliant manufacturing. This combination of efficiency, quality, and accessibility reinforces the country’s emerging role in regional and international pharmaceutical supply chains.

Key Market Challenges

Regulatory and Compliance Barriers

Despite improvements in Saudi Arabia’s regulatory environment, challenges remain in compliance with international standards and the speed of approvals. The Saudi Food and Drug Authority (SFDA) is working to streamline processes and improve transparency, but navigating regulations can still be complex, especially for foreign pharmaceutical companies entering the market.

International pharmaceutical companies often experience delays in approvals for new drug formulations and advanced therapies. These delays slow the entry of new products into the Saudi market.

Manufacturers also face the added challenge of adhering to multiple regulatory frameworks for export. CDMOs must comply with Saudi regulations and meet the stringent requirements of international markets such as the U.S., Europe, and Asia.

This dual compliance requirement increases both cost and operational complexity. Any discrepancies in meeting standards can cause production delays, loss of market access, or penalties. These risks reduce the ability of Saudi CDMOs to scale and compete globally.

Shortage of Skilled Labor and Expertise

Pharmaceutical manufacturing requires specialized skills in quality control, regulatory compliance, biotechnology, and process engineering. In Saudi Arabia, there is a shortage of skilled labor in these critical areas.

The local workforce, while expanding, often lacks the advanced technical expertise needed for a modern pharmaceutical environment. This skills gap makes it difficult for CDMOs to scale up production, implement advanced processes, and adopt new technologies efficiently.

The Saudi government is investing in education and training programs to address this gap. However, the pace at which the labor market can meet demand remains a challenge.

In the absence of a fully skilled workforce, CDMOs may struggle to maintain high standards, optimize production, and remain competitive on a global scale. Reliance on foreign expertise and the high cost of training and retaining professionals add further operational complexity for Saudi-based CDMOs..

Key Market Trends

Integration of Advanced Manufacturing Technologies

The future of pharmaceutical manufacturing in Saudi Arabia will rely on integrating advanced technologies such as automation, artificial intelligence (AI), and data analytics. These tools are reshaping production by improving efficiency, reducing errors, and optimizing resources.

Automation is being widely adopted by CDMOs to streamline operations, reduce manual labor, and enhance scalability. This allows faster production, lower costs, and consistent product quality.

AI and machine learning support process optimization, predictive maintenance, and quality control. By analyzing vast production data, CDMOs can detect inefficiencies, forecast equipment issues, and enhance performance. These tools are also crucial for complex drug manufacturing, including biologics, where precision in formulation and production is vital.

As Saudi Arabia advances technologically, CDMOs are expected to leverage these innovations to lead in high-tech manufacturing. This transition not only cuts production costs but also enables them to meet growing needs for high-quality, customized drugs efficiently and sustainably..

Shift Towards Biopharmaceuticals and Specialty Drugs

The pharmaceutical sector is shifting toward biopharmaceuticals and specialty drugs, and Saudi Arabia is part of this transition. Biologics, biosimilars, gene therapies, and targeted treatments are gaining importance as medical science advances and patient needs become more complex.

This shift creates strong growth opportunities for Saudi CDMOs, which are well-positioned to support the development and production of complex products. Saudi Arabia is gradually becoming a hub for biologics and specialty drug manufacturing in the Middle East. With greater government focus on reducing import dependence and boosting domestic output, CDMOs are investing in advanced facilities and equipment.

These include infrastructure for aseptic processing, cold chain storage, and bioreactors for cultivating living cells used in biologic production. As global demand for biopharmaceuticals rises, Saudi CDMOs can benefit from increased outsourcing by international firms seeking reliable, cost-efficient partners. This trend will continue to attract investment into Saudi Arabia’s pharmaceutical manufacturing sector and strengthen its CDMO market growth.

.jpg)

Download Free Sample Report

Segmental Insights

Product Insights

Based

on the category of Product, In 2024, the Active Pharmaceutical Ingredient (API) segment dominated the Saudi Arabia Pharmaceutical CDMO market. The main driver behind this leadership is the rising demand for generic drugs across Saudi Arabia and the wider Middle East. As healthcare systems focus on cost control and better access to essential medicines, generics have become a key focus due to their affordability.

Saudi CDMOs specializing in API production are meeting this demand by supplying active ingredients for a wide range of generic medicines, which represent a major share of the pharmaceutical market. Local API production reduces import dependence and improves access to affordable drugs within the region. This growing demand for generics provides strong growth opportunities for Saudi CDMOs, reinforcing the API segment’s dominance.

Saudi Arabia’s Vision 2030 supports self-sufficiency in pharmaceutical manufacturing through incentives such as tax breaks, subsidies, and investment support. These measures encourage CDMOs to build advanced facilities for large-scale API production, serving both domestic and export markets. This shift enhances the country’s competitiveness in the regional and global supply chain.

API manufacturing also offers economic advantages. It requires lower capital investment than full drug formulation and faces fewer regulatory hurdles, allowing faster scalability. Saudi CDMOs can expand capacity quickly, achieving cost efficiency and economies of scale. The cost benefits of local API production lead to competitive pricing, enabling Saudi CDMOs to supply high-quality active ingredients at lower prices than many international producers.

These factors rising generic demand, government-backed localization, and cost-efficient production—are expected to continue driving the growth and dominance of the API segment in Saudi Arabia’s pharmaceutical CDMO market.

Regional Insights

Northern

and Central emerged as the dominant in the Saudi Arabia Pharmaceutical CDMO market

in 2024, holding the largest market share in terms of both value and volume. The

Northern and Central regions of Saudi Arabia benefit from a strategic

geographic location, offering proximity to key domestic markets and access to

international trade routes. Riyadh, the capital city, is situated in the

Central region and serves as a central hub for both domestic and international

business, providing access to a well-developed infrastructure network that

connects the region to major commercial ports and transport corridors.

Riyadh’s

location allows it to serve as the primary business and logistical hub for

pharmaceutical CDMOs, enabling companies to efficiently distribute products

within Saudi Arabia and to other parts of the MENA region. The Central and

Northern regions' proximity to ports such as Dammam and Jeddah also facilitates

the import of raw materials and APIs, while providing convenient export routes

for finished pharmaceutical products.

This connectivity is crucial for

pharmaceutical companies looking to expand their reach across the Middle East,

North Africa, and Southeast Asia. The development of modern industrial zones

and state-of-the-art pharmaceutical manufacturing facilities in the Northern

and Central regions is a significant factor driving the dominance of these

areas in Saudi Arabia’s pharmaceutical CDMO market. Riyadh and Dammam are home

to numerous industrial parks that support pharmaceutical manufacturing,

equipped with cutting-edge facilities that adhere to international standards.

For

example, Riyadh has been a focal point for investments in high-tech

pharmaceutical production facilities, offering CDMOs the infrastructure to

produce everything from small-molecule drugs to biologics. The establishment of

dedicated pharmaceutical zones allows for the streamlined production and

regulatory compliance processes necessary for the CDMO sector, enabling

companies to scale operations and meet rising local and regional demand for

pharmaceuticals.

Recent Developments

- In March 2024, the Public Investment Fund (PIF) launched Lifera, a national biopharma CDMO platform designed to expand vaccine, biologics, and broader biomanufacturing capabilities, establishing sovereign-backed contract development and manufacturing within Saudi Arabia.

- In August 2024, SPIMACO entered a regional partnership with Altos Biologics to locally manufacture and commercialize ALT-L9 (aflibercept biosimilar), advancing technology transfer and regional production of specialty biologics in the Kingdom.

- In April 2025, Polaris Pharmaceuticals signed an exclusive licensing and supply agreement with Tabuk Pharmaceuticals to introduce ADI-PEG20 across Saudi Arabia and the GCC. Under this structure, Polaris oversees development and manufacturing, while Tabuk manages marketing authorization and commercialization reflecting a CDMO-linked supply and tech-transfer model.

- In

December 2024, Bio-Thera Solutions Inc, a biopharmaceutical company focused on

developing innovative therapies and biosimilars, has entered into a strategic

partnership with Tabuk Pharmaceutical Manufacturing Company, a fully owned

subsidiary of Astra Industrial Group and a leading pharmaceutical player in the

Middle East and North Africa (MENA) region. Under the terms of the agreement,

Tabuk has secured exclusive rights to manufacture, distribute, and market

BAT2206, Bio-Thera’s ustekinumab biosimilar, in Saudi Arabia. This partnership

aims to expand the availability of advanced biologic treatments in the region

while enhancing Tabuk's portfolio with a key biosimilar offering.

Key Market Players

- Tabuk

Manufacturing Company

- Lifera

- Saudi

Bio, Kingdom of Saudi Arabia

- Fresenius

Kabi MENA

- Hikma

Pharmaceuticals PLC

- Pfizer

Scientific Technical Limited Company

- Novartis

AG

|

By

Product

|

By

Application

|

By

Workflow

|

By

Region

|

- API

- Synthetic

- Solid

- Liquid

- Biotech

- Drug

Product

- Oral

Solid Dose

- Semi-solid

Dose

- Liquid

Dose

- Others

|

- Oncology

- Small

Molecule

- Biologics

- Infectious

Diseases

- Neurological

Disorders

- Cardiovascular

Diseases

- Metabolic

Disorders

- Autoimmune

Diseases

- Respiratory

Diseases

- Ophthalmology

- Gastrointestinal

Disorders

- Hormonal

Disorders

- Hematological

Disorders

- Others

|

|

- Eastern

- Western

- Northern

& Central

- Southern

|

Report Scope:

In this report, the Saudi Arabia Pharmaceutical

CDMO Market has been segmented into the following categories, in addition to

the industry trends which have also been detailed below:

- Saudi Arabia Pharmaceutical CDMO Market, By Product:

o API

o Synthetic

o Solid

o Liquid

o Biotech

o Drug Product

o Oral Solid Dose

o Semi-solid Dose

o Liquid Dose

o Others

- Saudi Arabia Pharmaceutical CDMO Market, By Application:

o Oncology

o Small Molecule

o Biologics

o Infectious Diseases

o Neurological Disorders

o Cardiovascular Diseases

o Metabolic Disorders

o Autoimmune Diseases

o Respiratory Diseases

o Ophthalmology

o Gastrointestinal Disorders

o Hormonal Disorders

o Hematological Disorders

o Others

- Saudi Arabia Pharmaceutical CDMO Market, By Workflow:

o Clinical

o Commercial

- Saudi Arabia Pharmaceutical CDMO Market, By

Region:

o Eastern

o Western

o Northern & Central

o Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi

Arabia Pharmaceutical CDMO Market.

Available Customizations:

Saudi Arabia

Pharmaceutical CDMO market report with the given market data, Tech Sci

Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Saudi Arabia Pharmaceutical CDMO Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]