|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

1.45 Billion

|

|

Market

Size (2030)

|

USD

1.86 Billion

|

|

CAGR

(2025-2030)

|

4.18%

|

|

Fastest

Growing Segment

|

Respiratory

|

|

Largest

Market

|

Northern

& Central

|

Market Overview

The Saudi Arabia Pediatric Hospitals Market was valued at USD 1.45 billion in 2024 and is expected to reach USD 1.86 billion by 2030 with a CAGR of 13.91% during the forecast period.

The pediatric healthcare sector in Saudi Arabia has witnessed growth, driven by the rising demand for specialized care, advancements

in medical technology, and substantial investments from the government.

A

growing pediatric population with complex medical needs is amplifying the

demand for advanced healthcare services. However, challenges such as a shortage

of skilled healthcare professionals and uneven healthcare access across urban

and rural areas continue to hinder the market's full potential. Overcoming

these challenges is critical for ensuring sustainable growth and equitable

healthcare delivery. The sector remains positioned for expansion, supported by

favorable demographic trends, ongoing technological innovations, and strategic

government initiatives. To capitalize on these opportunities, industry

stakeholders must prioritize resolving existing workforce gaps and

infrastructure disparities, positioning themselves for long-term success.

Download Free Sample Report

Key Market Drivers

Demographic Trends

Demographic trends are a key driver of growth in Saudi Arabia’s pediatric hospitals market. The population has reached 32.2 million, with foreign nationals making up 42% and 63% of Saudi citizens under 30, according to the General Authority for Statistics. The 2022 census reported a median age of 29, reflecting a young population and the government’s focus on accurate demographic data for policy and economic planning. This youth-heavy structure increases the demand for pediatric healthcare as more children require specialized medical services.

Although fertility rates have declined, Saudi Arabia’s birth rate remains high by global standards, ensuring a steady rise in the pediatric population. This growing base of young patients drives the need for more pediatric hospitals, expanded capacity, and specialized care. Pediatric services must address a range of needs, from check-ups to chronic disease management, surgeries, and care for congenital conditions. The increasing prevalence of childhood illnesses such as asthma, diabetes, and genetic disorders further reinforces the need for advanced pediatric facilities.

Rising awareness of child health has shifted focus toward prevention and early intervention. Hospitals are investing in diagnostic tools, vaccination programs, and preventive care to detect and manage diseases early. This approach supports the expansion of specialized pediatric services across the country. The government’s Vision 2030 plan prioritizes children’s health by developing more pediatric hospitals and clinics, aiming to provide accessible, high-quality care for the growing young population.

Saudi Arabia’s family-oriented culture strengthens this demand, as parents prioritize quality healthcare for their children. As awareness rises, families increasingly seek hospitals offering comprehensive and specialized pediatric care. Together, these demographic trends—youthful population, high birth rate, and growing health consciousness continue to shape and expand Saudi Arabia’s pediatric hospitals market.

Increased Awareness and Health

Consciousness

Rising health awareness and growing health consciousness among Saudi families are major drivers of the pediatric hospitals market. Parents are becoming more informed about the importance of early medical intervention, preventive care, and regular check-ups, leading to higher demand for specialized pediatric services. Awareness programs by healthcare providers, government agencies, and public health campaigns have increased focus on vaccinations, early diagnosis, and managing childhood illnesses.

Lifestyle-related conditions such as obesity, type 2 diabetes, and asthma are becoming more common, especially in urban areas, prompting parents to seek expert pediatric care. Hospitals are expanding services to include nutrition counseling, chronic disease management, and rehabilitation. A growing emphasis on preventive healthcare has also led to more screening for developmental, behavioral, and genetic disorders. During the pandemic, 79% of Saudi consumers reported becoming more health-conscious, reinforcing the shift toward proactive healthcare for children.

Advancements in pediatric medicine such as better diagnostics, minimally invasive procedures, and innovative therapies have strengthened public trust in specialized hospitals. Facilities promoting these capabilities attract families seeking advanced, high-quality care. Public health campaigns on vaccination, nutrition, and hygiene continue to improve parental awareness, empowering families to make informed healthcare choices.

Saudi Arabia’s family-oriented culture places children’s health at the forefront, with parents seeking the best care even for minor issues. Easy access to digital platforms and social media has created an informed population that researches symptoms, treatments, and healthcare providers online, raising expectations for care quality. Pediatric hospitals are responding by improving standards and expanding integrated care packages covering prevention, treatment, counseling, and rehabilitation.

This growing health awareness is reshaping Saudi Arabia’s pediatric healthcare landscape. As parents prioritize well-being and expect comprehensive, advanced care, pediatric hospitals are investing in technology, expanding services, and driving sustained growth in the sector.

Government Initiatives and

Investments

Government initiatives and investments are central to the growth of Saudi Arabia’s pediatric hospitals market, strengthening infrastructure, accessibility, and quality of care, underpinned by SAR 214 billion allocated to health and social development in the 2024 national budget. Vision 2030, launched in 2016, aims to transform healthcare through modernization, digitalization, and preventive health, while adhering to international standards for service quality and patient safety.

The Health Sector Transformation Program supports these goals by upgrading hospitals, improving workforce skills, and integrating advanced technologies and e-health solutions. Significant funding has been directed toward building and expanding pediatric hospitals, including pediatric and neonatal intensive care units and specialized centers for oncology and cardiology, evidenced by PPP tenders for three 500-bed maternity and children’s hospitals in Riyadh, Jeddah, and Al-Ahsa, NICU expansions such as 52 beds in Abha, 46 in Dammam, and 82 in Buraidah, and dedicated pediatric oncology capacity at KFNCCC (46 inpatient beds) and 24 pediatric transplant beds at KFSH&RC.

These efforts ensure wider access to advanced pediatric services and drive sector growth, complemented by the Seha Virtual Hospital connecting over 224 hospitals and having served more than 255,765 patients nationwide. Public-private partnerships (PPPs) are another key strategy, combining government resources with private expertise to establish specialized hospitals and introduce modern technologies, with a national pipeline exceeding 200 approved PPPs and plans to privatize 290 hospitals and 2,300 primary health centers.

This collaboration improves service quality and accelerates innovation, with the Ministry of Health projecting more than 100 PPP health services projects worth $12.8 billion in the next five years. Universal healthcare initiatives under the Ministry of Health make pediatric services more affordable and accessible through subsidies and insurance coverage, boosting hospital utilization, as private health insurance coverage now includes over 13 million beneficiaries. To address the shortage of pediatric specialists, the government funds training programs, scholarships, and partnerships with international medical institutions, including advanced neonatal intensive care diplomas and expanded pediatric programs in leading centers.

These investments help maintain a steady pipeline of skilled professionals and enhance hospital capacity through structured workforce development and program expansion. Efforts to reduce regional disparities include developing hospitals in underserved areas, expanding telemedicine, and deploying mobile clinics, ensuring equitable access across the country, with 60 MOH mobile clinics operating nationwide and SVH delivering virtual care across 224 hospitals via the Sehhaty platform, which has surpassed 30 million users. The government is also investing in pediatric research and digital technologies such as AI, robotics, and telehealth to improve diagnosis and treatment, reflected in SVH’s AI-enabled services and KFSH&RC’s pediatric oncology leadership and capacity.

Public health programs promoting immunization, nutrition, and disease prevention further strengthen pediatric care through national newborn and child health initiatives. Partnerships with global healthcare institutions have helped align Saudi pediatric hospitals with international standards through accreditation and quality benchmarks, reinforcing public trust and attracting patients. These combined initiatives have created a solid foundation for continued expansion, supported by substantial budgetary commitments and a robust PPP pipeline. By aligning healthcare strategy with pediatric needs, Saudi Arabia is enhancing care quality, accessibility, and innovation, positioning itself as a regional leader in pediatric healthcare.

Key Market Challenges

Workforce Shortages

A

critical challenge facing the Saudi pediatric hospitals market is the shortage

of skilled healthcare professionals specializing in pediatrics. The

number of qualified pediatricians, nurses, and allied health professionals is

insufficient to meet the growing demand for specialized pediatric care. This is

particularly evident in areas requiring advanced skills, such as neonatology,

pediatric cardiology, and pediatric oncology.

Saudi Arabia heavily relies on

expatriate medical professionals to fill gaps in its healthcare workforce.

However, this dependence can lead to staffing instability, as foreign

professionals may face visa restrictions or choose to relocate, causing disruptions

in service delivery. While the government has made significant investments in

medical education, the time required to train and retain local pediatric

specialists is lengthy. Furthermore, competitive global demand for healthcare

professionals makes it difficult for Saudi hospitals to retain skilled staff. This

shortage not only impacts the quality of care but also limits the ability of

hospitals to expand their services, restricting market growth.

Disparities in Healthcare

Access

Unequal

access to pediatric healthcare between urban and rural regions presents a

significant barrier to market development.

While

major cities like Riyadh, Jeddah, and Dammam host state-of-the-art pediatric

hospitals, rural and remote areas often lack adequate healthcare facilities.

This urban-centric development leaves large segments of the population

underserved, particularly in regions where travel to urban centers for care is

costly and time-consuming. The lack of infrastructure, including specialized

hospitals and trained professionals, exacerbates healthcare inequalities.

Rural

populations often depend on general hospitals with limited pediatric services,

which may not be equipped to handle complex medical cases. Delivering advanced

medical technologies and medicines to remote areas poses logistical

difficulties. Telemedicine, while promising, has not yet been fully adopted,

leaving a gap in reaching underserved populations. These

disparities hinder the overall market growth by preventing equitable service

delivery and reducing patient access to quality pediatric care.

Key Market Trends

Digital Transformation and

Smart Healthcare Solutions

The

integration of digital technologies and smart healthcare solutions is

redefining pediatric care in Saudi Arabia, driving efficiency, accessibility,

and personalization. Telemedicine

is becoming a cornerstone of healthcare delivery, allowing families to access

pediatric specialists remotely, particularly in underserved or rural areas.

This trend enhances convenience, reduces travel-related barriers, and ensures

timely medical intervention. Artificial intelligence (AI) is increasingly being

utilized to enhance diagnostic accuracy and predict disease progression in

children. AI-powered tools analyze medical data, such as imaging and genetic

profiles, to provide early detection of conditions like congenital anomalies

and developmental disorders.

Connected medical devices are gaining traction,

enabling real-time monitoring of pediatric patients. For instance, wearable

devices for tracking vital signs in infants and children are improving health

outcomes while reducing hospital admissions. Investments in smart hospital infrastructure, featuring integrated

digital systems for patient management, treatment planning, and data analytics,

are creating a seamless and efficient pediatric care ecosystem. These

advancements are revolutionizing care delivery, positioning the Saudi market at

the forefront of healthcare innovation.

Personalized and Precision

Medicine for Pediatrics

The

shift toward personalized and precision medicine is becoming a transformative

trend in pediatric healthcare, offering tailored treatments based on individual

genetic, environmental, and lifestyle factors. Advances

in genetic testing and sequencing are enabling early identification of

hereditary and rare pediatric conditions. This allows for customized treatment

plans that address the unique needs of each child, improving outcomes for

conditions such as metabolic disorders and pediatric cancers.

Precision

medicine is fostering the development of targeted therapies for chronic and

complex pediatric conditions. For instance, biologic drugs and gene therapies

are being used to treat autoimmune diseases and inherited genetic disorders in

children. Understanding how a child’s genetic makeup affects their response to

medications enables safer and more effective treatments. This approach

minimizes adverse effects and ensures optimal drug efficacy. The

adoption of precision medicine enhances the appeal of pediatric hospitals,

attracting families seeking advanced and individualized care.

Segmental Insights

Therapeutics Area Insights

Based

on the category of Therapeutics Area, the Respiratory segment emerged as the

dominant in the Saudi Arabia Pediatric Hospital market in 2024. Respiratory

conditions such as asthma, bronchitis, pneumonia, and upper respiratory tract

infections (URTIs) are among the most common health issues affecting children

in Saudi Arabia. The region's arid climate, frequent sandstorms, and high

levels of airborne pollutants contribute to the rising incidence of respiratory

conditions in children. Poor air quality, particularly in urban areas,

exacerbates conditions such as asthma and allergic rhinitis. Young children

have underdeveloped immune and respiratory systems, making them particularly

susceptible to infections and respiratory complications. This vulnerability

drives consistent demand for specialized respiratory care in pediatric

hospitals. The high burden of respiratory disorders ensures that the segment

remains a focal point for pediatric healthcare providers.

Pediatric

hospitals in Saudi Arabia are investing in advanced diagnostic tools and

treatments tailored to respiratory care, reinforcing the dominance of this

therapeutic area. Technologies such as pulmonary function tests (PFTs), imaging

modalities, and advanced spirometry are widely used to diagnose and monitor

respiratory conditions in children accurately. Hospitals offer cutting-edge

treatments, including nebulization therapy, inhaled corticosteroids, and

biologic drugs for severe asthma cases. These interventions provide effective

management options for complex respiratory conditions, attracting families

seeking high-quality care.

Pediatric hospitals emphasize long-term management

of chronic respiratory diseases, including education on trigger avoidance,

medication adherence, and routine check-ups. These capabilities enhance the

reputation of pediatric hospitals, positioning them as centers of excellence in

respiratory care. The Saudi government and healthcare authorities have

recognized the importance of addressing pediatric respiratory health,

implementing targeted policies and programs. Initiatives to promote vaccination

against common respiratory infections, such as influenza and pneumococcal

diseases, are reducing the incidence of severe respiratory conditions and

ensuring better outcomes.

Campaigns to educate families about the prevention

and management of respiratory conditions have increased the frequency of early

medical consultations, driving patient volumes in pediatric hospitals. Government

funding for state-of-the-art pediatric hospitals with dedicated respiratory

care units supports the development of specialized services in this segment. These

efforts create an enabling environment for the respiratory segment to thrive,

further consolidating its market leadership. These factors collectively

contribute to the growth of this segment.

Download Free Sample Report

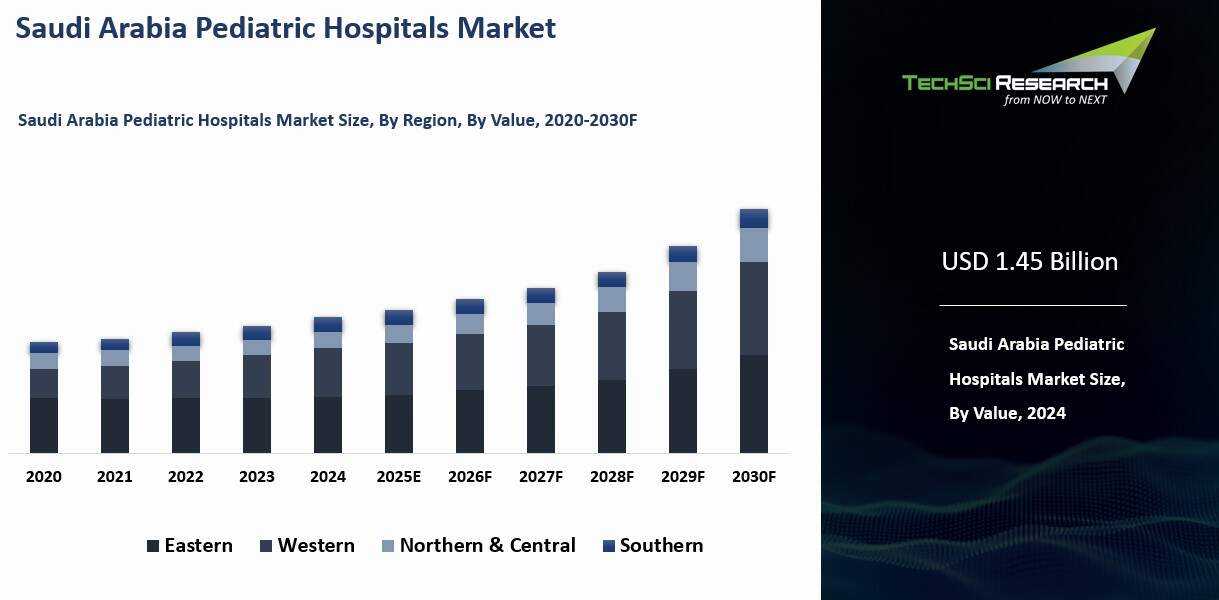

Regional Insights

Northern

& Central emerged as the dominant in the Saudi Arabia Pediatric Hospital market

in 2024, holding the largest market share in terms of value. Riyadh, located in

the Central region, serves as the political, economic, and healthcare hub of

Saudi Arabia, making it a focal point for pediatric hospital development.

Riyadh houses several world-class pediatric hospitals and medical centers

equipped with state-of-the-art technologies and specialized departments.

Facilities like King Abdullah Specialist Children's Hospital are renowned for

their comprehensive pediatric care. As the capital city, Riyadh benefits from

proximity to government healthcare authorities and decision-making bodies,

ensuring prioritized funding and policy support for healthcare initiatives. The

Central region has a high population density, including a significant pediatric

demographic. This drives demand for specialized pediatric care, contributing to

the region’s market dominance. The strategic importance of Riyadh positions the

Central region as a leader in pediatric healthcare services.

The

Northern region is emerging as a critical market player, supported by

government-led development initiatives aimed at enhancing healthcare access and

quality. The Northern region has seen increased investments in healthcare as

part of Saudi Arabia’s Vision 2030 initiative, which focuses on balanced

regional development. This includes building new hospitals and upgrading

existing facilities to cater to underserved populations. Government programs

have prioritized expanding pediatric healthcare infrastructure in the Northern

region, addressing disparities in access and ensuring equitable service

delivery. The Northern region’s proximity to neighboring countries drives

cross-border demand for pediatric healthcare services, further boosting its

market significance. The strategic focus on regional development enhances the

Northern region’s contribution to the pediatric hospitals market.

Recent Developments

- In December 2024, Saudi Arabia announced plans to open five new hospitals by 2025, adding 963 beds across key provinces. These projects include expansions for maternity and pediatric services under the national budget for health and social development.

- In April 2025, the Riyadh Emir inaugurated 28 health projects worth over SAR 7 billion. Among them, King Saud Medical City launched a 500-bed Women’s, Maternity, and Children’s Hospital tower to expand pediatric and neonatal capacity within the capital’s First Health Cluster.

- In the same month, the First Health Cluster outlined further upgrades across Riyadh, including expanded primary care and specialized dental services to strengthen pediatric pathways and referral networks connected to the new maternity and children’s tower.

- In October 2025, the Global Health Exhibition in Riyadh reported over USD 33 billion in health partnerships signed. The Ministry of Health emphasized continued investment in pediatric capacity and mother-and-child services through new facilities and expansions across the Kingdom.

Key Market Players

- King

Abdullah Specialized Children Hospital (KASCH)

- Salam

Hospital

- King

Faisal Specialist Hospital

- NEOM

Hospital

- Al

Aziziyah Children Hospital

- AlKhamis

Maternity and Children Hospital

|

By

Therapeutics Area

|

By

Type

|

By

Region

|

- Endocrinology

- Gastroenterology

- Cardiology

- Nephrology

- Neurology

- Allergy

& Immunology

- Oncology

- Respiratory

- Ophthalmology

- Anesthesiology

- Other

|

- Publicly/Government-Owned

- Not-for-profit

privately Owned

- For-profit

privately Owned

|

- Eastern

- Western

- Northern

& Central

- Southern

|

Report Scope:

In this report, the Saudi Arabia Pediatric

Hospitals Market has been segmented into the following categories, in addition

to the industry trends which have also been detailed below:

- Saudi Arabia Pediatric Hospitals Market, By Therapeutics Area:

o Endocrinology

o Gastroenterology

o Cardiology

o Nephrology

o Neurology

o Allergy & Immunology

o Oncology

o Respiratory

o Ophthalmology

o Anesthesiology

o Other

- Saudi Arabia Pediatric Hospitals Market, By Type:

o Publicly/Government-Owned

o Not-for-profit privately Owned

o For-profit privately Owned

- Saudi Arabia Pediatric Hospitals Market, By

Region:

o Eastern

o Western

o Northern & Central

o Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi

Arabia Pediatric Hospitals Market.

Available Customizations:

Saudi Arabia

Pediatric Hospitals market report with the given market data, TechSci

Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Saudi Arabia Pediatric Hospitals Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]