|

Forecast Period

|

2025-2029

|

|

Market Size (2023)

|

USD 1154.62 Million

|

|

Market Size (2029)

|

USD 1820.30 Million

|

|

CAGR (2024-2029)

|

7.84%

|

|

Fastest Growing Segment

|

Vitamins, Mineral, and Supplements (VMS)

|

|

Largest Market

|

Central Region

|

Market Overview

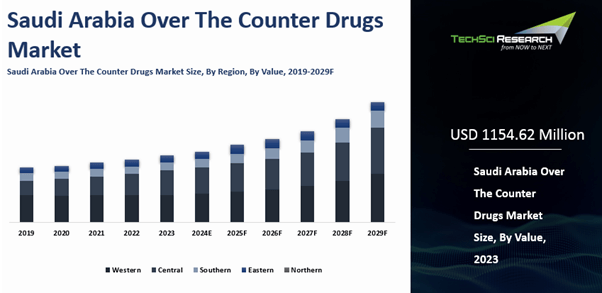

Saudi Arabia's Over-The-Counter Drugs Market was valued at USD 1154.62 Million in 2023 and is expected to reach USD 1820.30 Million by 2029 with a CAGR of 7.84% during the forecast period.

The Saudi Arabia over-the-counter (OTC) drugs market is driven

by increasing health awareness, a growing focus on preventive healthcare, and

rising consumer preference for self-medication. The expanding middle-class

population, coupled with higher disposable incomes, enables more individuals to

access and afford OTC medications. Advancements in retail and e-commerce

platforms have improved the availability and convenience of purchasing OTC

drugs. The government's initiatives to enhance healthcare access and regulatory

reforms supporting OTC drug sales also contribute to market growth. The increasing prevalence of common ailments, such as colds, allergies, and minor aches,

further fuels demand for readily available OTC solutions. These factors

collectively drive the expansion of the OTC drugs market in Saudi Arabia.

Download Free Sample Report

Key Market Drivers

Rising Health Awareness and Preventive Healthcare

The growing health awareness and shift toward preventive healthcare are key forces driving the Saudi Arabia over-the-counter (OTC) drugs market. Increasing public consciousness about health and wellness has reshaped consumer behavior, encouraging self-care and early intervention. As more individuals seek to manage minor ailments independently, demand for OTC medications used without prescriptions has surged.

Government initiatives and health education campaigns have been central to this shift. Through public service announcements, community programs, and workshops, the Saudi government and health organizations are promoting the benefits of disease prevention, self-care, and responsible use of OTC drugs. These efforts emphasize proactive health management and the importance of addressing minor issues before they progress into severe conditions.

In April 2022, Nahdi Medical Co., Saudi Arabia’s largest retail pharmacy chain, opened its flagship store in Riyadh spanning 2,800 square meters. The facility enhances consumer experience with curbside pickup, home delivery, e-pharmacist consultations, and self-checkout options, making access to OTC products more convenient than ever.

As a result, consumer behavior is shifting notably toward self-medication. Saudi citizens increasingly rely on OTC drugs for common ailments such as colds, headaches, and digestive issues, valuing convenience, affordability, and quick relief without needing a doctor’s visit. This trend also reflects the broader movement toward preventive healthcare, where individuals actively maintain wellness and prevent escalation of minor health problems through the timely use of OTC products.

The combination of rising health literacy, improved retail accessibility, and the government's emphasis on preventive care is transforming Saudi Arabia's healthcare landscape, positioning the OTC drugs market for sustained growth..

Government Initiatives and Regulatory Support

Government initiatives and regulatory reforms play a crucial role in driving the OTC drugs market in Saudi Arabia. The Saudi government has implemented policies to enhance healthcare access, with the Saudi Food and Drug Authority (SFDA) serving as the key regulatory body. Regulatory frameworks have been established to ensure the safety, efficacy, and quality of OTC products while promoting their availability. In 2023, the World Health Organization (WHO) recognized the SFDA with its highest Maturity Level 4 rating for medicines and vaccines regulation, a first for the Eastern Mediterranean region.

Initiatives to streamline the approval process for OTC drugs have resulted in the SFDA approving over 2,000 OTC products as of 2024. Approved drug applications receive a five-year registration certificate, which allows the company to market the product in Saudi Arabia. However, the process remains stringent, with over 200 applications reportedly pending due to regulatory scrutiny in early 2024.

The government's support for OTC drug sales is also reflected in efforts to increase public awareness of the benefits of self-medication and preventive care. While self-medication is a common practice in the Kingdom, studies have found that public awareness regarding its safe and responsible use is often inadequate, prompting calls for more robust educational campaigns.

Prevalence of Common Ailments and Lifestyle-Related

Health Issues

The high prevalence of common ailments and lifestyle-related health issues is a key factor driving the growth of Saudi Arabia’s over-the-counter (OTC) drugs market. Conditions such as colds, allergies, headaches, and digestive problems are widespread, creating consistent demand for OTC medications. A cross-sectional study involving 2,004 participants from across the Kingdom found that analgesics were the most commonly self-administered drugs, followed by antipyretics and cough syrups.

Colds and allergies remain among the most frequent health concerns, particularly during certain seasons. To address these issues, consumers frequently turn to OTC decongestants, antihistamines, and cough syrups for fast relief. A study in the Qassim province confirmed that antiallergics are one of the most commonly purchased OTC drug categories.

Headaches are another prevalent concern, often resulting from stress, dehydration, or disrupted sleep patterns. One study in central Saudi Arabia identified headaches as the most common symptom leading to self-medication. Widely available analgesics like ibuprofen and acetaminophen are commonly used to manage pain, sustaining high demand for OTC pain relief products. In a survey conducted in the Eastern Province, a very high number of respondents reported using OTC analgesics.

Digestive issues, including indigestion, constipation, and acid reflux, are also increasingly common due to dietary patterns and sedentary lifestyles. In the study of 2,004 participants, heartburn medication was a frequently used OTC product class. The growing intake of fast and processed foods has prompted greater use of OTC antacids, laxatives, and digestive aids available in Saudi pharmacies.

The accessibility of these medications through pharmacies and online platforms adds to their popularity, though, unlike in some countries, OTC sales in Saudi Arabia are restricted to community pharmacies. This enables consumers to manage minor health problems conveniently, and the rise of e-commerce has further transformed access, with online pharmacies becoming increasingly popular. Together, the widespread occurrence of everyday ailments and the growing impact of modern lifestyles continue to fuel the expansion of Saudi Arabia’s OTC drugs market.

Increased Awareness of Self-Medication Benefits

Increased awareness of the benefits of self-medication is a significant driver of the OTC drugs market. However, several studies in Saudi Arabia highlight a need for greater public education on its safe use. As consumers become more informed about the advantages of self-medication, including its convenience, there is a growing preference for OTC products, with one study showing that 75.5% of the population has engaged in this practice.

Educational campaigns and health information dissemination have played a role in shaping public perception. While a study found that 59.8% of participants perceived self-medication as safe, the same survey revealed that 17.5% experienced adverse effects, and a vast majority (92.6%) advocated for enhanced public education. This growing awareness encourages consumers to seek OTC solutions for everyday health concerns. For instance, a study of university students found that headaches, pain, and fever were the main reasons for using OTC medication.

The emphasis on self-care and personal responsibility for health management further supports the demand for OTC drugs. However, even with this trend, healthcare professionals remain the most trusted source of information for OTC products, indicating that while the Saudi public values self-care, they also rely on professional medical advice.

Key Market Challenges

Regulatory and Compliance Challenges

The Saudi Arabia OTC drugs market faces significant regulatory and compliance challenges, which can impact market dynamics and growth. The regulatory landscape, overseen by the Saudi Food and Drug Authority (SFDA), mandates stringent requirements for the approval, marketing, and distribution of OTC drugs. Companies must navigate a complex framework that includes rigorous testing, documentation, and compliance with Good Manufacturing Practices (GMP) and pharmacovigilance standards.

One major challenge is the lengthy approval process for new OTC products. The SFDA's stringent requirements, which can include a full registration dossier, can delay market entry. For instance, as of early 2024, over 200 applications for OTC products were reportedly pending due to regulatory scrutiny, creating a bottleneck for companies. An approved marketing authorization is valid for five years, and renewal applications must be submitted at least six months before expiry.

Regulatory changes and updates can impact product compliance and market strategy. The SFDA periodically revises regulations; for example, there have been several delays and updates to the aggregation deadlines for the Drug Track and Trace System (RSD). Companies must stay abreast of these changes, such as the requirements for reclassifying a drug's legal status from prescription to OTC, which requires a Type II variation request for the reference product. Failure to comply can result in penalties or product recalls.

The regulatory landscape involves varying requirements for product labeling, advertising, and packaging. Companies must ensure products meet specific SFDA labeling standards, including providing a Summary of Product Characteristics (SPC) and a Patient Information Leaflet (PIL). The SFDA also mandates a digital leaflet in addition to the printed one and requires that the authority approve all advertisements. Overall, these regulatory challenges require companies to invest in robust compliance systems and stay vigilant about regulatory changes to maintain market access.

Market Competition and Pricing Pressure

The Saudi Arabia OTC drugs market is highly competitive, with numerous local and international players vying for market share. While the Kingdom relies on imports for approximately 70% of its medications, local manufacturers like Pharmaceutical Solution Industries (PSI), TABUK, and SPIMACO contribute significantly to the market. This competitive environment, which also includes over 5,000 approved prescription medications, creates significant pricing pressure. The presence of established global brands and these local manufacturers intensifies competition, making it challenging for new entrants.

Pricing pressure is a major challenge, as the Saudi Food and Drug Authority (SFDA) enforces strict price control policies for branded, generic, and OTC drugs. Companies strive to balance profitability with consumer affordability, and the need to offer competitive prices while maintaining product quality and innovation can strain profit margins. In a market where consumers are increasingly price-sensitive, companies must carefully manage pricing strategies to attract and retain customers.

Competition drives the need for continuous product innovation and differentiation. To stand out, companies are introducing new products with improved formulations, such as rapid-acting pain relievers and upgraded antihistamines. A recent Saudi-US collaboration even resulted in a breakthrough in timed drug delivery technology. Failure to innovate can result in decreased market share.

The competitive landscape also impacts distribution channels, which include retail pharmacies, hospital pharmacies, and a growing number of e-pharmacies. Retail pharmacies remain the dominant channel. Companies must navigate these relationships to ensure product availability, as intense competition may lead to reduced shelf space or less favorable terms. The rise of online platforms is a key trend, with companies like Chefaa expanding operations across eight cities in the Kingdom after a recent funding round. To address these challenges, companies must adopt effective pricing strategies, invest in innovation, and develop robust marketing and distribution plans. Understanding consumer preferences and market trends is crucial for staying competitive and achieving growth in the dynamic Saudi OTC drugs market.

Key Market Trends

Expansion of Retail and E-commerce Channels

The expansion of retail and e-commerce platforms has significantly reshaped the over-the-counter (OTC) drugs market in Saudi Arabia. The rapid growth of online shopping has enabled consumers to purchase OTC medications from home, with traffic to major online pharmacy websites in the Kingdom surging significantly between October 2020 and September 2021. This shift towards digital platforms has provided easier access to a broad range of OTC products, from common pain relievers to specialized health supplements.

The increased availability and accessibility offered by online pharmacies and e-commerce sites have revolutionized the market, allowing consumers to compare prices and select products without the constraints of physical store inventories. The growth of brick-and-mortar retail chains, such as market leaders Nahdi Medical Company and Aldawaa Pharmacies, has further enhanced market reach, making OTC drugs more readily available across the country. This dual expansion in both digital and physical retail has driven market growth by offering greater convenience and choice for consumers.

In December 2023, Chefaa, a pharmacy platform focused on patient needs, secured USD 5.25 million in a significant funding round from both new and existing investors. The investment was co-led by Newtown Partners and Global Brain, with participation from GMS Capital Partners LLC, Verod-Kepple Africa Ventures, and M3, Inc. This funding follows Chefaa's successful entry into the Saudi Arabia market, where it now operates across eight cities, connecting over a million monthly active users to more than 1,100 pharmacies. The strategic capital will enable Chefaa to scale its digital supply chain models and enhance stakeholder engagement, thereby improving user experiences. Chefaa’s primary objective remains to drive the safe digital transformation of healthcare with a patient-focused, comprehensive approach.

Innovations & New Product Developments

Innovations and new product developments are pivotal drivers of growth in Saudi Arabia's over-the-counter (OTC) drugs market. Pharmaceutical companies are actively engaged in advancing the OTC sector; between 2022 and 2024, for example, more than 150 new OTC products were launched in the Kingdom, targeting categories like pain management, cough remedies, and digestive issues. These innovations encompass various aspects of drug development, including formulation improvements, advanced delivery mechanisms, and enhanced packaging solutions.

Modern advancements in drug formulations have led to the creation of more effective OTC medications that provide targeted relief, such as fast-acting pain relievers and improved antihistamines. Enhanced delivery mechanisms, like extended-release formulations and dissolvable tablets, further improve patient compliance and convenience. Innovations in packaging have also made OTC products more accessible and practical, with features like child-resistant packaging and tamper-evident seals contributing to safer use. These packaging advancements not only enhance product safety but also help in preserving the efficacy and shelf life of OTC drugs.

The continuous introduction of novel OTC products generates significant consumer interest and drives market growth. For example, the launch of new supplements, vitamins, and wellness products reflects a growing trend towards proactive health management and preventive care. Such innovations not only expand the range of available OTC solutions but also cater to emerging consumer preferences. Advancements in product development also lead to the introduction of specialized OTC medications that address conditions previously underserved by existing products, allowing consumers to find tailored solutions and thereby increasing demand.

Segmental Insights

Product Insights

Based on the Product, Vitamins,

Minerals, and Supplements (VMS) is the dominant segment. This dominance is

driven by a combination of growing health awareness, an increasing emphasis on

preventive care, and the rising popularity of self-medication among the Saudi

population. The increasing focus on preventive healthcare and wellness has

significantly boosted the demand for vitamins, minerals, and dietary

supplements. As more individuals become aware of the benefits of maintaining

optimal nutrient levels for overall health, there is a rising trend towards the

regular use of VMS products. This is partly driven by the widespread public

education campaigns highlighting the importance of nutritional balance and the

role of supplements in supporting a healthy lifestyle. Consumers are

increasingly turning to VMS products to address specific health concerns, such

as immune support, energy levels, and bone health, which further fuels market

growth.

The growing prevalence of

chronic health conditions, such as diabetes, cardiovascular diseases, and

obesity, has led to a greater focus on dietary management and nutritional

supplementation. Many consumers view VMS products as a way to complement their

dietary intake and manage these conditions more effectively. The market has

responded with a diverse range of VMS products designed to address various

health needs, contributing to its dominant position in the OTC drugs sector. The

Saudi Arabia market also benefits from a strong retail and e-commerce presence

for VMS products. The proliferation of online shopping platforms and increased

access to digital channels have made it easier for consumers to purchase these

products conveniently. This ease of access, coupled with a broad selection of

VMS options available through both physical and online retailers, has driven

significant consumer uptake.

Route of Administration Insights

Based on the Route of

Administration, oral formulations dominated as the leading segment. This

prominence is primarily due to their convenience, effectiveness, and wide range

of applications in managing common health issues. Oral OTC drugs encompass

various types of medications, including analgesics, vitamins and supplements,

gastrointestinal remedies, and cold and flu treatments, making them a preferred

choice for consumers seeking accessible and user-friendly solutions. The

dominance of oral OTC medications can be attributed to several factors. The

convenience of oral drugs is a significant driver of their popularity. Oral

formulations, such as tablets, capsules, and liquid suspensions, are easy to

administer and require no special equipment or medical expertise. This

simplicity makes them an attractive option for consumers who prefer

straightforward and hassle-free solutions for managing their health conditions.

Oral OTC drugs offer a

broad spectrum of uses, which contributes to their leading position in the

market. For instance, common analgesics and antipyretics like acetaminophen and

ibuprofen are widely used for pain relief and fever reduction. Similarly,

vitamins and dietary supplements are available in various oral forms to support

general health and well-being. The versatility of oral medications in

addressing a wide range of ailments, from minor issues like headaches and

digestive discomfort to more complex health concerns, ensures their continued

dominance. Another key factor driving the popularity of oral OTC drugs is their

effectiveness and ease of use. Oral medications can provide systemic relief by

being absorbed into the bloodstream and distributed throughout the body.

This

method of delivery is effective for managing various health conditions, from

gastrointestinal problems to systemic pain. Advancements in drug formulation

technology have led to the development of oral medications with improved

bioavailability and faster onset of action, enhancing their appeal to

consumers. The widespread availability of oral OTC medications also plays a

crucial role in their market dominance. Oral drugs are commonly found in retail

pharmacies, supermarkets, and online platforms, making them easily accessible

to a broad consumer base. The high availability and accessibility of oral OTC

products contribute to their popularity and continued market leadership.

Download Free Sample Report

Regional Insights

The Central Region stand out as the dominated area.

This prominence is attributed to several key factors, including its economic

significance, population density, and the concentration of healthcare

facilities and retail outlets. The Central Region, encompassing Riyadh—the

capital city of Saudi Arabia—serves as the political, economic, and cultural

heart of the country. Riyadh's status as a major urban center means that it

attracts a substantial portion of the population, which drives significant

demand for OTC medications. The concentration of both residents and transient

populations, such as business professionals and expatriates, further amplifies

the market for OTC products. The city’s large population and its role as a hub

for administrative and commercial activities contribute to the high consumption

of OTC drugs.

The Central Region benefits from an extensive

network of healthcare facilities and retail outlets. Riyadh and its surrounding

areas host numerous pharmacies, supermarkets, and specialized retail stores

that stock a wide range of OTC products. The presence of these retail channels

ensures easy accessibility for consumers, fostering greater utilization of OTC

medications. The high density of healthcare facilities, including hospitals and

clinics, increases awareness and availability of OTC products, reinforcing

their market dominance in the region. Economic factors also play a crucial role

in the Central Region's dominance.

Riyadh's economic prosperity, driven by its

status as the financial and business center of Saudi Arabia, supports higher

disposable incomes among residents. This economic affluence translates into

greater spending capacity for health and wellness products, including OTC

medications. As a result, consumers in the Central Region are more likely to

invest in OTC drugs for managing health and maintaining well-being. The Central

Region's strategic importance in the national healthcare infrastructure further

supports its leading position in the OTC drugs market.

Government initiatives

and investments aimed at improving healthcare services are often concentrated

in Riyadh and its vicinity, leading to enhanced healthcare access and the

proliferation of OTC products. The region's focus on healthcare development

aligns with the increased availability and consumption of OTC medications.

Recent Developments

- In April 2024, Saudi Arabia's Cigalah Healthcare and Abdi Ibrahim, a leading Turkish pharmaceutical company, signed a landmark agreement to form a joint venture named Abdi Cigalah Pharma. This collaboration is set to introduce a range of high-quality pharmaceutical products to the Saudi market, including treatments for the central nervous system (CNS), cardiovascular system (CVS), respiratory system, and oncology. The partnership includes plans for direct importation, local manufacturing through Cigalah's manufacturing arm, Alpha Pharma, and a commitment to full localization over time, aligning with Saudi Vision 2030.

- In October 2024, Eisai Saudi Arabia began the sales and marketing of Methycobal® and Fycompa® in the Kingdom.

- In April 2024, Cigalah Healthcare, a prominent name

in Saudi Arabia’s pharmaceutical and medical equipment sector, has entered into

a landmark agreement with Abdi Ibrahim, a leading Turkish pharmaceutical

company. This collaboration focuses on introducing premium pharmaceutical

products into the Saudi market.

- In late 2023, the SFDA approved ArtemiC™, a proprietary product from MGC Pharmaceuticals, for sale as an OTC dietary supplement. The approval followed successful clinical trials demonstrating its effectiveness in helping patients recover from COVID-19 and long-COVID. ArtemiC™ uses GraftBio® SNEDD technology to improve the bioavailability of its active ingredients.

Key Market Players

- Novartis Saudi Arabia

- Pfizer Saudi Limited Corporate

- Glenmark Saudi Arabia

- Sitco Pharma Co

- CAD Middle East Pharmaceutical Industries LLC

- Sudair Pharmaceutical Company

- Tabuk Pharmaceuticals Manufacturing Co.

- Jamjoom Pharmaceuticals Co

- GSK Saudi Arabia

- AstraZeneca Saudi Arabia

|

By Product

|

By Route of Administration

|

By Dosage Form

|

By Distribution Channel

|

By Region

|

- Cough, Cold and Flu

- Vitamins, Mineral, and Supplements (VMS)

- Analgesics

- Gastrointestinal Products

- Dermatology Products

- Others

|

|

- Tablets

- Capsules

- Liquids & Solution

- Creams/Lotions/Ointments

- Others

|

- Retail Pharmacy

- Hospital Pharmacy

- E-Pharmacy

|

- Western Region

- Central Region

- Southern Region

- Eastern Region

- Northern Region

|

Report Scope:

In this report, the Saudi Arabia Over The Counter

Drugs Market has been segmented into the following categories, in addition to

the industry trends which have also been detailed below:

- Saudi Arabia Over The

Counter Drugs Market, By

Product:

o Cough, Cold and Flu

o Vitamins, Mineral, and Supplements (VMS)

o Analgesics

o Gastrointestinal Products

o Dermatology Products

o Others

- Saudi Arabia Over The

Counter Drugs Market, By

Route of Administration:

o Oral

o Topical

o Parenteral

- Saudi Arabia Over The

Counter Drugs Market, By

Dosage Form:

o Tablets

o Capsules

o Liquids & Solution

o Creams/Lotions/Ointments

o Others

- Saudi Arabia Over The

Counter Drugs Market, By

Distribution Channel:

o Retail Pharmacy

o Hospital Pharmacy

o E-Pharmacy

- Saudi Arabia Over The

Counter Drugs Market, By Region:

o Western Region

o Central Region

o Southern Region

o Eastern Region

o Northern Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the Saudi Arabia Over The Counter Drugs Market.

Available Customizations:

Saudi Arabia Over The Counter Drugs Market report

with the given market data, TechSci Research offers customizations according

to a company's specific needs. The following customization options are

available for the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Saudi Arabia Over The Counter Drugs Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]