|

Forecast

Period

|

2025-2029

|

|

Market

Size (2023)

|

USD

0.26 Billion

|

|

CAGR

(2024-2029)

|

9.12%

|

|

Fastest

Growing Segment

|

Self Glucose

Monitoring Glucometers

|

|

Largest

Market

|

Northern

& Central

|

|

Market

Size (2029)

|

USD

0.44 Billion

|

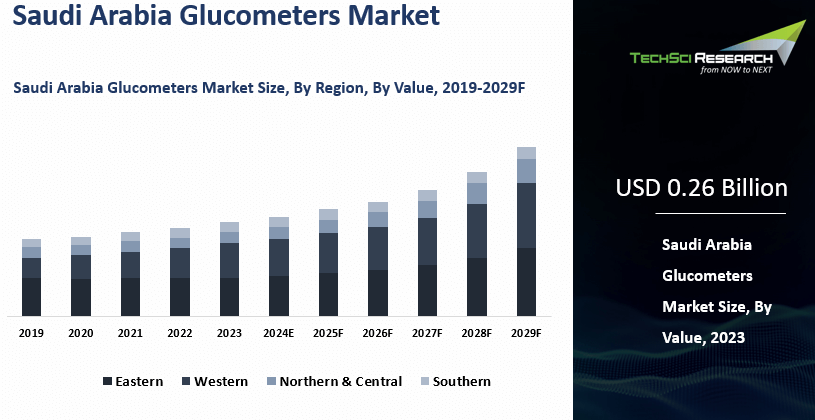

Market Overview

The Saudi Arabia Glucometers Market was valued at USD 0.26 billion in 2023 and is expected to reach USD 0.44 billion by 2029 with a CAGR of 9.12% during the forecast period.

A glucometer, also known as a glucose meter or

blood glucose meter, is a medical device used to measure the concentration of

glucose (sugar) in a person's blood. Glucometers are commonly used by

individuals with diabetes to monitor their blood glucose levels, which is a

critical part of diabetes management. Glucometers are

essential tools for individuals with diabetes. Regular monitoring of blood

glucose levels helps them make informed decisions about medication, diet, and

lifestyle to maintain their blood sugar within target ranges.

Glucometers

help individuals identify and respond to hypoglycemia (low blood sugar) and

hyperglycemia (high blood sugar) promptly. This is crucial for avoiding severe

complications. Blood glucose monitoring allows individuals to understand

how different foods and meals affect their blood sugar, helping them make

healthier dietary choices. Glucometers empower individuals with diabetes to

take an active role in managing their condition. They can learn how their body

responds to various factors and take steps to improve their health. Awareness

campaigns and educational initiatives about diabetes and the importance of

regular blood glucose monitoring have contributed to the increased adoption of

glucometers. Ongoing technological advancements have led to more accurate,

user-friendly, and feature-rich glucometers.

These advancements make the

devices more attractive to both healthcare providers and patients. An aging

population is often associated with a higher incidence of diabetes. The aging

demographic in Saudi Arabia is contributing to the sustained demand for

glucometers. Ongoing investments in healthcare infrastructure, including

hospitals, clinics, and pharmacies, have expanded the availability and

accessibility of glucometers to a broader population. Government

healthcare initiatives aimed at improving the management of chronic diseases,

including diabetes, have encouraged the use of glucometers. These initiatives

often include subsidies or support for individuals with diabetes.

Download Free Sample Report

Key Market Drivers

Advancements in Glucometer Technology

Technological advancements are a crucial driver for the Saudi Arabia glucometer market. Advancements have led to glucometers that provide more precise blood glucose measurements. A comparative study of commonly used glucometers in Saudi Arabia found that Accu-Chek Instant was the only one to meet the International Organization for Standardization (ISO) standard for precision. Modern glucometers can deliver blood glucose readings in seconds, and newer models require smaller blood samples, which is less painful.

Some glucometers offer the option for alternate site testing, from areas like the palm or forearm. Many now come with Bluetooth connectivity, enabling data transfer to smartphone apps. This integration facilitates remote monitoring, with some devices capable of sending alerts to healthcare providers if glucose levels are outside the target range. Advanced glucometers can store a history of measurements, and some include alarm and reminder features to prompt regular testing.

To accommodate individuals with visual impairments, certain glucometers offer voice guidance. Advances in lancing devices have also made blood sample collection less painful. Many manufacturers have developed companion smartphone apps that sync with the device for enhanced data tracking and trend analysis. Some glucometers now feature touchscreen displays for easier navigation.

While not traditional glucometers, Continuous Glucose Monitoring (CGM) systems have advanced significantly. In August 2023, the Saudi Food and Drug Authority (SFDA) approved Nemaura Medical's non-invasive wearable glucose sensor, sugarBEAT. CGM systems provide real-time blood glucose data and can be paired with insulin pumps, like Medtronic's MiniMed 780G, to automatically adjust insulin delivery. One study assessing CGM's effect on adults with type 1 diabetes in Saudi Arabia highlighted its benefits for diabetes control.

Users can often customize settings on modern glucometers, such as target ranges and measurement units. Some glucometers have rechargeable batteries, and many are smaller and more compact, making them easy to carry. These factors contribute to the development of the Saudi Arabia glucometer market, which is supported by government initiatives like Vision 2030 to enhance diabetes care..

Increased Awareness

Greater awareness of diabetes leads to more education about the disease, though studies have identified a considerable knowledge gap in the Saudi population. People who understand the risks associated with diabetes, which affects an estimated 4.27 million people in the Kingdom, are more likely to seek tools for better management.

Diabetes awareness campaigns often emphasize the importance of early detection, which is critical given that an additional 1.86 million people in Saudi Arabia may have undiagnosed diabetes. Diabetes management requires regular blood glucose monitoring, and increased awareness encourages individuals to adopt regular testing, as studies show that structured patient education combined with self-monitoring improves glycemic control. Awareness empowers individuals to take control of their health, and glucometers enable this self-monitoring, with the Ministry of Health providing guidance on their use at home.

Awareness initiatives often highlight the importance of lifestyle changes, such as healthy eating and exercise, in diabetes prevention. Glucometers help individuals track the effects of these changes on their blood glucose levels, reinforcing the connection between lifestyle choices and health outcomes. When patients are aware of the importance of blood glucose monitoring, they are more likely to discuss it with their healthcare providers, who can then recommend appropriate glucometers. Awareness campaigns may also include diabetes screening programs that offer glucometer kits to encourage testing.

Campaigns often highlight the latest advancements in glucometer technology, such as the Saudi Food and Drug Authority's (SFDA) approval of the non-invasive sugarBEAT wearable glucose sensor in August 2023. Government and healthcare organizations have launched numerous public health initiatives to raise awareness; for example, the Saudi Diabetes Charity has conducted around 12,449 awareness campaigns in Riyadh since 2008. In 2024, the Ministry of Health partnered with Ithnain to launch a coaching program for over 10,000 patients. Diabetes awareness fosters a sense of community and peer support, encouraging the use of glucometers and pacing up demand in the Saudi Arabian market.

Growing Lifestyle Changes

Greater awareness of diabetes leads to more education about the disease, though studies have identified a considerable knowledge gap in the Saudi population. People who understand the risks associated with diabetes, which affects an estimated 4.27 million people in the Kingdom, are more likely to seek tools for better management.

Diabetes awareness campaigns often emphasize the importance of early detection, which is critical given that an additional 1.86 million people in Saudi Arabia may have undiagnosed diabetes. Diabetes management requires regular blood glucose monitoring, and increased awareness encourages individuals to adopt regular testing, as studies show that structured patient education combined with self-monitoring improves glycemic control. Awareness empowers individuals to take control of their health, and glucometers enable this self-monitoring, with the Ministry of Health providing guidance on their use at home.

Awareness initiatives often highlight the importance of lifestyle changes, such as healthy eating and exercise, in diabetes prevention. Glucometers help individuals track the effects of these changes on their blood glucose levels, reinforcing the connection between lifestyle choices and health outcomes. When patients are aware of the importance of blood glucose monitoring, they are more likely to discuss it with their healthcare providers, who can then recommend appropriate glucometers. Awareness campaigns may also include diabetes screening programs that offer glucometer kits to encourage testing.

Campaigns often highlight the latest advancements in glucometer technology, such as the Saudi Food and Drug Authority's (SFDA) approval of the non-invasive sugarBEAT wearable glucose sensor in August 2023. Government and healthcare organizations have launched numerous public health initiatives to raise awareness; for example, the Saudi Diabetes Charity has conducted around 12,449 awareness campaigns in Riyadh since 2008. In 2024, the Ministry of Health partnered with Ithnain to launch a coaching program for over 10,000 patients. Diabetes awareness fosters a sense of community and peer support, encouraging the use of glucometers and pacing up demand in the Saudi Arabian market.

Key Market Challenges

Market Saturation

Glucometers have been widely available

and in use for many years in Saudi Arabia, especially in urban areas. Many

individuals with diabetes already have access to these devices. The pool of

potential new customers, particularly those who are unaware of their diabetes

or are newly diagnosed, may be limited. This is especially true in regions

where awareness of diabetes is already high. As the market becomes saturated,

competition among manufacturers and suppliers intensifies. This can lead to

price competition and pressure on profit margins. With a mature market, it can

be challenging for manufacturers to achieve significant growth in terms of

market share or revenue. They may need to focus on retaining existing customers

and increasing customer loyalty. Manufacturers must find ways to differentiate

their products through technological advancements, additional features, or

improved customer service to attract new customers or convince existing ones to

upgrade to newer models. The glucometers market in Saudi Arabia may have

already reached a stage of maturity where most individuals with diabetes who

would benefit from blood glucose monitoring already own a glucometer. Market

saturation can sometimes stifle innovation, as companies may be less motivated

to invest in R&D for incremental improvements when they believe that they

have captured much of the market. Manufacturers may need to consider

diversifying their product offerings or expanding into related markets or

complementary healthcare products to continue growing their businesses.

Affordability

Glucometer kits often include the device

itself, test strips, lancets, and other necessary components. The initial cost

of these kits can be a barrier for individuals, especially those with lower

income levels. Test strips are consumable components of glucometer kits and

need regular replacement. The recurring cost of test strips can be a burden for

individuals, as they need to purchase these items continuously for monitoring. Managing

diabetes involves various healthcare expenses, such as doctor's visits, medications,

and other supplies. Glucometer-related costs add to the overall financial

burden of diabetes management. While some individuals in Saudi Arabia have

health insurance, not all insurance plans cover the cost of glucometers and

related supplies. This can leave many patients responsible for these expenses

out of pocket. While some countries subsidize or provide glucometers and test

strips at reduced costs or for free, Saudi Arabia may have limited government

programs in place to make these devices more affordable. Economic disparities

within the country mean that not everyone can afford glucometers and related

expenses, especially in lower-income or underserved communities. In some

markets, generic or low-cost glucometer options may help address affordability

issues. If such options are limited in Saudi Arabia, it can exacerbate the

challenge. In rural or remote areas, access to affordable healthcare products,

including glucometers, can be limited. Transportation costs to reach urban

areas where products may be more affordable can add to the overall cost.

Key Market Trends

Integration with

Healthcare Ecosystem

Glucometers are increasingly designed to

sync with electronic health record systems used by healthcare providers. This

integration enables seamless sharing of blood glucose data with medical

professionals, ensuring that healthcare providers have real-time access to

patient information. Glucometers are integrated with telehealth platforms,

allowing individuals to share their blood glucose data with healthcare

providers remotely. This is especially valuable for patients who cannot easily

access healthcare facilities or for remote monitoring during pandemics. Many

glucometers are compatible with health and wellness apps and wearable devices,

enabling users to track their blood glucose alongside other health metrics like

heart rate, activity levels, and nutrition. Some healthcare providers and

clinics offer patient portals that integrate with glucometers, allowing

patients to log in and view their blood glucose trends and readings. Integration

with medication management systems helps individuals with diabetes stay on top

of their medication schedules and insulin dosages, ensuring better adherence to

treatment plans. Glucometers can send alerts and notifications to healthcare

providers or caregivers if blood glucose levels fall outside the target range,

ensuring timely intervention. Glucometers can be integrated with pharmacy

systems to facilitate prescription refills and timely access to test strips and

related supplies. Aggregated data from glucometers can be used for data

analytics, helping healthcare organizations identify population health trends

and develop targeted interventions for at-risk groups.

Segmental Insights

Technique Insights

Based on Technique, Non-Invasive emerged as the dominating segment in the Saudi Arabia Glucometers Market in 2023.Non-invasive glucometers do not require blood sampling, which can be uncomfortable for some individuals. The convenience of non-invasive testing may have driven more people to use these devices The non-invasive nature of these glucometers eliminates the pain associated with fingerstick testing. This could make them particularly appealing to individuals who are averse to needles. Non-invasive glucometers eliminate the risk of infection associated with traditional fingerstick testing, which could be especially important in a healthcare setting. Non-invasive glucometers may be easier to use for some individuals, especially for those who have difficulty performing fingerstick tests. The elimination of the need for blood sampling might improve patient compliance with regular blood glucose monitoring, which is crucial for diabetes management. Some non-invasive glucometers are integrated with digital technology and can transmit data to healthcare providers for remote monitoring, which became more important during the COVID-19 pandemic.

Product Type Insights

Based on Product Type, self glucose monitoring glucometers emerged as the fastest growing segment in the Saudi Arabian market for glucometers during the forecast period. Saudi Arabia is experiencing a rising incidence of diabetes, influenced by factors such as poor diet, sedentary lifestyles, and genetic predisposition. Consequently, a growing number of individuals are being diagnosed with diabetes and require effective monitoring solutions. Self-glucose monitoring devices provide a convenient, at-home method for managing blood sugar levels, which is critical for daily diabetes care. These glucometers offer an affordable option, enabling patients to regularly check their glucose levels without the need for professional medical assistance. Their ease of use and portability make them ideal for home care, allowing patients to quickly and accurately measure glucose levels at their convenience.

As awareness of diabetes management increases in Saudi Arabia, there has been a shift toward self-monitoring and home healthcare. Self-glucose monitoring glucometers are seen as essential tools, empowering patients to take control of their health and effectively manage their condition. Technological advancements in self-glucose monitoring, including enhanced accuracy, compact designs, and user-friendly displays, have made these devices more appealing. Newer models that require fewer blood samples and offer quicker results have further fueled their popularity. The ability to monitor glucose levels at home, without needing to visit a clinic, positions self-glucose monitoring as a vital tool for managing chronic diseases, driving greater demand in Saudi Arabia.

With the healthcare system increasingly focusing on home-based solutions, the demand for self-glucose monitoring devices has surged. This trend is supported by the growing adoption of home care, which reduces healthcare costs and enhances patient comfort. Additionally, the Saudi government’s proactive involvement in healthcare initiatives aimed at addressing the diabetes epidemic includes promoting home-based monitoring tools, which has further accelerated the growth of self-glucose monitoring glucometers in line with national health priorities.

Download Free Sample Report

Regional Insights

Based on region, Northern & Central emerged as the dominating region in the Saudi Arabia Glucometers Market in 2023. The Northern and Central

regions of Saudi Arabia, which include major cities like Riyadh (in the Central

region) and Jeddah (in the Western region), are highly populated. These urban

centers tend to have a higher prevalence of diabetes due to factors such as

sedentary lifestyles, dietary habits, and genetic predisposition. As a result,

there is a larger customer base for glucometers in these regions. These regions

are home to some of the country's most advanced healthcare facilities and

infrastructure. Hospitals, clinics, and healthcare providers in these areas are

more likely to have the resources to diagnose and manage diabetes effectively,

which includes the use of glucometers for monitoring blood glucose levels. The

Central and Northern regions are economic hubs in Saudi Arabia, attracting a

diverse workforce from various backgrounds. This can lead to a higher

prevalence of lifestyle-related diseases like diabetes, creating a strong

demand for glucometers. Residents in these regions typically have better access

to technology, including smartphones and apps that can be integrated with

glucometers for data management and monitoring. This access can drive the

adoption of more advanced glucometer technologies.

Recent Development

- In 2024, Abbott Laboratories entered into a partnership with Medtronic to integrate its FreeStyle Libre Continuous Glucose Monitoring (CGM) technology with Medtronic's automated insulin delivery (AID) systems and smart insulin pens available in Saudi Arabia.

- In January 2024, King Abdullah University of Science and Technology (KAUST) collaborated with Saudi health tech firm AmplifAI Health to develop an innovative system for diabetes detection.

- In March 2025, Insulet announced its plan to bring the Omnipod 5 Automated Insulin Delivery (AID) System to Saudi Arabia. This wearable, tubeless pod integrates with leading CGM sensors to automatically adjust insulin delivery for up to three days. The broader launch in the Middle East is anticipated for early 2026.

- In 2024, manufacturers prioritized advancements in CGM sensor technology to enhance user comfort, extend wear time, and reduce calibration needs. Key innovations include the development of long-wear sensors and pre-calibrated options.

- In

January 2024, King Abdullah University of Science and Technology (KAUST) and

Saudi healthtech company amplifAI health signed a Memorandum of Understanding

(MoU) to develop a new disease detection system combining amplifAI's AI

technology and KAUST’s hyperspectral imaging technology, Hyplex. The first

project will focus on using this technology to detect and manage diabetic foot

complications, with a clinical trial in the planning stages.

Key Market Players

- Abbott S.A.

- Roche Diagnostics Saudi Arabia LLC

- Batterjee National Pharmaceutical

- VitalAire Arabia

- Zimmo Trading Co. Ltd. (Omron Healthcare)

- Johnson & Johnson Medical Saudi Arabia Limited

- Medtronic Saudi Arabia LLC

- Sanofi Aventis Arabia Co. Ltd

|

By

Type

|

By

End User

|

By

Distribution

Channel

|

By

Technique

|

By

Product Type

|

By Region

|

|

Wearable

Non-Wearable

|

Hospitals &

Clinics

Diagnostic Centers

Home Care

Others

|

Hospital Pharmacies

Retail Outlet

Online

Others

|

Invasive

Non-Invasive

|

Self Glucose Monitoring Glucometers

Continuous Glucose Monitoring

Glucometers

|

Eastern

Western

Northern & Central

Southern

|

Report

Scope:

In this report, the Saudi Arabia

Glucometers Market has been segmented into the following categories, in

addition to the industry trends which have also been detailed below:

- Glucometers Market, By Product Type:

o Self Glucose

Monitoring Glucometers

o Continuous

Glucose Monitoring Glucometers

- Glucometers Market, By Technique:

o Invasive

o Non-Invasive

- Glucometers Market, By Type:

o Wearable

o Non-Wearable

- Glucometers Market, By Distribution Channel:

o Hospital

Pharmacies

o Retail

Outlet

o Online

o Others

- Glucometers Market, By End User:

o Hospitals

& Clinics

o Diagnostic

Centers

o Home

Care

o Others

- Glucometers Market, By Region:

o Eastern

o Western

o Northern

& Central

o Southern

Competitive

Landscape

Company

Profiles: Detailed analysis of the major companies presents

in the Saudi Arabia Glucometers Market.

Available

Customizations:

Saudi Arabia Glucometers Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company

Information

- Detailed

analysis and profiling of additional market players (up to five).

Saudi Arabia

Glucometers Market is an upcoming report to be released

soon. If you wish an early delivery of this report or want to confirm the date

of release, please contact us at [email protected]