|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

505.15 Million

|

|

Market

Size (2030)

|

USD

583.45 Million

|

|

CAGR

(2025-2030)

|

2.39%

|

|

Fastest

Growing Segment

|

Branded

|

|

Largest

Market

|

Northern

& Central

|

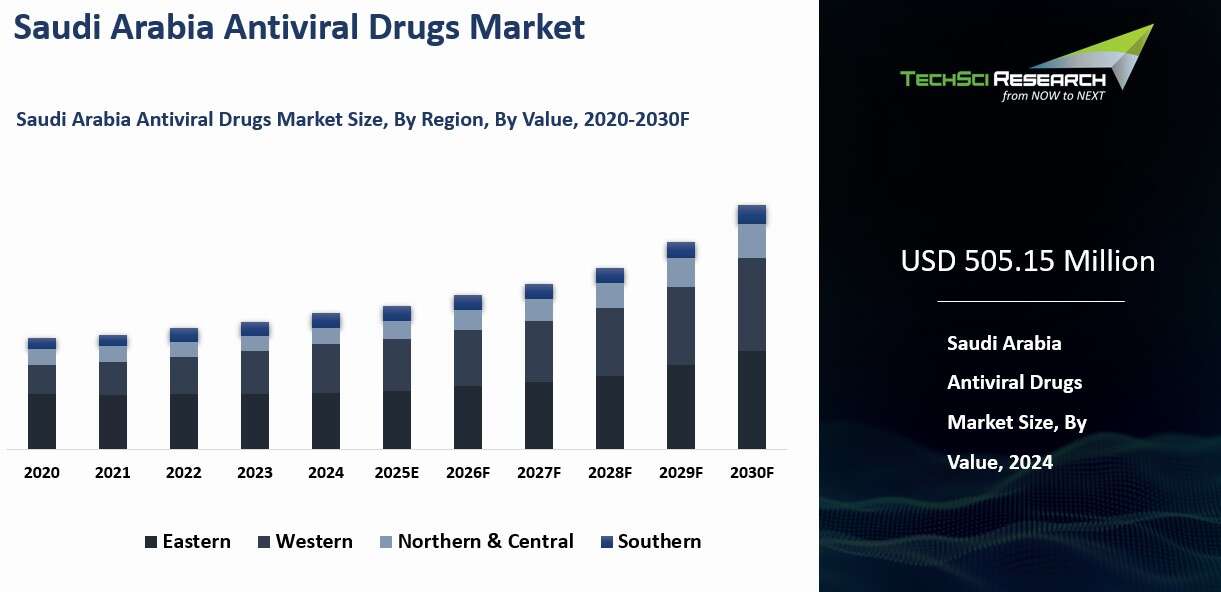

Market Overview

Saudi

Arabia Antiviral Drugs Market was valued at USD 505.15 Million in 2024 and is expected to reach USD 583.45 Million by 2030 with a CAGR of 14.67% during the forecast period.

The antiviral drugs market in Saudi Arabia is undergoing a significant transformation, driven by targeted healthcare initiatives, shifts

in disease patterns, and economic strategies. The Saudi government is

strategically investing in the expansion and modernization of healthcare

infrastructure, accompanied by increased budget allocations for medical

services. These investments aim to enhance the availability and accessibility

of antiviral therapies, directly shaping the market's trajectory.

Despite

forecasts predicting a contraction in market valuation, factors such as

progressive healthcare reforms, the potential for emerging viral threats, and

breakthroughs in antiviral drug research present opportunities for renewed

growth. For industry stakeholders, a proactive approach that includes thorough

analysis of evolving healthcare regulations, monitoring disease trends, and

leveraging pharmaceutical advancements will be critical in adapting to and

capitalizing on these dynamic market changes.

Download Free Sample Report

Key Market Drivers

Government Healthcare

Initiatives and Expenditure

Saudi Arabia's Vision 2030 has made healthcare a key focus, driving major growth in the antiviral drugs market. In 2024, the government committed SAR 214 billion (USD 57.04 billion) to health and social development, with large investments in the privatization of 290 hospitals and 2,300 primary health centers and the establishment of 21 health clusters expanding treatment capacity and improving access to antiviral therapies, increasing demand for advanced medications.

Telemedicine and electronic health records are improving prescriptions and patient management, especially in remote regions. The Saudi government allocated SAR 4 billion (approximately USD 1,066 million) to establish the National Electronic Health Record system across approximately 2,200 Primary Healthcare Centers, with over 70 e-health projects identified to achieve this vision. The goal of universal health coverage, supported by public and private insurance and government subsidies, is making antiviral drugs more affordable and accessible.

The government is also promoting pharmaceutical innovation through funding for R&D and partnerships with global firms to localize advanced antiviral therapies. Vision 2030 aims to recruit 175,000 healthcare professionals by 2030, including 69,000 doctors, 64,000 nurses, and 42,000 allied health workers, while increasing private sector participation from 40% to 65%. Biotechnology research is supporting the development of personalized treatments suited to local needs.

The Ministry of Health (MOH) is strengthening public awareness and disease control through national campaigns on hepatitis, HIV, and MERS, promoting early detection and treatment. The Saudi National Hepatitis Program has screened 5 million people and achieved cure rates exceeding 95% through free antiviral treatments, positioning the country to meet WHO's 2030 elimination goals. Financial incentives for local manufacturing are reducing reliance on imports, with 30% of the total pharmaceutical market now produced locally, ensuring consistent supply during global shortages.

Saudi Arabia's focus on epidemic preparedness further supports market stability. The MOH maintains drug reserves for emergencies like MERS, with 2,218 laboratory-confirmed MERS cases reported since 2012, and COVID-19, and invests in surveillance systems for rapid response.

Together, these efforts expanded infrastructure with 84,000 additional hospital beds needed by 2030, universal coverage, domestic production, and improved preparedness are shaping a strong antiviral drugs market aligned with Vision 2030's goal of a resilient and innovation-driven healthcare system.

Disease Epidemiology and

Prevalence

The demand for antiviral drugs in Saudi Arabia is driven by recurring and emerging viral diseases that shape national health priorities. The country remains the epicenter of MERS outbreaks, maintaining surveillance and stockpiles of antiviral drugs to manage and contain cases. Chronic hepatitis B and C are also key concerns, with government-led screening and treatment programs expanding the use of direct-acting antivirals (DAAs).

As a global travel and pilgrimage hub, Saudi Arabia faces high exposure to infectious diseases such as influenza and COVID-19. Mass gatherings during Hajj and Umrah fuel demand for preventive and curative antiviral drugs. The pandemic experience further strengthened regulatory efficiency for antiviral approvals and procurement.

Seasonal influenza outbreaks and a rise in chronic viral conditions like HIV sustain consistent demand for treatments, supported by broader access to antiretroviral therapy (ART). Improved diagnostics, including PCR testing, have enhanced early detection and increased the number of patients receiving antiviral care.

Rapid urbanization, greater mobility, and lifestyle diseases such as diabetes and obesity heighten vulnerability to viral infections, expanding the patient base. Awareness campaigns by the Ministry of Health have also reduced stigma around viral diseases and encouraged treatment uptake.

Overall, persistent viral infections, expanded diagnostic capacity, and strong government initiatives continue to support steady growth in Saudi Arabia’s antiviral drugs market.

Expanding Healthcare

Infrastructure

Saudi Arabia’s expanding healthcare infrastructure is strengthening access to antiviral treatments and driving market growth. The construction and modernization of hospitals, clinics, and infectious disease centers have improved treatment capacity for conditions like HIV, hepatitis, and MERS. These facilities, supported by government initiatives, ensure advanced antiviral therapies reach both urban and underserved areas.

The integration of telemedicine and automated hospital systems has enhanced drug accessibility and distribution efficiency, particularly in remote regions. Investments from both the Ministry of Health and private players continue to expand healthcare capacity, improving access to essential antiviral medicines.

Growth in diagnostic and laboratory facilities, including widespread PCR testing, enables early detection and treatment of viral infections. Government-funded screening programs for hepatitis and HIV have uncovered untreated cases, sustaining consistent demand for antiviral drugs.

The expanded infrastructure also supports outbreak preparedness by maintaining strong antiviral supply chains and rapid response mechanisms. Increasing health insurance coverage further boosts affordability and treatment uptake, ensuring broader population access to antiviral care across Saudi Arabia.

Key Market Challenges

High Cost of Advanced

Antiviral Therapies

The

cost of antiviral drugs, particularly novel and advanced therapies, presents a

significant barrier to market growth. Many

advanced antiviral treatments, such as direct-acting antivirals (DAAs) for

hepatitis C and antiretroviral therapies (ART) for HIV, are expensive. This

limits access for low- and middle-income patients despite increasing healthcare

expenditure. While health insurance coverage is expanding, certain antiviral

drugs may not be fully covered, leading to out-of-pocket expenses that deter

treatment adherence. Budget constraints within public healthcare institutions

restrict the large-scale procurement of high-cost antiviral drugs, impacting

their availability in the public sector.

To

overcome this challenge, pharmaceutical companies need to explore pricing

strategies, such as tiered pricing models and partnerships with government

agencies, to improve affordability and accessibility.

Limited Local Manufacturing

Capacity

The

dependency on imported antiviral drugs poses significant challenges in ensuring

consistent supply and affordability. A

substantial portion of antiviral drugs is imported, leading to higher costs and

potential supply chain disruptions, especially during global crises or

pandemics. Importing drugs involves complex regulatory approvals and logistics,

which can delay market entry for critical therapies and lead to shortages. Although

the Saudi government is investing in local pharmaceutical manufacturing, the

capacity to produce advanced antiviral drugs domestically remains limited,

reducing the country’s self-reliance in addressing viral disease outbreaks.

Scaling

up local production capabilities and fostering collaborations with

international pharmaceutical companies are essential to building a resilient

antiviral drug supply chain.

Key Market Trends

Increasing Focus on

Personalized and Precision Medicine

Advances in genomics and biotechnology, guided by the National Biotechnology Strategy, are driving a shift toward personalized and precision medicine, which is expected to play a significant role in the future of antiviral treatments in Saudi Arabia. The Saudi Human Genome Program is a foundational initiative aiming to sequence 100,000 local genomes to improve disease prediction and provide customized treatments.

Precision medicine involves customizing treatment plans based on the genetic makeup of both the patient and the virus, a model now being implemented by the King Faisal Specialist Hospital & Research Centre (KFSHRC), which has launched these services in its Family Medicine Clinics to make genetic tests more accessible. This trend allows for more effective antiviral treatments, minimizing side effects and improving patient outcomes.

The growing availability of genomic sequencing tools, supported by partnerships with firms like Illumina, helps in identifying specific viral strains and patient genetic profiles, enabling the development of targeted antiviral drugs for chronic infections like HIV and hepatitis. The national NPHIES digital platform further enables the data integration required for these personalized therapies. Personalized antiviral therapies will be increasingly favored due to their higher efficacy rates compared to traditional “one-size-fits-all” treatments, which drives demand for innovative antiviral medications.

Pharmaceutical companies and healthcare providers are investing in genomic research and the development of specialized antiviral treatments to stay competitive in this emerging area of personalized medicine. At the BIO International Convention 2025, where Saudi Arabia was represented by over 25 institutions and 160 delegates, the Kingdom signed over a dozen memoranda of understanding with firms including Vertex Pharmaceuticals and Amgen to localize cutting-edge therapeutic development.

Growing Role of Digital Health

and Remote Monitoring

The integration of digital health solutions and telemedicine in Saudi Arabia’s healthcare system is a transformative trend that is enhancing the delivery of antiviral treatments, with national platforms and policies accelerating digitized care pathways.

Telemedicine allows healthcare providers to offer consultations and prescribe antiviral treatments remotely, making it more convenient for patients, especially those in rural or underserved areas, to access care, from January 2022 to June 2023, 7,481,259 calls were offered to the 937 Medical Call Center with an average speed of answer of 13.2s and average talk time of 2.04min, while the Sehhaty app handled 712,984 immediate virtual consultations with an average speed of answer of 3.41min and average talk time of 7.3min, demonstrating high-volume, rapid access to remote triage and prescribing workflows that support antiviral therapy management.

Devices that track vital signs, such as heart rate and oxygen levels, are becoming more common in-patient care; hospital-grade and consumer wearables enable continuous monitoring of parameters like heart rate and oxygen saturation, generating actionable data to optimize antiviral regimens and improve adherence. The integration of artificial intelligence (AI) and big data analytics into patient management systems allows for real-time monitoring of viral infections and treatment outcomes; the Saudi Food and Drug Authority has issued formal guidance for AI and big-data-enabled medical devices, and national digital health platforms leveraged AI, mobile apps, and tracing during COVID-19 to operationalize timely surveillance and response.

The adoption of digital health solutions will drive demand for antiviral drugs by facilitating better patient management, earlier intervention, and more efficient use of healthcare resources, supported by the National EHR rollout under Vision 2030 that allocated SAR4 billion across about 2,200 primary healthcare centers and identified over 70 e-health projects , enabling more consistent antiviral prescribing, monitoring, and follow-up across the Kingdom.

Segmental Insights

Type Insights

The Branded segment dominated the Saudi Arabia Antiviral Drugs Market in 2024, driven by strong consumer trust, proven efficacy, and major investments from global pharmaceutical companies. This segment benefits from premium pricing, brand loyalty, and widespread use across hospitals and clinics. Branded antiviral drugs are backed by extensive clinical trials and post-market studies, ensuring reliability and safety. Their proven success in treating diseases such as HIV, hepatitis C, and influenza reinforces their preference among healthcare providers.

The Saudi Food and Drug Authority (SFDA) often approves branded drugs first due to their rigorous testing and established clinical data. This regulatory confidence, combined with consistent treatment outcomes, strengthens their dominance. Physicians prefer prescribing branded antiviral drugs because of their dependable performance and lower risk of adverse effects, while patients trust them due to prior positive experiences.

Global pharmaceutical companies like Gilead and Merck maintain market leadership through strong brand recognition, marketing campaigns, and partnerships with healthcare professionals. Drugs such as sofosbuvir and raltegravir have become well-known for their effectiveness, reinforcing brand trust.

In regions like Central and Northern Saudi Arabia, healthcare providers favor branded drugs supported by manufacturer-led training and patient adherence programs. Continued brand loyalty, high awareness, and consistent treatment results ensure the sustained dominance of branded antiviral drugs in Saudi Arabia’s market..

Drug Class Insights

The Protease Inhibitors segment is expected to witness strong growth during the forecast period, driven by its key role in treating chronic viral infections such as HIV and hepatitis C, along with emerging viral diseases. These drugs deliver high therapeutic efficacy and continue to benefit from ongoing innovation and improved formulations that enhance treatment outcomes and patient adherence.

Recent developments in protease inhibitors have focused on improving safety, tolerability, and convenience. Fixed-dose combinations, such as those pairing dolutegravir with protease inhibitors, simplify treatment regimens and improve compliance among HIV patients. For hepatitis C, all-oral and interferon-free therapies using protease inhibitors have significantly improved cure rates, reduced side effects, and shortened treatment durations.

The growing preference for these advanced, well-tolerated, and combination-based therapies is strengthening the market position of protease inhibitors in Saudi Arabia. Their proven efficacy, improved safety profiles, and role in simplifying antiviral treatments are key factors driving segment growth..

Download Free Sample Report

Regional Insights

The Northern and Central regions held the largest market share in the Saudi Arabia Antiviral Drugs market in 2024, supported by advanced healthcare infrastructure and high economic activity. Riyadh, the capital and a major medical hub, hosts some of the country’s most sophisticated hospitals and research centers specializing in viral diseases such as HIV, hepatitis, and MERS. These institutions, which include over 40 hospitals in Riyadh alone, lead in clinical research, antiviral drug trials, and patient care, creating strong demand for antiviral therapies.

The Northern region, including cities like Tabuk and Hail, also contributes to the market with well-equipped hospitals capable of managing infectious diseases. Together, these regions benefit from a dense network of healthcare facilities that ensure broad access to antiviral treatments and support the use of advanced therapies.

Economic prosperity in these regions further drives market growth. Riyadh’s high-income population, extensive health insurance coverage, and strong corporate healthcare benefits enable greater use of premium antiviral drugs, including costly direct-acting antivirals (DAAs) for hepatitis C. The Central region also attracts major public and private healthcare investments, ensuring steady procurement and distribution of antiviral drugs. This combination of superior infrastructure, research capabilities, and higher affordability positions the Northern and Central regions as the core markets for antiviral drugs in Saudi Arabia.

Recent Developments

- In September 2025, Tabuk Pharmaceutical Manufacturing Company, in partnership with Cumberland Pharmaceuticals, launched the injectable anti-infective drug Vibativ® (telavancin) in Saudi Arabia. This drug is approved for treating hospital-acquired and ventilator-associated pneumonia, including cases resulting from infections like influenza and COVID-19. Vibativ® is designed to combat serious and multidrug-resistant Gram-positive bacterial infections.

- In August 2025, A leading Saudi pharmaceutical company submitted a Breakthrough Medicine Designation application to the Saudi Food and Drug Authority (SFDA), indicating a focus on fast-tracking innovative treatments. Additionally, advancements in the management of Hepatitis C in the country were noted, with the increased adoption of pan-genotypic direct-acting antivirals (DAAs).

- In May 2025, A significant strategic collaboration was established through a Memorandum of Understanding signed by ImmunityBio, Saudi Arabia's Ministry of Investment, King Faisal Specialist Hospital and Research Centre (KFSH&RC), and King Abdullah International Medical Research Center (KAIMRC). This partnership aims to introduce the "Cancer BioShield" platform to the Middle East, a move that will bring advanced therapies to the region.

- In October 2025, the Ministry of Health is expected to announce new partnerships in biotechnology and pharmaceuticals during the Global Health Exhibition in Riyadh, an event intended to attract investment and advance the goals of Vision 2030.

- In October 2024, EVA Pharma, a global healthcare company, announced a collaboration with Al-Dawaa Pharmacies to improve sustainable access to high-quality medicines within the Saudi market.

- In April 2024, the Saudi Food and Drug Authority (SFDA) granted authorization for six new therapies, which included two biologics, one biosimilar product, and three new chemical entities (NCEs).

Key Market Players

- Roche

Diagnostics Region Saudi Arabia LLC

- Glaxo Saudi Arabia Limited (GSK)

- AbbVie Biopharmaceuticals GmbH

- Merck Limited

- Johnson & Johnson Medical Saudi

Arabia Limited

- Cipla

- Aurobindo Pharma Saudi Arabia ltd

|

By

Type

|

By

Drug Class

|

By

Distribution Channel

|

By

Application

|

By

Region

|

|

|

- DNA

Polymerase Inhibitors

- Reverse

Transcriptase Inhibitors

- Protease

Inhibitors

- Neuraminidase

Inhibitors

- Others

|

- Hospital

Pharmacy

- Retail

Pharmacy

- Online

Pharmacy

|

- HIV

- Hepatitis

- Herpes

- Influenza

- Others

|

- Eastern

- Western

- Northern

& Central

- Southern

|

Report Scope:

In this report, the Saudi Arabia Antiviral Drugs

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- Saudi Arabia Antiviral Drugs Market, By Type:

o Branded

o Generics

- Saudi Arabia Antiviral Drugs Market, By Drug Class:

o DNA Polymerase Inhibitors

o Reverse Transcriptase Inhibitors

o Protease Inhibitors

o Neuraminidase Inhibitors

o Others

- Saudi Arabia Antiviral Drugs Market, By Distribution Channel:

o Hospital Pharmacy

o Retail Pharmacy

o Online Pharmacy

- Saudi Arabia Antiviral Drugs Market, By Application:

o HIV

o Hepatitis

o Herpes

o Influenza

o Others

- Saudi Arabia Antiviral Drugs Market, By

Region:

o Eastern

o Western

o Northern & Central

o Southern

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi

Arabia Antiviral Drugs Market.

Available Customizations:

Saudi Arabia

Antiviral Drugs market report with the given market data, TechSci

Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

Saudi Arabia Antiviral Drugs Market is an

upcoming report to be released soon. If you wish an early delivery of this

report or want to confirm the date of release, please contact us at [email protected]