Forecast Period | 2026-2030 |

Market Size (2024) | USD 26.01 Billion |

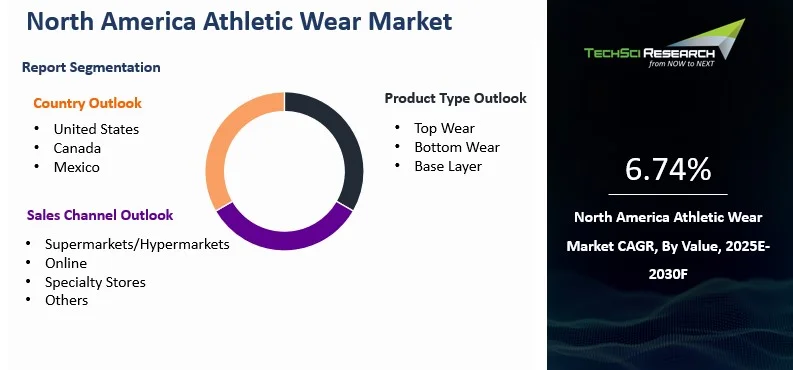

CAGR (2025-2030) | 6.74% |

Fastest Growing Segment | Online |

Largest Market | United States |

Market Size (2030) | USD 38.34 Billion |

Market Overview

North America Athletic Wear Market was valued at USD 26.01 billion in 2024 and is expected to reach USD 38.34 billion by 2030 with a CAGR of 6.74% during the forecast period. The North America Athletic Wear Market is experiencing significant growth, fueled by increasing health consciousness, fitness trends, and the rising popularity of athleisure. Consumers are seeking apparel that combines style, comfort, and performance for both athletic and casual use. The market benefits from a strong presence of leading brands, advancements in fabric technology, and growing participation in sports and fitness activities. E-commerce expansion and influencer-driven marketing are further driving sales. Additionally, the demand for sustainable and eco-friendly materials is shaping product innovations. The market is poised for continued growth as active lifestyles become more integrated into consumers’ daily routines.

Market Drivers

Rising Health Awareness and Fitness Trends

One of the most influential drivers of the North America athletic wear market is the increasing health awareness among consumers. There has been a significant rise in the number of individuals adopting healthier and more active lifestyles, leading to increased participation in fitness activities such as running, yoga, gym workouts, cycling, and sports. The growing prevalence of lifestyle-related diseases such as obesity, diabetes, and hypertension has also prompted people to engage in physical exercise as a preventive and corrective measure.

As a result, consumers are investing in high-quality athletic wear that supports performance and comfort during physical activities. Apparel designed for sweat-wicking, breathability, and flexibility has become essential. Moreover, the rise of fitness influencers, social media fitness challenges, and digital workout platforms has further strengthened the focus on fitness, indirectly boosting the demand for athletic wear across demographics.

Booming Athleisure Trend

The fusion of athletic wear with casual, everyday fashion commonly referred to as "athleisure" has reshaped the apparel landscape in North America. Athleisure has evolved from a trend to a lifestyle, reflecting a shift in consumer preferences toward versatile clothing that combines style, comfort, and functionality. Consumers are increasingly wearing leggings, joggers, hoodies, and sneakers beyond the gym, making these items suitable for running errands, socializing, or even casual work settings.

This trend is particularly prominent among millennials and Gen Z, who favor multi-functional apparel that complements their fast-paced lifestyles. The pandemic further accelerated this shift as remote work and stay-at-home orders led to a higher demand for comfortable, casual clothing. Even post-pandemic, the desire for comfort-driven fashion has persisted, driving sustained growth in the athletic wear market. Leading brands are capitalizing on this trend by launching innovative product lines that blur the lines between performance wear and streetwear.

Technological Advancements in Fabric and Apparel Design

Technological innovation plays a vital role in the growth of the North America athletic wear market. Consumers are increasingly demanding advanced features in their sportswear, such as moisture-wicking fabrics, odor resistance, temperature regulation, and muscle compression. The use of smart textiles and performance-enhancing materials not only boosts athletic performance but also enhances user comfort and durability of the apparel.

Brands are investing heavily in R&D to differentiate their offerings and stay competitive. For example, the integration of antimicrobial finishes, UV protection, and seamless construction enhances the functionality of athletic wear. Additionally, advancements in 3D knitting, ergonomic design, and fit personalization have improved the performance and appeal of these garments.

Wearable technology, such as fitness-tracking sensors integrated into clothing, is another emerging innovation gaining traction. These innovations not only improve the utility of athletic wear but also align with consumers’ desire for data-driven fitness experiences. The intersection of fashion and function through technology is expected to continue driving market growth in the region.

Download Free Sample Report

Key Market Challenges

Intense Market Competition and Price Pressure

The North America athletic wear market is highly saturated, with numerous global and regional players competing for market share. Leading brands such as Nike, Adidas, Under Armour, Puma, and Lululemon dominate the landscape, but they face stiff competition from emerging brands, fast-fashion retailers, and private labels entering the space. This intense competition puts significant pressure on pricing, innovation, and marketing.

As a result, companies must continuously invest in product development, brand positioning, and advertising to maintain visibility and relevance. These investments increase operational costs, which can reduce profit margins. Additionally, price-sensitive consumers often gravitate toward affordable alternatives, especially when comparable products are offered at lower prices by newer or less-established brands. This trend forces established players to find a balance between maintaining premium brand perception and offering competitive pricing. The market’s dynamic nature also increases the risk of short product life cycles and rapid trend shifts, making it difficult for companies to forecast demand accurately.

Supply Chain Disruptions and Production Costs

Global supply chain disruptions remain a major challenge for the North American athletic wear industry. The COVID-19 pandemic exposed vulnerabilities in the sourcing and manufacturing infrastructure, with delays in raw material procurement, factory shutdowns, and logistical bottlenecks. Even post-pandemic, challenges persist due to labor shortages, port congestion, rising transportation costs, and geopolitical tensions impacting trade.

Many athletic wear companies rely heavily on overseas production, particularly in countries like China, Vietnam, and Bangladesh. Any disruption in these regions directly affects inventory levels and product availability in North America. Additionally, rising costs of raw materials such as polyester, cotton, and spandex, coupled with increased labor costs, have led to higher production expenses. Brands are forced to either absorb these costs, which affects profitability, or pass them on to consumers, potentially impacting sales volumes.

Key Market Trends

Rise of Athleisure as Everyday Wear

One of the most prominent trends in the North American athletic wear market is the continued growth of athleisure a fusion of athletic and leisure apparel. Consumers are increasingly prioritizing comfort, style, and versatility in their clothing, and athleisure garments fit perfectly into this lifestyle shift. Items such as leggings, joggers, hoodies, and sneakers are no longer confined to gyms or workout spaces—they're now seen in offices, coffee shops, airports, and casual social settings.

This trend gained strong momentum during the COVID-19 pandemic when remote work and stay-at-home mandates led to a surge in demand for comfortable, casual attire. Post-pandemic, the appeal of athleisure has not diminished; instead, it has become a staple of modern wardrobes. Leading brands are capitalizing on this shift by designing products that blend technical performance with fashionable aesthetics, often incorporating bold colors, premium fabrics, and urban-inspired designs. The result is a market that not only caters to fitness enthusiasts but also to fashion-conscious consumers seeking functionality and flair.

Focus on Sustainability and Eco-Friendly Materials

Sustainability has become a defining theme in the North American athletic wear market. Consumers especially younger demographics like Millennials and Gen Z are demanding greater transparency and responsibility from brands regarding their environmental impact. This includes the sourcing of raw materials, manufacturing processes, packaging, and labor practices.

In response, many athletic wear companies are developing eco-friendly collections made from recycled polyester, organic cotton, bamboo fibers, and other sustainable materials. Brands are also introducing circular business models that include product recycling programs, resale platforms, and carbon-neutral pledges. Certifications such as GOTS (Global Organic Textile Standard) and OEKO-TEX are becoming more common, assuring consumers of responsible sourcing and safety.

Segmental Insights

Product Type Insights

Top wear is the dominating segment in the North America athletic wear market, driven by high consumer demand for versatile and stylish apparel such as t-shirts, hoodies, jackets, and sports bras. These items are widely used for both athletic activities and casual wear, aligning with the growing athleisure trend. Brands continuously innovate in fabric technology, comfort, and design, enhancing the appeal of top wear across diverse demographics. Moreover, frequent product launches, celebrity endorsements, and seasonal collections contribute to increased visibility and sales. The combination of functionality, fashion, and everyday usability makes top wear the leading category in the market.

Sales Channel Insights

Supermarkets and hypermarkets are the dominating distribution segment in the North America athletic wear market due to their wide accessibility, diverse product offerings, and competitive pricing. These retail formats provide consumers with the convenience of shopping for athletic wear alongside everyday essentials, encouraging higher foot traffic and impulse purchases. Additionally, partnerships between leading athletic wear brands and large retail chains ensure consistent availability of popular products. The presence of in-store promotions, seasonal discounts, and loyalty programs further drives sales. Their strong geographical presence and ability to reach a broad consumer base make supermarkets and hypermarkets key drivers in market dominance.

Download Free Sample Report

Country Insights

The United States was the dominating region in the North America athletic wear market, driven by a strong fitness culture, high consumer spending, and widespread adoption of athleisure fashion. The country is home to leading global brands like Nike, Under Armour, and Lululemon, which continuously innovate and influence market trends. Increasing health consciousness, gym memberships, and participation in sports and outdoor activities further boost demand. Moreover, the U.S. benefits from a well-developed retail infrastructure, both online and offline, enhancing product accessibility. The blend of fashion, functionality, and active lifestyles makes the U.S. a key growth hub in the regional market.

Recent Developments

- In April 2024, Aimé Leon Dore (ALD) debuted its first-ever golf collection, merging performance with style. The 28-piece range features panelled golf jackets, pleated pants, polos, relaxed bowling shirts, flat caps, and pleated trousers, providing golfers with versatile choices.

- In Feb 2025, Nike and SKIMS have announced a collaboration to launch NikeSKIMS, a new women's activewear brand combining Nike's performance innovation with SKIMS' inclusive design. The initial collection will debut in the U.S. this spring, followed by a global release in 2026.

- In July 2024, Under Armour introduced the Goin' Under Golf Collection, presenting a stylish take on athletic wear. This collection features hoodies, jackets, sweaters, lightweight polos, t-shirts, and Phantom Footwear, blending performance with contemporary style. Highlighting a gopher mascot, the line is available for purchase on UA.com and at select Under Armour retailers.

- In July 2024, FootJoy launched its Mid-Summer Apparel Collection, showcasing trendy prints and patterns. The collection includes two color stories: Pine Cliffs, featuring Emerald Green, Navy, and White, and Marina Bay, with Black, Purple Dusk, Pink, and White.

Key Market Players

- Topgolf Callaway Brands Corp.

- Columbia Sportswear Company

- Patagonia, Inc.

- Peter Millar LLC

- Oakley, Inc.

- Nike, Inc.

- Under Armour, Inc.

- Adidas America, Inc.

- The North Face, Inc.

- Lululemon Athletica Inc.

By Product Type | By Sales Channel | By Country |

- Top Wear

- Bottom Wear

- Base Layers

| - Supermarkets/Hypermarkets

- Online

- Specialty Stores

- Others

| - United States

- Canada

- Mexico

|

Report Scope:

In this report, the North America Athletic Wear Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

· North America Athletic Wear Market, By Product Type:

o Top Wear

o Bottom Wear

o Base Layers

· North America Athletic Wear Market, By Sales Channel:

o Supermarkets/Hypermarkets

o Online

o Specialty Stores

o Others

· North America Athletic Wear Market, By Country:

o United States

o Canada

o Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the North America Athletic Wear Market.

Available Customizations:

North America Athletic Wear Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

· Detailed analysis and profiling of additional market players (up to five).

North America Athletic Wear Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]