|

Forecast Period

|

2026-2030

|

|

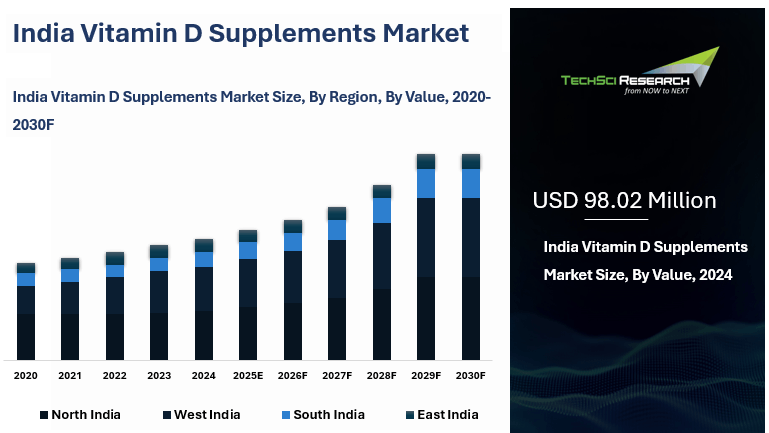

Market Size (2024)

|

USD

98.02 Million

|

|

CAGR (2025-2030)

|

8.22%

|

|

Fastest Growing Segment

|

Vitamin

D3 Supplements

|

|

Largest Market

|

North India

|

|

Market Size (2030)

|

USD 157.81 Million

|

Market Overview

India Vitamin D Supplements Market was

valued at USD 98.02 Million in 2024 and is expected to reach USD 157.81 Million

by 2030 with a CAGR of 8.22% during the forecast period. The India

Vitamin D Supplements Market is experiencing significant growth, driven by the

rising prevalence of vitamin D deficiency, which affects nearly 70-90% of the

population due to limited sun exposure, urbanization, and changing lifestyles.

Growing health awareness, particularly regarding the role of vitamin D in bone

health, immunity, and chronic disease prevention, has further spurred demand

for supplements, especially among urban and semi-urban populations. The

expansion of e-commerce platforms and the availability of innovative

formulations such as gummies, capsules, and fortified foods have made these

supplements accessible to a broader audience, including children and the

elderly.

However, the market faces challenges, including low

awareness in rural areas, where vitamin D deficiency remains underdiagnosed. Consumer price sensitivity also hinders the adoption of premium vitamin

D products, especially in price-conscious regions. Despite these hurdles, the

increasing focus on preventive healthcare, along with supportive government

initiatives and recommendations by healthcare professionals, is expected to

sustain market growth. Regions like North India are leading due to higher awareness

levels and healthcare accessibility, while other areas are gradually catching

up as awareness spreads.

Download Free Sample Report

Key Market Drivers

Increasing

Geriatric Population

The increasing geriatric population in India is a significant driver of the Vitamin D Supplements Market. For instance, the India Ageing Report 2023 prepared by UNFPA and IIPS notes that India had 149 million people aged 60 years and above in 2022, about 10.5 percent of the population, and projects this to rise to 347 million by 2050, about 20.8 percent of the population. Aging is often associated with reduced skin efficiency in synthesizing vitamin D from sunlight and decreased dietary absorption, making supplementation important to help prevent age-related issues such as osteoporosis, fractures, and chronic illnesses. This demographic shift is driving demand for vitamin D supplements as healthcare providers increasingly recommend them to support bone health and immunity among older adults.

The geriatric population in India is also experiencing a growing burden of lifestyle-related and chronic diseases, such as diabetes, cardiovascular disorders, and arthritis, which often require long-term healthcare management, including supplementation of essential nutrients like vitamin D. For instance, Government of India LASI findings for adults aged 60 years and above report hypertension at 32 percent and diabetes or high blood sugar at 14.2 percent, reinforcing the need for preventive approaches that reduce fall risk, muscle weakness, and fragility outcomes in routine elderly care. Vitamin D plays a critical role in supporting muscle function and bone mineralization, which is particularly relevant for older adults vulnerable to falls and fractures.

Furthermore, the surge in disposable incomes and improved access to healthcare services among this demographic has enabled greater adoption of preventive health measures, including dietary supplements. For instance, a Rajya Sabha reply by the Ministry of Finance citing National Accounts Statistics states that India’s per capita net national income at current prices increased from ₹1,32,341 in 2019-20 to ₹1,84,205 in 2023-24, indicating improving purchasing power that can support higher uptake of preventive supplements in urban and semi-urban areas. Urban centers in North and South India, in particular, are witnessing higher demand for vitamin D products as awareness campaigns and clinicians increasingly emphasize healthy ageing and bone health.

Rising

Prevalence of Vitamin D Deficiency

The rising prevalence of vitamin D deficiency is one of the most critical drivers of the India Vitamin D Supplements Market. Studies across India indicate a very high burden, commonly reported in the 70 to 90 range, driven by limited sun exposure linked to indoor, sedentary routines, rapid urbanization, and reduced effective sunlight exposure in dense, polluted environments, along with dietary patterns that are typically low in vitamin D rich foods and fortified products. For instance, a review in the Indian Journal of Medical Research notes that a high prevalence, broadly documented at 50 to 90, has been reported in Indian populations across multiple studies.

The problem is particularly acute among certain demographic groups. For instance, the Indian Journal of Medical Research reports that hypovitaminosis D ranged from 84.9 to 100 among school going children and 42 to 74 among pregnant women in selected Indian studies, highlighting substantial risk for maternal and child health. In high pollution metros such as Delhi NCR and other large urban clusters, reduced effective UVB exposure can further elevate deficiency risk, which in turn contributes to health issues such as rickets in children, osteoporosis, and broader immune and metabolic vulnerability.

This widespread deficiency has led to a surge in the demand for vitamin D supplements as a preventive and therapeutic measure. For instance, the same Indian Journal of Medical Research review characterizes vitamin D deficiency as a public health problem in India and documents consistently high prevalence across age groups, supporting why clinicians increasingly use supplementation to correct deficiency and reduce downstream complications. The growing awareness about the health risks of untreated vitamin D deficiency is further driving adoption as individuals incorporate supplements into routine preventive health and immunity focused regimens.

Key Market Challenges

Price

Sensitivity Among Consumers

One of the key challenges in India's vitamin D supplement market is high consumer price sensitivity, particularly in rural and semi-urban areas. While awareness of vitamin D deficiency is growing, many individuals, especially in low- and middle-income groups, prioritize essential healthcare expenses over supplements, viewing them as non-essential purchases. For instance, official results from the Household Consumption Expenditure Survey 2022-23 put average monthly per capita consumption expenditure at Rs 3,773 in rural India versus Rs 6,459 in urban India, indicating lower discretionary headroom in rural markets where supplement uptake can be most price constrained.

Premium vitamin D products, including advanced formats such as gummies or liquid drops, often remain unaffordable for a large segment of the population, and the affordability gap is compounded by limited financial protection in routine spending. For instance, National Health Accounts Estimates for India 2021-22 report household out-of-pocket expenditure on health of Rs 3,56,254 crore and note that out-of-pocket spending forms 45.11 percent of current health expenditure, reinforcing why many consumers continue to pay directly and ration non-urgent purchases such as supplements. This challenge is further compounded by competition from low-cost alternatives, including fortified foods and generic supplements, which can constrain the penetration of higher-priced branded products.

The price sensitivity issue is also influenced by market fragmentation, where unorganized players offer low-cost products that may not consistently adhere to labeling and quality norms, undermining consumer trust in the category. For instance, FSSAI specifies that health supplements and nutraceuticals fall under the Food Safety and Standards regulations notified in 2016, indicating that products are expected to meet defined standards and comply with requirements. At the same time, enforcement data across the broader packaged food ecosystem highlights the scale of non-compliance risk that can spill over into consumer perceptions: for instance, a Government of India statement to Parliament reported that in 2018-19, 94,288 processed food samples were analysed and 26,077 were found adulterated or misbranded, with penalties of about Rs 32.75 crore raised. These dynamics can deter long-term adoption when consumers worry about efficacy and safety, even if low-priced options are widely available.

Another dimension of this challenge is the uneven distribution of vitamin D products across regions. While urban centers like Delhi, Mumbai, and Bengaluru have greater access to a variety of supplements, rural and remote areas face logistical constraints due to thinner supply chains and fewer reliable retail touchpoints for regulated products. For instance, Health Dynamics of India reports a highly dispersed public health footprint as of March 31, 2023, including 1,69,615 sub-centres and 31,882 primary health centres, underscoring the geographic spread that last-mile distribution must cover to consistently reach smaller towns and remote communities. As a result, even consumers who recognize the importance of supplementation can struggle to access reliable, affordable options.

Key Market Trends

Shift

Toward Preventive Healthcare

The growing shift toward preventive healthcare is

emerging as a transformative trend in the India Vitamin D Supplements Market.

With growing awareness of the role of nutrition in maintaining long-term health, individuals are increasingly focusing on proactive measures to prevent disease rather than relying solely on treatment. This trend has gained

significant momentum, particularly after the COVID-19 pandemic, which

underscored the importance of strong immunity and overall health. Vitamin D

supplements, known for their critical role in boosting immunity, enhancing bone

health, and preventing chronic diseases such as osteoporosis, diabetes, and cardiovascular disease, have become an integral part of this preventive

approach.

India’s growing middle-class population, coupled with

increasing disposable incomes, has further fueled the adoption of supplements

as part of daily health routines. Urban and semi-urban consumers are

increasingly opting for vitamin D products to mitigate the risks associated

with a sedentary lifestyle, poor dietary habits, and limited sun exposure.

Moreover, healthcare professionals are actively recommending vitamin D

supplementation as part of routine preventive care for vulnerable groups, including children, pregnant women, and older adults.

The e-commerce boom has also accelerated this trend,

as consumers now have easier access to a wide range of vitamin D supplements,

including innovative formats like chewable tablets, gummies, and fortified

foods. The marketing strategies of supplement manufacturers that emphasize the preventive benefits of vitamin D resonate with health-conscious

consumers. Campaigns highlighting the risks of untreated deficiencies and the

broader benefits of maintaining optimal vitamin D levels are driving the adoption

of these products.

As awareness grows, the shift toward preventive healthcare is expected to sustain demand for vitamin D

supplements, transforming them from niche products into everyday essentials for

a significant portion of the population. This trend reflects a broader change

in consumer behavior, with a heightened focus on self-care and wellness,

further solidifying the market’s growth trajectory.

Segmental Insights

Product

Type Insights

Based on Product Type, Vitamin D2 Supplements have emerged as the dominant segment in the India Vitamin D

Supplements Market in 2024. Driving growth in the India Vitamin D Supplements Market in 2024, Vitamin D2 supplements have emerged as the dominant segment by product type. This dominance can be attributed to the widespread

adoption of plant-based and vegetarian dietary preferences among Indian

consumers, as Vitamin D2 is primarily derived from fungal and plant sources,

making it more appealing to those following vegetarian or vegan lifestyles.

The affordability of Vitamin D2 supplements compared

to Vitamin D3 has further fueled their market penetration. The increasing

awareness of Vitamin D deficiency, coupled with government initiatives

promoting fortified foods and supplements, has also contributed to the rising

demand for Vitamin D2 products. Moreover, the growing prevalence of

lifestyle-related disorders, such as osteoporosis and weakened immunity due to

inadequate sun exposure, has led to a surge in supplement consumption, further

reinforcing Vitamin D2's dominance in the Indian market.

Distribution

Channel Insights

Based on Distribution Channel, Online

Retailing have emerged as the fastest growing segment in the India Vitamin D

Supplements Market during the forecast period. This growth is driven by the rapid

expansion of e-commerce platforms and the increasing preference for online

shopping among consumers due to its convenience, variety, and accessibility.

Platforms like Amazon, Flipkart, and health-focused e-commerce sites such as

1mg and Netmeds provide a wide range of vitamin D supplements, catering to

diverse consumer preferences and price points.

One of the key reasons for the growth of this channel

is the digital transformation in India, with a significant rise in internet

penetration and smartphone usage. As of 2024, India has over 900

million internet users, and the convenience of ordering products from the

comfort of home has made online retailing a preferred choice, particularly

among urban and tech-savvy consumers.

Online platforms often offer attractive

discounts, subscription plans, and bundled deals, making supplements more

affordable and accessible to a broader audience. The availability of detailed

product descriptions, customer reviews, and personalized recommendations

further enhances the shopping experience and builds consumer trust.

Post-COVID-19, there has been a marked increase in health-conscious purchasing

behavior, with many consumers turning to online platforms for their nutritional

and healthcare needs.

Download Free Sample Report

Regional Insights

Based on Region, North India have

emerged as the dominating region in the India Vitamin D Supplements Market in

2024. ne of the primary reasons is the high prevalence of vitamin D deficiency

in the region, which has been attributed to factors such as urbanization,

pollution, and limited sun exposure. Major cities like Delhi, Chandigarh, and

Lucknow experience significant air pollution, which blocks UVB rays and reduces the body’s ability to synthesize vitamin D naturally. This has led to

an increased reliance on supplements to address the widespread deficiency.

North India has higher awareness of health and wellness than many other regions in the country. This awareness is

reflected in the rising adoption of preventive healthcare practices, including

the use of vitamin D supplements to mitigate deficiencies and associated health

risks. The region also benefits from a robust healthcare infrastructure, with a

strong network of pharmacies, health stores, and medical practitioners who

actively recommend supplements to address deficiencies, particularly among vulnerable

groups like children, women, and the elderly.

Recent Development

- In Apr 2024, Nestlé India and Dr. Reddy’s entered a definitive agreement to form a joint venture to bring nutraceutical brands to consumers in India and other agreed territories. In the announced licensing list, Dr. Reddy’s is to contribute brands including Kidrich-D3 (Vitamin D) into the JV portfolio, with the JV expected to become operational in Q2 FY’25.

- In

December 2024, Horlicks Women’s Plus has partnered with Apollo Diagnostics for

the fourth consecutive year to address women’s bone health in India. This

collaboration aims to raise awareness about Vitamin D deficiency, which impacts

bone health and increases the risk of conditions such as osteoporosis.

- In November 2024, Tata Tea Gold Care has

launched an innovative campaign aimed at raising awareness about Vitamin D

deficiency in India, combining traditional print media with cutting-edge

technology like Augmented Reality (AR). This unique initiative comes at a time

when Vitamin D deficiency affects a significant portion of the Indian

population, with nearly 50-90% of people reported to have inadequate Vitamin D

levels due to factors such as limited sunlight exposure, urban lifestyles, and

pollution.

- In May 2024, Entod Pharma introduced

India’s first vitamin D3-enriched lubricating eye drops, marking a significant

advancement in ocular health care. These innovative eye drops combine the

hydrating benefits of lubricants with the therapeutic properties of vitamin D3,

offering a comprehensive solution for managing dry eye syndrome and related

conditions. The inclusion of vitamin D3, a fat-soluble vitamin crucial for

anti-inflammatory and immune-modulating effects, is particularly

groundbreaking, addressing not only the symptoms of dry eyes but also their

underlying causes.

- In February 2024, an Indian

pharmaceutical company has achieved a groundbreaking milestone by launching the

world’s first aqueous Vitamin D injection, a water-based cholecalciferol

formulation, which is set to revolutionize the treatment of Vitamin D

deficiency. Unlike traditional oil-based Vitamin D injections, this innovative

aqueous solution offers enhanced solubility, leading to faster absorption and

more efficient correction of deficiencies. This marks a significant improvement

in the treatment landscape, addressing the challenges associated with the

slow-release nature and potential side effects of oil-based formulations.

Key Market Players

- Amway

Corporation

- GNC

India

- The

Nature's Bounty Co.

- Pfizer

Limited

- Otsuka

Pharmaceutical India Private Limited

- Bayer

Ag

- Healthwise

Pharma

- Fermenta

Biotech Limited

- Estrellas

Life Sciences Pvt. Ltd.

- MITS

Healthcare Pvt. Ltd:

|

By Product Type

|

By Distribution Channel

|

By Region

|

- Vitamin D2 Supplements

- Vitamin D3 Supplements

|

- Supermarkets/Hypermarkets

- Pharmacies/Health Stores

- Online Retailing

- Others

|

- East India

- West India

- North India

- South India

|

Report Scope

In this report, the India Vitamin D Supplements

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- India Vitamin D Supplements

Market, By

Product Type:

o Vitamin D2 Supplements

o Vitamin D3 Supplements

- India Vitamin D Supplements

Market, By

Distribution Channel:

o Supermarkets/Hypermarkets

o Pharmacies/Health Stores

o Online Retailing

o Others

- India Vitamin D Supplements

Market, By Region:

o East India

o West India

o North India

o South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the India Vitamin D Supplements Market.

Available Customizations:

India Vitamin D Supplements Market report with the

given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Vitamin D Supplements Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]