|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

USD

655.76 Million

|

|

Market

Size (2030)

|

USD

860.90 Million

|

|

CAGR

(2025-2030)

|

4.60%

|

|

Fastest

Growing Segment

|

Small

Molecules

|

|

Largest

Market

|

West

India

|

Market Overview

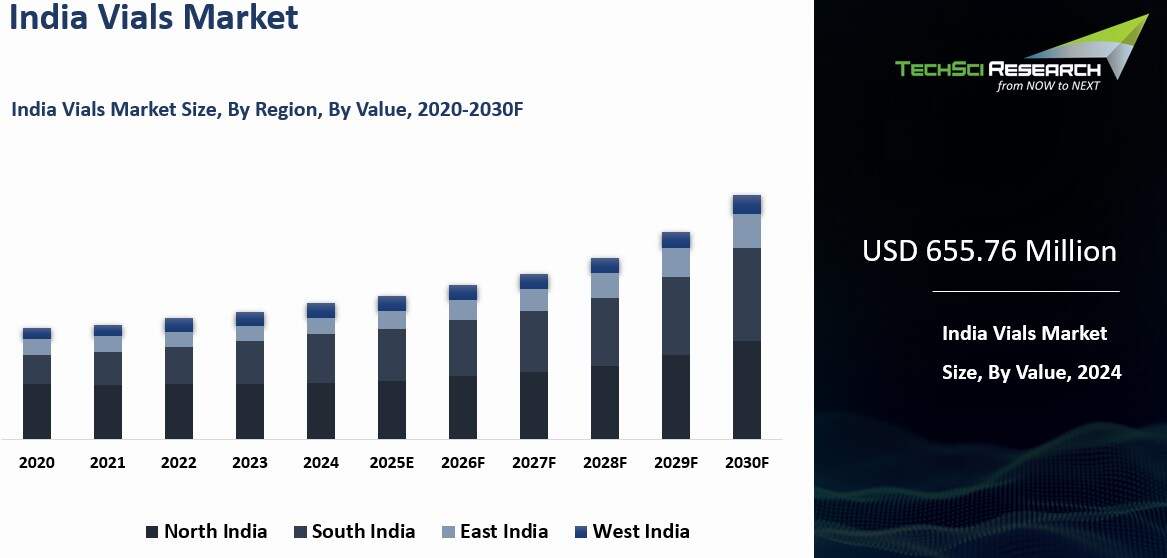

India Vials Market was valued at USD 655.76 Million in 2024 and is expected to grow to USD 860.90 Million by 2030 with a CAGR of 4.60% during the forecast period.

The India vials market plays a critical role in the country’s pharmaceutical

packaging sector, focused on the production and distribution of vials for

storing and administering injectable medications. This market has seen robust

growth, fueled by the increasing demand for injectable therapeutics, the

expanding pharmaceutical industry, and ongoing advancements in packaging

technologies.

Manufacturers are required to comply with stringent regulations,

including the standards outlined by the Central Drugs Standard Control

Organization (CDSCO) and Good Manufacturing Practices (GMP), ensuring the

quality and safety of products. As the demand for injectable drugs rises,

particularly due to the growing prevalence of chronic diseases, and as

innovations in packaging technologies continue to emerge, the market is

positioned for further expansion. To capitalize on this growth, stakeholders

must prioritize strategic investments in production capabilities while

maintaining strict adherence to regulatory frameworks to remain competitive and

ensure compliance.

Key Market Drivers

Expansion of the

Pharmaceutical Industry

The

expansion of the pharmaceutical industry in India is a critical factor driving

the growth of the Indian vials market. As the pharmaceutical sector in India

continues to evolve and expand, the demand for injectable drugs, biologics, and

vaccines has surged, creating a direct need for reliable and efficient

packaging solutions such as vials.

The growing focus on injectable medications,

driven by the need for treatments in chronic diseases such as cancer, diabetes,

and autoimmune disorders, has directly influenced the demand for vials.

Injectable drugs are essential for administering therapeutics that cannot be

delivered orally, such as biologics and vaccines. As the pharmaceutical

industry increases its production of these injectables to meet both domestic

and global demand, the need for vials as essential packaging components also

rises.

This includes vials designed for both single-use and multi-dose

applications, as well as those tailored for specific drug formulations. India's expanding middle class, now comprising 41% of the nation's 1.4 billion population, has led to increased disposable income, making medicines more accessible. Additionally, the growth of health insurance providers has further bolstered this accessibility. Currently, India relies on imports for nearly 70% of its active pharmaceutical ingredient (API) needs, predominantly from China. The government's policy outlines ambitious goals to boost the domestic production of APIs, aiming to significantly strengthen India's pharmaceutical security.

India's

pharmaceutical industry is increasingly focusing on the development of

biopharmaceuticals, which require specialized packaging due to their complexity

and sensitivity. Biologics, such as monoclonal antibodies and gene therapies,

are typically delivered through injections and require highly regulated,

secure, and durable packaging solutions like vials.

The expansion of India’s

biopharmaceutical sector is thus driving the need for specialized vials that

meet stringent regulatory standards and ensure the stability and safety of

these sensitive drugs. As India aims to become a global hub for biosimilars and

other biologics, the demand for vials designed to store and deliver these

treatments continues to rise. India plays a pivotal role in global vaccine

production, with many domestic manufacturers supplying vaccines for both

national and international markets.

The rise in vaccination programs,

especially during the COVID-19 pandemic and in response to other infectious

diseases, has dramatically increased the demand for vials used to store

vaccines. The government’s continued focus on expanding immunization programs

both domestically and internationally creates a persistent demand for vials

capable of storing large volumes of vaccines under specific temperature

conditions. Additionally, the increased production of vaccines for emerging

diseases further fuels this demand, contributing to the growth of the vials

market.

India

is a major global supplier of generic drugs, which are increasingly being

adopted by countries around the world due to their cost-effectiveness. As the

pharmaceutical industry in India continues to grow, particularly in the generic

drug segment, the need for vials for packaging these drugs also rises. Generic

injectable drugs, which often serve as alternatives to branded biologics,

require vials for storage and transportation.

The continued increase in both

domestic and export sales of generics supports the ongoing demand for vials,

driving growth in the packaging segment. India's pharmaceutical exports have

seen significant growth, particularly in markets like the United States,

Europe, and emerging regions. As Indian pharmaceutical manufacturers continue

to expand their presence globally, they must meet stringent international

packaging standards.

This includes the use of high-quality vials that comply

with regulatory requirements such as the U.S. FDA and European Medicines Agency

(EMA) standards. The increasing volume of exports, especially of injectables

and biologics, directly impacts the demand for vials, as they are integral to

the packaging of these products. As Indian companies scale their operations to

meet international demand, the growth of the vials market is closely linked to

the expansion of India’s pharmaceutical export sector.

The shift towards

patient-centric healthcare is another aspect of the expanding pharmaceutical

industry that drives vial demand. With the rise of self-administered injectable

therapies for conditions like diabetes and rheumatoid arthritis, there is a growing

emphasis on packaging solutions that offer convenience, safety, and ease of use

for patients. Pre-filled vials, which allow for single-dose injections, have

become increasingly popular in this regard. This trend reflects a broader shift

in the pharmaceutical industry towards personalized medicine and home

healthcare solutions, both of which increase the demand for specialized vials

designed for consumer use.

Download Free Sample Report

Surge in Demand for Injectable

Drugs

The

surge in demand for injectable drugs is a significant factor driving the growth

of the Indian vials market. As injectable medications become more integral to

the treatment of a variety of medical conditions, including chronic diseases,

infections, and cancers, the need for high-quality, reliable vial packaging

solutions has sharply increased.

The growing incidence of chronic conditions

such as diabetes (In India, an estimated 77 million adults aged 18 and above are affected by type 2 diabetes, with an additional 25 million individuals classified as prediabetic, placing them at a higher risk of developing diabetes in the near future. Notably, over 50% of those with diabetes remain unaware of their condition, which can lead to severe health complications if left undiagnosed and untreated), cardiovascular diseases, cancer, and autoimmune disorders has

dramatically increased the need for injectable medications.

Injectable drugs,

including insulin, monoclonal antibodies, and biologics, are essential for

treating these chronic conditions. For example, diabetes management

increasingly relies on injectable insulin and other advanced therapeutics,

which must be stored and administered in a secure, sterile manner, often in

vials.

As India experiences a rise in the burden of chronic diseases, the

demand for injectable drugs escalates, thereby driving the corresponding need

for vials. India is estimated to have around 1.1 million people who inject drugs (PWIDs), with an HIV prevalence rate of approximately 10% among this group. While HIV remains a key focus in discussions about injecting drug users (IDUs), there are several other critical health risks to consider. These include various cardiovascular and metabolic factors that pose significant threats to their overall well-being.

Biologics,

including monoclonal antibodies, vaccines, and gene therapies, have

revolutionized the treatment landscape for a variety of diseases, offering

targeted treatments with high efficacy. Biologic drugs are often administered

through injectables and require packaging solutions that ensure product

integrity and sterility. India’s increasing focus on the development and

manufacturing of biologics and biosimilars (biologic medicines that are similar

to innovator drugs) further drives the demand for vials. As these drugs grow in

popularity due to their precision in treatment, vials, particularly those

designed for biologic injectables, become essential components in their

distribution.

India

is a key player in the global vaccine market, both as a producer and

distributor. The increasing global demand for vaccines, particularly in the

wake of the COVID-19 pandemic and growing concerns over infectious diseases,

has led to a surge in vaccine production. Vaccines, which are primarily

delivered via injection, require vials for storage and distribution. With the

expansion of immunization programs both domestically and internationally the

need for vials used in the packaging of vaccines has sharply risen. India’s

extensive vaccine production capabilities, particularly for routine

immunization schedules and emergency health crises, rely heavily on the

availability of high-quality vials.

Biopharmaceuticals, which encompass a wide

range of therapeutic proteins, monoclonal antibodies, and gene therapies, are

increasingly being used to treat conditions that were once considered difficult

to manage. These drugs are typically administered by injection, either in a

clinical setting or at home. The surge in demand for these therapies,

particularly in areas such as oncology, immunology, and rare diseases, directly

impacts the vials market.

The complex nature of biopharmaceuticals, combined

with the sensitivity of these drugs to temperature and environmental

conditions, makes the need for specialized vial packaging solutions even more

critical. As India continues to expand its biopharmaceutical production, the

demand for vials tailored to the specific requirements of these medications

grows. As reported in the 2022 India BioEconomy Report, the biopharmaceutical sector is the largest contributor to India's biotechnology industry, generating an economic impact of approximately USD 39.4 billion in 2021.

The

growing focus on patient-centric healthcare solutions, such as home-based

healthcare and self-administration of medications, has boosted the demand for

injectable drugs. Pre-filled syringes and vials are becoming increasingly

popular for self-injection, allowing patients to manage chronic conditions such

as diabetes, rheumatoid arthritis, and multiple sclerosis from the comfort of

their homes.

The convenience of these solutions has led to higher patient

compliance, which, in turn, drives the market for vials, as they are the key

packaging solution for pre-filled injectables. As patient demand for

easy-to-use, ready-to-administer injectable drugs rises, the vials market is

seeing significant growth.

Government policies and regulatory support aimed at

accelerating the development and manufacturing of injectable drugs further

contribute to the demand for vials. Regulatory bodies such as the Central Drugs

Standard Control Organization (CDSCO) in India are establishing clear

guidelines to promote the production of high-quality injectables.

These

policies facilitate the growth of the injectable drug market by ensuring that

manufacturers meet the necessary standards, which often include requirements

for secure and compliant packaging solutions, such as vials. In response to

these regulations, manufacturers are increasingly investing in advanced vial

technologies to meet the growing demand for injectable drugs.

Increase in Vaccination

Programs and Biologics

The increase in vaccination programs and the expansion of biologics are key factors driving the growth of the Indian vials market. As global and domestic

healthcare priorities shift towards large-scale immunization and the

development of advanced biologic therapies, the demand for vials, which serve

as essential packaging for vaccines and biologics, has surged. This demand is

underpinned by several critical dynamics in the pharmaceutical and healthcare

sectors, all contributing to the acceleration of vial consumption in India. India

plays a pivotal role in global vaccination efforts, both in terms of production

and distribution.

The country is one of the world's largest manufacturers of

vaccines, supplying vaccines for various diseases such as polio, tuberculosis,

hepatitis, and, more recently, COVID-19. The government's ongoing efforts to

expand vaccination programs, aimed at achieving herd immunity and controlling

infectious diseases, have significantly boosted the demand for vials. National

immunization initiatives, such as routine childhood vaccination schedules, and

international campaigns, especially those focused on low- and middle-income

countries, rely heavily on large-scale vaccine production.

Vaccines are

predominantly stored and distributed in vials. With the growing scope of vaccination programs, the need for vials, especially multi-dose vials and those capable of maintaining the integrity of sensitive formulations, has dramatically increased. Furthermore, India's active involvement in global vaccination

efforts, particularly in the context of COVID-19 and other emerging diseases,

has led to increased production volumes. This surge in vaccine production

drives the need for more vials for storage, distribution, and safe

administration. The increase in vaccine production, both domestically and for

export, significantly influences the demand for vials in the market. As of March 4, 2023, India has successfully administered over 2.2 billion doses, encompassing the first, second, and precautionary (booster) doses of the currently approved vaccines.

Biologics

are a rapidly growing segment of the pharmaceutical industry, including

monoclonal antibodies, gene therapies, recombinant proteins, and vaccines.

These drugs are primarily delivered via injectables and require specific

packaging solutions to preserve their potency and stability. The rise of

biologics, which offer targeted treatments for diseases such as cancer,

autoimmune disorders, and genetic conditions, is directly contributing to the

growth of the vials market.

Biologics are typically more complex to manufacture

and store than traditional small-molecule drugs. Their sensitivity to

temperature, light, and handling means that specialized vials are required to

ensure their efficacy and safety throughout their shelf life. As the demand for

biologic drugs in India increases, driven by both domestic healthcare needs and

global exports, the corresponding demand for vials that meet the stringent

requirements for biologics packaging has surged. This includes vials designed

for specific formulations, such as pre-filled syringes and glass vials that

minimize the risk of contamination.

India is a leading supplier of vaccines

worldwide, especially in emerging markets. The global vaccine market has seen

substantial growth, driven by an increasing need for immunization against both

common and emerging diseases. For example, India has been a significant

producer and supplier of COVID-19 vaccines, which are stored and distributed in

vials.

As global vaccination programs expand, particularly in developing

countries, the need for high-quality vials to safely store and transport

vaccines grows. India’s role as a vaccine manufacturing hub has positioned it

as a critical player in global vaccination campaigns. The ongoing international

demand for vaccines, both for routine immunization and emergency health crises,

has spurred the demand for vials.

The country's capacity to produce vaccines on

a large scale necessitates an increased supply of vials, as vaccines are

distributed in large quantities across regions with varying climates and storage

conditions. The Immunization Program is a critical initiative aimed at protecting children from preventable, life-threatening conditions. As one of the largest immunization programs globally, it represents a significant public health effort in the country. The program targets the vaccination of 26 million newborns and 30 million pregnant women each year under the Universal Immunization Program (UIP). Over 9 million immunization sessions are held annually, supported by nearly 27,000 cold chain points nationwide.

With

the development of new vaccines and biologics, including mRNA-based vaccines,

there has been an increasing emphasis on packaging solutions that can meet the

advanced storage and distribution needs of these cutting-edge therapies. The

rise of biologics, particularly vaccines like the mRNA COVID-19 vaccines, which

have specific temperature requirements (e.g., ultra-low temperatures), has led

to the development of specialized vials capable of maintaining these

conditions. As more vaccines and biologic therapies are introduced to the

market, the demand for vials that are compatible with complex storage needs and

high-value drugs continues to rise. Moreover, the trend towards pre-filled

vials and syringes, which are designed to minimize contamination risks and

enhance patient compliance, is becoming more prevalent.

These innovations are

particularly important for biologics, as they require secure, efficient, and

user-friendly packaging. The demand for vials that support these innovations is

helping drive growth in the vials market. Government policies, both within

India and internationally, have played a pivotal role in boosting the

production and distribution of vaccines and biologics. The regulatory

frameworks that support the manufacturing of vaccines and biologics,

particularly in India, are designed to ensure the safety, efficacy, and quality

of these products. These regulations require high standards for packaging,

including vials, to ensure that vaccines and biologics remain stable and secure

throughout their lifecycle.

The regulatory emphasis on Good Manufacturing

Practices (GMP) and the guidelines set forth by bodies such as the Central

Drugs Standard Control Organization (CDSCO) in India, as well as international

regulatory authorities like the World Health Organization (WHO) and the U.S.

FDA, have driven the demand for vials that meet rigorous quality standards.

Manufacturers must ensure that their vials comply with these regulations, which

has spurred innovation in vial design and production, further boosting market growth.

Key Market Challenges

Stringent Regulatory

Compliance and Quality Standards

The

Indian vials market operates in a highly regulated environment, where

manufacturers must comply with rigorous standards and quality controls to

ensure the safety, efficacy, and integrity of pharmaceutical products.

Regulatory bodies such as the Central Drugs Standard Control Organization

(CDSCO) impose strict requirements on packaging materials and processes,

including vials used for injectable drugs, vaccines, and biologics.

Manufacturers

face substantial challenges in meeting both national and international

regulatory standards, which often include stringent testing protocols,

sterilization processes, and packaging materials that can withstand temperature

fluctuations and other environmental factors. Ensuring compliance with these

regulations demands significant investments in quality control, research and

development (R&D), and technology upgrades. For small and medium-sized vial

manufacturers, the cost and complexity of adhering to these standards can be

prohibitive, hindering their ability to scale operations.

Moreover, compliance

with international standards like those set by the U.S. FDA or European

Medicines Agency (EMA) is often necessary for manufacturers targeting global

markets, adding another layer of complexity and cost. As India’s pharmaceutical

exports grow, the pressure to meet these international standards becomes even

more pronounced, limiting the growth potential for some domestic vial

manufacturers. The ongoing need for continuous regulatory updates and

compliance can slow down market agility, presenting a barrier to market

expansion.

Raw Material Shortages and

Price Volatility

The

production of vials, especially glass vials, is highly dependent on the

availability of raw materials such as borosilicate glass, rubber stoppers, and

aluminum seals. India’s vials market is heavily influenced by the fluctuations

in the prices and availability of these critical materials, many of which are

imported. Disruptions in the global supply chain, such as those caused by

geopolitical tensions, trade restrictions, or natural disasters, can lead to

raw material shortages, price hikes, and delays in production.

For

instance, borosilicate glass, which is the preferred material for

pharmaceutical vials due to its resistance to chemical reactions and heat, is

in limited supply and subject to significant price volatility. Similarly, the

rubber and aluminum components that form the closure systems of vials also face

price instability due to global supply chain issues. These fluctuations in raw

material prices impact the overall cost structure of vial manufacturing, making

it difficult for manufacturers to maintain competitive pricing while ensuring

quality. Smaller manufacturers with limited resources may struggle to absorb

these costs, leading to reduced margins or even an inability to meet the

growing demand for vials. In turn, this can restrict the ability of the Indian

vials market to scale effectively, particularly as global demand for vaccines

and biologics increases.

Key Market Trends

Growing Demand for Biologics

and Specialty Drugs

One

of the most significant trends driving the future growth of the India vials

market is the rising demand for biologics and specialty drugs. Biologics,

including monoclonal antibodies, gene therapies, recombinant proteins, and

vaccines, are increasingly becoming the treatment of choice for a wide range of

chronic and complex diseases, such as cancer, autoimmune disorders, and rare

genetic conditions. These biologics are predominantly administered via

injectable formulations, necessitating high-quality vials for storage,

distribution, and administration.

India

has established itself as a major hub for the production of biologics and

biosimilars, with significant investments in biotechnology and

biopharmaceuticals. As the global market for biologics continues to grow,

India’s role in supplying both domestic and international markets is expanding.

The demand for vials, especially for biologics, is intensifying, driven by the

need for specialized packaging solutions that can ensure product integrity,

sterility, and ease of administration. Vials, particularly those designed for

biologics, must meet stringent requirements, such as temperature stability,

tamper-evident closures, and compatibility with self-injection systems. This

trend toward biologics and specialty drugs is expected to be a primary driver

for the growth of the vials market in India.

Technological Advancements in

Packaging Solutions

The

increasing sophistication of injectable drug delivery systems is another key

trend that will significantly impact the future of the India vials market.

Advances in vial packaging technology are leading to the development of

smarter, more user-friendly, and more secure vial solutions. These innovations

include pre-filled syringes, auto-injectors, and multi-dose vials that offer

convenience, reduce the risk of contamination, and improve patient compliance.

Additionally,

the growing adoption of anti-counterfeiting technologies in packaging is

reshaping the vials market. Vials are now being equipped with tamper-evident

seals, RFID tags, and other security features to protect against counterfeit

drugs, which are a growing concern globally. The integration of digital

technologies into vials, such as smart sensors that monitor temperature,

humidity, or even the vial’s usage, is gaining traction. These "smart

vials" offer real-time data, ensuring that drugs are stored and

transported within the recommended conditions, which is critical for biologics

and vaccines. As manufacturers strive to meet the needs of the evolving

pharmaceutical industry, the demand for technologically advanced vials will

increase, thereby driving market growth.

Segmental Insights

Application Insights

Based

on the category of Application, the Small Molecules segment emerged as the

dominant in the India Vials Market in 2024. The small molecules segment has

historically been the largest contributor to the India vials market, accounting

for a significant share of the overall demand for vials. Small molecules,

typically made up of low molecular weight compounds, are used in a wide range

of therapeutic areas, including antibiotics, pain management, cardiovascular

diseases, and other chronic conditions. These drugs are primarily delivered via

oral tablets and injectables, with injectable formulations requiring vials for

storage and administration.

India's

pharmaceutical sector, which is one of the largest in the world, is heavily

focused on the production and export of generic small-molecule drugs. The

country is a global leader in the production of affordable generic medications,

which are primarily injectable forms, driving a substantial demand for vials in

the domestic market. The small molecule market also benefits from its

relatively stable growth trajectory, as these drugs remain the standard

treatment option for many diseases. This has led to consistent demand for

vials, with manufacturers scaling production to meet both domestic consumption

and export needs. These factors are expected to drive the growth of this

segment.

Download Free Sample Report

Regional Insights

West

India emerged as the dominant in the India Vials Market in 2024, holding the

largest market share in terms of value. West India, particularly Maharashtra,

Gujarat, and Goa, is the dominant region in the Indian vials market. This

region is a key hub for the country’s pharmaceutical industry, which has a

direct impact on the demand for vials used in drug storage, packaging, and

administration.

West

India is home to many pharmaceutical manufacturers, including both

multinational corporations (MNCs) and domestic companies. Cities like Mumbai

(Maharashtra) and Ahmedabad (Gujarat) are well-established as centers for

pharmaceutical production, including the manufacturing of injectable drugs,

vaccines, and biologics—all of which require vials for packaging. The presence

of key pharmaceutical players in these regions drives high demand for vials,

particularly for small molecules, biologics, and vaccines. West India also

plays a pivotal role in India’s pharmaceutical export sector.

The region is

strategically located near major ports, such as Mumbai Port and Mundra Port,

facilitating the export of pharmaceutical products and vials to international

markets. As a result, the demand for vials in the region is not only driven by

domestic consumption but also by the need to cater to global markets. West

India boasts a well-developed infrastructure that supports both pharmaceutical

manufacturing and packaging. The region’s advanced research and development

(R&D) facilities, as well as its focus on technological innovations in

packaging, also contribute to the rising demand for vials with specialized

features, such as pre-filled syringes and multi-dose vials.

Recent Developments

- In October 2024, In response to the rising incidents of counterfeit medicines, particularly in the cancer treatment sector, anti-cancer drug vials and strips may soon be mandated to include QR codes and track-and-trace systems. This move aims to enhance the traceability and authenticity of these critical medications, helping to combat the growing threat of fake drugs in the market. The introduction of such technology is expected to bolster the security of drug distribution, ensuring that patients receive legitimate treatments while enabling regulatory bodies to monitor the supply chain more effectively.

- In March 2024, Syngene International, a global contract research, development, and manufacturing organization (CRDMO), announced the operational launch of its newly upgraded biologics facility (Unit 3) in Bangalore, India. The facility was set to support clinical and commercial supply for U.S. and European clients in the latter half of 2024. The facility’s drug substance capacity included two production suites, each equipped with five 2KL single-use bioreactors, totaling a capacity of 20KL. Additionally, the facility featured two high-speed vial filling lines, capable of producing up to one million vials per day, with fill volumes ranging from one to 100mL. Beyond production capacity, the site housed a development suite for the clinical supply of drug substances, which included a 500L single-use bioreactor. Syngene officials stated that further expansion plans were in place, including the addition of two vial filling isolator lines with capacities of 600 vials/minute and 100 vials/minute, respectively, as well as an expansion into perfusion cell culture processing for drug substance production.

- In

June 2023- Corning and SGD Pharma have announced a strategic joint venture to

establish a new glass tubing facility in Telangana, India, aimed at expanding

access to Corning’s Velocity Vial technology. This collaboration combines SGD

Pharma’s expertise in vial conversion with Corning’s advanced glass-coating

technology, marking a significant step toward improving vial quality, enhancing

filling-line productivity, and accelerating the global distribution of

injectable treatments. By breaking ground on this new manufacturing facility,

the two companies are positioning themselves to address the growing

complexities of capacity and quality demands in the pharmaceutical sector,

while supporting the global supply of essential medicines. This partnership is

designed to empower drugmakers with the advanced solutions necessary to meet

the evolving challenges in drug production and delivery.

Key Market Players

- Amcor

Group

- Corning

Incorporated

- Gerresheimer

AG

- KISHORE

GROUP

- Nipro

Medical India Pvt. Ltd

- SCHOTT

Glass India Pvt. Ltd.

- SGD

Pharma

- MITSUBISHI

GAS CHEMICAL COMPANY, INC

|

By

Preparation

|

By

Application

|

By

Material

|

By

End User

|

By

Region

|

- Ready

to use (RTU)

- Ready

to sterilize (RTS)

|

- Small

molecules

- Biologics

- Diagnostics

|

|

- Hospitals

& clinics

- Pharma

& biotech companies

- Contract

development and manufacturing organizations (CDMOs)

- Diagnostic

laboratories

- Other

|

- North

India

- South

India

- West

India

- East

India

|

Report Scope:

In this report, the India Vials Market has been

segmented into the following categories, in addition to the industry trends

which have also been detailed below:

- India Vials Market, By Preparation:

o Ready to use (RTU)

o Ready to sterilize (RTS)

- India Vials Market, By Application:

o Small molecules

o Biologics

o Diagnostics

- India Vials Market, By Material:

o Glass

o Polymer

o Hybrid

- India Vials Market, By End User:

o Hospitals & clinics

o Pharma & biotech companies

o Contract development and manufacturing

organizations (CDMOs)

o Diagnostic laboratories

o Other

- India Vials Market, By Region:

o North India

o South India

o East India

o West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Vials

Market.

Available Customizations:

India Vials

market report with the given market data, Tech Sci Research offers

customizations according to a company's specific needs. The following

customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional

market players (up to five).

India Vials Market is an upcoming report to be

released soon. If you wish an early delivery of this report or want to confirm

the date of release, please contact us at [email protected]