|

Forecast Period

|

2026-2030

|

|

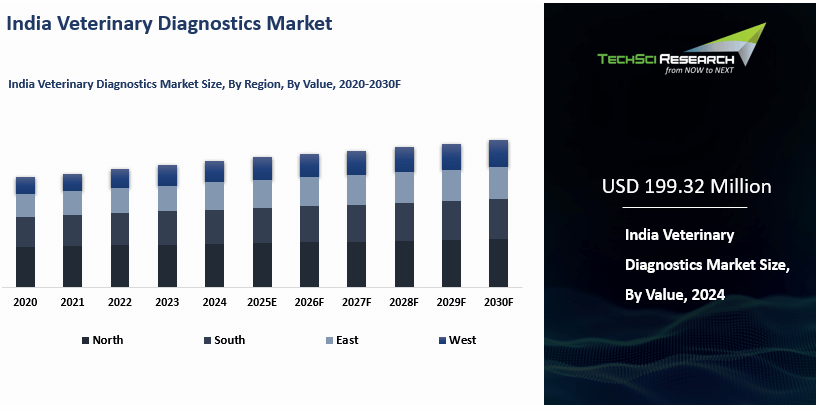

Market Size (2024)

|

USD

199.32 Million

|

|

CAGR (2025-2030)

|

13.91%

|

|

Fastest Growing Segment

|

Companion

Animals

|

|

Largest Market

|

South India

|

|

Market Size (2030)

|

USD 436.37 Million

|

Market Overview

India Veterinary Diagnostics Market was

valued at USD 199.32 Million in 2024 and is expected to reach USD 436.37 Million

by 2030 with a CAGR of 13.91% during the forecast period.

The veterinary

diagnostics market in India is experiencing robust growth, driven by factors

such as increasing pet ownership, particularly in urban areas, and the rising

demand for animal-based food products. As the middle class expands and

disposable incomes rise, more people are investing in the health and well-being

of their pets, spurring the need for diagnostic services. In addition, the

livestock sector, essential for dairy, poultry, and meat production, fuels the

demand for veterinary diagnostics to manage disease prevention and improve

productivity. Technological advancements, including the adoption of PCR

testing, digital imaging, and point-of-care devices, are further enhancing the

market’s growth by providing faster, more accurate results.

However, the market faces challenges

such as limited awareness and access to advanced diagnostic tools in rural

areas, which can hinder the widespread adoption of such services. Additionally,

the high cost of some diagnostic technologies may be a barrier for smaller

veterinary clinics, especially in remote regions. The fragmentation of the

veterinary services sector and the lack of trained professionals in some parts

of the country also pose challenges to market expansion. Despite these hurdles,

the ongoing urbanization, increasing disposable incomes, and growing awareness

of animal health continue to drive the market's positive trajectory in India.

Download Free Sample Report

Key Market Drivers

Increasing

Pet Ownership

Increasing Pet Ownership in India is one of the key

drivers of the veterinary diagnostics market, as more people adopt pets and

prioritize their health and well-being. Over the past few years, pet ownership

in India has seen a significant surge, driven by changing lifestyles,

increasing disposable income, and a growing awareness of the importance of

animal care. As urbanization continues, more individuals and families are

adopting pets, particularly dogs and cats, which has led to a greater demand

for veterinary healthcare services, including diagnostics.

In India, there are currently over 31 million pet dogs

and 2.44 million pet cats. The pet cat population is expected to grow

substantially, with projections suggesting that it may reach 4.89 million by

2026. This growth in pet ownership reflects the increasing attachment people

have to their pets, with many considering them as family members. As a result,

there is a rising demand for veterinary services, including regular health

check-ups, vaccinations, and diagnostic tests, to ensure the health and longevity

of pets.

In terms of spending, affluent households in India are

increasingly investing in the health of their pets, spending an average of Rs

4,500-5,000 per month on pet care. This figure reflects the growing awareness

among pet owners about the need for regular veterinary visits, including

diagnostic services to detect potential health issues early. On the other hand,

other households also allocate significant funds, spending at least Rs

1,000-1,500 per month on pet care, which indicates a broadening middle-class

adoption of veterinary services.

This increased expenditure on pet health directly

correlates with the rise in demand for veterinary diagnostics, as pet owners

are more likely to seek out advanced diagnostic services to ensure their pets'

well-being. As the number of pet owners continues to grow and their spending on

pet healthcare increases, the veterinary diagnostics market in India is

expected to see further expansion.

Rising

Livestock Farming

Rising Livestock Farming in India is a

significant driver for the veterinary diagnostics market, as the country

continues to strengthen its position as a global leader in animal agriculture.

The livestock sector plays a crucial role in India's agricultural landscape,

not only contributing substantially to the nation's economy but also providing

employment and supporting rural livelihoods. With growing domestic demand for

milk, eggs, meat, and other animal products, the importance of maintaining

healthy livestock has never been greater. As such, livestock farmers are

increasingly turning to veterinary diagnostics to ensure the health,

productivity, and disease management of their animals.

India is the largest producer of milk globally,

contributing 23% of total milk production worldwide. The dairy sector is the

most critical component of the Indian livestock industry, employing more than

eight crore (80 million) farmers directly. Alongside milk, India is a

significant player in the global egg and meat markets, ranking third in egg

production and eighth in meat production. The country also accounts for 7% of

the global egg production, 2.42% of global meat production, and 7.56% of global

fish production.

The sector’s robust growth is driven by increasing

consumption of dairy and meat products, as well as expanding export

opportunities. However, with this growth comes the need for better management

and health practices within livestock farming. To maximize productivity and

prevent losses due to diseases, farmers are increasingly adopting veterinary

diagnostics for disease detection, health monitoring, and ensuring the quality

and safety of animal products.

The CAGR of the livestock sector from 2014-15 to

2022-23 was 12.99%, indicating a strong and sustained increase in the sector’s

output. This growth is a testament to the rising importance of livestock

farming in India’s economy and the need for advanced veterinary diagnostics to

support this sector’s continued expansion. As farmers invest in improving the

health of their herds to meet both domestic and international demands, the

veterinary diagnostics market will continue to experience significant growth.

Key Market Challenges

Lack

of Awareness and Accessibility in Rural Areas

One of the major challenges hindering the full

utilization of veterinary diagnostic services is the lack of awareness and

accessibility, especially in rural areas where the majority of livestock

farmers reside. While urban centers have access to modern veterinary care and

diagnostics, rural regions are often underserved due to several factors,

including limited infrastructure, a lack of veterinary professionals, and

financial constraints.

Many rural farmers still lack a clear understanding of

the importance of veterinary diagnostics for maintaining livestock health and

productivity. Traditional farming practices, often passed down through

generations, focus more on conventional methods of care rather than preventive

health measures. As a result, many farmers do not prioritize early diagnosis or

regular health check-ups for their animals, which can lead to delayed detection

of diseases and poor animal welfare.

For example, farmers may not recognize symptoms of

diseases such as mastitis, foot-and-mouth disease, or avian influenza until it

is too late, resulting in reduced milk production, weight loss, or even death

of animals. This leads to not only economic losses for the farmers but also

poses a broader risk to the agricultural ecosystem, especially when infectious

diseases spread across livestock populations.

Limited Accessibility to Veterinary Services: Veterinary

diagnostics require advanced tools and equipment that may not be readily

available in rural areas. Inadequate infrastructure, including a shortage of

well-equipped veterinary clinics, diagnostic laboratories, and trained

professionals, makes it challenging for farmers to access essential services.

Even when these services are available, they may be geographically distant or

too costly for many small-scale farmers to afford.

Key Market Trends

Technological

Advancements

Technological advancements are reshaping veterinary diagnostics in India, improving both quality and accessibility of animal healthcare. Genomic technologies are now central to disease detection and genetic disorder identification in animals, enabling earlier interventions and reducing the risk of large-scale outbreaks. Cattle genome sequencing services, already available in India, provide detailed genetic insights that help livestock breeders enhance herd health and productivity.

Point-of-care diagnostic devices have become important in remote areas, enabling rapid testing for diseases such as rabies and canine distemper without relying on distant laboratories. Since its launch in 2021, India’s Mobile Veterinary Units program has served over 9.1 million farmers through early 2025, cutting diagnostic delays and improving treatment outcomes.

Artificial intelligence (AI) is playing a growing role in veterinary diagnostics. AI algorithms analyze blood tests, imaging scans, and pathological data, detecting health conditions often missed by human observation. Startups in Chennai have launched smartphone apps that use AI to assess pet health, supporting initial screenings and guiding veterinary visits. India’s largest dog rescue organization has also deployed an AI-based virtual health assistant that provides treatment advice tailored to local practices. In livestock care, AI-powered diagnostics show around 85% accuracy in detecting diseases like mastitis, offering significant benefits for India’s 190 million cattle and buffalo.

Veterinary telemedicine platforms are also expanding, bridging gaps in veterinary infrastructure, especially in rural India. Government-backed initiatives like NITIvet and private services such as Verdant Impact’s “Animal ICU” connect farmers with veterinarians for timely consultations.

Digital reporting and AI-driven monitoring systems are enhancing disease surveillance. The National Animal Disease Referral Expert System (NADRES V2), developed by ICAR-NIVEDI, provides early warnings and forecasts for livestock diseases. In November 2025, NADRES V2 demonstrated forecasting accuracy from 87% for African Swine Fever to more than 99% for Bluetongue. The platform received the National e-Governance Gold Award for 2024–2025 for its effective use of AI in delivering citizen-focused services.

Big data analytics is supporting comprehensive animal health management by combining diagnostic, clinical, and environmental data to identify disease patterns and improve preventive strategies. These advancements are driving precision veterinary medicine in India, enabling tailored treatment plans and enhancing livestock productivity and animal welfare.

Segmental Insights

Animal

Type Insights

Based on Animal Type, Companion Animals have

emerged as the fastest growing segment in the India Veterinary Diagnostics

Market in 2024. Diagnostics Market due to the rising trend of pet ownership

across the country, particularly among urban and affluent households. With

increasing disposable incomes, changing lifestyles, and a growing emotional

connection to pets, families are now treating companion animals as integral

members, driving a surge in demand for advanced veterinary care and

diagnostics. The influence of urbanization has also contributed to the

preference for pets like dogs, cats, and exotic animals, which are now seen as

symbols of comfort and companionship.

Additionally, the growing awareness about pet health

and well-being is leading to higher spending on preventive healthcare measures,

including regular veterinary check-ups and diagnostic tests. Pet owners are increasingly

seeking early detection of illnesses, improved vaccination protocols, and

tailored treatments, boosting the adoption of advanced diagnostic tools. The

rise of pet health insurance further supports this trend by making veterinary

services more affordable for many households.

Disease

Type Insights

Based on Disease Type, Oncology have

emerged as the fastest growing segment in the India Veterinary Diagnostics

Market during the forecast period. This growth is driven by increasing awareness among

pet owners about the importance of early cancer detection and treatment,

alongside advancements in diagnostic technologies that facilitate precise

identification of cancer in animals. As the population of companion animals

grows and pet owners adopt a more humanized approach to pet care, there is a

rising demand for specialized diagnostics, including imaging techniques like CT

scans and biopsies, to detect tumors at an early stage.

Moreover, the prevalence of cancer in pets,

particularly in older animals, has increased, leading to a heightened focus on

veterinary oncology. Conditions such as lymphoma, mast cell tumors, and

osteosarcomas are being diagnosed more frequently due to improved diagnostic

capabilities. The growing availability of veterinary oncology expertise and

advanced treatment options further underscores the emphasis on addressing

cancer in animals, contributing to the rapid growth of this segment within the

veterinary diagnostics market.

.png)

Download Free Sample Report

Regional Insights

Based on Region, South India have

emerged as the dominating region in the India Veterinary Diagnostics Market in

2024. This is due to several key factors. The region boasts a well-developed

veterinary healthcare infrastructure, with a higher concentration of veterinary

clinics, diagnostic laboratories, and skilled professionals compared to other

parts of the country. This robust infrastructure ensures greater accessibility

to advanced diagnostic services for both companion animals and livestock.

The region's significant livestock population,

particularly in states like Tamil Nadu, Karnataka, Andhra Pradesh, and

Telangana, also contributes to its dominance. South India is a hub for dairy

and poultry farming, two sectors that heavily rely on veterinary diagnostics

for disease prevention and productivity enhancement. The high awareness levels

among farmers in these states about the importance of regular veterinary care

and diagnostics further drive demand in the region.

Additionally, the rising trend of pet

ownership in urban areas of South India, such as Bengaluru, Chennai, and

Hyderabad, has fueled the growth of the companion animal diagnostics segment.

Pet owners in these cities are more inclined to invest in the health and

well-being of their pets, leading to increased demand for advanced diagnostic

tools and services.

Recent Development

- In September 2025, the Rajiv Gandhi Centre for Biotechnology (BRIC-RGCB) inaugurated its first veterinary medical laboratory services unit in Oyoor, Kollam, marking a significant advancement in animal husbandry healthcare. The state-of-the-art facility offers a comprehensive range of veterinary clinical diagnostics while also extending select diagnostic services to the public at affordable rates. Established in collaboration with the Kerala Animal Husbandry Department and housed in a building provided by the Velinelloor Village Panchayat, the multi-specialty centre is designed to strengthen both animal and community health services in the region.

- In July 2025, Esaote Asia Pacific Diagnostic Pvt. Ltd., a leader in medical and veterinary imaging, announced the first Asia-Pacific installation of its cutting-edge Magnifico Vet MRI system at MaxPetZ Hospital, Greater Kailash, New Delhi, marking a major milestone in advanced veterinary imaging capabilities.

- In June 2025, the College of Veterinary Science (CVSc) at Assam Agricultural University, Khanapara, achieved a significant breakthrough by developing a rapid detection kit for African Swine Fever (ASF), a critical step toward controlling the disease that has severely impacted pig farming across the region since 2020.

- In March 2025, Chennai-based startup MimiBowBow unveiled Pet Scan Pro, India’s first AI-enabled pet health scanning platform. Designed for both pet owners and veterinarians, the technology transforms any smartphone into a diagnostic tool capable of detecting early signs of illness with 95% accuracy. Using a smartphone camera, pet parents can scan their pet’s skin, teeth, eyes, bones, or joints; within one minute the AI analyzes the images against a database of more than 2.5 million real-time MRI scans to identify over 40 potential medical conditions. The app then seamlessly connects users to a registered veterinary doctor for prompt consultation.

- In December 2024, DCC Animal Hospital, a

globally acclaimed chain of veterinary centers, opened its first

state-of-the-art facility in Jaipur on December 1. Located at FS-6, Gayatri

Nagar, Durgapura, the hospital adheres to global Japanese standards, offering

cutting-edge pet healthcare. This launch brings advanced veterinary services to

Jaipur, revolutionizing pet care in the region.

- In November 2024, The West Bengal

Livestock Development Corporation (WBLDC) launched a diagnostic service for

pets, focusing on dogs and cats, in Kolkata and suburbs. Managed by CLART at

Kalyani, this state-run initiative offers advanced diagnostic tests to ensure

accurate diagnosis and effective treatment, enhancing veterinary healthcare

accessibility for pet owners.

- In March 2024, Tata Trusts inaugurated

India’s first state-of-the-art Small Animal Hospital in Mahalaxmi, Mumbai. The

hospital, a pioneering initiative, is designed to offer advanced healthcare

services for small animals, including pets, with cutting-edge diagnostic and

treatment facilities. This milestone project underscores Tata Trusts’

commitment to enhancing veterinary care standards in the country. The hospital

aims to cater to the growing demand for specialized pet healthcare in urban

areas, marking a significant advancement in India’s veterinary sector.

- In January 2024, ENTOD Pharmaceuticals

has unveiled "FUR by ENTOD (Veterinary)," a specialized division

focused on innovative Eye and Ear Care medicines for pets. This initiative aims

to address the rising need for advanced pet healthcare solutions, particularly

for treating ocular and auditory conditions in animals. With its commitment to

quality and innovation, ENTOD Pharmaceuticals seeks to enhance the well-being

of pets while setting new standards in veterinary medicine. The launch highlights

the growing emphasis on pet healthcare in Maharashtra.

Key Market Players

- Embark

India

- IDEXX

Laboratories, Inc.

- Zoetis

India Limited

- Thermo

Fisher Scientific Inc.

- bioMérieux

- Bio-Rad

laboratories India Pvt.Ltd

- FUJIFILM

India Private Limited

- Virbac

Animal Health India Private Limited

- BioNote,

Inc.

|

By Product

|

By Technology

|

By Animal Type

|

By Disease Type

|

By End User

|

By Region

|

|

|

- Clinical Biochemistry

- Molecular Diagnostics

- Hematology

- Urinalysis

- Immunodiagnostics

- Others

|

- Companion Animals

- Livestock

|

- Infectious Disease

- Endocrinology

- Oncology

- Cardiology

- Others

|

- Veterinary Reference Laboratories

- Veterinary Hospitals & Clinics

- Point-of-care/ In-house Testing

- Veterinary Research Institutes & Universities

|

- East India

- West India

- North India

- South India

|

Report Scope

In this report, the India Veterinary Diagnostics

Market has been segmented into the following categories, in addition to the

industry trends which have also been detailed below:

- India Veterinary Diagnostics

Market, By

Product:

o Consumables

o Instruments

- India Veterinary Diagnostics

Market, By

Technology:

o Clinical Biochemistry

o Molecular Diagnostics

o Hematology

o Urinalysis

o Immunodiagnostics

o Others

- India Veterinary Diagnostics

Market, By

Animal Type:

o Companion Animals

o Livestock

- India Veterinary Diagnostics

Market, By

Disease Type:

o Infectious Disease

o Endocrinology

o Oncology

o Cardiology

o Others

- India Veterinary Diagnostics

Market, By

End User:

o Veterinary Reference Laboratories

o Veterinary Hospitals & Clinics

o Point-of-care/ In-house Testing

o Veterinary Research Institutes & Universities

- India Veterinary Diagnostics

Market, By Region:

o East India

o West India

o North India

o South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the India Veterinary Diagnostics Market.

Available Customizations:

India Veterinary Diagnostics Market report with the

given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Veterinary Diagnostics Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]