|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 1,280.54 Million

|

|

Market Size (2030)

|

USD 2,005.36 Million

|

|

CAGR (2025-2030)

|

7.84%

|

|

Fastest Growing Segment

|

Knee Replacement

|

|

Largest Market

|

South India

|

Market Overview

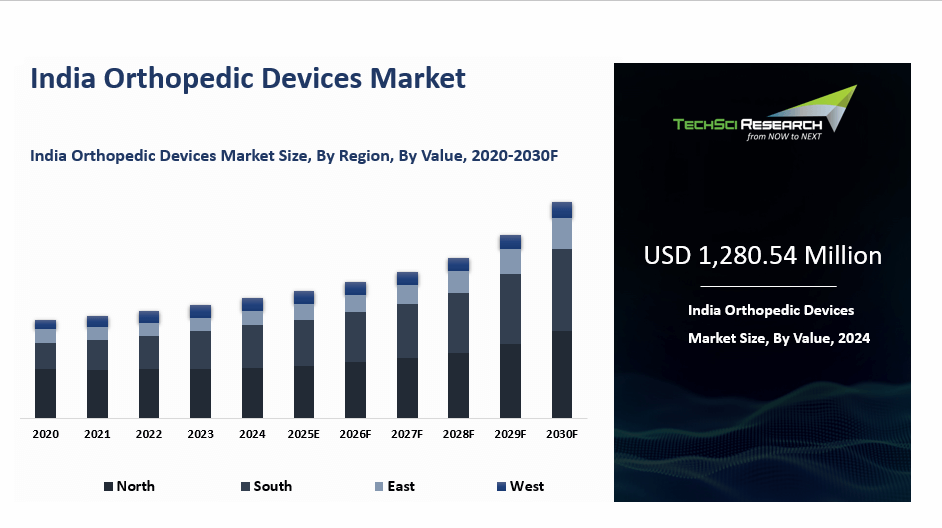

India Orthopedic Devices Market was valued at USD 1,280.54 Million in 2024 and is anticipated to reach USD 2,005.36 Million by 2030, with a CAGR of 7.84% during 2025-2030.

Orthopedic Devices are specifically designed to prevent or manage a wide

range of issues related to the musculoskeletal system. These devices, which are

readily available in hospitals, orthopedic clinics, and ambulatory surgical

centers, are offered by a diverse array of orthopedic device manufacturing

companies. They encompass a comprehensive range of solutions, including joint

reconstruction devices, orthopedic braces and supports, trauma fixation

devices, spinal devices, orthopedic prosthetics, and various orthopedic

accessories.

These

devices play a crucial role in providing support, stability, and mobility to

individuals with musculoskeletal conditions, helping them regain their quality

of life and overall well-being. By addressing specific needs and offering

tailored solutions, orthopedic devices contribute to the successful management

and treatment of various musculoskeletal conditions, enabling individuals to

lead active and fulfilling lives. Whether it's a joint replacement device that

restores mobility or an orthopedic brace that provides support and pain relief,

these devices are instrumental in improving the function and comfort of

patients with musculoskeletal issues. Furthermore, ongoing advancements in

orthopedic device technology continue to drive innovation in this field.

From

the development of more durable and biocompatible materials to the integration

of smart technologies for real-time monitoring, orthopedic devices are

constantly evolving to meet the needs of patients and healthcare professionals.

This commitment to innovation ensures that individuals with musculoskeletal

conditions have access to the most effective and cutting-edge solutions

available.

Download Free Sample Report

Key Market Drivers

Increasing

Number of Large Joint Reconstruction Surgeries

India is currently experiencing a significant surge in the demand for orthopedic devices. This surge can be attributed to the rising number of large joint reconstruction surgeries being performed, with around 70,000 joint replacements carried out annually in the country. Several factors contribute to this trend. Firstly, the country's geriatric population is increasing, leading to a higher prevalence of joint-related conditions such as osteoarthritis and rheumatoid arthritis (elderly are projected to reach 193.4 million by 2031 and may cross 300 million by 2050). As a result, the need for joint reconstruction surgeries and orthopedic devices is on the rise, and more revision arthroplasties are anticipated in the region.

Furthermore, lifestyle diseases like obesity are also contributing to the demand for orthopedic devices. Sedentary lifestyles and poor dietary habits are leading to an escalation in obesity rates, which is a major cause of joint problems (the ICMR-INDIAB national study reports a high burden of metabolic obesity). As the population becomes more aware of the available treatments and options, the demand for orthopedic devices continues to grow.

The high occurrence of road accidents and sports injuries in India is further fueling the demand for orthopedic devices. In the first half of 2025 alone, national highways recorded over 29,000 deaths and 67,933 accidents, 2024 saw 53,090 deaths on national highways, and 2023 logged 4,64,029 road accidents across the country. These incidents often result in severe bone injuries that require joint reconstruction surgeries and the use of orthopedic devices during the recovery process. The healthcare infrastructure in India is continually improving, making advanced procedures and treatments more accessible to the population.

This, combined with the increasing awareness among people about the available options, is driving the demand for orthopedic devices in the country. The rising number of joint reconstruction surgeries, coupled with factors like the aging population, lifestyle diseases, and accidents, is contributing to the growing demand for orthopedic devices in India. The healthcare system's advancements and the population's awareness of available treatments are further propelling this trend.

Growing

Burden of Orthopedic Disorders, Trauma, and Accident Cases

India is witnessing a significant rise in the demand for orthopedic devices due to an increasing burden of orthopedic disorders, trauma, and accidents. With a rapidly aging population and a surge in lifestyle diseases like obesity and diabetes, the prevalence of musculoskeletal conditions (MSDs) such as osteoarthritis and rheumatoid arthritis has reached alarming levels, with studies indicating that over half of Indian adults over the age of 45 suffer from an MSD. This has prompted a greater need for orthopedic interventions to alleviate pain and improve mobility.

Furthermore, India's burgeoning urbanization and industrialization have led to an upswing in accidents and trauma cases, further escalating the necessity for orthopedic devices, in 2024 alone, over 1.8 lakh people died in road accidents. The need for effective and timely medical interventions has become even more crucial in order to restore the health and well-being of individuals affected by these incidents.

In addition to these factors, advancements in healthcare infrastructure, growing medical tourism, and increased access to healthcare services are contributing to the increased procurement of orthopedic devices. From January to April 2025, India recorded 131,856 foreign tourist arrivals for medical purposes. This not only ensures that patients receive the best possible care but also boosts the overall healthcare sector in India. Moreover, there is a rising awareness about the benefits of early diagnosis and treatment of orthopedic conditions.

People are recognizing the importance of seeking medical attention at the earliest signs of discomfort or pain, which in turn drives the demand for orthopedic devices that aid in diagnosis, treatment, and rehabilitation. Thus, the escalating burden of orthopedic maladies, coupled with a rise in accident cases, is bolstering the need for orthopedic devices in India. The continuous advancements in medical technology and the growing emphasis on healthcare are paving the way for improved orthopedic care and a better quality of life for individuals who suffer from orthopedic conditions.

Development

of Bioabsorbable and Titanium Implants

India's

orthopedic devices market is experiencing remarkable growth, fueled by the

growing demand for bioabsorbable and titanium implants. The use of

bioabsorbable implants in orthopedic surgeries has gained popularity due to

their numerous advantages. These implants not only eliminate the need for

implant removal surgery but also reduce the risk of long-term complications,

making them highly preferred by both patients and surgeons alike. As these

implants gradually dissolve in the body over time, they leave no trace and

allow for natural bone healing to take place. On the other hand, titanium

implants, known for their exceptional strength and biocompatibility, are

increasingly being utilized in joint replacement surgeries.

The durability and

compatibility of titanium implants make them a reliable choice for patients

seeking long-lasting solutions for their orthopedic conditions. The demand for

orthopedic surgeries in India is further fueled by the country's aging

population and the rising prevalence of conditions such as osteoporosis and

osteoarthritis. With advancements in implant design and material technology,

manufacturers are now able to offer more innovative and effective solutions to

meet the specific needs of patients. Moreover, to cater to the price-sensitive

market in India, manufacturers are focusing on developing cost-effective

implants without compromising on quality.

As

awareness about the benefits of these advanced orthopedic devices continues to

grow, India is poised to witness a sustained upward trend in the adoption and

utilization of these devices. This positive trajectory is expected to have a

significant impact on the overall healthcare landscape in the country,

improving the quality of life for patients with orthopedic conditions.

Increasing

Rate of Geriatric Population

India's

growing geriatric population is significantly impacting the demand for

orthopedic devices. Aging is commonly associated with increasing

musculoskeletal issues, such as osteoporosis and arthritis, that often

necessitate the use of orthopedic equipment. In India, a country with a rapidly

aging population, there has been a notable surge in these conditions, thus

driving up the need for orthopedic devices. Moreover, as awareness about

orthopedic diseases and their treatment options continues to rise within the

elderly community in India, the demand for orthopedic devices is further

escalating. The elderly population is becoming more knowledgeable about the

benefits of orthopedic devices and seeking appropriate solutions for their

musculoskeletal issues.

Advancements

in medical technology have also played a crucial role in meeting the demand for

orthopedic devices. With continuous innovations and improvements in device

design and functionality, orthopedic equipment has become more effective and

user-friendly for the elderly population. Furthermore, increased accessibility

and affordability of healthcare services, along with improved insurance

coverage, have made these devices more attainable for a larger segment of the

elderly population in India. The intersection of factors including a rising

elderly population, growing awareness about orthopedic diseases, advancements

in medical technology, and improved healthcare services, contributes to the

escalating demand for orthopedic devices in India.

Key Market

Challenges

Poor

Reimbursement Scenario

The

Indian orthopedic device market is currently facing a significant challenge in

terms of poor reimbursement scenarios. Despite the increasing incidence of

orthopedic ailments and accidents necessitating such devices, demand is stifled

due to the high out-of-pocket expenses patients must bear. Moreover, the

current insurance framework in India does not adequately cover the cost of

orthopedic devices, which are often expensive due to the sophisticated

technology involved in their manufacture.

As

a result, many patients are left with limited options and often opt for

cheaper, traditional treatments or even delay necessary procedures. This not

only compromises their health outcomes but also reduces the overall demand for

these devices. Therefore, it is crucial to undertake a comprehensive review and

revision of the insurance reimbursement policies in the healthcare sector,

particularly in relation to orthopedic device coverage. By addressing the issue

of affordability and accessibility of these devices, we can potentially witness

a resurgence in demand and improved health outcomes for patients. This, in

turn, would contribute to the development of a more robust orthopedic device

market in India, fostering innovation and benefiting both patients and industry

stakeholders alike.

Lack

of Skilled Surgeons

The

demand for orthopedic devices in India has experienced a significant downturn

due to a critical shortage of skilled surgeons. This shortage has had a

profound impact on the population, as a substantial portion faces

musculoskeletal conditions such as osteoporosis, arthritis, and trauma injuries

that require orthopedic interventions. However, the lack of qualified

orthopedic surgeons has not only stifled the adoption of these medical devices

but has also resulted in suboptimal usage, further dampening consumer trust and

demand.

The scarcity of proficient surgeons has far-reaching consequences, particularly

in rural areas, where access to orthopedic care is limited. This lack of

accessibility not only hinders the timely treatment of musculoskeletal

conditions but also reduces the overall need for orthopedic devices. It is

worth noting that the deficit of expertise in handling orthopedic devices

raises concerns over the outcomes of surgeries, leading to reluctance amongst

patients to opt for such procedures. Addressing this skill deficit is of utmost

importance to revive the demand for orthopedic devices and to improve

musculoskeletal health in India.

By investing in training and education

programs for orthopedic surgeons, we can ensure that patients receive the

highest quality care and that the utilization of orthopedic devices is

optimized. This, in turn, will not only meet the growing healthcare needs of

the population but also instill confidence in patients and drive the demand for

these life-enhancing medical devices.

Key Market Trends

Alarming

Rise in the Road Accidents

Orthopedic devices in India are experiencing an unprecedented surge in demand, driven primarily by the alarming rise in road accidents, with the country recording 464,029 such incidents in 2023. The increasing number of trauma cases resulting from these accidents, which accounted for 58% of orthopedic trauma cases in one study, often involve severe musculoskeletal injuries, necessitating the use of advanced orthopedic devices for effective treatment and rehabilitation. As a result, the Indian orthopedic devices market is facing immense pressure to meet this growing need. With road safety remaining a major concern, an average of 20 people died every hour in road accidents in 2023, the number of victims requiring orthopedic support continues to escalate. This includes a diverse range of devices, such as joint implants, screws, plates, and other assistive products, all playing a crucial role in restoring mobility and improving the quality of life for patients.

The country's expanding geriatric population, projected to reach 193.4 million by 2031, is more prone to falls and fractures and further contributes to the demand for orthopedic devices. However, it is the significant surge in road accidents with 29,018 deaths on national highways in just the first half of 2025 that has fundamentally altered the healthcare landscape. This emerging trend underscores the urgent requirement for a robust healthcare infrastructure and increased investment in orthopedic research and development. These efforts are essential to enhance the efficacy of orthopedic treatments and accelerate the recovery process for patients, ultimately leading to improved outcomes and a better quality of life..

Rising

in Health Care Expenditure

India's

healthcare sector has experienced a notable surge in expenditure, driven in

part by the burgeoning middle class that places increased emphasis on health

and wellness. This rise in healthcare spending has had a direct impact on the

demand for orthopedic devices, as more individuals gain access to and can

afford high-quality medical care. The need for orthopedic solutions, ranging

from simple splints and braces to complex joint replacements, has witnessed a

sharp increase. Moreover, the prevalence of conditions like osteoporosis and

arthritis, combined with an aging population and a rise in lifestyle-related

injuries, further contribute to the growing demand for orthopedic devices.

Technological advancements in the field, such as minimally invasive surgeries

and 3D printing, have also played a pivotal role in driving this demand by

offering improved patient outcomes and treatment options. Consequently, the

escalating healthcare expenditure in India is significantly fueling the growth

of the orthopedic devices market, making it a promising sector with vast

potential for further advancements.

Segmental Insights

Product Type Insights

Based on the product

type, the joint reconstruction product segment is expected to maintain its

dominance in the market during the forecast period. This can be attributed to

several factors. There has been a remarkable increase in the

prevalence of the geriatric population, which has led to a higher demand for

effective joint replacement solutions. As the population ages, the need for

innovative and reliable joint reconstruction products becomes increasingly crucial

in providing improved quality of life and mobility for patients. Additionally,

the rising incidence of chronic diseases such as diabetes, obesity,

osteoarthritis, and osteoporosis has contributed to the growth of this segment.

These conditions affect a significant number of individuals in India, and the

demand for advanced joint reconstruction products continues to rise

accordingly. By addressing the specific needs of patients with these chronic

diseases, these products play a vital role in enhancing their overall

well-being.

The

Indian healthcare landscape is witnessing advancements in medical technology

and surgical techniques, further driving the demand for innovative joint

reconstruction products. As the medical field progresses, there is a growing

recognition of the importance of personalized and tailored solutions for

patients. The development and availability of advanced joint reconstruction

products cater to this need, ensuring that patients receive optimal care and

outcomes. The joint reconstruction product segment is poised for continued

growth due to the increasing prevalence of the geriatric population, the rising

incidence of chronic diseases, and advancements in medical technology. By

addressing the specific requirements of patients and providing effective

solutions, these products contribute significantly to improving the quality of

life and mobility for individuals in India.

Application Insights

Based on application,

knee replacement is the fastest growing segment due to the increasing rate of the geriatric population and the

growing demand for improved quality of life. As the elderly population

continues to rise, the need for effective and long-lasting knee replacement

procedures becomes paramount. With advancements in medical technology and

surgical techniques, more individuals are opting for knee replacement surgeries

to alleviate pain, restore mobility, and enhance their overall well-being.

This

trend is projected to drive the growth of the knee replacement market in the

coming years as healthcare providers and manufacturers strive to meet the

evolving needs of patients and provide them with optimal solutions for their

knee-related concerns. Furthermore, research and development efforts are

focusing on developing innovative materials and techniques to improve the

durability and longevity of knee implants. The incorporation of advanced

materials, such as ceramic and titanium alloys, and the use of

computer-assisted navigation systems during surgeries are revolutionizing the

field of knee replacement. These advancements aim to enhance the performance

and functionality of knee implants, resulting in better outcomes and greater

patient satisfaction.

The

rising awareness among individuals about the benefits of knee replacement,

coupled with the availability of minimally invasive procedures, is contributing

to the increasing adoption of knee replacement surgeries. Minimally invasive

techniques involve smaller incisions, reduced blood loss, and faster recovery

times, allowing patients to return to their normal activities more quickly. As

the knee replacement market continues to evolve, healthcare providers and

manufacturers are also focusing on personalized approaches to address

individual patient needs. Customized implants and patient-specific surgical

plans are being developed to optimize the fit and function of knee replacements

for each patient, leading to improved outcomes and patient satisfaction.

Download Free Sample Report

Regional Insights

South

India is expected to dominated the Indian Orthopedic Devices Market due to a

combination of factors. The region's rapid urbanization and higher

concentration of healthcare facilities contribute to greater accessibility to

orthopedic devices. With an aging population and lifestyle factors, the South

Indian population exhibits a higher incidence of orthopedic conditions, driving

the demand for these devices. Furthermore, the presence of major market players

in this region not only enhances the availability but also promotes the

adoption of advanced orthopedic devices, further solidifying South India's

position as a key player in the market.

Recent Developments

- In 2025, Zydus Lifesciences acquired the French medical device manufacturer Amplitude Surgical, which specializes in orthopedic products.

- In June 2025, Zimmer Biomet launched a comprehensive portfolio of orthopedic technologies in India. This included the mymobility® AI-powered digital care platform and the ROSA® Partial Knee and ROSA® Hip robotic-assisted surgical systems. The launch also featured the G7® Acetabular System and the RibFix Blu® Thoracic Fixation System.

- At MEDICA 2024 in November, Auxein launched a new range of advanced orthopedic and arthroscopy products, including AV-Wiselock Plates, an Osteochondral Transfer System, and a Reusable Suture Passer.

- Stryker launched its next-generation 1788 advanced surgical camera in India in September 2024, designed to improve surgical visualization across various specialties.

- In January 2024, Stryker introduced the Tornier Shoulder Arthroplasty Portfolio in India, which included the launch of the Tornier Perform® Humeral Stem. During the same year, the company also expanded its offerings with the Tritanium spinal implant system to enhance spinal fusion procedures.

- In

January 2024, Tynor Orthotics Private Limited, a prominent orthopedic manufacturer

and renowned global healthcare brand in India, has inaugurated one of its

largest manufacturing facilities in Punjab, India. This cutting-edge facility covers 240,000 square feet and is poised to establish a new standard in orthopedic appliance manufacturing. Equipped with state-of-the-art technology across machines, processes, and infrastructure, it aims to transform the orthopedic and healthcare landscape in India. Tynor is focused on positioning itself as a leader in healthcare and orthopedic device manufacturing, aspiring to elevate India into a global manufacturing hub to meet the worldwide demand for premium orthopedic and assistive appliances.

Key Market Players

- Globus Medical India Pvt. Ltd.

- Auxein Medical Pvt. Ltd.

- Smit Medimed Pvt. Ltd.

- GPC Medical Ltd.

- Femur Medical Pvt. Ltd.

- Stryker India Pvt. Ltd.

- India Medtronic Pvt. Ltd.

- Zimmer India Pvt. Ltd.

- Smith+Nephew Healthcare Pvt. Ltd.

- TriMed Solutions (India) Pvt. Ltd.

|

By Product Type

|

By Application

|

By End User

|

By Region

|

|

- Joint Reconstruction

- Spinal Devices

- Orthopedic Braces and Supports

- Trauma Fixation

- Orthopedic Accessories

- Orthopedic Prosthetics

|

- Hip Replacement

- Knee Replacement

- Spine Injuries

- Shoulder Replacement

- Others

|

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

- Others

|

|

|

|

|

|

|

Report

Scope:

In

this report, the India Orthopedic Devices Market has been segmented into the following

categories, in addition to the industry trends which have also been detailed

below:

- India Orthopedic Devices Market, By Product Type:

o

Joint Reconstruction

o

Spinal Devices

o

Orthopedic Braces and Supports

o

Trauma Fixation

o

Orthopedic Accessories

o

Orthopedic Prosthetics

- India Orthopedic Devices Market, By Application:

o

Hip Replacement

o

Knee Replacement

o

Spine Injuries

o

Shoulder Replacement

o

Others

- India Orthopedic Devices Market, By End User:

o

Hospitals

o

Orthopedic Clinics

o

Ambulatory Surgical Centers

o

Others

- India Orthopedic Devices Market, By Region:

o

North

o

South

o

West

o

East

Competitive

Landscape

Company

Profiles: Detailed

analysis of the major companies present in the India Orthopedic Devices Market.

Available

Customizations:

India

Orthopedic Devices Market report with the given market data, TechSci

Research offers customizations according to a company's specific needs. The

following customization options are available for the report:

Company

Information

- Detailed analysis and profiling of

additional market players (up to five).

India Orthopedic

Devices Market is an upcoming report to be released soon. If you wish an early

delivery of this report or want to confirm the date of release, please contact

us at [email protected]