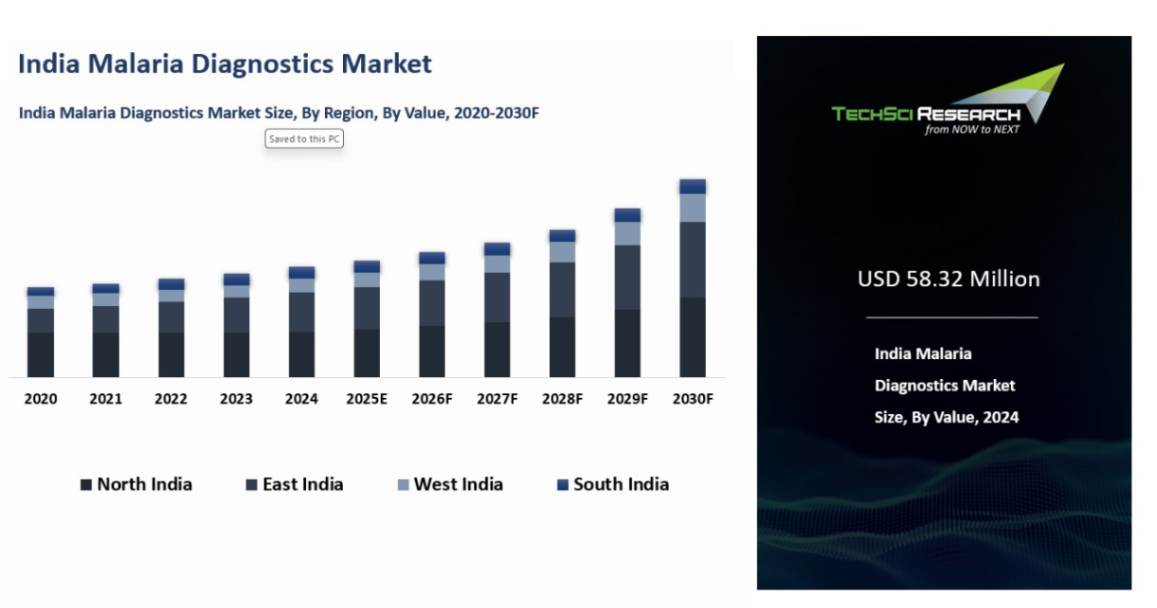

Forecast Period | 2026-2030 |

Market Size (2024) | USD 58.32 Million |

Market Size (2030) | USD 68.94 Million |

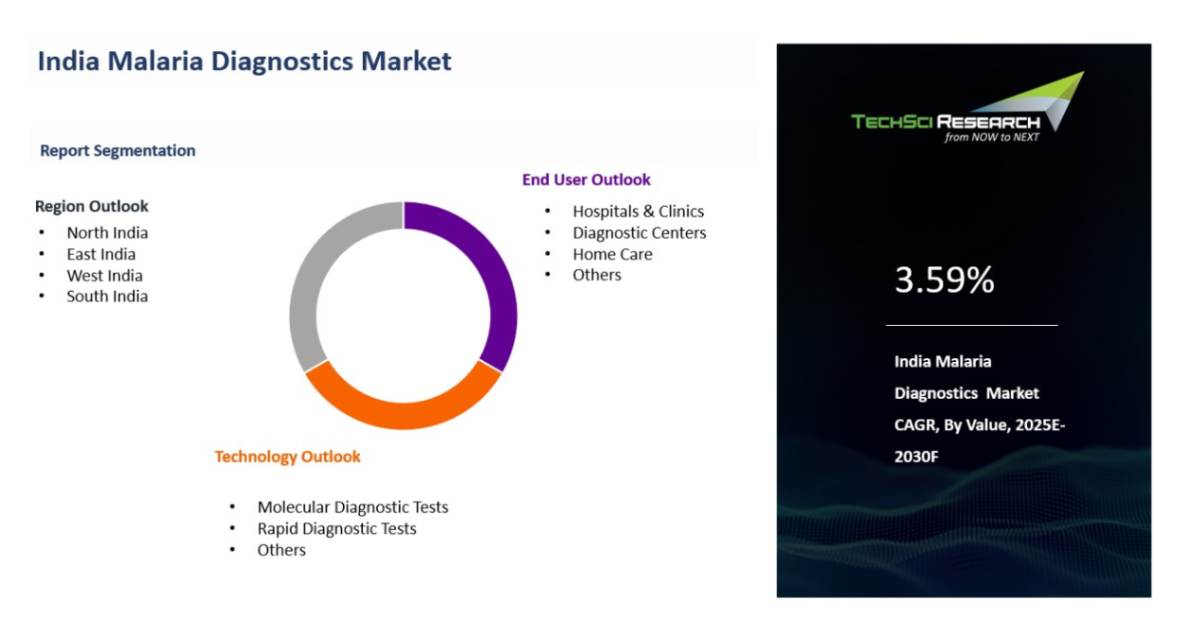

CAGR (2025-2030) | 3.59% |

Fastest Growing Segment | Diagnostic Centers |

Largest Market | East India |

Market Overview

India Malaria Diagnostics Market was valued at USD 58.32 million in 2024 and is expected to reach USD 68.94 million by 2030 with a CAGR of 3.59% during the forecast period. The high rate of malaria, the rising cost of healthcare, and the increase in R&D activities, among others are driving the growth of India Malaria Diagnostics Market. In recent years, India has witnessed an ongoing increase in the number of malaria cases, with a significant portion of the population at risk. To stop the spread of the disease, the Indian government has been actively encouraging the use of diagnostic tools for malaria. In order to encourage the use of malaria diagnoses, the National Vector Borne Disease Control Programme (NVBDCP) has been implementing several strategies into place, such as distributing rapid diagnostic tests (RDTs) to healthcare facilities all across the nation. This in turn is expected to support the growth of India Malaria Diagnostics Market.

Key Market Drivers

Growing Prevalence of Malaria

India's growing malaria prevalence is predicted to increase demand for malaria diagnostics market. There will be a larger need for precise and trustworthy diagnostic tests as more people develop the illness, in order to make sure that patients receive the right care. The Indian market for malaria diagnostics is anticipated to increase as a result in the upcoming years. India accounts for 3% of the world's malaria burden, according to the 2019 World Malaria Report. India has the highest rate of malaria in the SEA area, although compared to 2017, there were 49% less cases and 50.5% less fatalities due to the disease. The incidence of malaria has decreased significantly in India during the past few years. The good news is that India's malaria incidence has been seeing a spectacular reduction, with cases estimated to have fallen by 24% in 2017 compared to 2016 and 28% in 2018 compared to 2017. This decline was also noted in the World Malaria Report.

India has made great strides towards eliminating malaria in recent years, with the official malaria load falling by about 66% between 2018 and 2022. Even though this progress is commendable, there is still a long way to go before malaria is completely eradicated because the majority of the disease's burden in WHO's South-East Asia area still falls on India.

The rising incidence of malaria in India is projected to increase demand for diagnostic tests for the disease as well as encourage investment in their development. Because there is such a sizable and expanding market for malaria diagnostics, there is a sizable opportunity for businesses to create cutting-edge diagnostic technologies that can assist in overcoming the difficulties connected with malaria diagnosis in India. This could involve creating new point-of-care diagnostic tests that can be applied in environments with limited resources or creating new molecular diagnostic assays with enhanced sensitivity and specificity.

Technological Advancements

The technological advancements related to malaria diagnostics in India have had a significant impact on the growth of the India malaria diagnostics market in recent years and are expected to continue to influence its growth in the coming years. For instance, a Tata Trusts programme called India Health Fund (IHF), which focuses on infectious disease health outcomes, has announced financing for two platform technologies that may be used to diagnose a variety of diseases. The technologies being financed include a fever panel to identify dengue, chikungunya, and malaria, as well as microscope-independent AI-enabled diagnosis software that can be used to identify a variety of diseases. They were created by Ameliorate Biotech Pvt Ltd and Medprime Technologies, respectively.

Download Free Sample Report

Key Market Challenges

Inadequate Access to Healthcare Infrastructure

One of the primary challenges in the India malaria diagnostic market is the lack of adequate healthcare infrastructure, especially in rural and remote areas. Malaria is endemic in several parts of the country, particularly in states like Odisha, Chhattisgarh, and Madhya Pradesh. These areas often have limited access to quality healthcare facilities, diagnostic tools, and skilled medical professionals.

The absence of proper diagnostic infrastructure leads to delayed diagnoses, misdiagnoses, and difficulties in effectively managing the disease. Although rapid diagnostic tests (RDTs) have been introduced, their availability and affordability remain limited in underserved regions. This issue can hamper early detection and treatment, which is critical to prevent the spread of malaria and avoid complications. Addressing the healthcare infrastructure gaps is vital for improving the diagnostic process, increasing early detection rates, and ultimately reducing malaria cases and deaths.

High Cost of Advanced Diagnostic Tools

Another significant challenge in India’s malaria diagnostic market is the high cost of advanced diagnostic tools, particularly polymerase chain reaction (PCR) testing and other molecular diagnostics. These methods are accurate and highly sensitive but are often unaffordable for rural healthcare centers and lower-income populations. The high cost of both the diagnostic tests and the necessary equipment limits their widespread adoption.

In comparison, more affordable methods like RDTs, though effective, can sometimes yield false negatives or require proper storage and handling. The disparity in diagnostic technology between urban and rural areas exacerbates the challenge of ensuring equitable and accurate malaria diagnosis for all sections of society. Cost-effective innovations in diagnostic tools, along with subsidized pricing strategies, are crucial for overcoming this challenge.

Key Market Trends

Rise of Rapid Diagnostic Tests (RDTs)

The growing adoption of Rapid Diagnostic Tests (RDTs) is a significant trend in India’s malaria diagnostic market. RDTs are becoming increasingly popular due to their ease of use, fast turnaround times, and relatively low cost compared to other diagnostic methods. These tests provide accurate results within 15-20 minutes, making them ideal for use in rural and remote areas where laboratory facilities may be scarce. The government and non-governmental organizations (NGOs) have been promoting RDTs as a part of malaria control programs.

Furthermore, RDTs do not require specialized training, which helps overcome the lack of skilled healthcare personnel in rural regions. While RDTs are effective in diagnosing uncomplicated malaria, they may have limitations in detecting low parasitemia or mixed infections. However, their increasing use is likely to play a key role in improving the accessibility and efficiency of malaria diagnostics across the country.

Advancements in Molecular Diagnostics and Digital Health Integration

Another growing trend in the malaria diagnostic market in India is the integration of molecular diagnostics and digital health technologies. Techniques like PCR, loop-mediated isothermal amplification (LAMP), and next-generation sequencing (NGS) are improving the sensitivity and specificity of malaria detection. These methods allow for the identification of asymptomatic carriers, which can play a crucial role in malaria elimination efforts. Additionally, digital health solutions such as mobile apps and telemedicine are enhancing the efficiency of malaria diagnostics.

With mobile-based platforms, healthcare providers can upload test results and access expert consultations remotely, improving diagnosis accuracy and speed. These technologies also facilitate better tracking of malaria outbreaks and patient data, enabling public health authorities to make informed decisions in real-time. As these innovations become more accessible and affordable, they are expected to complement traditional diagnostic methods and improve malaria control and elimination efforts in India.

Segmental Insights

Technique Insights

Based on technique, the molecular diagnostic tests category is currently dominating the India Malaria Diagnostics market due to its high sensitivity and accuracy. Among various molecular techniques, Polymerase Chain Reaction (PCR) is the most widely used method, offering the ability to detect malaria parasites even at low levels of parasitemia, which is a limitation for other diagnostic tests like Rapid Diagnostic Tests (RDTs) and microscopy.

PCR tests are capable of identifying multiple species of malaria parasites, including Plasmodium falciparum and Plasmodium vivax, with higher accuracy compared to conventional methods. This makes them invaluable for distinguishing between malaria types and for detecting asymptomatic carriers who might not present with obvious symptoms but can still transmit the disease. The PCR method is also particularly useful for confirming cases in areas with mixed infections, where RDTs may fail to give accurate results.

Additionally, the increasing prevalence of next-generation sequencing (NGS) and Loop-mediated Isothermal Amplification (LAMP) in molecular diagnostics further strengthens the position of molecular techniques in the market. NGS provides deep insights into the genetic makeup of malaria parasites, aiding in better understanding of drug resistance patterns, while LAMP offers a faster and simpler alternative to PCR, with the benefit of being cost-effective and easy to use in field settings.

Download Free Sample Report

Regional Insights

Based on the region, East India is dominating in India Malaria Diagnostics Market in 2024, due to the high burden of malaria cases in states such as Odisha, Chhattisgarh, Jharkhand, West Bengal, and Bihar. These states are malaria-endemic areas where both Plasmodium falciparum and Plasmodium vivax malaria are prevalent, contributing significantly to the national malaria caseload. The tropical climate, monsoon seasons, and inadequate sanitation in many rural areas create favorable conditions for the spread of malaria. This high incidence drives the demand for effective and accurate diagnostic tools, ranging from traditional microscopy to more advanced molecular diagnostics like PCR, which are increasingly adopted in the region to improve diagnostic accuracy.

Additionally, the Indian government and non-governmental organizations (NGOs) have been focusing malaria control efforts in East India. Initiatives to reduce transmission and enhance diagnostic capabilities are particularly active in these high-incidence states. The widespread distribution of rapid diagnostic tests (RDTs) and the expansion of mobile health units and telemedicine are part of efforts to improve access to timely diagnostics in remote areas. The region’s ongoing malaria control programs emphasize better diagnostic solutions to manage the disease effectively.

Recent Developments

- In May 2024, the Serum Institute of India (SII) began distributing its R21/Matrix-M malaria vaccine to Africa, starting with the Central African Republic (CAR). Developed in partnership with Novavax and the University of Oxford, this vaccine is the second one approved for use in children living in malaria-endemic regions. The initial delivery includes 43,200 doses, part of a total allocation of 163,800 doses for the CAR region. So far, SII has produced 25 million vaccine doses, with the ability to scale up production to 100 million doses annually.

- In October 2023, St. John's Research Institute (SJRI) in Bengaluru was selected as one of four global partners in the Point of Care Technology Research Network (POCTRN), a collaborative initiative between Cornell University and the National Institutes of Health (NIH). The POCTRN aims to expedite the development, deployment, and commercialization of innovative point-of-care (POC) diagnostic devices.

Key Market Players

- Bio-Rad Laboratories Inc.

- Abbott India Limited

- Roche Diagnostics India Pvt Ltd

- Hologic, Inc.

- Access Bio Inc

- Becton Dickinson India Private Limited

- Siemens Healthineers AG

- Meridian Bioscience, Inc.

- Sysmex India Private Limited

- Nikon India Pvt Ltd

By Technology | By End User | By Region |

- Molecular Diagnostic Tests

- Rapid Diagnostic Test

- Others

| - Hospitals & Clinics

- Diagnostic Centers

- Home Care

- Others

| - North India

- South India

- East India

- West India

|

Report Scope:

In this report, the India Malaria Diagnostics Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- India Malaria Diagnostics Market, By Technology:

o Molecular Diagnostic Tests

o Rapid Diagnostic Test

o Others

- India Malaria Diagnostics Market, By End User:

o Hospitals & Clinics

o Diagnostic Centers

o Home Care

o Others

- India Malaria Diagnostics Market, By Region:

o North India

o South India

o East India

o West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the India Malaria Diagnostics Market.

Available Customizations:

India Malaria Diagnostics Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

India Malaria Diagnostics Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]