|

Forecast

Period

|

2026-2030

|

|

Market

Size (2024)

|

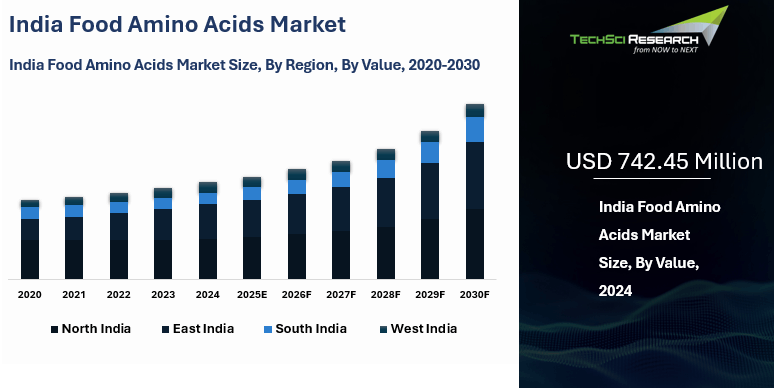

USD 742.45 Million

|

|

Market

Size (2030)

|

USD

1141.68 Million

|

|

CAGR

(2025-2030)

|

7.54%

|

|

Fastest

Growing Segment

|

Animal

|

|

Largest

Market

|

North India

|

Market Overview

India Food Amino Acids

Market was valued at USD 742.45 Million in 2024 and is expected to reach USD 1141.68 Million by 2030 with a CAGR of 7.54% during the forecast period.

Amino acids are essential organic compounds that function as the building blocks of proteins. They are critical for supporting vital biological functions, including growth, development, and the maintenance of body systems. The importance of these compounds in the formulation of dietary supplements and nutraceutical products is a key factor driving this market's expansion.

The human body requires several essential amino acids, such as histidine, isoleucine, leucine, lysine, and valine, which it cannot produce on its own. Therefore, these must be obtained through diet from sources like meat, fish, eggs, and legumes. These amino acids are necessary for maintaining overall health. The growing demand for fortified foods is directly linked to the need for these essential nutrients, further fueling the market as manufacturers incorporate them into various products to meet consumer health needs.

A significant trend fueling the market is India’s "protein paradox." As of April 2025, despite widespread protein deficiency, there is a boom in sales of protein-fortified foods. This rising demand directly stimulates the India Food Amino Acids Market, as producers increasingly rely on amino acid fortification. This has sparked discussions on the true nutritional impact of these products on India’s health and wellness landscape versus their role as a marketing trend, but the demand for fortification continues to grow.

In response to increasing demand from the food, pharmaceutical, and cosmetic sectors, industries are turning to synthetically produced amino acids. These offer several advantages, including consistent quality, standardized composition, and greater production efficiency. The controlled synthesis process allows manufacturers to ensure higher purity and targeted functionality. This makes synthetic amino acids a preferred option in various applications, meeting the rigorous standards for products like dietary supplements and functional foods while satisfying high-volume production needs.

Download Free Sample Report

Key Market Drivers

Growing

Health And Wellness Awareness

Growing health and wellness awareness is a significant driver impacting the market, as consumers in India become more conscious of their well-being. This trend is supported by nationwide government initiatives, such as the 'Swasth Nari, Sashakt Parivar Abhiyaan' launched in September 2025, which aims to provide women-centric health services through over 100,000 health camps across the country. A 2025 survey confirms that Indian consumers are proactively taking charge of their health through smarter food choices. This shift in consumer behavior toward preventive healthcare is creating new opportunities for products enriched with beneficial compounds that promote physical and mental well-being.

Amino acids are gaining particular attention due to their fundamental role in supporting health. They are essential for crucial functions like muscle development, immune system support, and promoting overall wellness. To meet this demand, industry innovation is accelerating. For example, in September 2024, Fermenta Biotech Ltd. partnered with the National Institute of Food Technology Entrepreneurship and Management, Kundli (NIFTEM-K) at World Food India 2024 to advance research in food science and fermentation-based amino acid production. Furthering this commitment, Fermenta also entered a strategic agreement with NIFTEM-Thanjavur in July 2025 to strengthen food fortification technologies in India.

The increasing emphasis on preventive healthcare and the pursuit of enhanced physical performance are further fueling demand for amino acid-rich products. A key factor in this demand is the rapid expansion of India's livestock industry, a major consumer of amino acids for animal feed. The Indian poultry sector, for instance, is projected to grow at a rate of 12.60% annually between 2025 and 2033, boosting the need for essential amino acids like lysine and methionine to ensure better meat and dairy quality. As consumers strive to maintain optimal health, they are increasingly turning to amino acid-based solutions, making these products popular among fitness enthusiasts, athletes, and individuals looking to boost energy levels and support tissue repair.

The rising adoption of plant-based diets and a preference for natural nutrition are also contributing to market growth. This trend is driving demand for amino acid supplements derived from sustainable plant sources, aligning with the broader movement toward environmentally friendly and ethical food choices. As consumers become more informed, their purchasing decisions reflect values like sustainability and clean-label products. This convergence of health awareness, lifestyle changes, and ethical consumption is solidifying the role of amino acids in the evolving wellness landscape.

Advancements in Medical Therapies

The increasing use of amino acids in medical therapies and pharmaceuticals is driving global adoption. Beyond their role in protein synthesis, these versatile compounds are crucial for various physiological processes. The development of amino acid-derived biopharmaceuticals, like antibody-drug conjugates, is revolutionizing drug delivery and targeting mechanisms. This offers a precise and effective treatment approach, creating a favorable market outlook for amino acids. These advancements in pharmaceutical science highlight the expanding role of amino acids in modern medicine and treatment protocols.

The therapeutic potential of amino acids extends far beyond basic protein synthesis. Promising results from amino acid-depleting treatments show their ability to inhibit cancer cell growth while sparing healthy cells, establishing them as a valuable tool in disease management. This targeted approach significantly minimizes the side effects commonly associated with traditional cancer treatments. As a result, patient outcomes and quality of life are improved, demonstrating the clinical benefits of leveraging amino acids in oncology and other specialized medical fields.

The rise of precision medicine is further catalyzing demand for personalized amino acid-based therapies. This approach tailors treatment strategies to individual patient profiles, considering genetic makeup, lifestyle, and disease characteristics. By optimizing treatment plans, healthcare providers can maximize efficacy and minimize adverse effects. This personalized method holds great promise for revolutionizing amino acid-based medicine and contributing to the growing demand for customized treatments. These advancements are enhancing drug delivery and improving patient outcomes in specialized care.

Technological Advancements in Production

Technological advancements are a significant driver of growth in the amino acid production market. Innovations in fermentation techniques, genetic engineering, and enzymatic processes have revolutionized production, leading to improved yields, enhanced purity, and greater sustainability. These advancements have successfully lowered production costs while also facilitating the development of novel amino acid derivatives with enhanced functionalities. This ongoing exploration is key to meeting rising industrial demand and creating more efficient manufacturing pipelines for high-quality amino acids worldwide.

Advanced technologies have also transformed the manufacturing process, enabling the isolation of pure amino acids from complex mixtures. Techniques like chromatography and membrane filtration ensure the highest product quality, which expands their applications beyond traditional industries. For instance, amino acids are now widely used in the cosmetics industry for effective skincare formulations. Furthermore, amino acids are playing an increasingly vital role in biofuel production, diversifying their use cases and contributing to a more sustainable and innovative industrial landscape.

These production advancements enable innovative consumer products. For instance, in November 2024, SuperYou launched protein-infused wafers, integrating protein into familiar Indian snacks to target health-conscious consumers. This product addresses the growing demand for convenient, functional foods by blending nutrition with everyday eating habits. It offers an accessible way for individuals to boost their protein intake without altering their regular snacking preferences, showcasing how production efficiency translates into market-ready, value-added food items.

Rising Demand for Functional Foods

The rising demand for amino acids as functional foods is driving substantial growth in the Indian market. As consumers become more health-conscious, their interest in foods fortified with essential nutrients escalates. Amino acids, the building blocks of proteins, are sought after for their crucial role in biological processes like muscle building, immune function, and energy production. This shift toward foods offering more than basic nutrition makes amino acid-fortified products a popular choice for individuals striving to maintain optimal well-being.

In India, growing awareness of protein deficiencies and the benefits of amino acids is encouraging consumers to seek out fortified products. This trend is amplified by urbanization, rising disposable incomes, and the influence of fitness culture, which propel the shift toward healthier food options. Consumers are increasingly choosing protein-enriched snacks, beverages, cereals, and dairy alternatives. This demand encourages manufacturers to incorporate amino acids into a wider variety of food products to meet the evolving dietary preferences of the Indian populace.

This focus on nutrition and preventive health positions amino acid-based functional foods as a key segment in the wellness industry. Government campaigns promoting balanced diets and nutritional awareness have added significant momentum to this market trend. Supported by ongoing innovations in food technology and expanding retail availability, the Indian food amino acids market is poised for continued expansion. As more consumers adopt proactive health measures, the demand for fortified foods is expected to grow steadily, solidifying their place in the modern Indian diet.

Key Market Challenges

Rising

Preference for Low Animal Protein Intake

The rising prevalence of

reducing animal protein intake is having a significant and transformative

impact on India's food amino acids market. As more individuals recognize the

health benefits and ethical considerations of adopting plant-based diets, the

demand for food products rich in essential amino acids is experiencing a

gradual decline. This shift in dietary preferences is not only driven by a

growing health consciousness but also by a deepening concern for animal welfare

and sustainability. The market players in India's food amino acid

sector face a unique challenge to innovate and diversify their product

offerings. They must adapt to the evolving consumer preferences by exploring

alternative sources of essential amino acids and developing innovative

techniques for extracting and incorporating them into plant-based food

products. This entails extensive research and development efforts to ensure

that the nutritional needs of individuals following plant-based diets are

adequately met.

This trend

opens up new opportunities for collaboration and partnerships between the food

amino acid industry and other sectors. For instance, collaborations with food

technology companies and startups specializing in plant-based alternatives can

lead to the creation of exciting new products that cater to the evolving tastes

and preferences of the health-conscious consumers.

The increasing adoption of

plant-based diets and the consequent decline in animal protein consumption are

reshaping India's food amino acids market. Market players must embrace this

change, invest in research and development, and actively seek innovative

solutions to meet the demands of the evolving consumer landscape. By doing so,

they can position themselves as leaders in providing sustainable and nutritious

food options for the growing population of individuals opting for plant-based

lifestyles.

Existing

High R&D Expenditure

The Food Amino Acids

Market is witnessing a significant impact from high R&D expenditure, which

acts as an entry barrier for smaller companies. The costly process of developing

and patenting new products limits competition and reduces product variety in

the marketplace. In India, this phenomenon is affecting the demand for food

amino acids, as consumers become increasingly price-sensitive due to the high

costs associated with extensively researched products. Consequently, there is a

potential decline in the demand for food amino acids in India, indicating the

necessity for more cost-effective production methods, intensified market

competition, or enhanced regulation.

Key Market Trends

Surge in Demand for Plant-Based Protein

The surge in demand for plant-based proteins in India is a significant driver for the Food Amino Acids Market. This trend stems from increasing health consciousness and a collective shift toward healthier dietary habits. As consumers recognize the benefits of plant-based proteins, they actively seek products rich in essential amino acids, which are crucial for muscle growth, repair, and overall bodily function. This growing consumer awareness is directly fueling the expansion of the market as demand for fortified plant-based alternatives rises.

The expanding vegan and vegetarian population in India has further contributed to the growth of the Food Amino Acids Market. With more individuals adopting plant-based lifestyles, the demand for clean-label and organic products has increased significantly. Consumers are seeking transparency in food labeling and are choosing options that align with their ethical and environmental values. This has prompted businesses to innovate with plant-based protein sources, diversifying their product offerings to meet this ever-growing consumer segment and promoting a more sustainable food ecosystem.

Rising Demand in Sports Nutrition

The rising demand in sports nutrition and health supplements is directly impacting the need for food amino acids in the Indian market. As the building blocks of proteins, amino acids play a crucial role in muscle repair and recovery, making them a key ingredient in sports nutrition products. The growing health awareness and surging fitness trend are leading more people to use dietary supplements to meet their nutritional needs. This, combined with the popularity of protein-rich diets, is causing an increased demand for amino acid-based products.

The growing interest in maintaining a healthy lifestyle has prompted individuals to seek products that enhance their overall well-being. Amino acids have gained recognition for supporting various bodily functions beyond just muscle repair. Athletes and fitness enthusiasts are particularly drawn to their benefits, as they aid in post-workout recovery and contribute to lean muscle development. This has led to a surge in the popularity of amino acid-based supplements, encouraging manufacturers to create innovative formulations to cater to diverse consumer preferences.

Segmental Insights

Type Insights

Based on the type, in the Indian food amino acids

market, glutamic acid holds a dominant position. This is largely due to its

widespread use in the food processing industry, particularly in the production

of MSG (Monosodium Glutamate), a popular flavor enhancer in many traditional

and processed foods. Glutamic acid's high demand stems from its remarkable

ability to enhance the savory taste of foods, also known as 'umami,' which adds

a rich and satisfying flavor profile to various culinary creations. Its

versatile nature allows it to be incorporated into a wide range of dishes, from

savory snacks to delectable main courses, making it a sought-after ingredient

for chefs and food manufacturers alike. With its unique ability to elevate the

taste experience, glutamic acid continues to be a key player in the Indian food

industry, enriching the flavors and satisfying the palates of consumers across

the nation.

Source Insights

Based on source, in the Indian food amino acids

market, the animal source is predominantly leading. This can be attributed to

the widespread consumption of animal-based products, such as meat and dairy,

which are rich in essential amino acids. However, there is a growing demand for

plant and microbial-based amino acids as well. This shift is driven by the

rising trend of vegetarianism, veganism, and health-conscious dietary choices

among the Indian populace. People are becoming more aware of the benefits of

plant-based protein sources and are seeking alternatives to animal-based

products. This increasing demand for plant and microbial-based amino acids is

creating new opportunities in the market, encouraging innovation and product

development in this segment. As a result, the Indian food amino acids market is

experiencing a dynamic shift towards a more diverse range of amino acid sources

to cater to the evolving preferences and needs of consumers.

Download Free Sample Report

Regional Insights

The northern region of

India, encompassing states such as Punjab, Haryana, and Uttar Pradesh, holds a

commanding position in the country's food amino acids market. This dominance

can be attributed to several factors. Firstly, the region boasts vast

agricultural lands, where farmers cultivate a diverse range of crops, including

pulses, grains, and oilseeds. These agricultural activities contribute

significantly to the availability of protein-rich food products, meeting the

high demand from consumers seeking nutritious options. The northern

region benefits from a robust food processing sector, which plays a crucial

role in preserving and enhancing the nutritional value of food products.

The

advanced processing techniques employed by food manufacturers ensure that the

amino acids present in pulses and other protein sources remain intact,

providing consumers with high-quality and wholesome dietary choices. The widespread

consumption of pulses in the northern region further reinforces its supremacy

in the food amino acids market. Pulses, such as lentils, chickpeas, and kidney

beans, are not only staple ingredients in the local cuisine but also serve as a

valuable source of amino acids. The inclusion of pulses in traditional dishes

showcases the region's rich culinary heritage while simultaneously promoting a

balanced and protein-rich diet.

The northern region of

India's dominance in the food amino acids market can be attributed to its

extensive agricultural activities, high demand for protein-rich food products,

and a robust food processing sector. The region's emphasis on the consumption

and production of pulses further underscores its supremacy, making it a pivotal

player in meeting the nutritional needs of the nation.

Recent Developments

- In October 2025: IFFCO launched 'DharAmrut', a next-generation bio-stimulant. This product is scientifically formulated with amino acids, alginic acid, carbon, and essential trace minerals designed to boost crop yield.

- In September 2024: Fermenta Biotech Ltd. partnered with the National Institute of Food Technology Entrepreneurship and Management (NIFTEM-K) to advance food science research and technology. This collaboration, announced at World Food India 2024, supports innovations in fermentation-based amino acid production.

- In April 2025: A notable trend, dubbed "India's protein paradox," emerged, showing a boom in sales of protein-fortified foods like yogurt, muesli, and coffee. This occurred despite widespread dietary protein deficiency in the country. This increasing demand directly fuels the Indian food amino acids market as manufacturers increasingly rely on amino acid fortification.

- In February 2025: At Vitafoods India held in Mumbai, Angel Yeast showcased its innovative yeast protein solutions. Their flagship product, AngeoPro, a yeast protein with a comprehensive amino acid profile, drew significant attention for its potential as an alternative to whey protein and its applications in functional foods and sports nutrition.

Key Market Players

- Siddhi

Vinayaka Spechem Private Limited

- Tagros Chemicals India Private Limited

- Chaitanya Biologicals Pvt Ltd

- Priya Chemicals

- M.D. Agrotech

- Max Life Sciences

- Nutricore Biosciences Private Limited

- Claris Lifesciences Limited

- Tablets medopharm Pvt ltd

- Albert David Ltd.

|

By

Type

|

By

Source

|

By

Application

|

By

Region

|

- Glutamic

Acid

- Lysine

- Tryptophan

- Methionine

- Phenylalanine

- Others

|

|

- Nutraceuticals

& Dietary Supplements

- Infant

Formula

- Food

Fortification

- Convenience

Food

- Others

|

|

Report

Scope:

In this report, the India Food

Amino Acids Market has been segmented into the following categories, in

addition to the industry trends which have also been detailed below:

- India Food Amino Acids Market, By Type:

o

Glutamic Acid

o

Lysine

o

Tryptophan

o

Methionine

o

Phenylalanine

o

Others

- India Food Amino Acids Market, By Source:

o

Animal

o

Microbial

o

Plants

- India Food Amino Acids Market, By Application:

o

Nutraceuticals &

Dietary Supplements

o

Infant Formula

o

Food Fortification

o

Convenience Food

o

Others

- India Food Amino Acids Market, By Region:

o

North

o

South

o

West

o

East

Competitive

Landscape

Company

Profiles: Detailed analysis of the major companies present in

the India Food Amino Acids Market.

Available

Customizations:

India Food Amino Acids

Market report with the given market data, TechSci Research offers

customizations according to a company's specific needs. The following

customization options are available for the report:

Company

Information

- Detailed

analysis and profiling of additional market players (up to five).

India Food Amino Acids Market is an upcoming report to

be released soon. If you wish an early delivery of this report or want to

confirm the date of release, please contact us at [email protected]