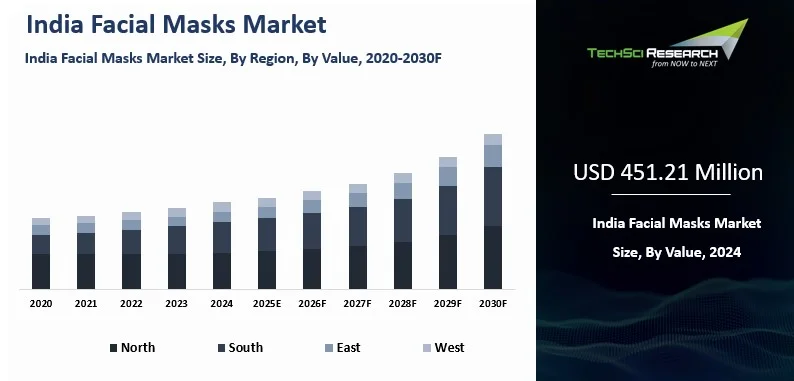

Forecast Period | 2026-2030 |

Market Size (2024) | USD 451.21 Million |

CAGR (2025-2030) | 3.61% |

Fastest Growing Segment | Online |

Largest Market | North |

Market Size (2030) | USD 556.12 Million |

Market Overview

India Facial Masks Market was valued at USD

451.21 million in 2024 and is anticipated to grow USD 556.12 million by 2030 with a CAGR of 3.61% through 2030.

The India Facial Masks Market has seen significant growth in recent years,

propelled by a rising focus on skincare and wellness among consumers. This

growth is fueled by several factors, including increasing urbanization, rising

disposable incomes, and a growing middle class with heightened beauty

consciousness. The market offers a diverse range of products catering to

various skin concerns such as hydration, anti-aging, brightening, and pollution

protection.

Urban lifestyles have increased the

exposure to pollutants, leading to a greater demand for products that address

environmental damage and skin rejuvenation. Consequently, both domestic and

international brands are expanding their portfolios to include innovative and

specialized masks, such as sheet masks, clay masks, peel-off masks, and

overnight masks, to meet varied consumer needs. The market's expansion is supported by

aggressive marketing strategies and collaborations between beauty brands and

celebrities. With ongoing advancements in product formulations and increasing

consumer awareness about skincare benefits, the India Facial Masks Market is

poised for continued robust growth in the foreseeable future.

India's youthful population, with over 50% under 25 and more than 65%

under 35, as per the 2022 World Population Prospects, is a significant driver

of the facial mask market. This demographic is highly conscious of skincare and

appearance, influenced by social media, urbanization, and rising disposable

incomes. India's urbanization rate is set to increase from 35% to 53% by 2047,

with approximately 400 million people moving into cities. This rapid urban

growth is likely to drive demand for facial masks as air pollution, dust, and

allergens remain significant challenges in metropolitan areas. With the growing

population in cities, particularly in regions with high pollution levels, the

need for protective masks will escalate, further driving market growth.

Key Market Drivers

Increasing

Skincare Awareness and Wellness Trends

India has seen a significant rise in awareness about

skincare and overall wellness. Consumers are becoming increasingly

knowledgeable about the benefits of skincare routines and the importance of

addressing specific skin concerns. On average, Indian consumers allocate USD 14.54

towards beauty and personal care (BPC) products every six months, with working

women typically spending USD 23.26during the same period. These figures

highlight the significant expenditure in the BPC sector, underscoring the

diverse spending patterns and preferences among different demographic segments.

Moreover, the wellness trend, which emphasizes

holistic health and self-care, has gained momentum. Facial masks, often

marketed for their relaxation and therapeutic benefits, align well with the

growing consumer focus on wellness and self-indulgence. The demand for products

that offer both aesthetic and wellness benefits has contributed significantly

to the expansion of the facial masks market in India.

Diversified

Product Offerings Catering to Specific Skin Needs

The Indian market is characterized by its diverse

consumer base with varying skin types and concerns. Recognizing this, brands

have expanded their product lines to offer a wide range of facial masks

tailored to address specific needs such as hydration, anti-aging, brightening,

acne control, and pollution protection.

Innovations in product formulations have led to the

introduction of various types of masks, including sheet masks, clay masks,

peel-off masks, and overnight masks. Each type serves a different purpose and

caters to different preferences and skincare routines. For instance, sheet

masks are popular for their convenience and instant hydration, while clay masks

are favored for deep cleansing and oil control.

There is a growing trend towards natural

and organic ingredients, with consumers increasingly seeking products free from

harmful chemicals. Brands are responding by incorporating ingredients like aloe

vera, charcoal, turmeric, and green tea, which are known for their skin

benefits and align with the traditional Indian emphasis on natural remedies.

Urbanization

and Changing Lifestyles

India’s rapid urbanization has significantly impacted

consumer lifestyles and spending patterns. Urban dwellers, who are more exposed

to environmental pollutants and stressors, are increasingly seeking skincare

solutions that address these challenges. The rising levels of air pollution in

metropolitan areas have particularly heightened the demand for facial masks

that offer protection and rejuvenation.

Moreover, urban lifestyles often come with busy

schedules and higher disposable incomes, leading consumers to seek convenient

and quick skincare solutions. Facial masks, with their easy application and

immediate results, perfectly fit into the fast-paced urban lifestyle. This has

led to a surge in demand for masks that can be used at home or on-the-go,

providing a spa-like experience in the comfort of one’s home. The aspirational value associated with urban living

also drives consumers to invest in premium skincare products. This is evident

in the growing preference for high-end facial masks and luxury brands, which

are perceived to offer superior quality and efficacy.

Download Free Sample Report

Key Market Challenges

Intense

Market Competition and Brand Saturation

The facial masks market in India is

characterized by intense competition and brand saturation. The increasing

demand for facial masks has attracted a plethora of brands, ranging from

well-established international players to emerging local startups. While this

competition drives innovation and provides consumers with a wide range of

options, it also creates a challenging environment for brands trying to

establish or maintain market share.

With the influx of numerous brands,

differentiation becomes a significant challenge. Many brands offer similar

products with comparable benefits, making it difficult for consumers to

distinguish between them. This saturation can lead to price wars, aggressive

marketing tactics, and heavy discounting, which can erode profit margins and

potentially devalue the perceived quality of the products.

Moreover, smaller and newer brands may

struggle to gain visibility and compete with the established names that have

more resources for extensive marketing and distribution. This competitive

pressure forces all players in the market to continuously innovate and find

unique selling propositions to attract and retain customers.

Consumer

Skepticism and Trust Issues

In the rapidly growing beauty and

skincare market, consumer skepticism and trust issues are significant hurdles.

With so many products claiming miraculous results, consumers are often wary of

exaggerated marketing claims and unverified benefits. This skepticism is

compounded by instances of counterfeit products and misleading labeling, which

can damage trust and tarnish the reputation of legitimate brands.

Moreover, the influx of new brands and

products, particularly those introduced through online platforms, can overwhelm

consumers, making it difficult to identify genuine and effective products. The

prevalence of fake reviews and paid endorsements further complicates the

situation, leading consumers to question the authenticity and efficacy of

facial masks.

To address these trust issues, brands

need to prioritize transparency and build credibility. Providing clear,

accurate information about product ingredients, sourcing, and benefits is

essential. Brands must also engage in honest marketing and leverage credible

third-party endorsements, such as dermatological testing or certifications, to

reassure consumers about the quality and safety of their products.

Regulatory

Challenges and Compliance Issues

Navigating the regulatory landscape

poses a significant challenge for the facial masks market in India. The

skincare industry is subject to strict regulations to ensure consumer safety

and product efficacy. Compliance with these regulations requires substantial

investment in research and development, testing, and quality control processes.

Brands must adhere to the guidelines set

by the Central Drugs Standard Control Organization (CDSCO) and other relevant

authorities. These regulations cover aspects such as product labeling,

ingredient safety, manufacturing practices, and advertising claims.

Non-compliance can lead to product recalls, fines, and damage to brand

reputation.

Additionally, the regulatory framework

is constantly evolving, and keeping up with the changes can be challenging,

especially for smaller brands with limited resources. International brands

entering the Indian market must also navigate the complexities of local

regulations, which may differ from those in their home countries. Ensuring

compliance while maintaining cost-effectiveness and speed to market is a

delicate balancing act that requires careful management and strategic planning.

Key Market Trends

Rise

of Natural and Organic Products

One of the most significant trends in

the India facial masks market is the growing preference for natural and organic

products. Consumers are increasingly becoming aware of the harmful effects of

synthetic chemicals and are seeking products with natural ingredients that

promise safety and efficacy. This shift is driven by heightened awareness of

health and wellness and the influence of Ayurveda and traditional Indian

medicine, which emphasize the use of natural ingredients.

Brands are responding to this demand by

launching facial masks formulated with ingredients like turmeric, neem, aloe

vera, sandalwood, and other plant-based components known for their skin

benefits. These products are often free from parabens, sulfates, and artificial

fragrances, catering to the segment of consumers who prioritize clean and green

beauty.

Moreover, organic certification has

become a key selling point. Products that are certified organic are perceived

as safer and more effective, helping to build consumer trust. As this trend

continues to gain momentum, we can expect more brands to innovate with natural

formulations and secure organic certifications to meet consumer expectations.

Customization

and Personalization in Skincare

In the age of personalized experiences,

consumers are increasingly looking for skincare solutions tailored to their

unique needs. Customization and personalization in skincare have emerged as

prominent trends, driven by advancements in technology and a deeper

understanding of individual skin profiles.

Brands are now offering personalized

facial masks that address specific skin concerns, such as hydration,

anti-aging, acne, and pigmentation. Some companies provide online skin

assessments and consultations to recommend products that match the consumer's

skin type and preferences. This trend extends to the formulation stage, where

some brands allow consumers to choose specific ingredients for their facial

masks, creating a bespoke skincare product.

Technology is playing a crucial role in

this trend. AI-powered tools and apps can analyze skin conditions and recommend

products accordingly. Additionally, DNA-based skincare analysis, which examines

genetic markers related to skin health, is gaining traction, offering highly

customized skincare solutions.

This move towards personalization

reflects a broader consumer desire for products that cater to their individual

needs, providing a more targeted and effective skincare experience. As

technology continues to evolve, the scope for customization in facial masks is

likely to expand further.

Sustainability

and Eco-Friendly Innovations

Sustainability is becoming a cornerstone

of consumer decision-making, and the facial masks market is no exception. As

awareness of environmental issues grows, there is increasing demand for

eco-friendly products and practices in the beauty industry.

Brands are innovating to reduce their

environmental footprint by using biodegradable and recyclable materials for

mask sheets and packaging. Some are developing waterless formulations, which

not only reduce the need for preservatives but also minimize water usage—a

critical aspect in a water-scarce world.

Another aspect of sustainability is the

sourcing of ingredients. Ethical and sustainable sourcing practices are being

adopted, ensuring that the ingredients used in facial masks do not harm the

environment or deplete natural resources. This is often accompanied by fair

trade practices that support the livelihoods of local communities involved in

the production process.

Zero-waste and minimal packaging

solutions are also gaining popularity. Consumers are showing a preference for

brands that offer refillable options or use minimalistic, sustainable packaging

materials. As consumers become more eco-conscious, brands that prioritize

sustainability will likely see stronger loyalty and preference from their

customer base.

Innovation

in Product Formats and Delivery Systems

The facial masks market is witnessing

significant innovation in product formats and delivery systems, catering to

diverse consumer preferences and lifestyles. This trend is driven by the need

for convenience, efficacy, and a unique user experience. Traditional cream and clay masks are

being complemented by a range of new formats, including sheet masks, hydrogel

masks, peel-off masks, and overnight masks. Each format offers distinct

benefits and caters to different skincare needs and usage occasions. For

example, sheet masks are popular for their ease of use and mess-free

application, while hydrogel masks provide a cooling, soothing effect that is

particularly appealing in hot climates.

In addition to new formats, advanced

delivery systems are being developed to enhance the effectiveness of facial

masks. These include encapsulated ingredients that ensure deeper penetration

into the skin and controlled-release technologies that provide prolonged

benefits over time. The rise of multifunctional masks that

combine several benefits, such as hydration, anti-aging, and brightening, into

a single product, is also notable. These innovations are designed to meet the

needs of consumers who seek comprehensive skincare solutions in one easy-to-use

product.

Segmental Insights

Product

Type Insights

Sheet masks have rapidly emerged as the

fastest-growing segment in the India Facial Masks Market, driven by their

unique blend of convenience, efficacy, and trend appeal. Unlike traditional

masks that require application and removal, sheet masks offer a mess-free,

easy-to-use solution that appeals to the modern, time-pressed consumer. Each

mask is soaked in a nutrient-rich serum and provides immediate hydration and

skin benefits, making them an attractive option for quick and effective

skincare.

The surge in popularity of K-beauty

(Korean beauty) routines, which emphasize sheet masks as essential skincare

steps, has significantly influenced Indian consumers. Social media platforms

and beauty influencers have played a crucial role in popularizing these masks,

often showcasing them as part of daily or weekly skincare rituals. This visibility

has led to a widespread adoption of sheet masks among beauty enthusiasts across

various demographics.

The availability of sheet masks

targeting specific skin concerns like hydration, brightening, and

anti-aging—caters to a wide range of consumer needs, enhancing their appeal.

With ongoing innovation in formulations and materials, sheet masks are set to

continue their rapid expansion in the Indian market, positioning them as a

staple in contemporary skincare.

Download Free Sample Report

Regional Insights

The North region of India stands out

as the dominant market for facial masks, driven by a confluence of

socio-economic and cultural factors. This region, encompassing states like

Delhi, Punjab, Haryana, and Uttar Pradesh, boasts a high concentration of urban

centers and a burgeoning middle class with increasing disposable incomes. These

factors collectively contribute to a higher demand for skincare products,

including facial masks.

Delhi, as the national capital, serves

as a major hub for fashion, beauty, and lifestyle trends. The city's exposure

to pollution and harsh weather conditions further fuels the need for skincare

solutions that address issues like hydration, cleansing, and anti-pollution

protection. The Northern consumer base, characterized by a keen awareness of

beauty and personal care, is highly receptive to innovative and premium

skincare products.

The presence of a

well-developed retail infrastructure and a thriving e-commerce market in this

region facilitates easy access to a wide variety of facial masks. Both

international and domestic brands actively target this region with their latest

offerings and marketing campaigns, capitalizing on the high consumer engagement

and willingness to spend on quality skincare products.

Cultural factors also play a role, with

traditional beauty practices integrating with modern skincare trends, making

the North a fertile ground for both natural and technologically advanced facial

masks. As such, the Northern region's dominance in the India Facial Masks

Market is poised to continue growing, driven by its affluent, trend-conscious

population and robust market infrastructure.

Recent Developments

- In September 2023, L'Oréal announced its

debut in the Indian dermocosmetic market with the introduction of L'Oréal

Dermatological Beauty (LDB). This new division is dedicated to delivering

specialized skincare products directly to dermatologists, patients, and

consumers across the country. LDB aims to cater to the growing demand for

advanced dermatological solutions in India.

- In Jan 2023, Hindustan Unilever Limited

(HUL) announced its acquisition of a 51% stake in Zywie Ventures, expanding its

footprint in the nutrition and wellness segment. This strategic move allows HUL

to capitalize on Zywie's expertise in healthy and organic food products. The

acquisition aligns with HUL's commitment to enhancing its portfolio with

innovative offerings that address evolving health trends and preferences in the

Indian market.

Key Market Players

- Himalaya Drug Company Private Limited

- Lotus Herbals Pvt. Ltd.

- Colorbar Cosmetics Private Limited

- Swiss Beauty Cosmetics India Pvt Ltd

- Bio Veda Action Research Private Limited

- Mountain Valley Springs India Private Limited

- Kaya Limited

- VLCC Health Care Limited

- L’Oréal India Pvt Ltd

- Hindustan Unilever Limited

|

By Product Type

|

By Application

|

By Price Range

|

By Sales Channel

|

By Region

|

- Sheet Mask

- Cream Mask

- Clay Mask

- Peel-Off Mask

- Others

|

- Hydration & Relaxation

- Brightening

- Anti-Aging

- Acne/ Blemishes

- Others

|

|

- Beauty Parlors/Salons

- Cosmetic Stores

- Online

- Supermarkets/Hypermarkets

- Others

|

|

Report Scope:

In this report, the India Facial Masks Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- India Facial Masks Market, By

Product Type:

o Sheet Mask

o Cream Mask

o Clay Mask

o Peel-Off Mask

o Others

- India Facial Masks Market, By

Application:

o Hydration & Relaxation

o Brightening

o Anti-Aging

o Acne/ Blemishes

o Others

- India Facial Masks Market, By

Price Range:

o Economical

o Medium

o Premium

- India Facial Masks Market,

By Sales Channel:

o Beauty Parlors/Salons

o Cosmetic Stores

o Online

o Supermarkets/Hypermarkets

o Others

- India Facial Masks Market,

By Region:

o North

o South

o East

o West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents

in the India Facial Masks Market.

Available Customizations:

India Facial Masks Market report with the given

market data, TechSci Research offers customizations according to a company's

specific needs. The following customization options are available for the

report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Facial Masks Market is an upcoming report to

be released soon. If you wish an early delivery of this report or want to

confirm the date of release, please contact us at [email protected]