|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 55.41 Million

|

|

Market Size (2030)

|

USD 70.12 Million

|

|

CAGR (2025-2030)

|

4.08%

|

|

Fastest Growing Segment

|

Oral

|

|

Largest Market

|

West India

|

Market Overview

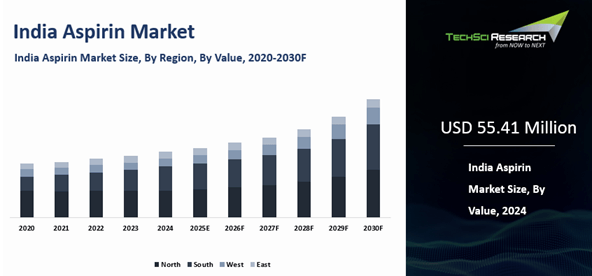

India Aspirin Market was valued at USD 55.41 Million in 2024 and is anticipated to reach USD 70.12 Million by 2030, with a CAGR of 4.08% during the forecast period. The aspirin market, a

segment within the global pharmaceutical industry, encompasses the production,

distribution, and sale of aspirin. This widely used medication is renowned for

its analgesic, antipyretic, and anti-inflammatory properties, making it a go-to

option for pain relief and fever reduction. As the market evolves, it involves

various stakeholders, including pharmaceutical companies, healthcare providers,

and consumers, who play critical roles in shaping its dynamics. The aspirin

market is influenced not only by health trends, regulatory policies, and research developments but also by a growing understanding of its potential benefits for cardiovascular disease prevention. Given its established efficacy in managing pain, fever, and certain inflammatory conditions, the aspirin market's significance within the pharmaceutical industry remains strong.

The

global aspirin market is constantly evolving, as new research findings and advances in pharmaceutical technology drive growth. The demand for aspirin continues to rise, driven by its wide

availability, affordability, and the increasing awareness of its multifaceted

therapeutic potential. As a result, the aspirin market holds immense importance

in addressing the healthcare needs of millions of individuals worldwide.

Download Free Sample Report

Key Market Drivers

Growing

Cases of Headaches

The rise in instances of headaches in India has led to a significant surge in the demand for aspirin, a commonly used over-the-counter medication known for its pain-relieving properties. The widespread adoption of digital technology and increased screen exposure have become integral to daily life, and this constant use of smartphones, tablets, and computers can contribute to eye strain and muscle tension that trigger headaches. For instance, TRAI reported that India’s total internet subscribers increased to 954.40 million as of March 31, 2024, including 924.07 million broadband subscribers, underscoring the scale of digital access that can lead to longer screen time for large sections of the population.

The fast-paced and competitive nature of modern life has also contributed to escalating stress levels that can trigger headaches and worsen their frequency and intensity. For instance, in December 2023, Saridon, Bayer India’s leading headache relief brand, released the second edition of its national headache survey conducted by HANSA Research among 5,310 respondents aged 22 to 45 across 20 urban cities in 15 Indian states, where 93% of participants with headaches reported a noticeable rise linked to increased stress and 1 in 3 acknowledged higher stress levels in the post-pandemic period.

Irregular sleep patterns have become common, with demanding work schedules, lifestyle choices, and always-on connectivity disrupting natural sleep-wake cycles and increasing the likelihood of headaches. Sleep deprivation or poor-quality sleep can directly contribute to headaches and make them more frequent, pushing more consumers toward easily available OTC relief options such as aspirin. In addition, ongoing urbanization and modernization are reshaping lifestyles and health patterns, and a growing share of consumers seek quick symptomatic relief to stay functional at work and in daily responsibilities. For instance, TRAI has also stated that India’s broadband subscriber base crossed the 1 billion mark in November 2025, indicating further deepening of always-connected digital lifestyles that can compound screen exposure and related headache triggers. As a result of increased screen exposure, rising stress levels, irregular sleep patterns, and rapid lifestyle shifts, more individuals are seeking relief by reaching for aspirin because its OTC availability and familiarity make it a convenient option to alleviate discomfort and resume daily activities with minimal interruption.

Expanding

Prevalence of Common Cold

The expanding prevalence of the common cold and other cold-like respiratory infections in India has increased demand for aspirin, a widely available over-the-counter medicine used by many adults to manage fever, headaches, and body aches that often accompany such illnesses. India’s densely populated settings and frequent close-contact environments enable respiratory viruses to spread quickly, raising the incidence of symptomatic infections and reinforcing the need for readily accessible fever and pain relief. When people develop cold-like symptoms such as fever, headache, body aches, and congestion, they often look for quick symptomatic relief, which can contribute to higher retail off-take of common analgesics and antipyretics, including aspirin.

India’s climate variability and seasonal transitions also contribute to recurrent waves of respiratory illness, as shifts in temperature and humidity can increase susceptibility to viral infections and trigger symptom-management purchases. Aspirin is primarily used in adults, and it is not recommended for children; however, the overall household burden of fever and aches across age groups still drives demand for OTC symptom-relief products. For instance, UNFPA notes that India’s elderly population is currently about 153 million people aged 60 and above and is expected to reach 347 million by 2050, and older adults are among the groups more vulnerable to complications from seasonal respiratory infections.

The pharmaceutical industry has responded by offering multiple aspirin formulations and combinations positioned for cold and flu symptom relief, typically pairing analgesic and antipyretic effects with decongestant-style benefits depending on the product and label claim. For instance, the Government of India’s update citing IDSP-IHIP surveillance reported 3,038 laboratory-confirmed cases of various influenza subtypes including H3N2 as of March 9, 2023, with monthly counts of 1,245 in January, 1,307 in February, and 486 in March up to March 9. Additionally, the same IDSP-IHIP update recorded 397,814 Acute Respiratory Illness/Influenza-Like Illness cases nationwide in January 2023, rising to 436,523 in February 2023, with 133,412 cases reported in the first nine days of March 2023, illustrating the high volume of cold-like illness that typically drives symptomatic treatment demand. The expanding prevalence of common cold-like illness in India can therefore increase demand for aspirin due to its role in adult symptom relief and its wide availability, but it should be used responsibly as per label guidance and with professional advice when needed, especially for higher-risk individuals..

Growing

Demand for Branded Generics

The

growing demand for branded generics in India has led to increased demand for aspirin, a widely recognized and trusted medication.

Branded generics are generic drugs that are marketed under a brand name, often

associated with quality and reliability. In India, where healthcare

affordability is a significant concern, branded generics have gained immense

popularity among consumers. One of the key reasons behind the rising demand for

branded generic aspirin is the perception of quality and efficacy. Consumers

tend to trust established brands more than unbranded or generic medications.

Aspirin, a common over-the-counter drug, is no exception. When it comes to

health and well-being, individuals often prefer to purchase familiar, trusted brands, even when the active ingredient is the same as in generic

versions.

Pharmaceutical companies have invested in marketing and promoting branded

generics, raising awareness of their products and highlighting the specific benefits of their aspirin formulations. This marketing effort has not

only increased consumer confidence but also contributed to the growth in

aspirin sales. The competitive pricing of branded generics, compared

to their branded counterparts, has made them an attractive option for

cost-conscious consumers. Aspirin, being an essential medication for various

pain relief needs, is more affordable in its branded generic form, making it

accessible to a broader segment of the population. The growing demand for

branded generics in India has led to an increased demand for aspirin, driven by

consumer preferences for trusted brands, marketing efforts by pharmaceutical

companies, and competitive pricing. This trend underscores the importance of

branding and accessibility in shaping consumer choices and healthcare

utilization in India.

Increased

Presence of Companies Offering Acetylsalicylic Acid Products

The

increased presence of companies offering acetylsalicylic acid (commonly known

as aspirin) products in India has significantly boosted the demand for this

versatile medication. This growth in availability and competition among

manufacturers has had several notable effects on aspirin demand. The

proliferation of aspirin producers has expanded the range of available formulations in the Indian market. These

variations cater to specific consumer preferences and needs, such as

enteric-coated aspirin for gastric sensitivity or aspirin combined with other

active ingredients for multi-symptom relief. This diversification allows

consumers to choose aspirin products that best suit their requirements, thus

increasing overall demand.

The

increased presence of aspirin manufacturers has driven price competitiveness.

As a result, aspirin has become more affordable and accessible to a broader

demographic of the Indian population. The affordability factor has played a

pivotal role in boosting demand, especially among budget-conscious consumers

who rely on aspirin for pain relief, fever reduction, and cardiovascular

health. The presence of multiple companies has intensified

marketing efforts and product promotions. As a result, consumer awareness of

aspirin's benefits and uses has grown, spurring demand. Advertising campaigns

and healthcare professionals' recommendations have also contributed to

aspirin's popularity.

The

increased presence of companies offering acetylsalicylic acid products in India

has led to greater product diversity, price competitiveness, and enhanced

consumer awareness, collectively driving up demand for

aspirin. This trend underscores the significance of market competition in

shaping healthcare product accessibility and consumer choices in the country.

Key Market

Challenges

Increasing

Presence of Counterfeit Drugs

The

increasing presence of counterfeit drugs in India has had a detrimental impact

on the demand for genuine aspirin, causing a decline in its consumption.

Counterfeit drugs pose significant risks to public health and safety, and this

menace has adversely affected the trust and demand for legitimate

pharmaceutical products like aspirin. One of the primary concerns associated

with counterfeit aspirin is the uncertainty surrounding its quality, safety,

and efficacy. Counterfeit drugs often contain incorrect or substandard active

ingredients, making them ineffective in treating medical conditions. As a

result, consumers who unknowingly purchase counterfeit aspirin may not

experience the expected relief from pain, fever, or other conditions, eroding

trust in the medication.

Counterfeit drugs can lead to adverse health effects and exacerbate medical

issues, which, in turn, can deter individuals from seeking aspirin or any other

medication in the future. The presence of counterfeit aspirin in the market also

impacts the reputation of legitimate pharmaceutical companies. This loss of

trust in the authenticity of medicines can lead consumers to avoid or reduce

their reliance on aspirin altogether, further diminishing its demand. The

increasing presence of counterfeit drugs in India has had a negative impact on

the demand for genuine aspirin. The risk to public health, uncertainty about product quality, and erosion of trust in pharmaceuticals have collectively led consumers to be cautious or reluctant to use aspirin or other medications, thereby reducing demand. Addressing the issue of

counterfeit drugs is crucial to restore confidence in the pharmaceutical

industry and ensure the safety and effectiveness of essential medications like

aspirin.

Price

Sensitivity Issues

Price

sensitivity is significantly affecting demand for aspirin in India, leading to a decline in consumption. As a common over-the-counter medication,

aspirin's demand is closely linked to its affordability, and several factors

contribute to price sensitivity concerns. India is a country with a diverse

socioeconomic landscape, and a substantial portion of the population faces

financial constraints. For many, the cost of healthcare and medications is a

significant burden. Aspirin, despite being relatively affordable compared to

some prescription drugs, may still be considered expensive by certain segments

of the population, leading them to limit its usage or seek cheaper

alternatives.

The

availability of a wide range of pain relievers and fever reducers in the Indian

market has intensified competition. Generic versions of aspirin and other pain

relief medications are often more cost-effective, further encouraging

price-sensitive consumers to opt for these alternatives. The presence of

government-sponsored healthcare programs and initiatives aimed at providing

free or subsidized medications for certain medical conditions may discourage

some individuals from purchasing aspirin at full price.

In

response to price sensitivity issues, pharmaceutical companies have introduced

lower-priced generic versions of aspirin to cater to budget-conscious

consumers. However, this price-driven competition has still resulted in a

decrease in demand for brand-name aspirin. Price sensitivity in India has led to a decline in demand for aspirin as consumers seek more

affordable alternatives. Market competition, the availability of

generic options, and government healthcare programs all contribute to this

trend. Balancing affordability with quality healthcare remains a significant

challenge in the Indian pharmaceutical market.

Key Market Trends

Over-the-counter

Availability

The

over-the-counter (OTC) availability of aspirin in India has significantly increased its demand. As a readily accessible and

affordable medication, aspirin has become a go-to choice for a wide range of

health concerns, contributing to its widespread use. Unlike prescription

medications that require a doctor's consultation and prescription, aspirin can

be purchased directly from pharmacies and drugstores without the need for a

prescription. This accessibility allows individuals to quickly obtain aspirin

for immediate relief from common ailments like headaches, fever, and mild pain.

OTC availability empowers consumers to take charge of their health and

self-medicate responsibly. For minor health issues, individuals can confidently

purchase aspirin, saving time and healthcare costs associated with doctor visits.

The versatility of aspirin also drives its demand. It is not limited to a

specific ailment, making it suitable for a wide range of conditions, including

pain relief, fever reduction, and heart health maintenance. This versatility

has made aspirin a staple in many households and a first-choice remedy for

various health concerns. The over-the-counter availability of aspirin in India

has significantly increased its demand due to easy access, affordability, and

its versatility in addressing common health issues. The convenience of

obtaining aspirin without a prescription has made it a trusted and widely used

medication for millions of Indians, reinforcing its position as a go-to

solution for a variety of health-related needs.

Rising

Online Sales

The

increasing popularity of online sales channels in India has had a substantial

impact on the demand for aspirin, leading to a notable uptick in its

consumption. Several factors contribute to the rise in online sales, boosting demand for this versatile medication.

Online

platforms provide convenience and accessibility to a wide range of consumers.

Aspirin can be easily purchased from e-commerce websites and delivered to one's

doorstep, eliminating the need for a visit to physical stores or pharmacies.

This convenience factor has encouraged more people to procure aspirin online,

thus contributing to increased demand. The digital marketplace allows consumers

to compare prices and access discounts more effectively. Price-sensitive

shoppers can browse multiple online retailers to find the best deals and

discounts on aspirin products. This price transparency encourages individuals

to make cost-effective choices, often leading to increased purchases.

The

vast reach of online sales platforms ensures that aspirin is available to

consumers even in remote or underserved areas where physical pharmacies may be

scarce. This expanded accessibility has opened up new markets and reached a

broader demographic, further fueling demand. Online reviews and

recommendations play a crucial role in influencing consumer choices. Positive

user experiences and endorsements can boost consumer confidence in aspirin

products, driving demand.

Segmental Insights

Form Insights

Based on the form,

tablet forms of aspirin have emerged as the dominant choice in the Indian

market, primarily due to their unparalleled convenience and cost-effectiveness.

In a country where healthcare access can be challenging in certain regions, the mass production of aspirin tablets has enabled widespread distribution and availability, addressing the healthcare needs of a

vast population. Tablets offer inherent advantages for storage and transportation, making them a more practical choice for vendors and consumers alike. Their compact size and durability ensure that they

can be easily stored and transported without the risk of damage or

deterioration. This not only simplifies logistical challenges but also enables the efficient, seamless delivery of essential medications across the country.

The

extended shelf life of tablets further enhances their appeal. With a longer

expiration date, tablets can be stocked, preserved, and utilized for an

extended period, reducing the risk of wastage and ensuring a steady supply of

aspirin to meet the healthcare needs of the population. The

familiar tablet form often makes them a more accepted choice for consumers.

The ease of consumption is undeniable: tablets can be taken with water, eliminating the complexities of other forms such as powders or liquids. This ease of use enhances patient compliance and

contributes to a positive healthcare experience. The dominance of tablet forms

of aspirin in the Indian market can be attributed to their convenience,

cost-effectiveness, ease of storage and transportation, extended shelf life, and

consumer-friendly administration. These factors collectively help ensure widespread access to aspirin, ultimately benefiting the overall health

and well-being of the population.

Route of

Administration Insights

In India, the oral route is the most preferred for aspirin use due to several factors. The

oral route offers simplicity and convenience because it does not require medical supervision or assistance, unlike injectable or topical methods. This makes it

easier for individuals to self-administer aspirin and adhere to their

medication regimen. Oral aspirin formulations, such as tablets or

capsules, are widely available and often more cost-effective than other forms. This affordability ensures that aspirin is accessible

to a larger population, promoting its widespread use and potential health

benefits. Cultural practices and beliefs in India play a significant

role in promoting the oral consumption of medicines. The tradition of oral

ingestion is deeply ingrained in Indian culture, with a long history of using

this method for various therapeutic purposes. This cultural acceptance further

solidifies the popularity of aspirin's oral administration route. The

preference for oral consumption demonstrates the trust and acceptance of this

method among the Indian population, ensuring widespread accessibility and

adherence to aspirin therapy, ultimately contributing to improved health

outcomes.

Download Free Sample Report

Regional Insights

The

Western region of India, comprising the bustling state of Maharashtra, is

currently taking the lead in the aspirin market across the country. This

dominance can be attributed to several factors. The region boasts a high

population density, resulting in a substantial consumer base for pharmaceutical

products, including aspirin. With a large number of potential customers, the

demand for aspirin is consistently high, fueling its market growth in the

Western region. The Western region is equipped with a robust healthcare

infrastructure, ensuring convenient access to healthcare facilities and

medications. This accessibility plays a crucial role in the popularity and

usage of aspirin among the residents. The availability of healthcare facilities

and medications, including aspirin, encourages people to prioritize their

health and seek preventive measures.

The

presence of major pharmaceutical companies in this region further contributes

to its stronghold in the aspirin market. These companies have established a

strong foothold in the Western region, manufacturing and distributing aspirin

efficiently. Their presence not only ensures a steady supply of aspirin but

also fosters competition, leading to innovation and advancements in the aspirin

industry. These factors create a favorable environment for the growth and

success of the aspirin industry in the Western region of India. The combination

of a large consumer base, a robust healthcare infrastructure, and the presence

of major mpanies has positioned the Western region as a leader in the aspirin

market, setting the stage for continued growth and development in the future.

Recent Developments

- In Oct 2024, Aarti Drugs said salicylic acid production commenced at the start of the financial year and was running at ~100 tonnes/month initially, with ramp-up underway.

Key Market Players

- AstraZeneca Pharma India Limited

- Sun Pharmaceutical Industries Ltd.

- Eli Lilly and Company (India) Private Limited

- Unnati Pharmaceutical Private Limited

- Taj Pharmaceuticals Limited

- Lupin Limited

- Zydus Lifesciences Limited

- Cipla Limited

- Reckitt Benckiser (India) Limited

- Natco Pharma Limited

|

By Product Type

|

By Form

|

By Route of Administration

|

By Source

|

By Distribution Channel

|

By Application

|

By Region

|

|

|

|

|

- In-House

- Contract Manufacturing Organizations

|

|

- Cardiovascular Diseases

- Pain

- Fever

- Arthritis

- Others

|

|

|

|

|

|

|

|

|

|

Report

Scope:

In

this report, the India Aspirin Market has been segmented into the following

categories, in addition to the industry trends which have also been detailed

below:

- India Aspirin Market, By Product Type:

o

Prescription

o

OTC

- India Aspirin Market, By Form:

o

Tablet

o

Capsule

o

Solution

- India Aspirin Market, By Route of Administration:

o

Oral

o

Intravenous

- India Aspirin Market, By Source:

o

In-House

o

Contract Manufacturing Organizations

- India Aspirin Market, By Distribution Channel:

o

Online

o

Offline

- India Aspirin Market, By Application:

o

Cardiovascular Diseases

o

Pain

o

Fever

o

Arthritis

o

Others

- India Aspirin Market, By Region:

o

North

o

South

o

West

o

East

Competitive

Landscape

Company

Profiles: Detailed

analysis of the major companies present in the India Aspirin Market.

Available

Customizations:

India

Aspirin Market report with the given market data, TechSci Research

offers customizations according to a company's specific needs. The following

customization options are available for the report:

Company

Information

- Detailed analysis and profiling of

additional market players (up to five).

India

Aspirin Market is an upcoming report to be released soon. If you wish an early

delivery of this report or want to confirm the date of release, please contact

us at [email protected]