|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

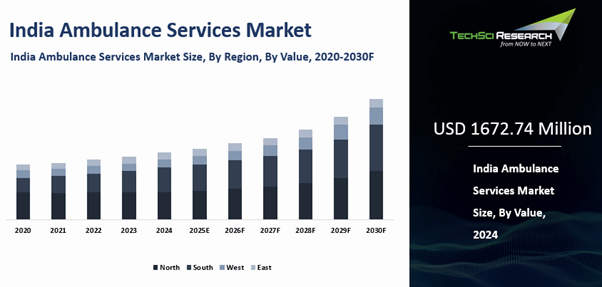

USD 1672.74 Million

|

|

Market Size (2030)

|

USD 2219.45 Million

|

|

CAGR (2025-2030)

|

4.75%

|

|

Fastest Growing Segment

|

Ground

|

|

Largest Market

|

West India

|

Market Overview

India Ambulance Services Market was valued at USD 1672.74 Million in 2024 and is anticipated to reach USD 2219.45 Million by 2030, with a CAGR of 4.75% during 2025-2030.

The India Ambulance Services

Market is primarily driven by factors such as increasing healthcare awareness,

rising demand for emergency medical services, and improving healthcare

infrastructure. With the growing prevalence of accidents, medical emergencies,

and chronic diseases, there is a heightened need for timely and efficient

ambulance services to transport patients to healthcare facilities swiftly. Government

initiatives aimed at strengthening emergency medical services, training

paramedics, and enhancing ambulance fleet infrastructure contribute to market

growth. Advancements in technology, such as GPS tracking systems, telemedicine

integration, and ambulance dispatch optimization, enhance service efficiency

and patient care. The emergence of private ambulance operators, partnerships

with healthcare providers, and investments in mobile healthcare solutions

further propel market expansion, ensuring broader accessibility and improved

healthcare outcomes for individuals across India.

Download Free Sample Report

Key Market Drivers

Rising Prevalence of Chronic Diseases

The prevalence of chronic diseases like cardiovascular diseases, surgeries, trauma, and injuries requires urgent emergency services for the care and treatment of patients. In India, non-communicable diseases account for 53% of all deaths and 44 % of disability-adjusted life-years lost. India is considered a home to more than a sixth of the world’s population and has been witnessing a rapid epidemiological transition, i.e, a shift towards chronic non-communicable diseases along with socio-economic development. According to the Department of Biotechnology, Government of India, India has the highest number of people with Diabetes in the world at around 77 million, which is a data expected to have a projection of 134 million by 2045, as per the International Diabetes Federation. India

experiences premature death as a result of cardiovascular disease, which causes

one-fourth of all fatalities. The increasing prevalence of diseases and

accidents have significantly increased the number of people requiring immediate

treatment and transportation to hospitals, thereby supporting the market growth

for ambulances in India.

Increase in the Number of Road Accidents

Generally, the increase in the number of road accidents

leads to many injuries and deaths. For instance, according to the Times of India, two-wheelers accounted for the maximum fatal road accidents (69,240 deaths), contributing 44.5% of total road accident deaths, followed by cars and trucks/lorries in 2021. The rise in the adoption of commercial and personal vehicles has led to an increase in the number of road accident incidents in the country, resulting in the creation of the requirement for emergency hospital admissions for urgent medical care and assistance. According to the data from

the National Crime Records Bureau (NCRB), a total of 4,03,116 road accident

cases were reported in 2021, which is an increase from 3,54,796 in 2020. This,

in turn, is anticipated to positively influence the market growth in the coming

years.

Increase Technological Advancement

Rapid advancements in research and development

(R&D) activities are propelling the growth of the market. The new technology-based programmes are developed that provide specific medical services and care in emergencies. Major companies are developing advanced

technologies and launching new services to stay competitive in the market. For

instance, in 2021, JCBL was developed with reliability and advantages, which is

fully equipped with all the facilities that a basic mobile medical unit may

need, including a PA system, oxygen cylinders, emergency stretchers, and an

operating table, complete with all necessary medical supplies.

In 2020, Ziqitza Healthcare Ltd (ZHL), Asia’s

largest emergency medical service provider company and one of the

fastest-growing holistic healthcare solution platforms in India, introduced

Ambulance Subscription services for corporates and large business units under

the Corporate Wellness product extension, recently in India. In September 2020, Karnataka, India, launched

the country’s first integrated air ambulance service, a collaboration between

the International Critical Air Transfer Team (ICATT) and the Kyathi.

Rising Development in Hospital Facilities &

Infrastructure

The improving healthcare infrastructure across

India will increase the number of hospital establishments across the country,

which in turn will increase the demand for ambulance services. Every hospital

has either their own ambulance or ambulance services in collaboration with any

service provider. The Indian government is continuously investing in upgrading the

existing hospitals' infrastructure and establishing new hospitals in the

country. For instance, in 2019, the NITI Aayog announced that India will

have 2,500 new hospitals in the next five years. Similarly, on March 26th,

2022, the Delhi government announced that it would be upgrading 15 hospitals

and building 4 new hospital facilities in Delhi. Also, in August 2022, the

Delhi State Health Department announced that Delhi will soon have 11 new

hospitals adding more than 10,000 beds to the health infrastructure of the

city. Hence, these factors show the growth of the market at an impressive

rate in the coming years.

Rise in Medical Tourism in India

India is one of the potential countries for medical

tourism, on account of affordable treatment costs, availability of skilled

healthcare professionals, lesser wait times, etc. The increasing medical

tourism has further created significant demand for air ambulance services. According to the Minister of State for Civil Aviation, India has only

49 air ambulances operated by 19 operators. Out of these 49, Delhi has 39 air

ambulances, followed by Maharashtra with 5. However, this number is set to

increase in the coming years due to growth in medical tourism, thereby creating

new prospects for market growth. The increase in medical tourism has also

led to the emergence of various new players in the market offering ambulance

services, and has also made the existing ones improve their services and cost

offerings. This, in turn, is expected to create lucrative opportunities for the

growth of the ambulance services market in the coming years, within India.

Key Market Challenges

Quality of Services and Training Shortages

The quality of ambulance services and shortages of trained

personnel pose significant challenges to the India Ambulance Services Market.

While the availability of ambulances has increased in recent years, disparities

in service quality, equipment standards, and paramedic training persist across

different regions and service providers. Ambulances may lack essential medical

equipment, diagnostic tools, and life-saving medications, compromising the

delivery of timely and effective pre-hospital care. Shortages of qualified

paramedics, emergency medical technicians (EMTs), and medical responders limit

the availability of skilled personnel capable of providing advanced life

support (ALS) interventions and critical care en route to healthcare

facilities. Addressing these challenges requires investments in paramedic

training programs, standardized protocols, and accreditation systems to ensure

uniformity, quality assurance, and competency in ambulance services nationwide.

Regulatory and Legal Frameworks

Regulatory and legal challenges pose obstacles to

the India Ambulance Services Market, impacting service standards, operational

efficiency, and liability issues. Ambulance services are subject to a complex

regulatory landscape encompassing various central and state-level regulations,

guidelines, and licensing requirements, leading to inconsistencies,

bureaucratic hurdles, and compliance challenges for operators. Ambulance

operators must navigate licensing procedures, vehicle registration

requirements, equipment standards, and emergency response protocols, often facing

delays and regulatory ambiguities. Legal liabilities, insurance coverage, and

medico-legal issues surrounding ambulance operations, patient care, and

transport further complicate service delivery and risk management. Streamlining

regulatory processes, harmonizing standards, and establishing clear guidelines

for ambulance operations, training, and accountability are essential to address

regulatory challenges and improve the efficiency and effectiveness of ambulance

services in India.

Key Market Trends

Rising Disposable Income and Healthcare Expenditure

Rising disposable income and higher healthcare spending in India are driving demand for premium ambulance services and advanced medical transportation solutions. Monthly ambulance registrations reached a record 2,359 units in April 2025, reflecting rapid fleet expansion across the country. As incomes grow and living standards improve, individuals and families are increasingly willing to invest in quality healthcare services, including reliable and well-equipped ambulance transportation. This trend is shaped by the clinical burden of chronic conditions, with 77 million people currently living with diabetes and projections of 134 million by 2045, along with high cardiovascular mortality.

Expanding health insurance coverage and employer-sponsored healthcare benefits are encouraging more people to choose private ambulance services with enhanced features. These include advanced life support systems, trained medical personnel, and luxury fleets offering improved comfort and care during transport. Air ambulance services are also expanding, with 49 units operational nationwide, 39 in Delhi, and 5 in Maharashtra, with further additions expected.

The growing preference for premium and customized ambulance options presents strong opportunities for service providers to differentiate their offerings. Regional centers such as Mumbai anchor dense private networks and high-spec fleets across Western India, signaling a clear shift toward professionalized, technology-enabled, and value-added medical transportation.

Urbanization and Traffic Congestion

Urbanization and worsening traffic congestion in major Indian cities are driving demand for ambulance services by intensifying transport challenges and raising the frequency of accidents and medical emergencies. India recorded 480,583 road accidents and 172,890 deaths in 2023, underscoring the urgent need for efficient emergency response systems. As cities expand and populations concentrate in metropolitan areas, longer commute times hinder access to healthcare. In 2024, Bengaluru reported an average travel time of 34 minutes and 10 seconds to cover just 10 km, highlighting the growing strain on urban mobility.

Ambulances equipped with navigation systems, traffic management tools, and route optimization software are helping reduce delays and improve response times. City fleets such as Delhi’s Centralised Ambulance Trauma Services have expanded, adding 110 new vehicles fitted with advanced medical and tracking equipment to enhance coordination and efficiency.

Innovative approaches like motorcycle ambulances, bicycle ambulances, and rapid response units are improving accessibility in congested zones and narrow streets. These agile solutions allow paramedics to reach patients faster in dense urban areas where conventional vehicles struggle. Delhi’s 16 bike ambulances, for instance, received over 2,000 emergency calls within months of launch, demonstrating their growing role in urban emergency care delivery.

Segmental Insights

Transport Vehicle Insights

Based on the Transport

Vehicle, in the India Ambulance Services Market, ground ambulance services

dominate over air ambulance services due to several factors. Ground ambulances

are more accessible and cost-effective compared to air ambulances, making them

the preferred choice for medical transportation in most scenarios. Ground

ambulances are equipped to navigate diverse terrain, including urban, suburban,

and rural areas, providing timely response and transportation to patients in

need. They offer versatility in terms of vehicle types, such as basic life

support (BLS) ambulances for non-critical patients and advanced life support

(ALS) ambulances equipped with advanced medical equipment and trained personnel

for critical care.

Ground ambulances are

better suited for short-distance transfers, inter-facility transports, and

community-based emergency response, catering to a wide range of medical

emergencies and patient needs. While air ambulances offer rapid transportation

over long distances and remote areas, their limited availability, high

operational costs, and regulatory constraints restrict their widespread

adoption in the Indian context. Ground ambulances play a crucial role in

facilitating door-to-door transportation, patient triage, and on-scene medical

interventions, ensuring comprehensive pre-hospital care and seamless

integration with the broader healthcare system. Despite the advantages of air

ambulances in certain scenarios, such as mass casualty incidents, natural

disasters, and organ transplants, ground ambulances remain the backbone of the

India Ambulance Services Market, providing essential medical transportation

services to millions of patients across the country.

Services Insights

Based on Services, In the

India Ambulance Services Market, emergency ambulance services dominate over

non-emergency ambulance services due to the critical role they play in

addressing life-threatening medical situations and providing urgent medical

care to patients in need. Emergency ambulance services are equipped to respond

promptly to medical emergencies, such as accidents, trauma cases, heart

attacks, strokes, and other acute illnesses, where timely intervention is

crucial for patient survival and recovery. These ambulances are staffed with

trained paramedics, equipped with advanced life support (ALS) equipment and

medications, and operate on a 24/7 basis to ensure rapid response and

transportation to healthcare facilities.

Emergency ambulance

services prioritize patient triage, stabilization, and on-scene medical

interventions, facilitating seamless coordination with hospitals and emergency

departments for timely definitive care. While non-emergency ambulance services

cater to patients requiring scheduled medical transportation, such as hospital

transfers, routine medical appointments, and non-urgent transfers between

healthcare facilities, they constitute a smaller segment of the market. The

dominance of emergency ambulance services reflects the critical need for timely

emergency response and pre-hospital care in addressing life-threatening

emergencies and ensuring optimal patient outcomes in the India Ambulance

Services Market.

Download Free Sample Report

Regional Insights

The Western region of India emerges as a dominant

region in the India Ambulance Services Market, comprising states such as

Maharashtra, Gujarat, Rajasthan, and Goa. Several factors contribute to the

Western region's prominence in the Ambulance Services Market. Maharashtra, with

its bustling metropolis of Mumbai, serves as a hub for healthcare services,

emergency response, and medical infrastructure. Mumbai, known as the financial

capital of India, boasts a comprehensive network of ambulance services,

including both public and private providers, catering to the city's dense

population and high demand for emergency medical care. The presence of premier

medical institutions, such as Tata Memorial Hospital, Lilavati Hospital, and

Bombay Hospital, underscores the critical need for reliable ambulance services

to facilitate timely access to specialized treatments and trauma care.

Gujarat, with its industrial cities like Ahmedabad

and Vadodara, is a major contributor to the Ambulance Services Market in the

Western region. Ahmedabad, in particular, is home to a robust healthcare

ecosystem, comprising hospitals, medical colleges, and emergency medical

services (EMS) providers. The city's strategic location, well-developed

infrastructure, and proactive approach to emergency preparedness make it a key

player in ambulance services, catering to urban and rural populations across

Gujarat and neighboring states.

Recent Developments

- In June 2025, Maharashtra’s Public Health Department signed a 10-year concession agreement with SUMEET SSG BVG Maharashtra EMS to expand and operate the MEMS 108 ambulance network under a Rs 1,600 crore program. The phased rollout, starting in November 2025, includes CAD/VTMS integration and a planned fleet of 1,756 vehicles.

- In February 2025, Reuters reported that Indian eVTOL startup ePlane signed a preliminary agreement worth over $1 billion to supply 788 electric air ambulances to ICATT. The collaboration targets district-level coverage and aims to accelerate the adoption of battery-powered air ambulances across India.

- In 2025, EMRI Green Health Services issued tender and rate-contract documents indicating active procurement for equipment and refurbishment supporting 108 ambulance services in multiple states, with defined service-level agreements and penalties for delays.

- In June 2025, Artemis Hospitals, in collaboration with MeduLance, introduced 5G-enabled ambulances in Gurugram, India, marking a significant advancement in emergency medical response. These next-generation ambulances are equipped with 5G connectivity, AI-powered diagnostic tools, and real-time telemedicine capabilities. The technology facilitates live video consultations, continuous transmission of patient vitals, and remote expert intervention during transit enhancing the speed and quality of critical care en route to the hospital.

- In March 2025, Zenzo launched a nationwide network of 25,000 private ambulances across 450 cities in India, aiming to achieve an emergency response time of under 15 minutes. As part of its rollout strategy, Zenzo has partnered with major delivery platforms, including Zomato, as well as various e-commerce and mobility companies, to raise awareness around emergency response preparedness. These collaborations focus on training delivery personnel often among the first to arrive at emergency scenes in basic life-saving techniques and engaging the public on emergency protocols.

- In January 2025, Blinkit, the Zomato-owned quick commerce platform, announced the launch of a 10-minute ambulance delivery service, marking its expansion beyond grocery and printout deliveries. This unexpected move into emergency medical response underscores the pressing challenges surrounding ambulance accessibility in India. The initiative brings to light the gaps in the current system, where timely access to ambulances remains a critical issue, particularly during emergencies.

- In May 2024, RED.Health, a

startup headquartered in Hyderabad, which has successfully raised $20 million

in Series B funding. This funding round was led by Jungle Ventures. RED Health

specializes in a medical emergency response platform and has gained recognition

for its ability to dispatch ambulances within eight minutes. Apart from Jungle

Ventures, other investors participating in this funding round include

HealthQuad, HealthX, and Alteria Capital. The significant infusion of capital

underscores the robust faith investors have in RED.Health's progress within the

realm of emergency ambulance services.

- In July 2024, Meghalaya’s National Health Mission released a request for proposal to manage and operate ERS-108 ambulance services, continuing competitive contracting for 108 operations across several Indian states.

- In April 2024, Odisha’s Health Department extended the submission deadline for ambulance service tenders through a clarification and corrigendum, reflecting active tendering cycles for emergency medical transport.

Key Market Players

- Ziqitza Health Care Limited

- Stanplus Technologies Private

Limited

- Medulance Healthcare Private

Limited

- Air Rescuers Worldwide Private

Limited

- Panchmukhi Air & Train

Ambulance Services Pvt. Ltd.

- EMSOS Medical Pvt. Ltd.

- AmbiPalm Health Private

Limited

- BVG India Limited

- Falcon Emergency

- EMRI Green Health Services

|

By Transport Vehicle

|

By Services

|

By Service Operators

|

By Equipment Type

|

By Region

|

|

|

|

- Hospital Based Service

- Private Ambulance Service

- Government Ambulance Service

- Others

|

- Advanced Life Support

- Basic Life Support

|

|

Report Scope:

In this report, the India Ambulance Services Market

has been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- India Ambulance Services

Market, By

Transport Vehicle:

o Ground

o Air

- India Ambulance Services

Market, By

Services:

o Emergency

o Non-Emergency

- India Ambulance Services

Market, By

Service Operators:

o Hospital Based Service

o Private Ambulance Service

o Government Ambulance

Service

o Others

- India Ambulance Services

Market, By

Equipment Type:

o Advanced Life Support

o Basic Life Support

- India Ambulance Services

Market, By

Region:

o North

o South

o West

o East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the India Ambulance Services Market.

Available Customizations:

India Ambulance Services Market report with

the given market data, TechSci Research offers customizations according to a

company's specific needs. The following customization options are available for

the report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

India Ambulance Services Market is an upcoming

report to be released soon. If you wish an early delivery of this report or

want to confirm the date of release, please contact us at [email protected]