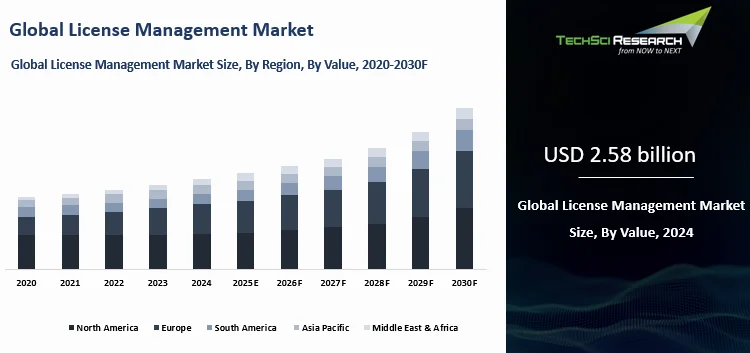

Forecast Period | 2026-2030 |

Market Size (2024) | USD 2.58 billion |

Market Size (2030) | USD 5.05 billion |

CAGR (2025-2030) | 11.67% |

Fastest Growing Segment | On-premises |

Largest Market | North America |

Market Overview

The Global License Management Market was valued at USD 2.58 billion in 2024 and is expected to reach USD 5.05 billion by 2030 with a CAGR of 11.67% during the forecast period.

The License Management Market refers to the ecosystem of software, tools, and services that enable organizations to track, monitor, and optimize the use of software licenses, ensuring compliance with vendor agreements, avoiding penalties, and maximizing return on technology investments. It plays a critical role in helping enterprises manage the growing complexity of software deployment across on-premises, cloud, and hybrid environments. Organizations today rely heavily on diverse software applications to operate efficiently, which increases the risk of overspending on unused licenses, non-compliance with regulatory or contractual obligations, and inefficient resource utilization.

License management solutions address these challenges by offering real-time visibility into license usage, enabling organizations to prevent unauthorized software use, detect underutilized licenses, and make data-driven decisions for renewals or new purchases. The market is also gaining momentum due to the rapid adoption of subscription-based and Software-as-a-Service models, which demand more dynamic and automated license tracking. Rising cybersecurity threats and regulatory scrutiny across industries further amplify the need for robust license management practices to prevent breaches, financial penalties, and reputational risks.

Additionally, enterprises are increasingly adopting cloud-based license management platforms due to their scalability, cost-effectiveness, and ability to provide centralized monitoring across geographically dispersed operations. The growth of digital transformation initiatives in sectors such as healthcare, financial services, information technology, government, and manufacturing is expanding the demand for efficient license management solutions that align with evolving business models and compliance frameworks.

Furthermore, the integration of emerging technologies like artificial intelligence, automation, and analytics within license management tools is helping enterprises gain predictive insights, optimize resource allocation, and enhance operational efficiency. With software investments becoming a critical part of organizational budgets, the focus on cost optimization and compliance assurance is expected to drive strong adoption of license management solutions. Consequently, the License Management Market will continue to rise steadily as organizations prioritize governance, risk management, and efficiency in their software usage strategies.

Key Market Drivers

Rapid Adoption of Cloud-Based Solutions

In the License Management Market, the rapid adoption of cloud-based solutions serves as a fundamental driver, revolutionizing how organizations handle software licensing by providing scalable, flexible, and cost-effective alternatives to traditional on-premises models that often struggle with the demands of dynamic business environments. As enterprises increasingly migrate their operations to the cloud to support remote workforces, hybrid infrastructures, and agile development practices, license management platforms integrated with cloud ecosystems enable seamless tracking, allocation, and optimization of software assets across distributed systems, reducing administrative overheads and ensuring compliance in real-time without the limitations of physical hardware dependencies.

This driver is particularly influential in a landscape where digital transformation accelerates the proliferation of software-as-a-service applications, necessitating advanced tools that can automatically discover, monitor, and manage licenses for thousands of cloud-hosted applications, thereby mitigating risks associated with over-deployment or under-utilization that could lead to financial penalties or operational inefficiencies. Furthermore, cloud-based license management facilitates centralized visibility into usage patterns, allowing IT departments to forecast demand, negotiate better vendor contracts, and implement usage-based pricing models that align expenditures with actual consumption, fostering greater financial predictability in volatile economic conditions.

Regulatory pressures and industry standards, such as those from ISO and GDPR, further amplify this trend by requiring robust audit trails and data sovereignty features that cloud solutions inherently support through encrypted, geo-redundant storage and automated reporting capabilities. Sectors like finance benefit from this by securing sensitive data while dynamically scaling licenses for analytics tools during peak periods, whereas healthcare organizations leverage it to maintain compliance with HIPAA through role-based access controls integrated into cloud license managers. Manufacturing firms utilize cloud license management to synchronize software usage across global supply chains, optimizing costs for CAD and ERP systems that fluctuate with production cycles.

Retailers employ it to manage e-commerce platforms' licenses, ensuring uninterrupted service during high-traffic seasons like holidays. In the energy sector, cloud solutions enable remote monitoring of licensing for simulation software used in resource exploration, reducing downtime in field operations. Public sector agencies adopt these platforms to standardize license procurement across departments, enhancing transparency and accountability in taxpayer-funded IT investments. Entertainment companies scale licenses for content creation software based on project demands, avoiding wasteful perpetual licenses.

Agricultural businesses integrate cloud license management with IoT devices for precision farming tools, optimizing software spend on variable field data. Educational institutions manage licenses for learning management systems, accommodating fluctuating student enrollments. Financial services firms ensure compliance in algorithmic trading software, where cloud agility prevents license violations during market volatility. Gaming developers use it to handle licenses for development kits in collaborative cloud environments. Social media platforms track licenses for data processing tools, supporting massive user growth. E-learning providers dynamically allocate licenses for virtual classrooms, enhancing accessibility.

Telemedicine services manage licenses for diagnostic software, ensuring regulatory adherence. Supply chain managers optimize licenses for tracking software, improving resilience against disruptions. Environmental firms license modeling software for climate analysis, with cloud facilitating collaborative research. Government operations streamline inter-agency software sharing, reducing duplication. Media companies manage editing software licenses for distributed teams. Hospitality sectors license reservation systems, scaling with seasonal demand. Insurance providers handle actuarial software licenses, ensuring accurate risk assessment.

Real estate firms license property management tools, supporting remote viewings. Automotive manufacturers manage design software licenses for electric vehicle development. Pharmaceutical companies license research software, accelerating drug discovery. Overall, the rapid adoption of cloud-based solutions propels the License Management Market by enabling efficient, compliant, and adaptable software asset management that aligns with the evolving needs of modern enterprises across all sectors.

In the United States, over 70% of enterprises have adopted cloud-based applications for core operations, creating a critical demand for license management platforms that can ensure compliance, cost efficiency, and real-time visibility across hybrid and multi-cloud environments.

Escalating Concerns Over Software Compliance and Auditing

In the License Management Market, escalating concerns over software compliance and auditing emerge as a critical driver, compelling organizations to invest in sophisticated platforms that automate the detection, reporting, and remediation of non-compliant usage to avoid costly fines, legal repercussions, and reputational damage in an era of stringent regulatory scrutiny. As businesses expand their software portfolios to include diverse applications from multiple vendors, license management solutions provide essential capabilities for inventorying assets, reconciling entitlements against actual deployments, and generating audit-ready reports that streamline compliance processes and reduce the burden on IT teams facing frequent vendor audits.

This driver gains momentum from the rising incidence of software piracy and overuse, where advanced analytics within license management tools identify unauthorized installations and over-deployments, enabling proactive enforcement that transforms potential liabilities into revenue recovery opportunities through targeted compliance campaigns. Enterprises in regulated industries, such as banking, utilize these systems to ensure adherence to financial standards like SOX by tracking license usage in real-time and alerting administrators to deviations, while healthcare providers maintain HIPAA compliance by managing licenses for electronic health record software with granular access controls.

Manufacturing operations leverage license management to audit CAD and PLM tools across global facilities, preventing intellectual property risks from unlicensed copies. Retail chains monitor point-of-sale software licenses to comply with payment card industry standards, avoiding breaches that could erode customer trust. Energy utilities employ these platforms to manage SCADA system licenses, ensuring operational integrity amid cybersecurity threats. Public administrations use license management for transparent tracking of taxpayer-funded software, enhancing accountability during governmental audits. Entertainment studios audit content creation software to protect against piracy in collaborative environments.

Agricultural enterprises manage licenses for farm management systems, complying with data privacy laws in precision agriculture. Educational organizations track e-learning platform licenses to meet accreditation requirements. Financial institutions automate audits for trading software, mitigating risks in high-stakes environments. Gaming companies monitor development tool licenses to prevent unauthorized distribution. Social media firms ensure compliance in data analytics software amid privacy regulations. E-learning providers audit virtual classroom licenses for equitable access.

Telemedicine services manage diagnostic tool licenses to uphold medical standards. Supply chain operators track logistics software licenses for trade compliance. Environmental agencies license monitoring tools, ensuring data accuracy for regulatory reporting. Governmental bodies standardize software audits across agencies for fiscal responsibility. Media outlets manage editing software licenses to avoid copyright infringements. Hospitality businesses audit reservation system licenses for PCI compliance. Insurance companies track actuarial software usage to meet solvency regulations. Real estate firms manage property software licenses for data protection.

Automotive manufacturers audit design tools for industry standards. Pharmaceutical entities ensure research software compliance with FDA guidelines. Overall, escalating concerns over software compliance and auditing fuel the License Management Market by necessitating robust, automated solutions that safeguard organizations against the multifaceted risks of non-compliance in a software-centric world.

Global unlicensed software usage represents an USD18.7 billion revenue opportunity for technology companies in 2025, with one-third of respondents reporting piracy, overuse, and misuse as major problems causing over 30% revenue losses. Organizations can increase profits by 11% through improved software compliance, highlighting the economic imperative for license management.

Shift Towards Subscription and Usage-Based Licensing Models

In the License Management Market, the shift towards subscription and usage-based licensing models acts as a transformative driver, encouraging the development of dynamic platforms that track consumption metrics, automate billing, and optimize costs in alignment with evolving business needs where perpetual licenses are giving way to flexible, pay-as-you-go structures. This transition allows organizations to scale software usage without upfront capital investments, with license management tools providing real-time visibility into consumption patterns to prevent overage charges and ensure value realization from subscribed services. The driver is bolstered by the proliferation of SaaS offerings, where integrated management solutions facilitate multi-vendor license orchestration, enabling enterprises to mix and match services while maintaining centralized control over expenditures and renewals.

Finance sectors adopt these models for analytics software, paying only for processed data volumes to enhance budgeting accuracy. Healthcare providers subscribe to EHR systems, with management platforms monitoring user access to align costs with patient loads. Manufacturers utilize usage-based CAD licenses, optimizing spend during design phases. Retailers manage e-commerce platform subscriptions based on transaction volumes. Energy companies track simulation software usage for variable exploration projects. Public sectors subscribe to citizen service apps, scaling with demand fluctuations. Entertainment firms pay for content tools based on production hours.

Agricultural businesses subscribe to precision tools, billed on acreage monitored. Educational institutions manage learning software on per-student usage. Financial services subscribe to risk models, paying for computed scenarios. Gaming developers use engine licenses based on deployment metrics. Social media platforms subscribe to analytics tools per data stream. E-learning providers bill content access on consumption. Telemedicine services manage diagnostic subscriptions per consultation.

Supply chain operators subscribe to tracking software per shipment. Environmental firms pay for modeling based on simulations run. Governments subscribe to policy tools per user session. Media companies manage editing subscriptions per project. Hospitality subscribes to booking systems per reservation. Insurance firms pay for actuarial models per policy assessed. Real estate subscribes to virtual tour tools per listing.

Automotive subscribes to design software per prototype. Pharmaceuticals manage research tools per experiment. Overall, the shift towards subscription and usage-based licensing models advances the License Management Market by demanding agile, metric-driven platforms that support cost-effective, scalable software consumption in diverse operational contexts.

The subscription-based software sector demonstrates robust growth, with a projected compound annual growth rate of 19% from 2021 to 2025, leading to a market volume of USD679 billion by 2025. This expansion underscores the increasing preference for flexible licensing, driving demand for advanced management solutions to handle dynamic billing and compliance.

Expansion of Digital Transformation Across Industries

In the License Management Market, the expansion of digital transformation across industries constitutes a key driver, as organizations digitize operations to enhance efficiency, innovation, and competitiveness, requiring comprehensive license management to govern the burgeoning array of software tools integral to these initiatives. This expansion involves adopting AI, IoT, and big data analytics, where license platforms ensure optimal allocation and compliance for these technologies, preventing budget overruns and supporting seamless integration across ecosystems. The driver is intensified by the need for agility in volatile markets, with management solutions enabling rapid provisioning of licenses for new digital projects while auditing legacy systems for cost savings.

Banking transforms with fintech licenses managed for secure transactions. Healthcare digitizes patient records, licensing telehealth software compliantly. Manufacturing adopts Industry 4.0, managing IoT licenses for smart factories. Retail enhances omnichannel experiences, licensing e-commerce tools. Energy sectors digitize grids, licensing predictive maintenance software. Public services transform citizen engagement, licensing e-gov platforms. Entertainment digitizes content delivery, managing streaming licenses. Agriculture adopts precision tech, licensing drone software. Education shifts to online learning, licensing virtual tools. Finance digitizes trading, licensing algorithmic software. Gaming transforms with VR, licensing development kits.

Social media digitizes user analytics, licensing AI tools. E-learning expands platforms, licensing adaptive software. Telemedicine digitizes consultations, licensing diagnostic apps. Supply chains digitize tracking, licensing blockchain software. Environmental monitoring adopts sensors, licensing data analysis tools. Governments digitize services, licensing cybersecurity software. Media digitizes production, licensing editing suites. Hospitality transforms bookings, licensing AI chatbots. Insurance digitizes claims, licensing automation tools.

Real estate adopts virtual tours, licensing AR software. Automotive digitizes design, licensing simulation tools. Pharmaceuticals transform R&D, licensing bioinformatics software. Overall, the expansion of digital transformation across industries invigorates the License Management Market by necessitating sophisticated governance for the software underpinning these evolutions.

Digital transformation is projected to add USD100 trillion to the world economy by 2025, with 54% of employees requiring significant reskilling. Worldwide expenditures on digital transformation are expected to reach USD3.9 trillion by 2027, emphasizing the need for robust license management to support these initiatives.

Download Free Sample Report

Key Market Challenges

Complexity of Software Licensing Models

One of the most significant challenges facing the License Management Market is the growing complexity and diversity of software licensing models. Software vendors increasingly adopt a wide range of licensing structures to meet the evolving needs of enterprises and to maximize their revenue streams. These include perpetual licenses, subscription-based licenses, usage-based models, concurrent licensing, node-locked licenses, and hybrid arrangements that combine multiple approaches. While these licensing models are designed to provide flexibility, they have created enormous complexity for organizations that must monitor and manage multiple types of agreements simultaneously.

Enterprises that rely on software from multiple vendors often find themselves entangled in a web of varied terms, usage metrics, and compliance obligations. Each vendor may define usage in different ways, such as per user, per device, per processor, or per transaction, making it difficult to establish a standardized method of monitoring. This creates confusion among information technology administrators and procurement teams, who are responsible for ensuring compliance and optimizing costs. Furthermore, as organizations scale globally, they must navigate licensing agreements that may vary by region, jurisdiction, or business unit, compounding the complexity even further.

Without proper systems in place, enterprises risk overspending on unnecessary licenses, facing penalties for under-licensing, or experiencing disruptions in business operations due to compliance audits. Vendors themselves may intentionally design licensing models to be opaque, making it harder for customers to detect oversubscription or underutilization. This imbalance of power between vendors and enterprises places additional stress on businesses, as negotiating or renegotiating contracts becomes both time-consuming and resource-intensive. The challenge is magnified by the increasing adoption of cloud-based solutions, where licensing terms may change dynamically based on consumption, leading to unpredictable expenses.

As a result, organizations often struggle to develop clear strategies for managing licensing portfolios effectively. This complexity not only impacts cost control but also hinders the agility of enterprises that need to rapidly adopt new technologies to remain competitive. To overcome this challenge, businesses must invest in advanced license management platforms capable of providing real-time insights, automation, and predictive analytics, yet the implementation of such solutions can itself be resource-heavy and require significant organizational change. Ultimately, the convoluted nature of licensing models remains a core obstacle that slows down the efficiency and scalability of the License Management Market.

High Cost of Implementation and Maintenance

Another prominent challenge that restricts the growth of the License Management Market is the high cost of implementing and maintaining advanced license management systems. Enterprises recognize the importance of ensuring compliance and cost optimization, but the financial burden associated with deploying these solutions often becomes a barrier, particularly for small and medium-sized businesses. License management platforms require substantial investment in infrastructure, customization, integration, and training. Organizations must ensure that these systems are compatible with their existing information technology ecosystems, which can involve complex integrations with enterprise resource planning systems, procurement tools, and cloud platforms.

The initial implementation often demands dedicated consulting services, technical expertise, and specialized staff to design and configure the solution according to organizational requirements. Additionally, ongoing maintenance costs, such as software updates, vendor support contracts, and system upgrades, place a continuous financial strain on enterprises. The situation becomes even more challenging as the software landscape rapidly evolves, requiring license management platforms to keep pace with changing licensing models, regulatory mandates, and new deployment methods such as multi-cloud environments. For smaller organizations with limited budgets, this cost burden often forces them to rely on manual tracking methods such as spreadsheets, which are prone to inaccuracies and inefficiencies.

Even large enterprises that invest heavily in license management often struggle to achieve a timely return on investment, as the benefits of cost savings and compliance risk reduction may not be immediately visible. Moreover, organizations need to allocate resources for employee training and change management initiatives to ensure proper adoption of these platforms across departments. Without adequate adoption, the system may fail to deliver its intended value, further inflating costs. In some cases, vendors offering license management solutions may charge high subscription fees themselves, which paradoxically adds another layer of financial obligation for enterprises already trying to optimize licensing expenditures. This high cost of entry discourages widespread adoption of robust license management systems, limiting the market’s overall growth potential. Unless vendors can offer scalable, cost-effective, and modular solutions that cater to businesses of all sizes, the challenge of affordability will remain a major roadblock to the long-term expansion of the License Management Market.

Key Market Trends

Rising Adoption of Cloud-Based License Management Solutions

The License Management Market is experiencing a significant trend with the rising adoption of cloud-based solutions. Organizations are increasingly moving their core operations, software assets, and digital tools to cloud platforms, leading to complexities in managing diverse software licenses across multiple environments. Traditional on-premises license management systems are proving inadequate to handle the dynamic needs of hybrid and multi-cloud infrastructures. As a result, enterprises are embracing cloud-based license management platforms that provide centralized oversight, real-time license tracking, automated compliance monitoring, and integration with cloud service providers.

This trend is driven by the need for flexibility, scalability, and reduced operational costs. Furthermore, businesses in industries such as healthcare, finance, and information technology are under growing pressure to ensure compliance with stringent regulatory requirements. Cloud-based license management systems provide better auditing capabilities and improved visibility, which strengthens compliance while reducing risks of penalties and legal disputes. Vendors in the market are also integrating advanced features such as artificial intelligence-driven insights, predictive analytics, and automated license optimization, which help enterprises avoid underutilization or over-licensing.

The shift toward cloud adoption not only enhances operational efficiency but also ensures business continuity by enabling remote accessibility and real-time updates. With global enterprises accelerating their digital transformation journeys, cloud-based license management solutions are becoming a critical investment, ensuring that organizations remain agile, compliant, and cost-efficient. This trend is expected to continue dominating the License Management Market as businesses aim for greater control over complex software ecosystems.

Integration of Artificial Intelligence and Automation in License Management

Another transformative trend in the License Management Market is the increasing integration of artificial intelligence and automation. Organizations are seeking advanced solutions that can automate routine license management tasks such as tracking renewals, identifying unused licenses, and allocating software resources effectively across departments. Artificial intelligence technologies are enabling predictive analytics that help businesses forecast license requirements based on usage patterns and business growth. This reduces the risks associated with under-provisioning or overspending on software licenses.

Automation plays a pivotal role by eliminating manual errors, streamlining reporting, and ensuring that compliance audits are always up to date. For example, intelligent systems can detect non-compliance risks in real-time and alert administrators to take corrective action before regulatory violations occur. Furthermore, artificial intelligence-driven license optimization tools are being integrated into enterprise resource planning and cloud management systems, enhancing overall operational efficiency. Enterprises in technology-intensive industries such as banking, financial services, and healthcare are particularly benefiting from this trend as they deal with vast and complex license portfolios.

The use of automation also helps businesses adapt quickly to changing vendor licensing models, such as subscription-based or usage-based models, which require continuous monitoring. This integration of artificial intelligence and automation is not only improving compliance management but also providing actionable insights that drive strategic decision-making. As enterprises continue to focus on cost reduction and regulatory adherence, the role of artificial intelligence and automation in license management is expected to expand significantly.

Increasing Focus on Cybersecurity and Compliance in License Management

A critical trend shaping the License Management Market is the increasing focus on cybersecurity and compliance. With the rise in cyberattacks, data breaches, and intellectual property theft, enterprises are prioritizing secure and compliant license management practices. Unauthorized or pirated software usage can expose organizations to significant cybersecurity vulnerabilities, financial losses, and reputational damage. As regulatory frameworks across regions become more stringent, businesses are under constant scrutiny to demonstrate compliance with license agreements and data protection standards. License management systems are evolving to include advanced security features such as encryption, user authentication, and access control, which help organizations protect sensitive information and mitigate risks.

Furthermore, industries such as healthcare, government, and finance are increasingly adopting license management platforms that provide detailed compliance reports and automated audit trails, ensuring adherence to industry-specific regulations. Vendors are also integrating license management tools with cybersecurity frameworks, enabling enterprises to detect anomalies, unauthorized installations, and potential threats in real time. This heightened emphasis on cybersecurity is particularly important for global enterprises operating across multiple jurisdictions, where compliance requirements vary significantly.

In addition, the rise of remote work environments has increased the need for secure license management practices, as employees access software from diverse devices and locations. Enterprises are therefore investing in solutions that provide both robust compliance assurance and strong cybersecurity protection. This trend underscores the evolving role of license management systems from being administrative tools to becoming strategic enablers of enterprise security and governance. As digital threats continue to rise, the demand for secure and compliant license management practices is expected to remain a top priority across industries.

Segmental Insights

Component Insights

In 2024, the software segment dominated the global license management market and is expected to maintain its dominance throughout the forecast period. The growing need for organizations across industries to manage, monitor, and optimize the use of software licenses has significantly contributed to the adoption of license management software. This segment enables enterprises to reduce compliance risks, avoid unnecessary expenses arising from unused or underutilized licenses, and ensure adherence to regulatory standards. With the rapid digital transformation across industries, organizations are increasingly deploying diverse software applications, cloud solutions, and enterprise resource planning systems, which has further intensified the need for robust software-based license management solutions.

These solutions provide enhanced visibility into software usage, automate the tracking of licenses, and deliver actionable insights that support cost optimization and operational efficiency. Moreover, the rising complexity of licensing agreements, particularly in hybrid and multi-cloud environments, has amplified the reliance on advanced software platforms that can handle dynamic licensing models. Vendors are also introducing innovative software solutions with integrated artificial intelligence and machine learning capabilities, enhancing predictive analytics and compliance management.

The growing emphasis on subscription-based licensing models and the transition toward software-as-a-service has further elevated the importance of license management software in ensuring scalability and flexibility for businesses. In addition, industries such as information technology, healthcare, banking, financial services, and manufacturing are increasingly relying on automated license management software to strengthen governance and security frameworks.

These factors collectively position the software segment as the cornerstone of the license management market, enabling enterprises to not only manage their digital assets more effectively but also to achieve higher cost efficiency and compliance assurance. Therefore, the dominance of the software segment is expected to remain firm, driven by technological innovation and increasing organizational reliance on software ecosystems.

Deployment Mode Insights

In 2024, the cloud-based segment dominated the global license management market and is projected to maintain its dominance throughout the forecast period. The increasing adoption of cloud technologies across industries has fueled demand for cloud-based license management solutions due to their scalability, flexibility, and cost-effectiveness. Organizations are increasingly shifting from traditional on-premises systems to cloud-based platforms as these solutions allow seamless integration across diverse business applications, enable real-time monitoring of software usage, and provide enhanced accessibility from multiple locations. Cloud-based license management platforms are particularly valuable in hybrid and remote work environments, where enterprises require centralized visibility and control over their software assets.

Furthermore, the cloud-based model significantly reduces the upfront infrastructure investment and maintenance costs associated with on-premises deployment, making it an attractive option for both large enterprises and small to medium-sized businesses. Another major driver of this dominance is the ability of cloud-based solutions to support dynamic licensing models, subscription-based services, and software-as-a-service ecosystems, which are rapidly gaining traction across industries. In addition, cloud-based license management systems offer advanced security features, automated compliance monitoring, and analytics-driven insights that help organizations avoid penalties and optimize resource allocation.

Vendors are also innovating by incorporating artificial intelligence, machine learning, and automation tools into cloud-based platforms, thereby enhancing predictive capabilities and strengthening compliance governance. The global trend toward digital transformation and the widespread adoption of multi-cloud strategies are further reinforcing the demand for cloud-based deployment models. Given these advantages, the cloud-based segment has emerged as the preferred choice for organizations seeking agility, efficiency, and future-ready license management solutions, and it is expected to sustain its leading position in the global license management market over the coming years.

Download Free Sample Report

Regional Insights

Largest Region

In 2024, North America dominated the global license management market and is expected to maintain its dominance throughout the forecast period. The region’s leadership is primarily driven by the strong presence of major technology companies, advanced digital infrastructure, and widespread adoption of enterprise software across various industries. Organizations in North America are at the forefront of digital transformation, cloud migration, and subscription-based business models, all of which require robust license management solutions to ensure compliance, security, and cost optimization.

The high level of regulatory scrutiny in sectors such as banking, financial services, healthcare, and government further strengthens the need for advanced license management systems, as enterprises must adhere to strict software usage and compliance guidelines. Moreover, the rapid expansion of cloud-based deployment models and software-as-a-service ecosystems in the region is fueling demand for dynamic and scalable license management platforms. The rising complexity of managing hybrid and multi-cloud environments, coupled with increasing concerns regarding software piracy and unauthorized usage, has also encouraged enterprises in North America to invest heavily in comprehensive license management solutions.

In addition, the region is home to a large number of small, medium, and large enterprises that are increasingly adopting advanced analytics, artificial intelligence, and automation technologies, creating further opportunities for license management vendors to expand their offerings. Strong research and development activities, combined with strategic partnerships between software providers and service vendors, continue to drive innovation and growth in the North American market. With its advanced technological ecosystem, high software penetration rate, and early adoption of emerging digital solutions, North America is expected to sustain its dominant position in the global license management market over the coming years.

Emerging Region

The Middle East and Africa region is emerging as a significant growth frontier in the license management market during the forecast period. Although the market in this region is at a relatively nascent stage compared to more established markets such as North America and Europe, the region is demonstrating increasing potential due to rapid digital transformation initiatives, expanding adoption of enterprise software solutions, and the growing need for regulatory compliance across various industries. Organizations in sectors such as oil and gas, telecommunications, banking and financial services, and government are increasingly recognizing the importance of efficient license management to optimize software costs, ensure compliance with global licensing regulations, and mitigate risks associated with unauthorized usage.

Governments in the region are actively investing in information technology infrastructure and encouraging businesses to adopt modern enterprise software solutions, which further drives the need for structured license management practices. Additionally, the rise of small and medium-sized enterprises in countries such as the United Arab Emirates, Saudi Arabia, and South Africa is contributing to demand as these businesses seek scalable and cost-efficient license management tools to support their growth.

While challenges such as limited awareness and budget constraints persist, the rising focus on digitalization, coupled with growing partnerships between global license management vendors and local players, is expected to unlock significant opportunities in the region. The Middle East and Africa region is therefore emerging as an important hub for future expansion in the license management market, with strong potential to transition from early adoption toward more mature deployment in the coming years.

Recent Development

- In December 2024, Flexera made a major investment in its global partner program, unifying benefits from Flexera and Snow Software to create a stronger ecosystem. The initiative introduced enhanced capabilities for Managed Service Providers and added a partner services layer in Flexera One, designed to deliver scalable and customized customer services. This strategic move reflects Flexera’s focus on strengthening collaboration, driving innovation, and supporting partners in delivering greater value to clients across diverse industries worldwide.

- In January 2025, Flexera signed a definitive agreement to acquire NetApp’s Spot FinOps and Cloud Infrastructure business, including solutions such as SpotInst, CloudCheckr, and Fylamynt. This acquisition strategically enhanced Flexera’s hybrid cloud FinOps portfolio by broadening its container cost management capabilities and improving multi-cloud visibility. The move positioned Flexera to better support enterprises in optimizing cloud costs, managing complex hybrid infrastructures, and delivering stronger value in cloud financial operations.

- In August 2025, Flexera was recognized as a Leader in the Gartner Magic Quadrant for Software as a Service Management Platforms. This acknowledgment highlighted the company’s strong execution capabilities and comprehensive vision in the rapidly expanding Software as a Service management domain. The recognition reinforced Flexera’s position as a trusted provider of advanced Software as a Service management solutions, showcasing its ability to deliver innovation, value, and strategic support to enterprises navigating complex cloud and Software as a Service environments.

- In February 2024, Reprise successfully migrated its hosted services, including RLM Cloud and Activation Pro, to Amazon Web Services. This strategic move was aimed at enhancing reliability, ensuring greater service stability, and leveraging cloud-native capabilities. By shifting to Amazon Web Services, Reprise strengthened its infrastructure foundation, enabling improved scalability and performance while ensuring customers benefit from a more resilient and efficient service delivery environment aligned with evolving cloud adoption trends.

Key Market Players

- Flexera Software LLC

- Reprise Software Inc.

- Snow Software AB

- Thales Group (Gemalto NV)

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Hewlett Packard Enterprise Development LP

- ServiceNow Inc.

- Cherwell Software LLC

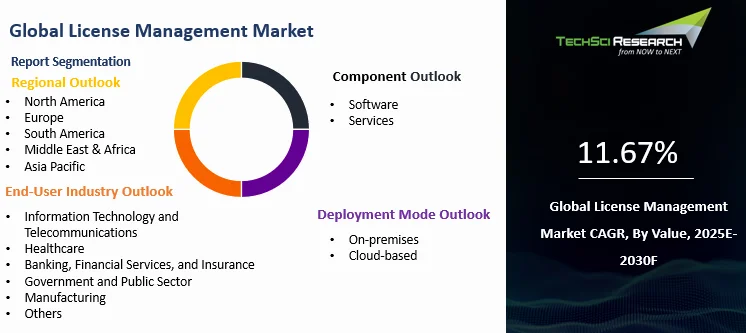

By Component | By Deployment Mode | By End-User Industry | By Region |

| | - Information Technology and Telecommunications

- Healthcare

- Banking, Financial Services, and Insurance

- Government and Public Sector

- Manufacturing

- Others

| - North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

|

Report Scope:

In this report, the Global License Management Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- License Management Market, By Component:

o Software

o Services

- License Management Market, By Deployment Mode:

o On-premises

o Cloud-based

- License Management Market, By End-User Industry:

o Information Technology and Telecommunications

o Healthcare

o Banking, Financial Services, and Insurance

o Government and Public Sector

o Manufacturing

o Others

- License Management Market, By Region:

o North America

§ United States

§ Canada

§ Mexico

o Europe

§ Germany

§ France

§ United Kingdom

§ Italy

§ Spain

o South America

§ Brazil

§ Argentina

§ Colombia

o Asia-Pacific

§ China

§ India

§ Japan

§ South Korea

§ Australia

o Middle East & Africa

§ Saudi Arabia

§ UAE

§ South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global License Management Market.

Available Customizations:

Global License Management Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Global License Management Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]