|

Forecast Period

|

2025-2029

|

|

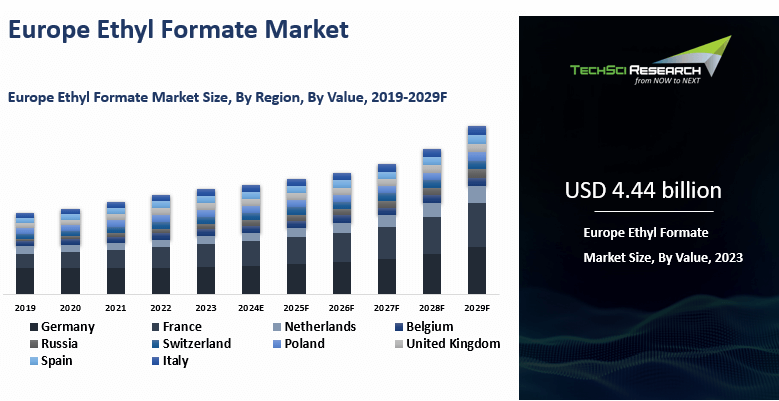

Market Size (2023)

|

USD 4.44 billion

|

|

CAGR (2024-2029)

|

3.48%

|

|

Fastest Growing Segment

|

Pharmaceutical

Intermediates

|

|

Largest Market

|

Germany

|

|

Market Size (2029)

|

USD 5.75 Billion

|

Market Overview

Europe Ethyl Formate Market was valued at USD

4.44 billion in 2023 and is anticipated to project robust growth in the

forecast period with a CAGR of 3.48% through 2029. Ethyl formate, also known as

ethyl methanoate, is an ester that is formed by the combination of formic acid

and ethanol through a chemical reaction called esterification. This compound is

widely used across various industries due to its excellent solvent properties.

One of its primary applications lies in

its ability to act as a solvent for cellulose acetate, which is a commonly

utilized material in the production of films, coatings, and synthetic fibers.

By effectively dissolving cellulose acetate, ethyl formate facilitates the

processing and application of this versatile material. Not only is ethyl

formate valued for its solvent capabilities, but it is also renowned for its

pleasant fruity fragrance, reminiscent of the enticing aromas of rum and

raspberries. This delightful scent has made it a popular choice as a flavoring

agent in the food and beverage sector. It imparts a delightful fruity note to a

wide range of products, including confectionery, baked goods, beverages, and

even ice cream.

Ethyl formate serves as a

fragrance component in perfumes, cosmetics, and personal care items, adding a

touch of fruity allure to the final product. Furthermore, ethyl formate plays a

crucial role as an intermediate compound in the synthesis of various

pharmaceuticals. It serves as a reagent during the production of diverse

pharmaceutical compounds, including antibiotics, anti-inflammatory drugs, and

antihistamines. The unique chemical properties of ethyl formate make it

well-suited for specific reaction steps in the synthesis of these important

compounds, contributing to the development of life-saving medications and

treatments.

Ethyl formate is a versatile

compound that serves multiple purposes across different industries. From its

solvent properties for cellulose acetate to its delightful fruity fragrance as

a flavoring agent, and its role in pharmaceutical synthesis, ethyl formate

continues to play a significant role in various applications, making it a

valuable asset in the world of chemistry and beyond.

Key Market Drivers

Growing Demand of Ethyl Formate in the Food

& Beverage Industry

The food and beverage industry is renowned for its unwavering focus on taste and flavor. Ethyl formate, a natural flavoring agent, plays a pivotal role in achieving this desired sensory experience by imparting a delightful and fruity aroma to various food and beverage products. Its versatility is evident in its widespread use across different sectors of the industry, including the production of flavored drinks, confectionery, bakery goods, dairy products, and alcoholic beverages.

By incorporating ethyl formate into these products, manufacturers can enhance the overall sensory experience for consumers, creating a sought-after and captivating palate. In the realm of fruit-flavored products, such as juices, carbonated drinks, and candies, ethyl formate takes center stage by providing an authentic and natural fruit taste. Its application extends to the dairy industry as well, where it contributes to the flavor profile of popular products like ice cream, yogurt, and flavored milk. This versatility and ability to recreate unique and appealing food products make ethyl formate a valuable ingredient in the creation of exquisite culinary experiences.

The growing demand for ethyl formate in the food and beverage industry is supported by rigorous regulatory approvals and adherence to stringent safety standards. Regulatory authorities ensure that ethyl formate meets the highest criteria for purity, quality, and safety before it can be used as a food additive. These approvals provide consumers with the confidence and assurance they seek, further promoting the utilization of ethyl formate in various food and beverage applications across Europe.

As consumers continue to prioritize natural and authentic flavors in their culinary choices, the demand for ethyl formate as a flavor enhancer is anticipated to surge. Furthermore, advancements in food processing technologies and the ongoing development of innovative food and beverage products are expected to bolster the demand for ethyl formate in the region, creating new opportunities for its utilization in the culinary landscape.

Growing Demand for Ethyl Formate in the Pharmaceutical Industry

Ethyl formate offers numerous benefits

and has a wide range of applications within the pharmaceutical industry. As an

intermediate in the synthesis of pharmaceutical compounds, it plays a crucial

role in the development of life-saving medications. Its versatility extends

beyond synthesis, as ethyl formate also possesses insecticidal properties,

making it an effective fumigant to control pests in stored pharmaceutical

products. In addition to its role as a solvent in

pharmaceutical formulations, ethyl formate plays a vital role in dissolving

active pharmaceutical ingredients (APIs) and other components. This aids in the

development of stable and effective formulations, ensuring the efficacy of the

final pharmaceutical products. Furthermore, its reactivity and compatibility in

synthesis pathways make it a preferred choice for pharmaceutical manufacturers,

enabling the production of a wide variety of therapeutic compounds. The growing

demand for ethyl formate in the pharmaceutical industry is supported by

rigorous regulatory approvals and adherence to safety standards.

Regulatory authorities ensure that ethyl

formate meets stringent criteria for purity, quality, and safety before it can

be used in pharmaceutical applications. These regulatory approvals provide

assurance to pharmaceutical companies, instilling confidence in the use of

ethyl formate in drug manufacturing processes across Europe and beyond.

Overall, ethyl formate's multifaceted nature, from its role in synthesis to its

insecticidal properties, makes it an invaluable ingredient in the

pharmaceutical manufacturing process. Its regulatory compliance and safety

standards further reinforce its position as a trusted and preferred choice in

the pharmaceutical industry.

Growing Demand of Ethyl Formate in Chemical

Synthesis

Ethyl formate offers numerous benefits

and versatile applications within the chemical industry. As a highly effective

solvent, it plays a vital role in dissolving and dispersing various substances,

facilitating the formulation of stable and efficient chemical products.

Furthermore, ethyl formate serves as a key intermediate in the production of a

wide range of chemical compounds, including pharmaceuticals, agrochemicals, and

flavoring agents. The growing popularity of ethyl formate is supported by its

reactivity and compatibility in synthesis pathways, making it a preferred

choice for chemical manufacturers. Its versatility and compatibility allow for

seamless integration into various chemical manufacturing processes, enhancing

overall efficiency and productivity.

To ensure the safety and quality of

ethyl formate, regulatory authorities impose stringent criteria for purity and

adherence to safety standards. These regulatory approvals provide assurance to

chemical companies, promoting the widespread use of ethyl formate in various

chemical applications across Europe. In the European market, the demand for

ethyl formate is expected to witness significant growth, driven by the rising

demand from the chemical industry. As the chemical sector continues to innovate

and develop new products and formulations, the demand for ethyl formate as a

solvent and intermediate is projected to increase. Additionally, advancements

in chemical manufacturing technologies and the emergence of sustainable and

eco-friendly solutions further contribute to the growing demand for ethyl

formate in the chemical industry.

Download Free Sample Report

Key Market Challenges

Lack of Sourcing of Raw Material

Certain raw materials used in the

production of ethyl formate are classified as critical by the European Union.

These critical raw materials, which have a high economic importance, are

essential for the production of ethyl formate and are associated with a high

risk of supply disruption. They play a vital role in the manufacturing of

various goods and applications, contributing significantly to Europe's economy.

Securing access to these raw materials is a pressing issue for Europe's ethyl

formate industry. The industry faces a growing demand for ethyl formate, driven

by its wide range of applications.

However, limited domestic sources pose

challenges in meeting this demand, necessitating the need for effective

sourcing strategies. Dependence on imports further raises concerns regarding

supply chain vulnerabilities, geopolitical risks, and price volatility.

Ensuring a stable and reliable supply of these critical raw materials becomes

crucial to mitigate these risks and maintain a sustainable ethyl formate industry

in Europe.

High Cost of Research and Development

R&D initiatives involve significant

financial investments, including personnel, equipment, facilities, and

materials. The cost of conducting thorough research, testing, and development

processes can be substantial, particularly for complex chemical compounds like

ethyl formate. These costs can create financial challenges for companies

operating in the Europe ethyl formate market.

The lengthy duration of

R&D projects can further contribute to the overall costs. It may take

several years of dedicated research and testing before a breakthrough is

achieved or a new product formulation is developed. This extended timeline

increases expenses and requires sustained financial commitment from ethyl formate

manufacturers. The high cost of R&D poses challenges to the competitiveness

and market growth of the Europe ethyl formate industry. Smaller companies with

limited financial resources may struggle to allocate funds for extensive

R&D activities. This can hinder their ability to innovate, develop new

products, and keep up with market demands.

The high costs associated

with R&D can increase the price of ethyl formate products. If manufacturers

are unable to recoup their investment in research and development, they may

pass on these costs to consumers, potentially making their products less

competitive in the market. In addition to the financial implications, the

complexity of R&D activities in the ethyl formate industry requires specialized

expertise and resources. Companies need to invest in skilled researchers,

advanced equipment, and state-of-the-art facilities to effectively carry out

their R&D projects. This adds another layer of complexity and cost to the

overall R&D process.

The global regulatory

landscape surrounding chemical compounds like ethyl formate adds additional

challenges to R&D efforts. Companies must navigate through stringent

regulations and compliance requirements, which can further increase the time

and cost associated with R&D initiatives. Given these factors, companies in

the Europe ethyl formate market need to carefully evaluate the potential

benefits and risks of undertaking R&D activities. While R&D can lead to

groundbreaking discoveries and product advancements, it requires substantial

financial commitment and a long-term perspective. Balancing the costs and

benefits of R&D is crucial for sustaining competitiveness and driving

market growth in the ethyl formate industry.

Key Market Trends

Growing Advancements in Synthesis of

Ethyl Formate

Advancements in the synthesis of ethyl

formate play a crucial role in the Europe ethyl formate market. These

advancements, driven by continuous research and innovation, enable

manufacturers to improve the efficiency and quality of the production process.

By exploring new applications and techniques, they are able to enhance the

overall sustainability of ethyl formate manufacturing.

One area of research focuses on the

activated release of ethyl formate vapor from its precursor compounds. This

technique allows for a controlled and targeted release of ethyl formate, making

it a promising alternative to synthetic fumigants. Scientists are working on

developing innovative methods to achieve this, ensuring effective and safe application

in various industries.

Catalytic methods have

shown promising results in enhancing the activity and selectivity of ethyl

formate synthesis. By employing catalysts such as copper and supported

catalysts like ZrO2, manufacturers can facilitate efficient reactions and

improve the overall yield of ethyl formate. These developments not only

contribute to the advancement of the synthesis process but also have a positive

impact on cost-effectiveness and productivity.

Scientists are actively

exploring novel precursors for ethyl formate synthesis. For instance, the

condensation reaction of adipic acid dihydrazide and triethyl orthoformate has

been investigated to form diethyl N,N'-precursor for activated release

applications. This innovative approach expands the possibilities for ethyl

formate production and enables manufacturers to diversify their product

offerings. In conclusion, the growing advancements in the synthesis of ethyl

formate are reshaping the Europe ethyl formate market. These continuous

improvements provide manufacturers with valuable opportunities to optimize

their production processes, reduce costs, and expand their product offerings.

By embracing innovation and sustainable practices, the future of ethyl formate

manufacturing looks promising.

Segmental Insights

Type Insights

Based on the category of type, the superior

grade segment emerged as the dominant segment in the Europe market for ethyl formate

in 2023. There is a significant and ever-increasing demand for high-quality

products in Europe, particularly within the food and beverage and

pharmaceutical industries. These sectors prioritize the use of superior-grade ethyl formate due to its ability to meet the stringent quality requirements

imposed by the European Union. To ensure the safety of human consumption and

use, the European Union has implemented rigorous regulations concerning the

utilization of ethyl formate. These regulations explicitly mandate that ethyl

formate must be of the highest quality, adhering to strict standards. The

recognition and appreciation for the benefits of utilizing superior grade ethyl

formate are continuously growing. Its superior quality offers numerous

advantages over first-grade ethyl formate, including enhanced purity, a higher

flash point, and an extended shelf life. These properties make it an ideal

choice for industries that prioritize safety, efficiency, and longevity in

their products.

Download Free Sample Report

Regional Insights

Germany emerged as the dominant region in the Europe Ethyl Formate Market in 2023, holding the largest market share in

terms of value. Germany has a well-established and globally recognized chemical

industry that has thrived over the years. With a rich history of chemical

manufacturing, Germany has honed its expertise and built advanced research and

development capabilities, making it a true leader in various chemical markets,

including the production of ethyl formate. The country's central location in

Europe further enhances its competitive edge, facilitating efficient export and

distribution of chemical products to an extensive network of European and

international markets. This strategic advantage, combined with Germany's robust

infrastructure and commitment to innovation, solidifies its dominance in the

chemical market, setting the stage for continued growth and success.

Key Market Players

- Ernesto Ventós S.A.

- Merck KGaA

- Thermo Fisher Scientific GmbH

- Symrise AG

- ECSA Chemicals AG

- abcr GmbH

- Eastman Chemical B.V.

- Redox Ltd

- Santa Cruz Biotechnology, Inc.

- Ataman Kimya A.S.

|

By Type

|

By Application

|

By Country

|

- First Grade

- Superior Grade

|

- Solvent

- Pharmaceutical Intermediates

- Insecticide and Bactericides

- Flavors

- Others

|

- Germany

- United Kingdom

- France

- Russia

- Spain

- Italy

- Netherland

- Poland

- Switzerland

- Belgium

|

Report Scope:

In this report, the Europe Ethyl Formate Market has

been segmented into the following categories, in addition to the industry

trends which have also been detailed below:

- Europe Ethyl Formate Market, By Type:

o First Grade

o Superior Grade

· Europe

Ethyl Formate Market, By

Application:

o Solvent

o Pharmaceutical Intermediates

o Insecticide and Bactericides

o Flavors

o Others

- Europe Ethyl Formate Market,

By Country:

o Germany

o United Kingdom

o France

o Russia

o Spain

o Italy

o Netherland

o Poland

o Switzerland

o Belgium

Competitive Landscape

Company Profiles: Detailed analysis of the major companies

present in the Europe Ethyl Formate Market.

Available Customizations:

Europe Ethyl Formate Market report with the given

market data, TechSci Research offers customizations according to a company's

specific needs. The following customization options are available for the

report:

Company Information

- Detailed analysis and

profiling of additional market players (up to five).

Europe Ethyl Formate Market is an upcoming report

to be released soon. If you wish an early delivery of this report or want to

confirm the date of release, please contact us at [email protected]