|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 321.67 million

|

|

Market Size (2030)

|

USD 618.13 million

|

|

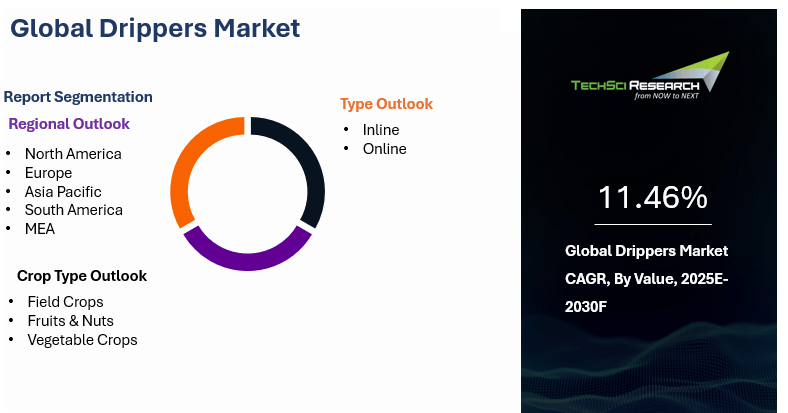

CAGR (2025-2030)

|

11.46%

|

|

Fastest Growing Segment

|

Inline

|

|

Largest Market

|

Asia Pacific

|

Market Overview

Global Drippers Market was valued at USD

321.67 million in 2024 and is expected to reach USD 618.13 million in the

forecast period with a CAGR of 11.46% through 2030. The growth of the global

drippers market is being driven by the increasing adoption of micro-irrigation

systems, particularly in water-scarce regions and countries facing agricultural

water management challenges. Drippers, being a core component of drip irrigation

systems, ensure precise water delivery directly to the root zone of plants,

significantly reducing water wastage. With rising awareness of sustainable

agricultural practices and increasing government support for efficient

irrigation technologies, farmers are increasingly shifting toward dripper-based

systems to improve crop yield and optimize water usage.

Technological advancements in dripper

design, such as pressure-compensating emitters, anti-clogging features, and

UV-resistant materials, have improved system durability and efficiency. These

innovations are gaining traction across both developed and emerging markets.

Additionally, the rise of smart irrigation solutions integrated with sensors

and automation is further enhancing the performance of dripper systems,

allowing real-time control and monitoring, thereby attracting large-scale and

commercial farmers toward advanced irrigation systems.

Moreover, the expansion of horticulture,

greenhouse farming, and high-value crop cultivation such as fruits, vegetables,

and flowers—has significantly boosted the demand for drippers. Inline drippers,

in particular, are witnessing rapid adoption due to their ease of installation,

reduced maintenance, and suitability for dense crop spacing. As food security

concerns rise and climate change continues to impact traditional farming,

precision irrigation technologies like drippers are expected to play a vital role

in transforming global agricultural practices and ensuring sustainable growth

in the coming years.

Key Market Drivers

Increasing

Government Initiatives for Supporting Farmers

Governments across the globe are

actively promoting micro-irrigation systems, including drippers, as part of

their broader efforts to conserve water and increase agricultural productivity.

Subsidies, low-interest loans, and financial incentives are being offered to

encourage farmers to transition from traditional irrigation methods to drip

systems. These programs aim to reduce water consumption, especially in arid and

semi-arid regions, while enhancing crop yields. According to the

International Commission on Irrigation and Drainage (ICID), over 75 countries

had national-level micro-irrigation support programs as of 2024, reflecting the

global shift toward sustainable irrigation.

In developing economies, such as India

and Brazil, governments are scaling up efforts to make precision irrigation

more accessible. In India, under the Pradhan Mantri Krishi Sinchayee Yojana

(PMKSY), farmers are eligible for subsidies up to 55% for adopting drip

irrigation systems. As per the Indian Ministry of Agriculture, over 1.4

million hectares of land were covered under micro-irrigation in 2023, with a

large share adopting dripper systems. Such initiatives not only help

farmers manage water more efficiently but also reduce input costs related to

energy and fertilizers by delivering water directly to the root zone.

The role of public-private partnerships

is also increasing in the promotion of drippers. Companies like Netafim, Jain

Irrigation, and Rivulis are working closely with governments to implement

large-scale irrigation projects. A recent example includes Netafim’s

establishment of its first production facility in North Africa, supported by

regional development initiatives, to locally manufacture and distribute

precision irrigation equipment. These collaborations are helping to reduce

dependency on imports and are lowering product costs, making drippers more

affordable for local farmers, particularly in Africa and the Middle East.

Furthermore, regional governments are

launching targeted programs to accelerate dripper adoption in water-stressed

areas. For instance, the government of Andhra Pradesh, India, allocated

approximately USD 181 million in 2022 to introduce drip irrigation on 3.75 lakh

acres of farmland. In the United States, the USDA’s Environmental Quality

Incentives Program (EQIP) continues to fund the installation of water-saving

irrigation technologies. These programs are vital for improving long-term

agricultural sustainability and food security, while also boosting demand for

drippers in both domestic and export markets.

Reducing

Water Wastage

The increasing scarcity of freshwater resources across

the globe has significantly influenced the demand for drippers in modern

agriculture. With traditional irrigation methods leading to high levels of

water wastage due to evaporation, runoff, and deep percolation, farmers are

shifting toward efficient irrigation technologies. Drippers release water

slowly and directly to the root zone of plants, minimizing water loss and

optimizing absorption. This targeted watering technique not only conserves

water but also improves plant health by maintaining consistent moisture levels,

thus supporting sustainable farming practices in drought-prone and arid

regions.

Drippers also help in preventing common soil problems

associated with conventional irrigation, such as waterlogging and soil erosion.

By allowing water to seep gradually into the soil from the top, drippers

protect the soil’s structure and preserve its fertility. This is crucial for

maintaining long-term crop productivity. Moreover, data shows that drip

irrigation systems can reduce water usage by up to 60% compared to flood

irrigation, making it an effective solution for conserving one of the most

vital agricultural inputs. As awareness of soil health grows, farmers

increasingly recognize drippers as essential tools for long-term land

sustainability.

Governments around the world are introducing programs

focused on wastewater management and water conservation, in which drip

irrigation plays a key role. In Turkey, for instance, initiatives have been

launched to promote drip irrigation systems and the construction of underground

dams. These measures aim to conserve water while improving agricultural

efficiency in semi-arid regions. Such programs not only address water shortages

but also encourage farmers to adopt technologies like drippers that align with environmental

conservation goals.

With climate change intensifying and water

availability becoming more erratic, the role of smart and precise irrigation

systems is becoming increasingly important. Drippers, often integrated with

modern technologies like automated timers and soil moisture sensors, enable

real-time control and data-driven irrigation decisions. As more farmers and

agribusinesses adopt precision farming techniques, the use of drippers is

expected to accelerate, contributing significantly to water conservation and

the overall efficiency of global agricultural practices

Download Free Sample Report

Key Market Challenges

High Initial Installation and Maintenance

Costs

One of the most significant challenges in the global

drippers market is the high initial cost of system installation, which includes

expenses for pipelines, emitters, filtration units, pressure regulators, and

connectors. For small and marginal farmers—particularly in developing

regions this upfront investment can be prohibitively expensive despite the

promise of long-term water savings and improved yields. Unlike traditional

irrigation systems, drip systems require careful layout planning and professional

setup to ensure optimal functioning. Additionally, energy costs associated with

water pumping and pressure regulation can further increase the total cost of

ownership. While government subsidies are available in many countries, they are

not always accessible or timely, creating uncertainty for growers considering

this transition. As a result, many farmers, especially in resource-constrained

areas, delay or avoid the adoption of dripper systems despite understanding

their long-term efficiency and sustainability benefits.

Beyond the initial investment, ongoing maintenance

costs also pose a challenge, especially in regions with poor water quality.

Drippers are sensitive to clogging from sediments, minerals, or biological

contaminants present in the water. This necessitates the use of filtration

systems and regular system flushing, which adds to operational costs. In

addition, damaged or malfunctioning emitters must be frequently monitored and

replaced to ensure uniform water distribution. Lack of technical expertise

among users can further increase maintenance issues, requiring external support

or service contracts that may not be readily available in rural regions. For

commercial farms managing large-scale installations, the labor and time

required for routine inspection and repair can be considerable. These

persistent maintenance demands, combined with limited access to technical

support, continue to hinder widespread adoption of dripper systems.

Key Market Trends

Rising Adoption of Smart and Automated

Irrigation Systems

The global drippers market is witnessing a significant

shift toward smart and automated irrigation systems, driven by the need for

improved efficiency, precision, and sustainability in agriculture. These

systems utilize sensors, timers, weather forecasting tools, and IoT-based

controllers to monitor soil moisture, temperature, and crop requirements in

real-time. By automating water delivery through drippers, farmers can apply the

exact amount of water needed, minimizing waste and maximizing crop health. This

not only reduces labor costs and human error but also supports higher yields

and resource optimization. The increasing penetration of smartphones and

internet connectivity in rural areas, coupled with falling prices of sensors

and smart devices, is accelerating the adoption of such technologies.

Large-scale farms, especially in North America and Europe, are leading this

transition, while developing nations are also beginning to embrace digital

solutions under government and private sector initiatives.

Smart irrigation systems offer several long-term

benefits, particularly in regions prone to water scarcity or extreme climatic

conditions. Automated drippers help in consistent irrigation scheduling,

reducing the risk of under- or over-watering, which is critical for sensitive

crops. Moreover, integration with satellite data and mobile apps allows farmers

to control and adjust irrigation remotely, enhancing operational convenience.

These systems also generate actionable insights through data analytics, helping

growers make informed decisions regarding water usage, fertilization, and crop

planning. As environmental concerns grow and sustainable farming practices gain

importance, the demand for smart irrigation systems is expected to rise

further. Agricultural technology companies are increasingly investing in

R&D to make such systems more affordable and user-friendly, expanding their

appeal among small and medium-scale farmers globally.

Segmental Insights

Type

Insights

Based

on the type, Inline drippers emerged as the fastest-growing segment in the Global Drippers Market, driven by their ease of installation, uniform water distribution, and cost-effectiveness for large-scale farming. These drippers are integrated directly into the lateral pipes, significantly reducing labor requirements and minimizing risks of emitter dislocation or damage. They are particularly well-suited for closely spaced crops such as vegetables, cotton, and sugarcane—key components of intensive farming. Moreover, their clog-resistant design and compatibility with mechanized installation methods make them highly attractive for commercial agriculture. These advantages are fueling rapid adoption across both developed and emerging markets.

Crop

Type Insights

Based on the crop type, Field Crops

emerged as the dominant segment in the Global Drippers Market in 2024 due to

the increasing adoption of drip irrigation systems for water-intensive and

large-acreage crops such as cotton, sugarcane, maize, and pulses. Field crops

benefit significantly from precise water delivery provided by drippers, which

helps reduce water wastage, improve crop yields, and lower energy and

fertilizer usage. Governments in countries like India, Brazil, and China have

actively promoted drip irrigation in field crop cultivation through subsidies

and training programs. This has driven large-scale implementation, especially

in water-stressed and high-productivity agricultural regions.

Download Free Sample Report

Regional Insights

Asia Pacific emerged as

the dominant region in the Global Drippers Market in 2024, driven by increasing

government initiatives to promote micro-irrigation, rising water scarcity, and

growing adoption of modern farming techniques. Countries like India and China

are at the forefront, supported by large agricultural land availability and

favorable policies offering subsidies for drip irrigation systems. The region's

focus on improving crop yields while conserving water has led to widespread

implementation of drippers, especially for field crops and horticulture.

Additionally, the presence of key manufacturers, expanding rural

electrification, and rising awareness among farmers about efficient water use

are fueling market growth.

Asia-Pacific emerged as

the fastest growing region in the Global Drippers Market during the forecast

period, driven by rapid agricultural modernization, increasing awareness about

water conservation, and growing government support for micro-irrigation systems.

The region faces significant water scarcity issues, especially in countries

like India, China, and Vietnam, making precision irrigation solutions like

drippers highly essential. Subsidy programs, low-interest loans, and awareness

campaigns are encouraging small and marginal farmers to adopt drip irrigation.

Moreover, the expansion of high-value crop cultivation, advancements in

agri-tech, and increasing private sector involvement are accelerating adoption.

Rising population and food demand further push the need for efficient

irrigation systems, fueling robust market growth.

Recent Developments

- In February 2025, Orbia’s precision ag unit, Netafim, has introduced the world’s first Hybrid Dripline, integrating inline dripline with a built-in outlet. This innovative system merges precision of inline and on-line drippers into one clog‑resistant, leak‑free setup, eliminating manual hole‑punching and migration rings. It offers significant labor savings and reliable performance for vineyards, orchards, greenhouses—and even mining irrigation.

- In November 2024, Rivulis has launched the D4000 PC thin‑wall pressure‑compensated drip line, specifically engineered for high-value crops like potatoes and tomatoes grown on challenging terrain. With uniform flow across slopes, extended lateral coverage (25 % longer runs), and customizable flow rates (0.16 and 0.23 gph), it enhances productivity, reduces material costs, and supports sustainable farming with recyclable components.

- In October 2024, Orbia Precision Agriculture’s Netafim unveiled groundbreaking irrigation innovations at EIMA 2024 in Bologna. The company introduced GrowSphere™, an all‑in‑one irrigation and fertigation operating system powered by IoT and data analytics, alongside Orion PC™, a thin‑wall, pressure‑compensated dripline. These products aim to boost efficiency, optimize water use, and simplify operations across diverse farm types.

Key Market Players

- The Toro Company

- Hunter Industries Inc.

- Rivulis Irrigation Ltd

- Netafim Limited

- Rain Bird Corporation

- Jain Irrigation Systems

Ltd.

- Elgo Irrigation Ltd.

- Metzer

- Chinadrip Irrigation

Equipment Co. Ltd.

- Azud

|

By Type

|

By Crop Type

|

By Region

|

|

|

- Field Crops

- Fruits & Nuts

- Vegetable Crops

|

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

|

Report Scope:

In this report, Drippers Market has

been segmented into following categories, in addition to the industry trends

which have also been detailed below:

- Drippers Market, By Type:

- Drippers Market, By Crop Type:

- Field Crops

- Fruits & Nuts

- Vegetable Crops

- Drippers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company

Profiles: Detailed

analysis of the major companies present in Drippers Market.

Available Customizations:

With the given market data, TechSci

Research offers customizations according to a company’s specific needs. The following

customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Drippers Market is an upcoming report to be released soon. If you wish an early delivery of this report or want to confirm the date of release, please contact us at [email protected]