|

Forecast Period

|

2026-2030

|

|

Market Size (2024)

|

USD 1.19 Billion

|

|

Market Size (2030)

|

USD 1.70 Billion

|

|

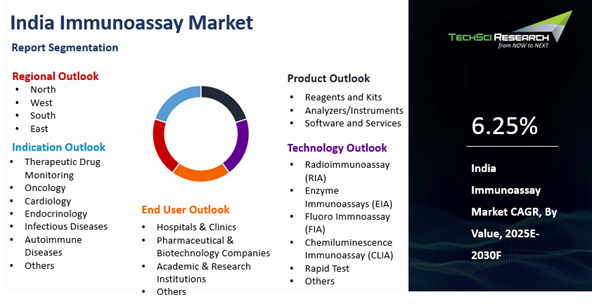

CAGR (2025-2030)

|

6.25%

|

|

Fastest Growing Segment

|

Reagents and Kits

|

|

Largest Market

|

West India

|

Market Overview

The Immunoassay Market in India was valued at USD 1.19 billion in 2024 and is projected to reach USD 1.70 billion by 2030, growing at a CAGR of 6.25% during the forecast period. This growth reflects the increasing reliance on immunoassay technologies as essential tools in clinical diagnostics and biomedical research.

Immunoassays are biochemical tests that detect and quantify specific substances in complex biological samples by leveraging the highly selective binding of antibodies or immunoglobulins. These assays are widely used in diagnostics and research, including infectious disease testing, endocrinology, autoimmune disorders, and oncology, making them indispensable in modern healthcare systems.

Growth in the Immunoassay Market in India is primarily driven by the rising prevalence of chronic, autoimmune, and infectious diseases, which has heightened demand for accurate, sensitive, and rapid diagnostic solutions. Immunoassays play a critical role in early disease detection, prognosis, and treatment monitoring, supporting improved clinical outcomes.

Clinical evidence continues to reinforce the diagnostic value of immunoassay technologies. In October 2023, a tertiary care study in Bihar evaluated the use of Indirect Immunofluorescence (IIF) and Line Immunoassay (LIA) for diagnosing autoimmune diseases in 98 patients. The study demonstrated that specific IIF fluorescence patterns most notably the speckled pattern were strongly associated with systemic lupus erythematosus, with autoantibodies such as anti-U1-snRNP, anti-SS-A/Ro60, and anti-SS-B/La frequently identified. The findings highlighted IIF as an effective screening method, with LIA recommended for confirmatory testing in cases with clinical ambiguity.

Technological advancements are further accelerating market expansion by enhancing assay sensitivity, specificity, automation, and ease of use. These innovations have increased the clinical utility of immunoassays across hospitals, diagnostic laboratories, and research institutions. Additionally, improved availability and broader access to immunoassay products are supporting their widespread adoption across India’s expanding healthcare infrastructure.

As the Immunoassay Market in India continues to grow, it is expected to strengthen diagnostic capabilities, improve patient management, and support ongoing advancements in medical research and precision diagnostics.

Key Market Drivers

High Sensitivity

and Specificity of Immunoassays

The high sensitivity and specificity of immunoassays are key factors supporting greater adoption in Indian diagnostic laboratories, as they can detect and quantify biomarkers at very low concentrations, enabling earlier and more reliable clinical decision-making for both infectious diseases and cancer care. For instance, India’s National Cancer Registry Programme estimated 14,61,427 new cancer cases in 2022, which increases routine demand for accurate screening and monitoring assays where immunoassays are widely used for biomarker-based evaluation and follow-up.

As a second India-specific indicator of the expanding organised testing ecosystem, the Government of India’s e-RaktKosh platform is used by more than 2800 blood banks across 36 States and Union Territories, reflecting the scale at which quality-focused, standardised laboratory workflows are being digitised. In this context, high-performing immunoassays help reduce false results, build clinician confidence, and support timely intervention, which sustains utilisation as India’s diagnostic capacity and preventive screening culture continue to deepen.

Technological

Advancements in Immunoassay Instruments

Technological advancements in immunoassay instruments are playing a pivotal role in accelerating growth in India's immunoassay market. The rising prevalence of chronic and infectious diseases has intensified demand for reliable, high-performance diagnostic solutions. In response, next-generation immunoassay systems characterized by high sensitivity, rapid turnaround times, and compact design are transforming diagnostic workflows by enabling early disease detection and more effective patient management, thereby reducing pressure on healthcare systems.

Manufacturers are increasingly prioritizing automation and miniaturization to improve laboratory efficiency, throughput, and consistency. These innovations are not only enhancing diagnostic accuracy but are also opening new opportunities in advanced therapeutics research and drug discovery, positioning immunoassays as a critical component of India’s expanding life sciences ecosystem.

A notable example is Mindray, whose immunoassay platforms incorporate advanced chemiluminescence technology to deliver high sensitivity, specificity, and a broad assay menu. The Mindray Serum Automation Line (SAL-6000 and SAL-9000) integrates chemistry analyzers with chemiluminescence immunoassay systems through a patented automated serum analysis design. This integration optimizes laboratory space and manpower utilization while ensuring highly reliable and reproducible test results, supporting high-volume diagnostic environments.

The rapid adoption of point-of-care (POC) immunoassay testing is further reshaping diagnostics in India. POC systems are improving accessibility to quality diagnostics in remote and resource-limited regions, enabling faster clinical decision-making, timely treatment, and improved patient outcomes.

Government initiatives to strengthen healthcare infrastructure, combined with growing awareness of preventive healthcare and personalized medicine, are further supporting market expansion. These efforts are ensuring wider deployment of advanced immunoassay instruments across the country. Collectively, technological innovation, improved accessibility, and supportive policy frameworks are positioning immunoassay instruments as key growth drivers in the Immunoassay Market in India, fundamentally transforming the nation’s diagnostic landscape.

Increasing

Prevalence of Chronic and Infectious Diseases

In India, the

surge of chronic and infectious diseases, such as cardiovascular disease,

diabetes, cancer, tuberculosis, and hepatitis, has significantly driven the

growth of the immunoassay market. These diseases have posed a formidable

challenge to the healthcare system, necessitating the development and adoption

of improved diagnostic techniques. In response to this growing need,

immunoassays have emerged as a vital tool, offering fast, accurate, and

cost-effective detection of various diseases. Their ability to provide reliable

results has made them increasingly prominent in the Indian healthcare

landscape.

According to National Library of Medicine, about 21% of the elderly in India reportedly have at least one chronic disease. Seventeen percent elderly in rural areas and 29% in urban areas suffer from a chronic disease. Hypertension and diabetes account for about 68% of all chronic diseases. The rise in health awareness among the population and the Indian government's

focus on improving healthcare infrastructure have played a crucial role in the

widespread adoption of immunoassays. The establishment of advanced diagnostic

centers equipped with state-of-the-art technologies has further accelerated

their usage.

India's large population also creates a significant patient pool, increasing demand for efficient and reliable diagnostic methods. As a result, the

immunoassay market has expanded rapidly, becoming an indispensable

component in India's fight against the escalating burden of chronic and

infectious diseases. The continued growth and advancement of the immunoassay

market in India underscore the importance of these diagnostic tools in

addressing the nation's healthcare challenges. By facilitating early

and accurate detection, immunoassays improve patient outcomes and overall population well-being.

Increasing Incidence

of Cancer

The rising incidence of cancer in India is a significant driver of the immunoassay market's growth. Immunoassays, a bioanalytical method used to detect the

presence and concentration of proteins in a sample, play a vital role in cancer

diagnosis, patient monitoring, and therapy selection. As the number of cancer

cases continues to rise, the demand for accurate, reliable, and quick

diagnostic methods has soared, fueling the expansion of the immunoassay market

in India.

India, with

its burgeoning population and a rising middle-class, presents a vast patient

pool and a growing demand for advanced healthcare infrastructure. With the

growing awareness about the importance of early detection of cancer, there has

been a surge in routine screenings, further increasing the need for

immunoassays. The government's efforts to improve healthcare

infrastructure and make cutting-edge diagnostic tools accessible to a wider segment of the population have also contributed to the growth of the

immunoassay market in the country. The rise of local immunoassay

manufacturers focused on cost-effective solutions for the Indian market has made these essential diagnostic tools more accessible to healthcare facilities nationwide, catalyzing the industry's expansion. This

combination of factors underscores how the rising incidence of cancer in India directly drives growth in the immunoassay market, creating opportunities for innovation and advances in cancer diagnostics and treatment.

Key Market Challenges

Stringent

Regulatory Scenario for Approval of Immunoassays

The stringent

regulatory environment for approving immunoassays in India is a

significant hindrance to market growth. Obtaining approval for new assays

requires a rigorous, time-consuming process that involves a thorough review of

clinical efficacy, safety, and quality. The Central Drugs Standard Control

Organization (CDSCO), the national regulatory body for pharmaceuticals and

medical devices, mandates strict adherence to these parameters. This regulatory

scrutiny, albeit necessary to maintain high standards of healthcare and ensure

patient safety, often results in substantial delays in bringing new products to

the market. Given the rapidly evolving nature of diseases and the resultant

demand for advanced diagnostic tools, these delays could prove costly for both

patients and manufacturers. Timely access to innovative immunoassays can significantly impact disease diagnosis and treatment outcomes. However, the

stringent regulatory requirements and the associated lengthy approval process

may discourage companies from investing in the development of new immunoassays

in India.

In addition to

delays, the high costs of complying with these regulatory norms further strain manufacturers' resources. Small and medium-sized

companies, in particular, may find it challenging to navigate the complex and

expensive regulatory landscape. In an environment where innovation and speed

are essential, these challenges pose a barrier to the growth and development of

the immunoassay market in India. Efforts to streamline the regulatory approval

process and reduce the burden on manufacturers while maintaining high standards

of safety and efficacy are crucial. Balancing the need for stringent regulation

with the need to facilitate timely access to innovative immunoassays is vital to the growth and advancement of healthcare in India.

Complexity of

Procedures

The growth of

immunoassay techniques in India is currently being hindered by the complexity

of the procedures involved. Immunoassays, despite their diverse applications in

diagnostic and therapeutic settings, often involve intricate

protocols and require a high level of expertise to perform accurately. This

complexity is a significant barrier, especially in a country like India, where

resources and specialized training can be limited. Coupled with this, the lack

of standardized procedures and the need for advanced laboratory infrastructure

to execute these tests further exacerbate the challenge. Equally significant is

the time-consuming nature of these assays, limiting their use in time-sensitive

diagnostics. The cost implications of these complex procedures

cannot be overlooked. The costs of procuring sophisticated

reagents and maintaining the necessary equipment can be prohibitive, thereby

limiting the widespread adoption of immunoassay techniques. When combined, these factors are slowing the growth of immunoassays in India, calling for urgent

simplification of procedures and training of personnel to unlock the full potential

of this powerful tool in healthcare.

Key Market Trends

Increased

Patient Awareness

The growth of

immunoassay testing in India is significantly influenced by increasing patient awareness of advances in diagnostic techniques.

Immunoassays, which provide fast and accurate results, are becoming the

preferred diagnostic method for numerous conditions, including infectious

diseases, endocrine disorders, and oncological conditions. As the Indian

population gains knowledge about these modern diagnostic tools through health

education initiatives, online platforms, and patient-doctor interactions, the

demand for immunoassay testing is surging.

One of the key

factors driving this demand is the rise in lifestyle diseases, such as diabetes

and cardiovascular ailments. As patients recognize the importance of early and

precise diagnosis for effective treatment, they are increasingly turning to

immunoassays for accurate and timely results.Public and private companies are boosting the India immunoassay demand by initiatives such as, In

March 2024, Fapon, a global leader in life sciences, reaffirmed its commitment

to advancing the Indian IVD industry at Medical Fair India 2024, held from

March 13 to 15 in Mumbai. As one of the premier medical trade fairs in India,

the event served as a key platform for Fapon to showcase its innovative IVD

technologies and comprehensive solutions designed for IVD manufacturers.

At the

fair, Fapon introduced a range of novel IVD products, technologies, and

solutions tailored to the Indian market, including new biomarkers, blockers,

bulk reagents, assays, and instrument platforms, all designed to meet the

evolving needs of the local healthcare sector. This trend is further fueled by

the Indian government's efforts to enhance healthcare infrastructure and ensure access to sophisticated diagnostic services, even in rural areas.

These initiatives are crucial to driving the expansion of the

immunoassay market in India.

In addition to

the increasing patient awareness and the prevalence of lifestyle diseases,

government initiatives are also contributing to the growth of the immunoassay

market. By focusing on improving healthcare infrastructure and making

sophisticated diagnostic services more accessible, the Indian government is

creating an environment that supports the adoption of immunoassay testing. This

combination of increased patient awareness, rising rates of lifestyle diseases, and

government initiatives is driving the expansion of the immunoassay market in

India.

Emerging Trend

of Smartphone-Based Formats and Multiplex Bead Assays

Emerging

trends in Smartphone-Based Formats and Multiplex Bead Assays are propelling the

growth of Immunoassay in India. The integration of smartphones with immunoassay

systems offers a multitude of benefits such as portability, affordability, and

the ability to handle multiple tests simultaneously, making it a practical

choice for areas with limited resources. The use of smartphone technology is

revolutionising the field of diagnostics, by providing real-time interpretation

of test results and facilitating seamless data sharing between healthcare

professionals. Multiplex Bead Assays, on the other hand, enable the

simultaneous detection of multiple analytes in a single sample, thereby

enhancing the efficiency and accuracy of diagnostic procedures. This technique

is particularly beneficial for detecting complex diseases, such as

autoimmune disorders and cancers, where multiple biomarkers are often involved.

The rising prevalence of such diseases in India necessitates more efficient

diagnostic tools, thereby increasing the demand for advanced immunoassay

techniques. The growth of the immunoassay market is supported by

the Indian government's initiatives to improve healthcare infrastructure and

accessibility. By embracing these innovative technologies, India is setting a

new benchmark in immunoassays, paving the way for rapid, accurate,

and affordable diagnostics.

Segmental Insights

Product Insights

Based

on the product, Reagents and kits accounted for the largest market share in the India immunoassay market in 2023. This segment is projected to maintain

its lead over the forecast period, driven by the high demand for immunoassay

reagents and kits for diagnostic purposes. With the growing prevalence of

infectious and autoimmune diseases, there is an increasing need for reliable

and efficient immunoassay solutions. The approval and launch of novel

immunoassay kits are expected to further support this segment's growth,

providing more advanced and accurate diagnostic options.

On

the other hand, the software and services segment is expected to grow at a

steady compound annual growth rate (CAGR) over the forecast period. This can be

attributed to the increased availability and high demand for cost-effective

immunoassay services, especially in developing markets. For example, in June

2020, Sysmex Corporation began offering novel coronavirus (SARS-CoV-2) antibody

lab assay services, addressing the urgent need for reliable testing during the

pandemic. Overall, the India immunoassay market is poised for significant

growth, driven by ongoing advancements in reagents, kits, software, and services that are crucial for accurate and timely diagnosis of various

diseases.

Technology Insights

Based

on technology, Enzyme Immunoassays (EIA) are expected to remain dominant in the India immunoassay market. This is primarily due to its extensive use in clinical diagnostics, drug

monitoring, and pharmaceutical analysis. EIA stands out due to its remarkable

accuracy, affordability, and ability to deliver rapid results, making it a

preferred choice in the Indian medical landscape.

The versatility of EIA in detecting a wide range of diseases is another key

factor contributing to its dominance. From infectious diseases to chronic

diseases and even cancer, EIA has proven effective in diagnosing and monitoring a range of health conditions. This comprehensive disease detection

capability further solidifies EIA as the technology of choice for healthcare

professionals in India. With its widespread adoption and numerous benefits, the

Enzyme Immunoassays technology continues to play a vital role in advancing

medical diagnostics and improving patient care in India.

Download Free Sample Report

Regional Insights

The Western

region of India, encompassing the vibrant cities of Mumbai and Pune, is currently dominating the immunoassay market nationwide. This

remarkable feat can be attributed to the rapid growth of the healthcare sector in this region, which has seen a surge in advanced diagnostic facilities and the prevalence of chronic diseases. The

region's robust ecosystem benefits from the presence of leading pharmaceutical

companies and renowned research institutes, further bolstering its market share

and solidifying its position as a key player in the field. The healthcare

sector in the Western region has witnessed significant advancements in recent

years. The availability of state-of-the-art diagnostic facilities has

contributed to accurate and timely detection of various diseases. This, in turn,

has led to improved patient outcomes and a higher demand for immunoassay

technologies. The region's proactive approach towards healthcare

has attracted leading pharmaceutical companies to establish their presence

here. Their collaborations with renowned research institutes have led to groundbreaking discoveries and innovations in immunoassays. This

collaborative approach has not only enhanced the region's market share but also

positioned it as a hub for cutting-edge research and development.

In addition,

the Western region's strategic geographical location and well-developed

infrastructure have played a crucial role in its dominance in the immunoassay

market. The region's easy accessibility, coupled with efficient logistics, has enabled the seamless distribution of immunoassay products across the country. The Western region of India has emerged as a frontrunner in the

immunoassay market, driven by the healthcare sector's remarkable growth, a strong ecosystem, and strategic advantages. With continuous advancements and

collaborations, the region is poised to further expand its market share and

solidify its position as a key player in the field.

Recent Developments

- In September 2024, Agappe published an official product video introducing the Mispa i121 fully automated chemiluminescence enzyme immunoassay analyzer and positioned it as a cartridge-based CLIA system with 120 tests/hour throughput.

- In February 2024, Erba-Transasia stated it planned 2024 launches supported by patented technologies including chemiluminescence systems (immunoassay) as part of its India-focused product and capability roadmap.

- In June 2024, Fujirebio and Agappe’s CLIA analyzers-and-reagents rollout was described as scheduled to launch starting June 2024 (with a phased release across multiple clinical parameters).

- In

January 2024, Fujirebio Holdings, Inc. and Agappe Diagnostics Ltd announced

their collaboration through a Contract Development and Manufacturing

Organization (CDMO) partnership. This partnership focuses on the production of

cartridge-based CLIA system reagents for the immunology analyzers Mispa i60 and

Mispa i121. Under this agreement, the analyzers and reagents will be marketed

under Agappe’s brand, establishing Agappe as the first Indian company to offer

a complete chemiluminescence solution with locally manufactured reagents.

- In

September 2024, diagnostic tools developed under the 'Make in India' initiative

for the early detection of critical diseases such as Alzheimer’s, cancer, and

gastrointestinal disorders were officially launched. Approved

by the Drugs Controller General of India (DCGI), these innovative in-vitro

biomarkers will be produced in Kochi, Kerala. This milestone collaboration

brings advanced Chemiluminescent Enzyme Immunoassay (CLEIA) technology to the

forefront, marking a significant advancement in India’s healthcare sector for

early disease detection.

Key Market Players

- F. Hoffmann-La Roche Ltd.

- Abbott India Ltd.

- BioMérieux India Pvt. Ltd.

- Bio-Rad laboratories India Pvt.Ltd

- Becton Dickinson Pvt.Ltd

- Thermo Fisher Scientific India Pvt. Ltd.

- Danaher India (DHR Holding India Pvt. Ltd.)

- Siemens Healthcare Private Limited

- Randox Laboratories (India) Pvt. Ltd.

- Sysmex India Pvt. Ltd.

|

By Product

|

By Technology

|

By Indication

|

By End User

|

By Region

|

- Reagents and Kits

- Analyzers/Instruments

- Software and Services

|

- Radioimmunoassay (RIA)

- Enzyme Immunoassays (EIA)

- Fluoro Immnoassay (FIA)

- Chemiluminescence Immunoassay (CLIA)

- Rapid Test

- Others

|

- Therapeutic Drug Monitoring

- Oncology

- Cardiology

- Endocrinology

- Infectious Diseases

- Autoimmune Diseases

- Others

|

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Others

|

|

Report Scope:

In this report,

the India Immunoassay Market has been segmented into the following categories,

in addition to the industry trends which have also been detailed below:

- India Immunoassay Market, By Product:

o Reagents and Kits

o Analyzers/Instruments

o Software and Services

- India Immunoassay Market, By Technology:

o Radioimmunoassay (RIA)

o Enzyme Immunoassays (EIA)

o Fluoro Immnoassay (FIA)

o Chemiluminescence Immunoassay (CLIA)

o Rapid Test

o Others

- India Immunoassay Market, By Indication:

o Therapeutic Drug Monitoring

o Oncology

o Cardiology

o Endocrinology

o Infectious Diseases

o Autoimmune Diseases

o Others

- India Immunoassay Market, By End User:

o Hospitals & Clinics

o Pharmaceutical & Biotechnology Companies

o Academic & Research Institutions

o Others

- India Immunoassay Market, By Region:

o North

o South

o West

o East

Competitive

Landscape

Company

Profiles: Detailed analysis of the major companies

present in the India Immunoassay Market.

Available

Customizations:

India Immunoassay

Market report with the given market data, TechSci Research offers

customizations according to a company's specific needs. The following

customization options are available for the report:

Company

Information

- Detailed analysis and profiling of additional market players (up to

five).

India Immunoassay

Market is an upcoming report to be released soon. If you wish an early delivery

of this report or want to confirm the date of release, please contact us at [email protected]